According to the Income Tax Act, 1961, payees are required to pay a specified amount as Tax Deducted at Source (or TDS). It is applicable on professional fees, dividends, interest from securities, royalty, and commission.

Before the advent of the internet, TDS return filing was a challenging task. But thanks to the TDS e-payment system, the process has become a lot more convenient.Using the official NSDL website, you can easily pay TDS online using the 8-step process outlined in the next section. Therefore, by choosing to deposit TDS online, you are saving a considerable amount of time and effort.

How to Deposit TDS

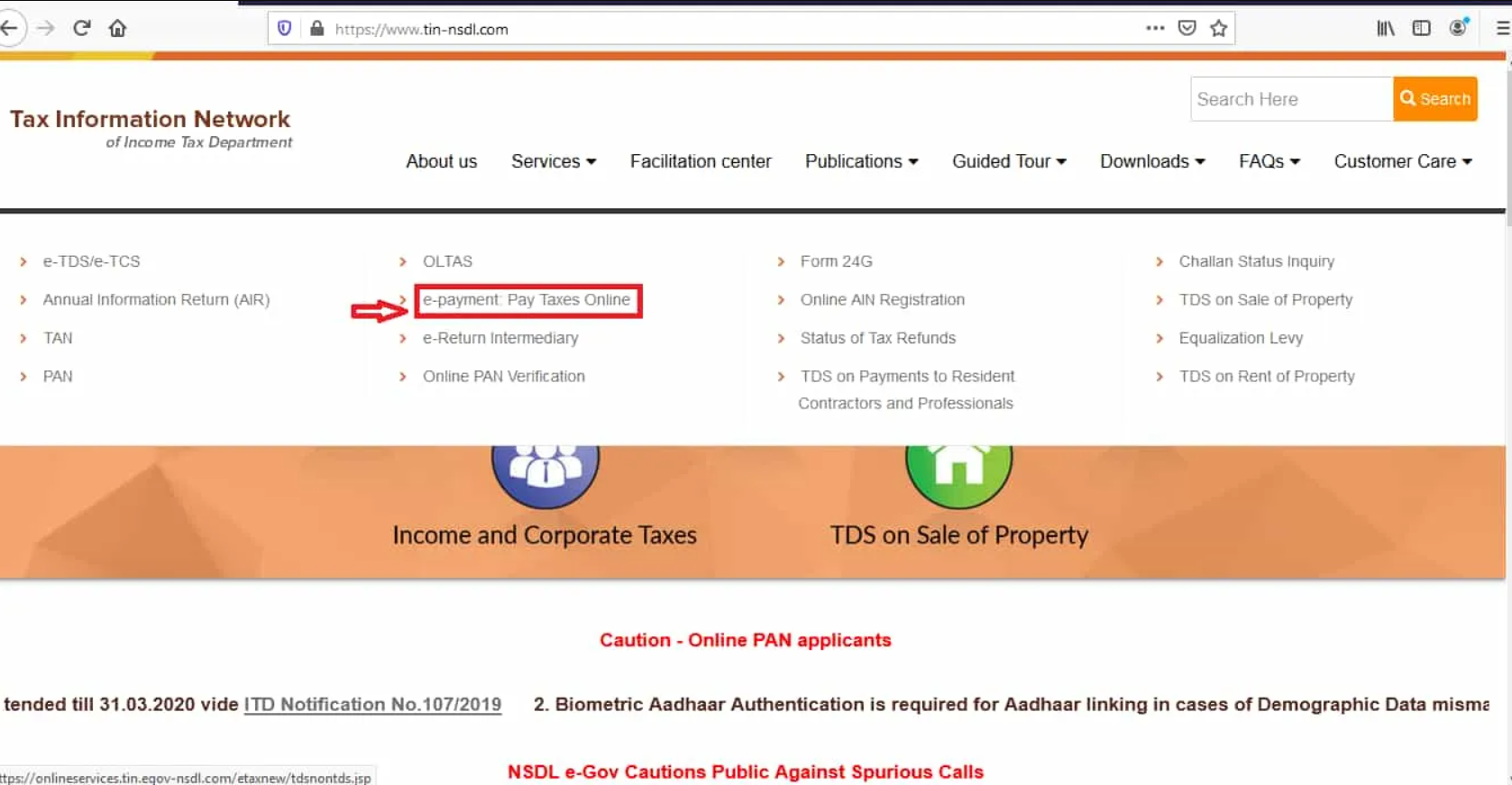

To make the TDS payment online, you need to visit the official website of National Securities Depository Limited (NSDL).

1. Once you visit the site, select 'Services' and then 'e-payment'. Here, you will see the option 'Click to pay tax online'. Select it.

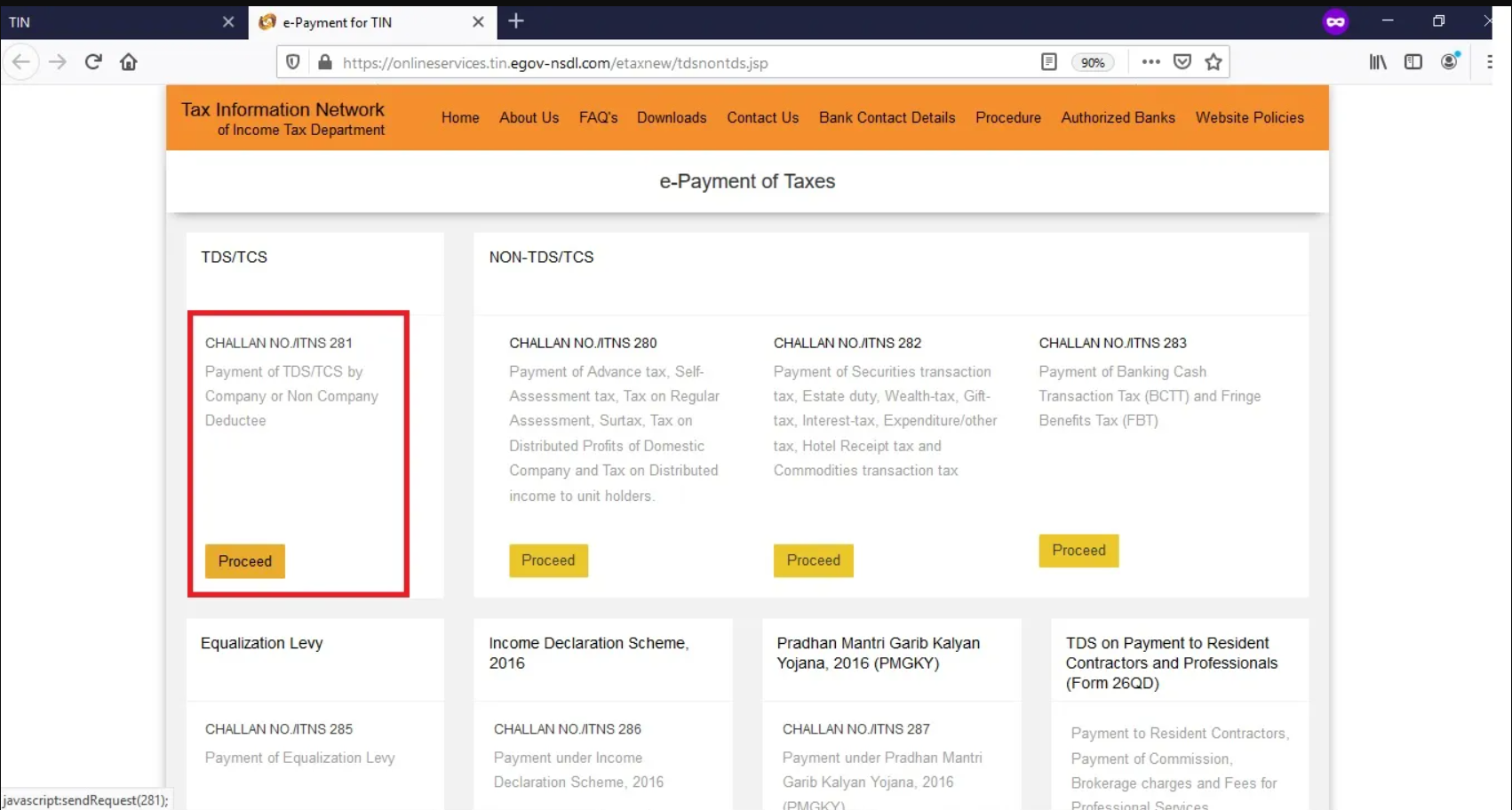

2. On the next page, you will see a list of applicable challans. You have to select the 'CHALLAN NO./ITNS 281' option.

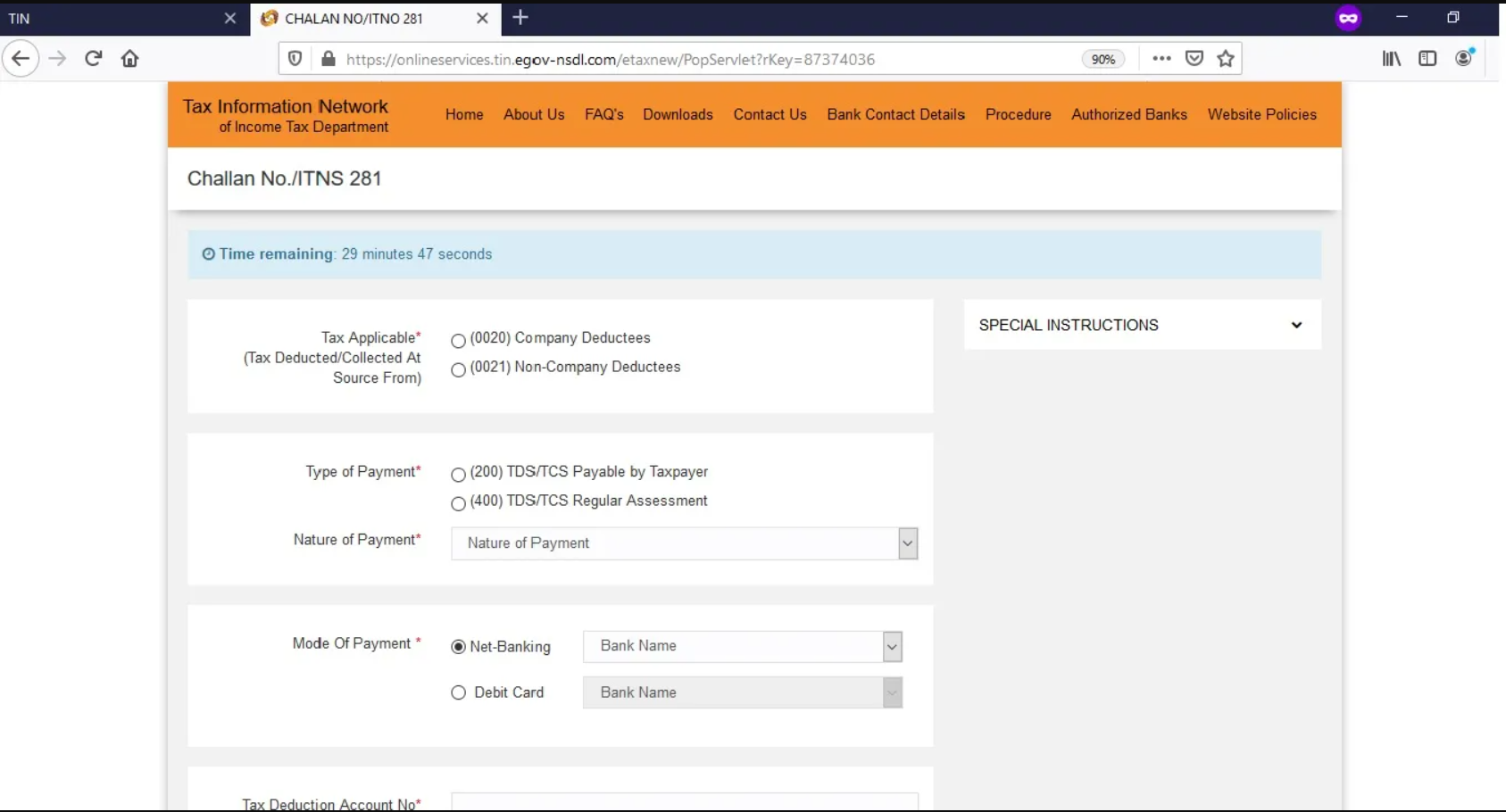

3. You will be taken to a page where you have to enter your details as required.

4. On the new web page, you have to fill in the following details:

- Tax applicability

- Tax Deduction Account Number (TAN)

- Assessment Year (AY)

- Pin code and state

- Payment mode

- Type of payment

Next, input the captcha code and hit 'Proceed'.

5. In this step, your TAN will be verified upon form submission. After successful verification, you will see the taxpayer's full name on the screen.

6. Once you confirm the data, you will be redirected to your bank's net banking website.

7. Log in to your internet banking profile to make the TDS payment online.

8. You will now see a counterfoil challan on the screen after successful payment. Apart from that, you can see the Corporate Identity Number (CIN) on it. It has other information like payment details and your bank's name. Save this challan for future reference.

What happens if you don't file TDS on time? Let's find out:

Due Date for TDS Payment and Returns

Government assessees and other assessees have different due dates for TDS payment as shown below:

Government Assessees

| Remittance of taxes without challan | Day of deduction |

| Remittance of taxes with challan | 7th of the following month |

| Taxes charged on perquisites (remitted by employer) | 7th of the following month |

Other Assessees

| Taxes deductible in March | 30th April of the following year |

| Taxes deductible in other months | 7th of the following month |

Quarterly Payment Option

You also have the option to make quarterly TDS payments, if permitted by an Assessing Officer and the Joint Commissioner.

Listed below are TDS return due dates for quarterly payments:

| First quarter, ending June 30th | July 7th |

| Second quarter, ending September 30th | October 7th |

| Third quarter, ending December 31st | January 7th |

| Fourth quarter, ending March 31st | April 30th |

What Are the Advantages of Online TDS Payment?

Here are some advantages of TDS challan payment online:

- You get instant payment acknowledgement.

- There is no requirement for a physical challan.

- You can pay TDS online on behalf of others or the company.

- The online method allows you to pay TDS from anywhere and at your convenience.

- Your e-challan is directly sent to the Income Tax department.

How to Check TDS Payment Status Online

Listed below are the steps to check your TDS payment status online:

- Visit the site.

- Enter your verification code and hit 'Proceed'.

- Fill in your TAN and PAN details.

- Select type of returns, quarter, and the financial year.

- Select 'Go'. You can now see your TDS status.

Here's another method of checking the TDS payment status:

- Visit the official portal of the Income Tax Department.

- If you are a new user, you must first register on the website. Registered users can, however, simply log in to the portal using their credentials.

- Under the 'My Account' section, click 'View Form 26AS'.

- Select PDF format and the year, and download your password-protected file. Your date of birth (DoB) is the required password. For example, if your DoB is 8 July 1992, your password would be 08071992.

You can use net banking to view your TDS payment status as well. That said, your net banking portal must have your PAN details for you to view the status successfully.

Penalty for the Late Payment of TDS

This is what happens if you delay TDS payment online:

Non-Deduction of Tax at Source

In this case, you will be charged a 1% interest rate per month on the due amount. The duration is from the date when the tax was supposed to be deducted to the date when it is actually deducted.

Post Deduction of Tax at Source

If there is a delay after the deduction, you will be charged a 1.5% interest rate per month on the due amount. This interest is charged for every month (or a part of it), during which the TDS payment is delayed. It begins on the tax deduction date.

FAQs Related to TDS Payment Online

Q. Is it possible to download Form 16 online?

No, only your employer can issue Form 16. You cannot download it from the website.

Q. How should I check 26AS online?

Visit this site and log in to your account. Under 'My Account', you will find Form 26AS (or tax credit). Download the file in the PDF format.

3. How can I use net banking to check my 26AS?

If you own a PAN card, you can use your net banking account to check 26AS. First, ensure that your PAN card details are added to the internet banking account. Then, you only need to select Form 26AS to check the status.

4. Is it possible to download Form 26AS from the TRACES website?

Yes, it is. You can use your date of incorporation, date of birth, password, and user ID to log in to the e-filing website. Under 'My Account', you will find 'View Form 26AS' from the drop-down. Click on it to check the details.

5. How can I make the TDS payment through my bank?

Listed below are two methods to pay TDS through your bank:

- Visit the Branch: In this offline TDS payment method, you can visit the nearest branch to make the cash payment.

- Visit the Net Banking Website: Log in to your bank's net banking page using your credentials. Input all the required information on the website and then make the payment with their integrated payment gateway.

6. Can I use my credit card to pay TDS online?

Yes. While choosing the payment method, select 'Credit card'. After the transaction is over, you will immediately receive an acknowledgement slip for the same.

7. Why is TDS deducted?

This provision under the Income Tax Act, 1961 has been set up to prevent or reduce tax evasion. It is directly paid to the governing authority.

8. What if I missed the due date for filing my TDS returns?

If you missed the deadline, you can still pay the delayed TDS by following the same steps for depositing TDS online. However, you will be charged either 1% or 1.5% interest on the due amount per month.

In this article

Back to all resources

Back to all resources