An account statement is more than just a list of numbers—it's your financial report card. Whether you're reviewing salary credits, tracking expenses, or preparing documents for a loan, your bank statement gives you a clear picture of how your money flows.

Let’s break down everything you need to know about account statements, from formats and access methods to password protection and legal nuances.

What is an Account Statement?

An account statement (also known as a bank statement, e-statement, or bank account summary) is a formal document issued by banks like SBI, HDFC, ICICI, Federal Bank and Axis Bank. It lists all transactions—deposits, withdrawals, charges, interest, and your running balance—within a chosen time frame.

This means that it serves as both a tracking tool for personal finance and an official record for tax filings or loan applications.

Simple explanation of ‘Bank Account Statement’ in some of the Indian Languages

How to explain the concept of ‘Account Statement’ to kids?

Imagine your bank statement is like your monthly money diary. It tells you what came in (like pocket money from father, mother, grandmother, etc.) and what went out (like payment for chocolates, toys, chips, etc.). You can get it online, as a paper from the bank, or even download it in Excel or PDF file.

Types of Account Statements

- Savings Account Statement – Most common for individuals

- Current Account Statement – Used by businesses

- Credit Card Statement – Includes billing cycle, interest, and due date

Duration of Statements

Banks usually provide:

- Monthly Statements

- Quarterly Statements

- Custom Periods on Request

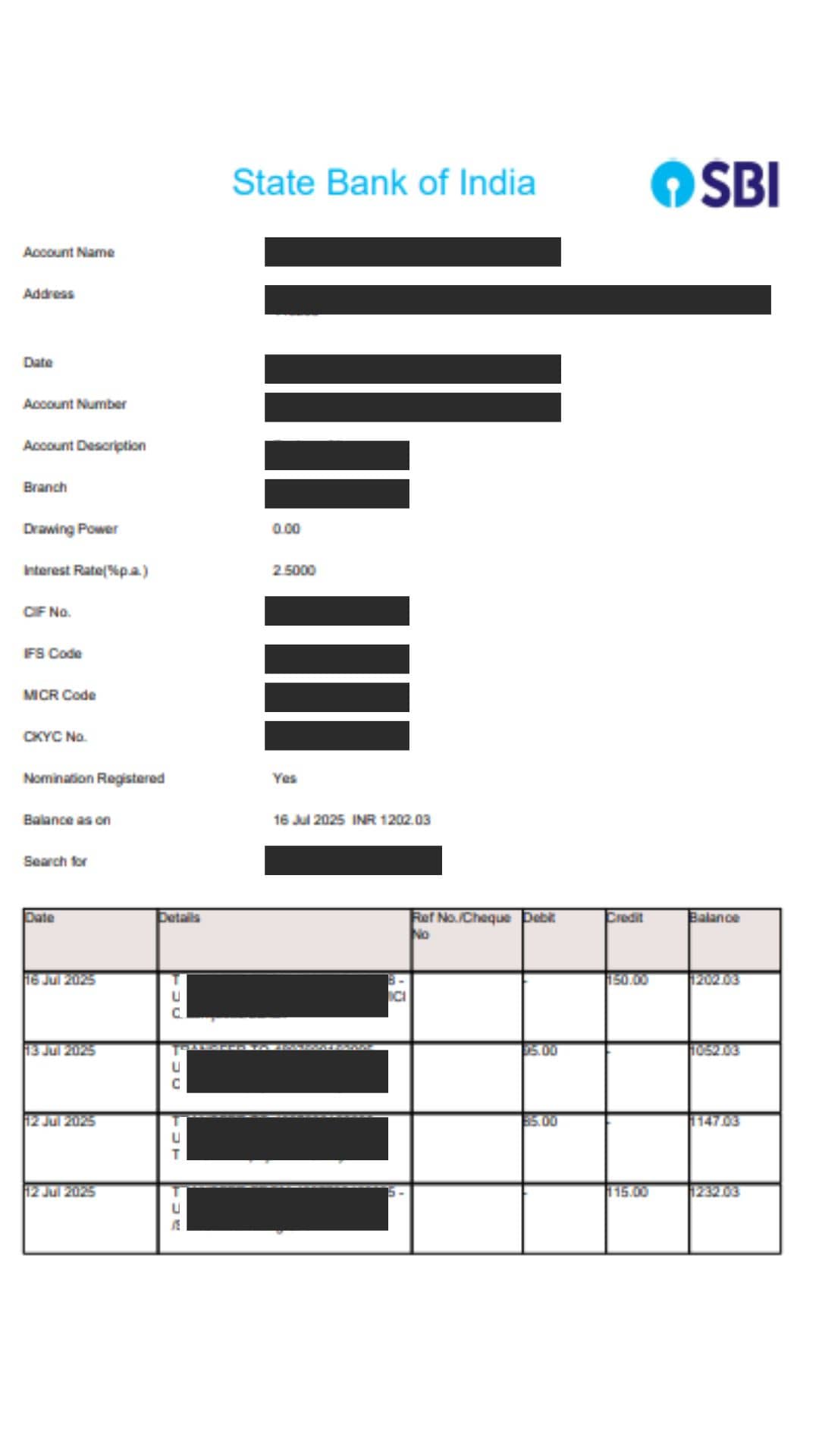

What Does a Bank Account Statement Contain?

Typically, a bank statement includes the following elements:

- Account holder details

- Account number and IFSC

- Date-wise list of transactions

- Debit and credit amounts

- Opening and closing balances

Common Terms Found in Account Statements

- NEFT/IMPS/UPI – Transaction modes

- DR/CR – Debit/Credit

- POS – Point of Sale

- ATM WDL – ATM Withdrawal

How to Access or Download Your Account Statement

You can access your bank account statement using:

- Netbanking portals (e.g., ICICI iMobile, HDFC NetBanking)

- Mobile banking apps (like SBI YONO, Axis Mobile)

- Email statements sent monthly

- Physical copies from branch

Digital vs Physical Statements

- E-Statements are secure, environment-friendly, and instant

- Physical Statements are still preferred for official submissions in some cases

RBI Guidelines on Account Statements

According to RBI norms, banks are required to:

- Maintain records for at least 10 years

- Provide statements on request (charges may apply)

- Offer statements in a secure format (e.g., password-protected PDFs)

- Most banks offer downloadable formats including PDF and Excel.

Typical Excel-Style Bank Statement Format

Can You Get a Statement from a Closed Bank Account?

Yes, but there’s a catch. If you're wondering “Can I get a statement of a closed bank account?”, the answer is yes, but only within a specific time frame (often up to 12 months post-closure).

To do this:

- Visit your branch with ID proof

- Submit a written request

- Some banks may charge a retrieval fee

How to Open an Account Statement Password

Downloaded statements, especially PDF files, are often password-protected for security reasons.

Here’s how most banks format their passwords:

- DOB format: DDMMYYYY

- Combination: First 4 letters of your name + DOB

- Check email instructions accompanying the statement

Account Freeze vs Account Closure vs Statement Access

- Account Freeze: Temporarily locked due to suspicious activity or non-compliance. Statement access may be limited.

- Account Closure: Final shut down. Statements can be accessed retrospectively (as per RBI guidelines).

Normal Statement Access: Active accounts have full access via net banking or apps.

FAQs About Bank Account Statements

What is a bank account statement?

A bank account statement is a summary of your account transactions like credits, debits, and balances which are issued periodically.

Q2. How can I download my bank account statement?

Use net banking or mobile apps to download it in PDF or Excel formats.

Q3. Can I get a bank statement of a closed account?

Yes, within a limited period and usually by request at the bank branch.

Q4. What is an account statement password?

A code used to open your downloaded statement. It could be your birthdate or name combination.

Q5. Is there a standard Excel format for bank statements?

Yes, most statements list date, description, debit, credit, and balance in columnar Excel format.

In this article

Back to all resources

Back to all resources