Evaluate Your Mutual Fund Portfolio Performance - A 6-Point Guide

By Jupiter Team · · 8 min read

Mutual funds are a popular investment avenue among investors as they have the potential to offer high returns in the long term. However, when we talk about the long term, it doesn't mean you invest and forget. Since mutual funds are marketable securities, they are exposed to market risks and thus require constant monitoring. You must review your mutual fund portfolio often to ensure your investments are giving good returns.

How to evaluate the performance of mutual funds?

You can check the performance of your mutual funds through the following ways.

#1 Link your investment with your goal: By linking your goals with your investment, you can track the progress of your investments. Estimate the money needed for your goal, and see whether your investments are helping you progress towards your goal. If not, then it's time you rethink your investment in that fund.

#2 Compare with the benchmark performance: You can also check whether your fund is performing well or not by comparing it with its benchmark. A fund's benchmark is usually disclosed in the scheme information document. By comparing the fund's returns and the benchmark, you can check whether your fund is underperforming or beating the benchmark.

#3 Compare with similar funds: There are several mutual fund houses, each of which has funds for different categories. So, pick up funds of a similar category from other asset management companies (AMC) and compare your fund's returns with them. If your fund is underperforming, then it's time you switch your investment from underperforming to a better one.

#4 Check historical performance: Although a mutual fund's past performance doesn't guarantee future returns, it is important to check the fund's past performance. Check how the fund has performed in different cycles, and look for consistency in returns. Consistency helps understand the expertise and skill of the fund manager.

#5 Check the expense ratio: The expense ratio of the fund is important while assessing the performance of a fund. Although a high expense ratio means lower returns, a fund with a high expense ratio can sometimes perform extremely well, as the manager might need additional funds for quick decision-making to capitalize on an opportunity.

#6 Evaluate the risk-adjusted returns: Mutual funds come with a risk that is difficult to eliminate. However, checking whether the returns justify the risk is important. Several ratios, such as alpha, Sharpe, and information ratios, can be used to measure risk-adjusted returns.

Evaluating the performance of the mutual fund isn't rocket science. However, it is a time taking process. Imagine the amount of time you have to spend to compare the performance of the fund with its benchmark or peers and estimate the risk-adjusted returns! It is a time taking process and can get demotivating to do often.

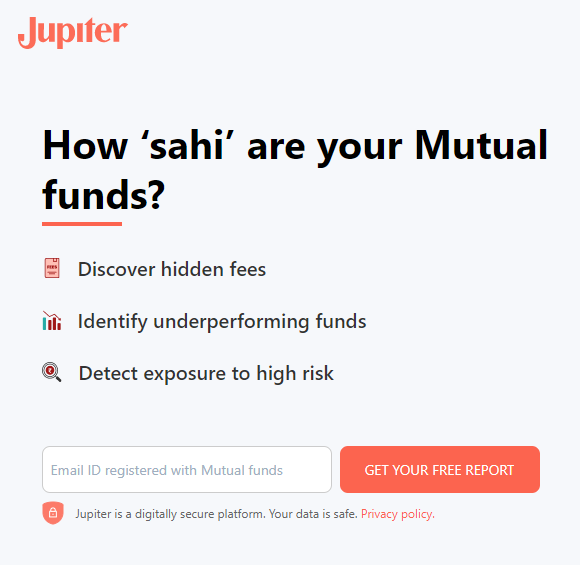

This is why Jupiter came up with a free portfolio analyser tool to check the health of your performance. You can use its portfolio analyser tool even if you are not investing with Jupiter. Let's see how to use the tool and what its benefits are.

How to Use Jupiter’s Free Portfolio Analyser?

The following steps will guide you to use the portfolio analyser tool.

To use Jupiter's portfolio analyser tool, you must enter the email ID you used to register for your mutual funds.

You will receive your mutual fund statement from CAMS on your registered email ID. You must forward that email to investments@jupiter.money.

Jupiter Money will send you an insightful report about your mutual fund investments. It will give you insights into hidden fees and how to reduce them. The report also shows the top-performing sectors and your risk exposure. It also recommends the top sectors you must invest in.

Benefits of using Jupiter’s Portfolio Analyser Tool

Free of cost: Jupiter Money's tool is free and doesn't charge a single rupee to analyse your portfolio.

Quick and time-saving: The tool analyses your portfolio within seconds and saves you the effort and time you must invest in portfolio monitoring.

Simple to use: The tool is simple and straightforward and doesn’t involve complex steps and processes to get the report.

Helps in decision making: It helps make informed decisions by telling you your risk exposure and underperforming funds.

Why should we keep checking the performance of your investments in mutual funds?

You must've often come across the statement 'mutual funds are subject to market risk'. This means mutual funds are marketable securities and are exposed to market volatility. Hence it is important to analyse them before you invest in them. Once you do your analysis, you can invest in the best fund that suits you, which will help you build long-term wealth. However, this is only half of your investment journey.

Once you invest, it is important that you keep monitoring the performance of the funds. This is because there are high chances that these funds can underperform in the future, harming your portfolio. Even if your funds are one of the top-performing funds in the market, you must monitor them regularly.

The following are the reasons why you must check the performance of your mutual fund investments.

Tracks the progress towards your goal: Experts advise investing based on their goals. It helps estimate the investment amount, find the best investment option, and monitor the progress towards the goal. So, by checking the fund's performance, you can see whether you are progressing towards your goal. If not, you can sell your investment and find a better alternative.

Informed decisions: By continuously monitoring your investments, you can make informed decisions about your portfolio. For example, suppose you want to increase your investment in the existing funds. In that case, you can check which one is performing exceptionally through portfolio monitoring and increase your investment in that fund.

Rebalancing portfolio: Capital markets are volatile and can change the portfolio's asset allocation. By monitoring your portfolio, you can rebalance the asset allocation whenever it exceeds your desired limit.

How often should we evaluate the performance of the mutual fund?

Ideally, you must evaluate the performance of your mutual fund investments every six months to one year. Analysing your portfolio daily or even monthly might not give you accurate insights. Depending on your goal and investment horizon, reviewing your portfolio once a year for long-term goals and once in six months for short-term goals is enough.

With Jupiter's portfolio analyser tool, evaluating your mutual fund portfolio has become easier than ever and will hardly take any time.

Different types of ‘Returns’ in mutual fund

A mutual fund's performance is evaluated based on returns. Though mathematically, there is only one way to estimate the profit; there are several kinds of returns that you can use to analyse your mutual funds. Below are the different types of mutual returns.

Absolute returns – It is the simplest form of return and tells by how much the investment has grown, irrespective of the time period.

Annualised returns – Also known as CAGR (compound annual growth rate), this return is the average annual return of a mutual fund estimated over a period of time.

Total return – The actual return you make from an investment is the total return. It considers dividends, interest, and capital gains for calculating the return from a mutual fund.

Point-to-point return – It is the return from a mutual fund between two time periods. To calculate it, you must have start and end dates.

Trailing return – Return from mutual funds over a period of time until the current date is trailing return. it takes into account the volatility in the net asset value (NAV) over a period of time and not just the initial and final NAV.

Rolling returns – The average annual return of a fund over a short period of time is rolling returns. It helps identify the fund’s strong and poor performance in a period of time.

Extended internal rate of return (XIRR) – XIRR estimates the returns from SIP (systematic investment plan). It measures the return from a mutual fund when multiple transactions are involved at different time periods. XIRR is usually calculated in Microsoft Excel, Apple Numbers or Google Sheets, as it is difficult to calculate it manually.

Financial ratios to evaluate mutual funds

Alpha: It measures how much has the mutual fund outperformed its benchmark. It is calculated by subtracting the benchmark’s return from the fund return. A positive alpha indicates the fund has outperformed the benchmark, whereas a negative alpha indicates its performance is less than the benchmark.

Beta: It measures the volatility in the fund relative to the benchmark and is often used as a measure of risk. A beta of one indicates that the fund has a similar risk as the market. If the beta is above one, it means the fund is more volatile than the market, whereas a beta less than one indicates the fund is less volatile.

Portfolio turnover: It measures how many times the portfolio has been turned over in a year. A high portfolio turnover ratio indicates that the mutual fund holdings have been changed, often leading to high transaction costs. In contrast, a low portfolio turnover ratio indicates lower transaction costs and higher returns.

Sharpe ratio: It is a measure of a mutual fund’s risk-adjusted returns by comparing the return against the returns of a risk-free asset. It is calculated by subtracting the risk-free return from the portfolio's return and dividing it by the standard deviation. A higher Sharpe ratio is considered better.

Sortino ratio: It is a variation of the Sharpe ratio and measures the risk-adjusted returns against the risk-free asset by considering only the downside standard deviation. A higher Sortino ratio is considered good.

Frequently Asked Questions

How to calculate profit percentage in a mutual fund?

The profit or return on mutual funds can be calculated in multiple ways. You can use absolute or annualised returns for lumpsum investments and XIRR for SIP investments to estimate the return from mutual funds.

How to calculate the annual return on a mutual fund?

Annual returns can be calculated by dividing the NAV of the latest date by the NAV exactly one year back and then subtracting one from it.

Annual return = (Today’s NAV/Old NAV) - 1

Where can I track mutual fund performance?

You can track your mutual fund's performance on the fund houses' websites. For example, you can track your investment in Aditya Birla Fund on their website. However, checking each fund’s performance at different places can be difficult. So, you can always check your portfolio's performance on the CAMS website or Jupiter's Portfolio Analyser.

Which app is best for mutual fund analysis?

Jupiter Money’s free portfolio analyser can be used for analysing your mutual fund portfolio. It is a very simple tool and will generate an insightful report in no time.

What metrics do you use to evaluate mutual funds?

To evaluate mutual funds, you have to check the fund's historical performance and compare it with the benchmark and the peers. Apart from this, you can also use risk-adjusted ratios such as the Sharpe ratio, Sortino ratio, and information ratio.

In this article

Back to all resources

Back to all resources