How to Keep Track of Your Income Tax Returns Refund Status Online

By Jupiter Team · · 5 min read

Indian taxpayers may miscalculate their taxes and end up paying more money than they owe to the Income Tax Department. Luckily, if you overpay your taxes, you are eligible for an income tax refund. When that money hits your bank account, it is an exhilarating feeling. You can choose to invest it or use it to fund one of your life goals or points on your bucket list!

This guide explains everything there is to know about the ITR refund and how to check its status online. Let's start by understanding who is allowed to claim the refund.

When Am I Eligible For an Income Tax Refund?

Income taxpayers are typically eligible for a refund when the tax paid by them exceeds the tax liability. Tax refunds are typically paid after the end of the financial year. For individual taxpayers, it can take between two weeks to four months. One way to expedite your refund is to file your taxes early.

How Is My Income Tax Refund Calculated?

The first step to calculating your online refund status is accurately figuring out your tax liability. Take the following factors into consideration:

- You have paid more tax in advance on the basis of self-assessment than the tax payable on the basis of regular assessment.

- The TDS paid on your salary, securities, dividends and other sources of income is higher than the tax payable on the basis of regular assessment.

- Your income is already taxed in a foreign country with which the Government of India has an agreement to avoid double-taxation.

- Your investments come with tax benefits and deductions, which you have not declared.

If your gross tax liability on the total taxable income is less than your net tax liability, the extra amount will be refunded to your account.

How Will My Income Tax Refund Be Processed?

- The first step is to file your returns online every year before the deadline. The earlier you file, the better because your income tax refund can be expedited.

- Once you have filed your returns, your income tax returns must be verified electronically via an Aadhaar number OTP or EVC generated through your registered bank account. Your tax returns can also be physically verified. In this case, you must submit a signed ITR-V (acknowledgement) to the Centralised Processing Centre (CPC) within 120 days of filing the return.

- The CPC located in Bengaluru processes your income tax returns. If the taxes paid are higher than the liability, an income tax refund order is generated.

- Finally, the refund order is transferred to the ITR banker, which then credits the refund to your registered bank account.

How Will I Receive My Tax Refund?

An income tax refund can be paid in two ways. One way is paying it via an account payee cheque drawn in favour of the taxpayer. Alternatively, it can be directly credited to your bank account that was added while filing your returns. Make sure that you add your bank details correctly.

How Can I Check My Income Tax Refund Status?

Check Online ITR Refund Status Via E-Filing Portal

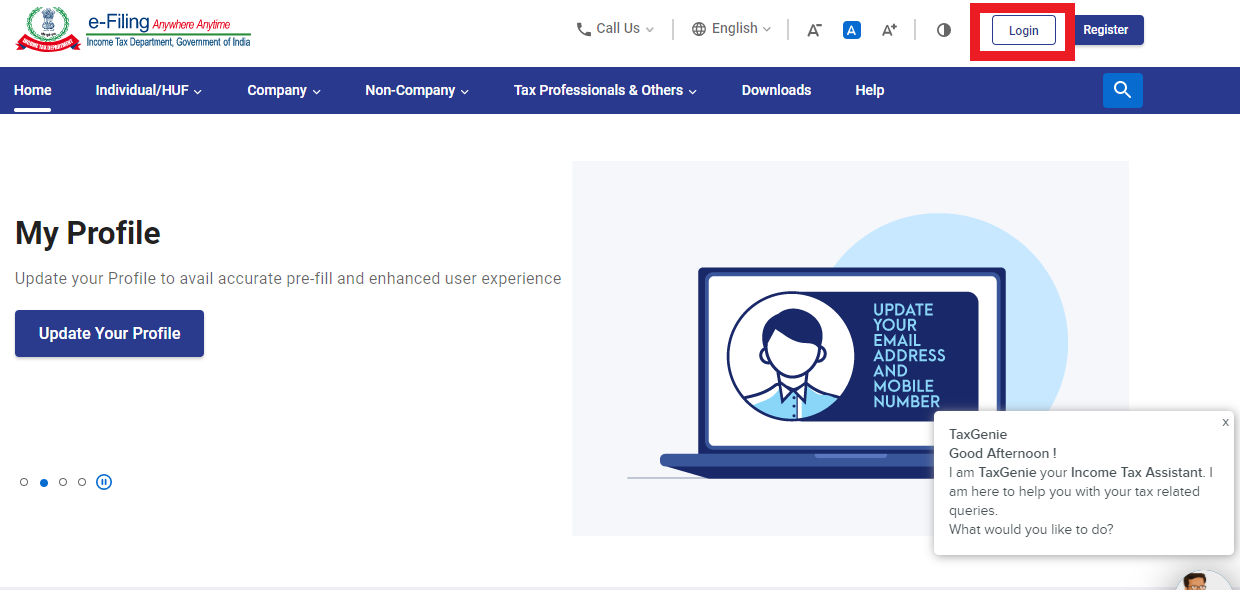

If you have registered on the e-filing website, you can follow these steps to check your income tax refund status.

- Visit the e-filing portal.

- Click on the 'Login' button in the top right corner of the website.

- Enter your user ID. If your Aadhaar is linked to your PAN card, you can input the Aadhaar number. If not, enter your PAN.

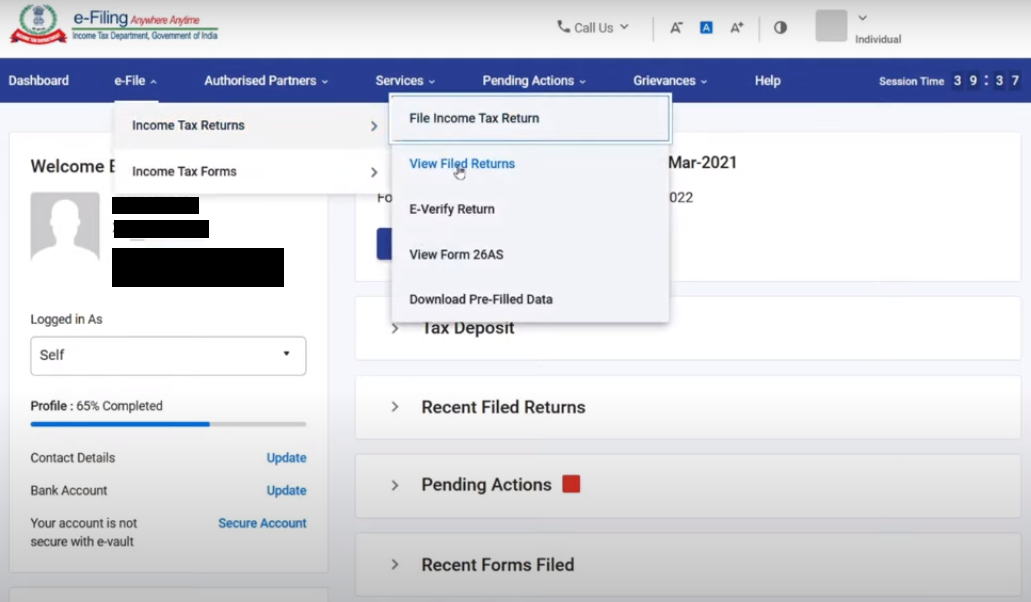

- Click on 'e-File' on the top menu bar and select 'Income Tax Return'. Then click on 'View Filed Return'.

- You will then see the statuses of all the returns you have filed.

Check Online ITR Refund Status Via NSDL Portal

One of the quickest ways to check your ITR refund status is through the NSDL Portal.

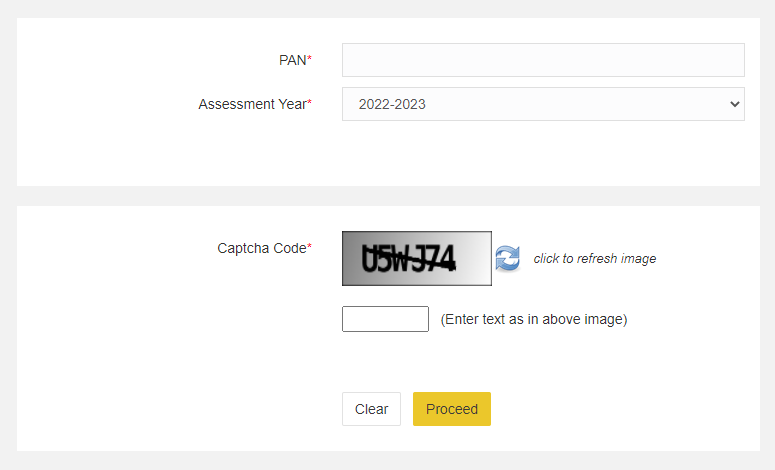

- Click here, and you will immediately arrive on the refund status page.

- Enter your PAN Number, assessment year and the captcha code on the page.

- Press 'Proceed'.

4. You will be taken to a page that displays your NSDL refund status.

What Are the Types of Income Tax Refund Status?

- Not Determined: Your online ITR refund is still being processed. Revisit this page in a few days to see if the status changes.

- Refund Paid: This means either a cheque has been dispatched or the refund has been credited to your bank account.

- Refund Failed: The IT Department could not process your refund because your bank account details are incorrect or incomplete. You must request a refund re-issue and ensure the details are filled out properly.

- Refund Expired: Failure to encash your cheque within 90 days will result in your refund expiring. If you see this message, you must request the IT department to issue another cheque.

- The Cheque Has Been Encashed: This means your cheque has been cashed. Check to see if the amount reflects in your bank account.

- Refund Returned: If you fail to receive the cheque, it is sent back to the IT Department. If you see this status, you need to request a refund re-issue via the income tax portal.

- Refund Adjusted Against Last Year’s Outstanding Demand: You will see this status if your refund is adjusted against any previous outstanding tax demand. The IT department sends an intimation for such an adjustment, which you must respond to within 30 days. If you don't respond, the department will proceed as per their suggestions.

Can I Earn Interest on Refund of Income Tax?

Yes, absolutely. If you paid excess tax in advance, your refund will be granted with interest. Under section 244A, you are eligible for interest as follows:

- If the refund is 10% or more of your taxes, you qualify for an interest rate of 0.5% per month or part of a month.

- The interest is calculated from April 1st of the assessment year, i.e., the year after the financial year, until the date your refund is granted.

FAQs

Q. What are the various forms in which taxes are paid?

The forms of taxes include TDS, self-assessment tax payments, advance tax payments, and foreign tax credits.

Q. How is my refund calculated?

You must file your tax returns by declaring income earned during the financial year, investments made, deductions claimed, and taxes already paid. When the tax paid is more than the tax payable, you will get a refund.

Q. Is it important for me to know the refund amount?

Yes, it is extremely important to know the refund amount. Sometimes, there could be a calculation error by the department. If that is the case, knowing the amount will help you request a refund re-issue.

Q. Why must I verify my returns?

Without verification, the Centralised Processing Centre (CPC) will not process your ITR, and consequently, your refund.

Q. How long does it take to get an income tax refund?

If you are a salaried person, your refund may be credited within two weeks, especially if you have filed your returns early on. On average, the estimated time span for the ITR is between one and four months. For businesses, the return can take between 3 to 6 months to be processed.

Q. If my income tax refund is not processed, what do I do?

If your ITR is not processed, you must create a refund request for failed requests. You can log into the income tax filing website, click on "Services" and then "Refund Re-issue". If it indicates that there is no failed request, you can visit the grievances section and file a request there.

In this article

Back to all resources

Back to all resources