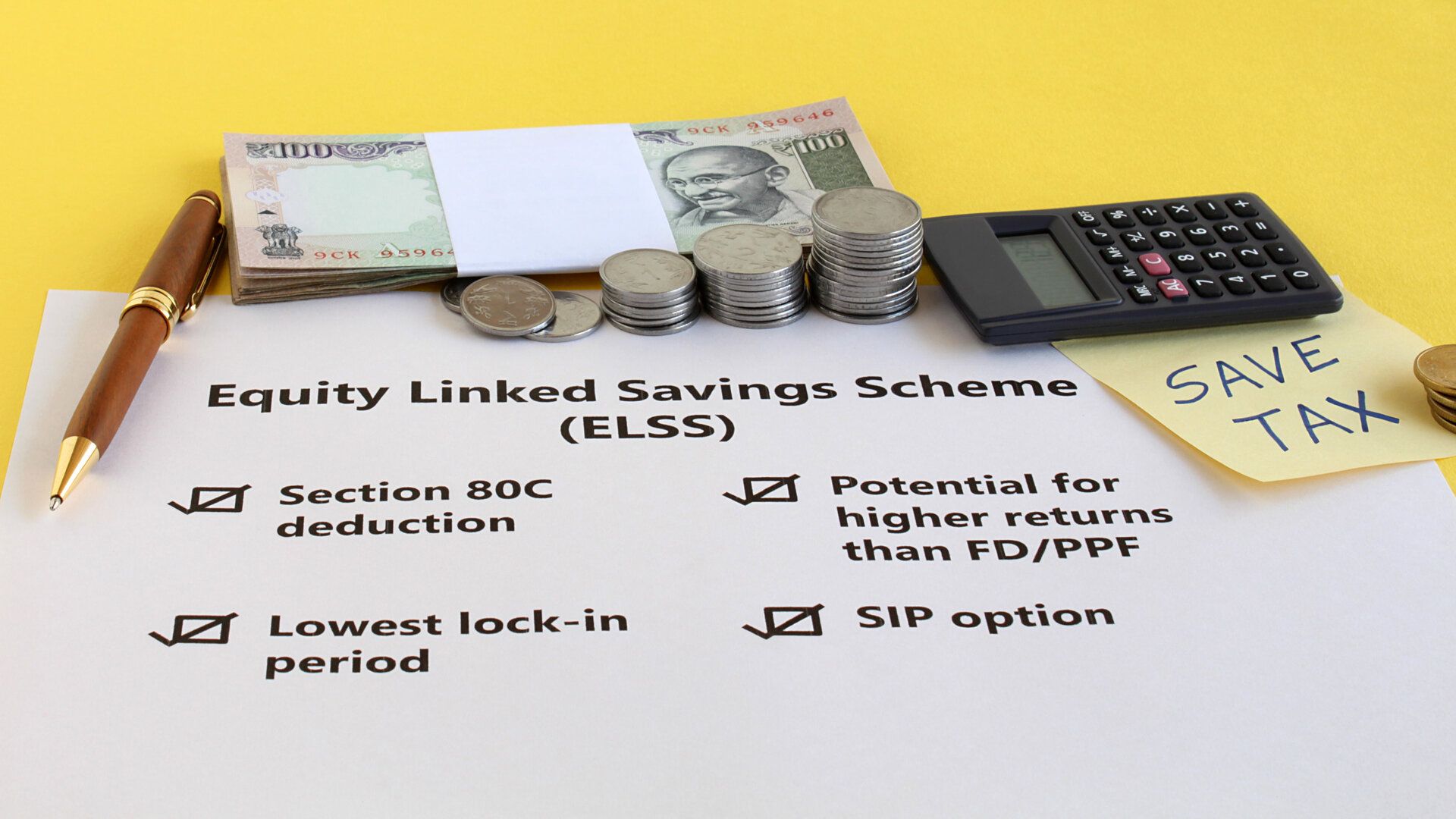

Equity-Linked Savings Scheme (ELSS) is an open-ended diversified equity mutual fund plan that provides the opportunity to earn higher returns on your investment along with tax benefits. Read on to know more about this scheme.

What is ELSS?

ELSS includes diversified equity funds that invest most of the corpus in the shares of listed companies as per the fund investment philosophy. The investee companies are chosen across different market capitalization and industries.

The primary objective of ELSS funds is to maximize the returns over the long term. The fund manager chooses the listed companies after in-depth research to deliver optimal risk-adjusted returns to the investors.

What are the features of ELSS funds?

Some of the features of ELSS mutual funds are as follows:

- At least 80% of the fund corpus is invested in equities and equity-related instruments.

- Any income earned is considered as long-term capital gains (LTCG) and taxed as per the existing rules.

- Fund corpus is diversified across different industries, market capitalization, and sectors.

- Your investment is eligible for tax benefits under section 80C of the Income Tax Act, 1961.

- The minimum lock-in period is three years with no maximum limit for the investment horizon.

Who should invest in ELSS?

Salaried individuals

A portion of your salary may be invested in Employee Provident Fund (EPF), which is a fixed-income instrument. Therefore, to enjoy tax benefits while balancing the risk and return on your overall investment portfolio, opting for an ELSS scheme is advisable.

First-time investors

If you are starting your investment journey, ELSS is a good option to understand the workings of mutual funds and equity. Although these financial products entail certain risks, if you stay invested for five years or longer, this risk can be mitigated.

What are the benefits of ELSS?

Tax benefits offered by ELSS funds

The ELSS tax-saving benefit is available on the principal investment for an amount of up to INR 1.50 lakhs per year under section 80C of the Income Tax Act, 1961.

However, the investment has a three-year lock-in period. You may redeem it after three years and the gains are taxed as LTCG, which are tax-free for up to INR 1 lakh per annum.

Any additional returns exceeding INR 1 lakh are taxed at 10% without any indexation benefits.

Other benefits

In addition to the ELSS tax benefits, some other advantages are as follows:

- Shorter lock-in period

Compared to options like National Pension System (NPS) and Public Provident Fund (PPF), ELSS has a shorter lock-in period, which is of three years. NPS investment is locked in until retirement and PPF has a 15-years lock-in period.

- Regular income

If you choose the dividend option while investing in ELSS, you can earn a regular income during the lock-in period. This additional income can help in meeting your day-to-day expenses and reduce your financial burden.

- Possibility of earning higher returns

Compared to other tax-saving instruments like PPF and fixed deposits (FDs), ELSS offers the opportunity to earn higher returns on your investments.

Unlike fixed-income products, ELSS can deliver market-linked returns, helping you accumulate more wealth in the long run.

Why you should invest in ELSS

Diversification

Most of these schemes invest in different types of companies across various sectors ranging from small-cap to mid-cap to large-cap. Therefore, you can benefit from the diversification of your investment risk.

Low minimum investment

You may invest in ELSS for as little as INR 500, which makes it easy for you to opt for this type of fund. You may start the investment without waiting to accumulate a sizeable corpus.

Systematic investment plan (SIP)

You can invest a lump sum in an ELSS. However, if you do not have adequate funds, you can opt for an SIP, which allows you to invest a certain amount at periodic intervals. This helps you to inculcate financial discipline, which can benefit in wealth accumulation over a longer period.

Things to consider before investing in ELSS

While making an ELSS investment, here are some important things you should consider before making your decision:

Lock-in period

ELSS has a three-year lock-in period during which you cannot withdraw your investment. Therefore, ensuring the amount invested will not be required for this term is important.

Returns

ELSS is a market-linked investment product and does not offer guaranteed or assured returns. The earnings are directly based on the performance of the underlying assets.

Before investing, you may check the net asset value (NAV) and performance of various funds to determine what is outperforming.

Investment duration

Generally, equities perform better and deliver higher returns in the long term (five years or more). Therefore, while opting for ELSS, make sure you stay invested for a longer duration to maximize the benefits and mitigate the short-term market volatility and the related risk.

Fund manager and history

The fund managers make all the investment decisions, and therefore, ensuring they are competent and experienced is advisable. It is also recommended you opt for funds that have delivered consistent returns over the last five or 10 years.

How to invest in ELSS?

You may open an ELSS account online or offline with the fund house of your choice. You can invest either as a lump sum or an SIP based on your financial situation. The minimum amount you can invest is INR 500 with no upper limit.

Best ELSS Funds

Top-performing funds vary based on the returns; however, some of the best ELSS funds are listed below:

|

Fund name |

Three-year returns (%) |

Five-year returns (%) |

|

Quant Tax Plan Direct – Growth |

30.29 |

22.71 |

|

Mirae Asset Tax Saver Fund Direct – Growth |

21.02 |

22.03 |

|

Canara Robeco Equity Tax Saver Direct – Growth |

19.91 |

19.05 |

|

IDFC Tax Advantage (ELSS) Direct Plan – Growth |

16.98 |

18.00 |

|

Motilal Oswal Long Term Equity Fund Direct – Growth |

14.67 |

17.46 |

SIP or lump sum: Which investment is better option?

If you do not want to assume higher risk, you may opt for an SIP. This allows you to invest during different market cycles. Therefore, when the market is low, you can buy more units and vice versa, which reduces your average cost.

Moreover, when the market rises, you can redeem the units for a higher price, delivering better returns.

On the other hand, investing a lump sum is advisable if you want to stay invested for a longer period and are willing to assume more risk.

Frequently asked questions (FAQs)

What are ELSS funds?

ELSS funds are diversified equity schemes that are eligible for tax benefits under section 80C of the Income Tax Act, 1961. They have a minimum lock-in period of three years. And a major portion of the corpus is invested in equity and related investments.

How to invest in ELSS?

To begin with, you need to complete the know-your-customer (KYC) verification. This can be done with an authorized agent, and you will need a photo, permanent account number (PAN) card, and address proof. You can then invest in your chosen scheme online or offline.

How to open an ELSS account?

You will have to open an account with the fund house and undergo the KYC procedure. After this, you may select the scheme you want to invest in and purchase the number of units.

In this article

Back to all resources

Back to all resources