Are you currently facing financial challenges that can’t wait until your next paycheck arrives?

Whether you need to cover unexpected expenses or make ends meet during a salary delay, Jupiter’s Advance Salary Loan is the perfect solution. With just a few taps on our user-friendly platform, you can receive the funds you need to bridge your financial gaps.

From anniversary gifts to sudden car repairs or your child’s school fees, our advance salary loan has got you covered. While receiving a loan may not be as exciting as getting your salary credited, it will help you easily meet your financial obligations. You have the flexibility to repay the loan with your next salary or choose from our convenient monthly instalment plans.

So why wait? Apply now and enjoy the peace of mind that comes with knowing you have the financial support you need to tackle any unexpected expenses that may come your way.

What is an Advance Salary Loan or Early Salary Loan?

An advance salary loan or early salary loan is a type of short term personal loan that allows you to borrow money against your upcoming salary. It is a short-term loan typically designed to help individuals who need cash urgently before their next payday.

With an advance salary loan, you can access a certain percentage of your salary before your actual payday. The amount that you can borrow depends on your salary and the lender’s policies. These loans are usually unsecured, meaning you don’t have to provide any collateral or security to get the loan.

Repayments for the advance salary can be deducted from a single paycheck or spread out over several future paychecks. In addition to private companies, several financial institutions and NBFCs offer advance salary loans to salaried individuals at reasonable interest rates. These loans can be used to cover a wide range of expenses, such as travel costs, education expenses, utility bills, credit card bills, or unexpected medical emergencies.

Advance salary loans have become increasingly popular among young professionals who may struggle financially toward the end of the month. Moreover, an advance salary loan can be beneficial for various reasons and offer much-needed financial assistance in times of need.

Features and Benefits of Salary Advance Loan by Jupiter

The Features and Benefits of Salary Advance Loan offered by Jupiter are:

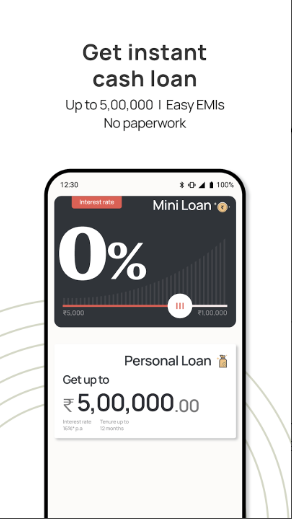

1. Zero Interest Rates

Jupiter’s advance salary loan comes with a unique and attractive feature that sets it apart – a 0% interest rate for a one-month tenure. This means that you can borrow the money you need without worrying about any additional interest charges as long as you repay the loan in full within the specified time frame of one month.

For longer tenures of three and six months, Jupiter offers competitive interest rates as low as 1.5% per month. This ensures that you can still enjoy the benefits of an advance salary loan without worrying about high-interest rates that can add to your financial burden.

By choosing Jupiter’s advance salary loan, you can have the peace of mind that you are not paying exorbitant interest rates, making it an affordable and convenient solution to cover unexpected expenses.

2. No Collateral

As an unsecured loan, a salary advance loan does not require you to provide any collateral or security against the amount of money you receive. This means that if you need this loan, you do not have to worry about providing any assets as a guarantee for the loan, making it a convenient option for you if you do not have any collateral to offer.

3. Hassle-Free loan

Jupiter’s advance salary loan is designed to offer hassle-free financial assistance to individuals in need. One of the ways in which Jupiter achieves this is by eliminating the need for extensive documentation. Unlike traditional loans that require a plethora of documents to be submitted, Jupiter’s advance salary loan requires zero documentation, making the process quick and convenient.

Jupiter understands that unexpected expenses can arise at any time and therefore ensures quick disbursal of the loan amount. Once the loan is approved, the money is disbursed directly to your bank account, allowing you to access the funds you need without any unnecessary delays.

4. No Extra Charges

Jupiter stands out in the market by offering a unique benefit to its customers – no extra charges. This means that, unlike other lenders, Jupiter does not levy any prepayment charges or penalties for foreclosure. This feature allows customers to repay their loans earlier than the agreed-upon tenure without incurring any additional costs. By waiving these charges, Jupiter empowers its customers with the freedom to manage their finances without any restrictions or hidden fees.

This benefit also helps borrowers save money on interest payments, which they would have otherwise incurred had they not opted for early repayment. Overall, Jupiter’s no extra charges policy reflects its customer-centric approach and commitment to providing affordable and hassle-free financial solutions to its customers.

5. Flexibility to Pay Back in 1, 3 and 6 Months

Jupiter’s salary advance loans offer a high degree of flexibility regarding loan repayment. Unlike traditional lenders that impose rigid repayment terms, Jupiter allows borrowers to choose a repayment tenure that suits their financial situation.

Whether it is one month, three months, or six months, borrowers have the option to select the tenure that aligns with their repayment capacity. This flexibility enables borrowers to manage their finances better and avoid the stress of high monthly installments. Furthermore, it empowers them to plan their finances more effectively, as they can choose a repayment schedule that matches their cash flow.

6. Lower CIBIL Score

CIBIL score is a crucial factor that lenders use to assess a borrower’s creditworthiness. A higher score indicates a better credit history, and lenders are more likely to approve loan applications from borrowers with good CIBIL scores. However, not everyone has a high CIBIL score, which can be a roadblock to accessing credit. That’s where Jupiter’s salary advance loans come in.

With a lower minimum CIBIL score requirement, these loans are accessible to a broader range of borrowers, including those with less-than-perfect credit histories. This feature makes Jupiter’s salary advance loans an attractive option for those who may not meet the eligibility criteria for traditional personal loans due to their CIBIL scores. Additionally, by providing access to credit to a wider segment of the population, Jupiter is playing a crucial role in promoting financial inclusion in the country.

7. Supports a Wide Range of Applications

At Jupiter, we understand that financial needs can vary from person to person. That’s why our instant loans are designed to be versatile and can be used for any purpose you desire. The possibilities are endless, but to give you an idea, here are a few examples of what you could use our instant loans for:

- Funding a vacation or travel plans

- Covering unexpected medical bills

- Financing home repairs or renovations

- Paying for school tuition fees

- Covering your monthly rent

- Purchasing groceries and household essentials

- Financing vehicle or car repairs

- Buying gifts for loved ones

- Paying bills such as electricity, water, or internet bills

These are just a few examples of the many ways you could use Jupiter’s instant loans to cover your financial needs. So, why wait? Apply for a salary advanced loan from Jupiter today and take the first step towards achieving your financial goals.

Top Usage of Salary Advance Loans in India

A salary advance loan is ideal for fulfilling your one-time financial requirements. Whenever you encounter expenses that are not recurring, you can easily manage them by availing of this loan. Here are the top 5 common areas where people often utilize this loan:

- House or Rent Deposit: Many individuals require a substantial amount of money as a deposit while renting or buying a house. Salary advance loans can help people meet this expense and secure a place to live.

- Education and Upskill Expenses: With rising tuition fees and the increasing need for upskilling, salary advance loans can be helpful in covering education expenses.

- House and Vehicle Repair: Unexpected repair expenses for homes or vehicles can arise at any time. A salary advance loan can provide quick access to funds to cover such expenses.

- Payment of Bills: Salary advance loans can be used to pay off outstanding bills such as credit card bills, utility bills, or medical bills.

- Wedding Expenses: Weddings can be expensive affairs, and a salary advance loan can be useful in covering the costs associated with weddings, such as venue, catering, and decoration expenses.

Eligibility Criteria for Availing a Salary Advance Loan From Jupiter

Jupiter performs a manual check on the loan application to ensure the borrower’s creditworthiness. The Jupiter team conducts a thorough analysis of the borrower’s credit history, payment behaviour, and other risk factors before approving or declining the loan application. This manual check is done in conjunction with real-time checks to ensure that the borrower’s creditworthiness is assessed accurately.

How to Get an Salary Advance Loan from Jupiter?

With Jupiter Money, you can:

→ Get a Mini Loan up to Rs. 1.5 Lakh at 0% interest

→ Get a Personal Loan up to Rs. 5 Lakh

To get an Advance Salary Loan (Mini Loan) from Jupiter, follow these simple steps:

Step 1: Download and install the Jupiter App. Download link for the Jupiter App

Step 2: Register with your basic details and complete the KYC process.

Step 3: Click on the homepage banner/widget of on-demand salary.

Step 4: Input your salary details.

Step 5: Select your desired loan amount and tenure.

Step 6: Finally, withdraw the loan amount once approved.

By following these steps, you can easily apply and avail of the loan from Jupiter, which can help you meet your immediate financial requirements.

FAQs

Is it good to take a salary advance?

A salary advance loan can be a preferable option as compared to using a credit card. These loans can be availed of quickly, and if utilized productively, they do not affect the borrower’s financial discipline. In contrast, credit card usage can sometimes lead to uncontrolled spending and high-interest charges, creating a financial burden in the long run. By opting for a salary advance loan, borrowers can meet their financial needs while maintaining their financial stability and discipline.

What is the minimum & maximum amount that I can get with an advance salary loan from Jupiter?

The minimum loan amount that can be availed is ₹ 5000, and the maximum loan amount that can be availed is ₹ 3 lakh. The loan amount is determined based on the borrower’s monthly income, creditworthiness, and Jupiter’s risk assessment.

What will be the duration of an advanced salary loan from Jupiter?

The duration of the loan can be chosen by the borrower based on their preference. Jupiter offers loan tenures of 1 month, 3 months, or 6 months, and the borrower can select the tenure that suits them the best. However, it is important to note that the loan amount and interest rate may vary based on the chosen tenure.

How much advance loan can I get on my salary?

The loan amount that a borrower can get on their salary from Jupiter depends on various factors such as their monthly income, creditworthiness, and other risk factors determined by the Jupiter team. Based on these factors, Jupiter will perform a risk assessment and offer a loan amount that is suitable for the borrower. Therefore, the loan amount can vary from person to person and is not fixed.

How is the advance salary loan calculated?

When it comes to determining your eligibility for an advance salary loan, there is no fixed formula to calculate the loan amount you are entitled to receive. However, your monthly income is a crucial factor in this regard. While processing your loan application, the lender, such as Jupiter, evaluates whether you have sufficient income to repay the loan EMIs in a timely manner. Based on your income and other risk factors, the lender determines the loan amount that you can qualify for.

How long does it take to get approved for an advance salary loan?

Jupiter’s salary advance loan approval process is quick and hassle-free, taking as little as 3 minutes for the loan to be approved and the loan amount to be credited to the borrower’s account. With its fast processing and easy-to-use mobile app, Jupiter offers a convenient borrowing experience for those needing immediate financial assistance.

What are the repayment terms for an Advance Salary Loan?

The repayment terms for an Advance Salary Loan are designed to be flexible and convenient for the borrower. There are two options for repayment:

One-time full payment: The borrower can choose to repay the loan amount in full after a month at 0% interest. This is the easiest and most hassle-free way to repay the loan.

EMIs: The borrower can also choose to pay the loan amount back in 3 or 6 equal monthly instalments (EMIs), with interest rates as low as 1.5% per month. The first EMI will be deducted on the 5th of the next month if the user has opted for the loan in the first 20 days of the month. If the user has opted for the loan on or after the 20th of the month, the first EMI will be deducted on the 5th date of the next to next month.

In case the borrower’s mandate fails on the due date, they can repay the loan via IFT or UPI. However, if the borrower misses an EMI, they will be charged a fee of ₹ 354 (including GST), and if the payment is delayed beyond the due date, they will be charged a late fee of 0.1% of the overdue amount per day.

Overall, the repayment terms for Advance Salary Loans are designed to be flexible and easy for the borrower, with multiple options for repayment and low-interest rates.

Is there a penalty for early repayment of an Advance Salary Loan?

The Advanced Salary Loan from Jupiter has a unique advantage – there are no prepayment penalties. This means that borrowers can choose to pay off their loan before the due date without incurring any additional charges.