During an emergency, we experience a money crunch and tend to take out money from our savings, liquidate our investments, or take a loan. However, instead of liquidating your investment, you could take a loan against it. Although rare, several banks offer loans against your financial assets, such as mutual funds, shares, and other securities. It is always better to take a loan against your mutual funds than liquidate them. Read to find out how a loan against mutual fund works, what are the interest rates, and its advantages.

What is a loan against mutual funds?

When you borrow money against your mutual funds, using it as collateral, it is known as taking a loan against mutual funds. It is similar to taking a loan against your home, fixed deposit, or any other asset. In case you fail to pay, the bank or non-banking finance company (NBFC) will sell your investment to repay the loan.

It is important to note that not all banks give loans against mutual funds; only some do. Hence you must check the bank’s website before applying for such a loan.

The following are the features of loans against mutual funds:

- Instant processing: The loan against mutual funds is processed immediately after you get a lien on mutual funds from the fund house. A lien is a document that gives the bank or NBFC the right to sell the units in case of a default. You must physically visit the fund house’s office to get a lien on the bank’s name.

- Instant money: The money on the loan is instantly credited to your account after you submit the lien document.

- No liquidation: Even after you get the loan on mutual funds, you remain invested in them. The fund house will not liquidate your mutual fund investments.

- Continue to earn returns: Even if you pledge your mutual funds, you will earn a return on them as you are invested in the scheme. Just because you pledged the units doesn’t mean you will stop earning a return on it.

- Maximum limit of the loan: The quantum of the loan you get depends on the type of mutual fund you are invested in. For example, for equity mutual funds, the maximum loan you can get is 50% of the net asset value (NAV). In the case of debt mutual funds, it is 80% of the NAV. However, this varies across banks and NBFCs. Some banks offer up to 60% for equity funds and 85% for debt funds.

- The lower and upper limit of the loan: The minimum and maximum amount of loan you can get on mutual funds is fixed by banks and NBFCs. The minimum amount of loan you have to take against mutual funds is Rs 50,000, and the maximum is Rs 20 lakhs in the case of equity funds and Rs 1 crore for debt funds. The limit is higher in the case of NBFCs and can go up to Rs 25 lakhs for equity funds and Rs 10 crores for debt funds.

- Interest rate: The interest rate for mutual fund loans is lower than for personal or credit card loans. Hence, they are considered more affordable than other loans. The interest rate on mutual fund loans is usually around 11-15% per annum.

- Processing fee: The processing fee for mutual fund loans is usually between 0-1%, which is lesser than for other kinds of loans.

- Loan against approved schemes only: Not all mutual fund schemes are eligible for taking a loan. You must check the bank’s website to find out which schemes are eligible for taking a loan.

- Eligibility: To get a loan against a mutual fund, you must be a resident of India. NRIs, sole proprietors, partnership firms, private trusts, and public and private companies are also eligible to get a loan. However, minors are not eligible to get a loan.

How does a loan against mutual funds work?

When you take a loan against mutual funds, you are using it as collateral. This means the bank will use it as collateral until you repay back the entire loan. So this means you can continue to invest in the scheme, and you will earn a return and dividends as usual, but you cannot sell them.

Even if you want to book profits or withdraw your money from a mutual fund, you will not be able to do it until you repay back the entire loan to the bank or NBFC. Once you repay the loan, the bank will ask the fund house to release the lien. Upon releasing the lien, you are free to redeem your mutual funds.

In case you paid the loan partially, you can request the bank to partially release the lien on your mutual funds. This will free up some units while the rest remain under the control of the lender (bank or NBFC). If you fail to repay your loan, the bank will be free to sell the units to get back its money. In this scenario, the bank will ask the fund house to redeem the units and send a cheque against its name. The bank will deposit this cheque against your loan to complete your liability to the bank.

How to apply for a loan against mutual funds?

To apply for a loan against mutual funds, you must log in to your net banking facility or visit the nearest branch of a bank or NBFC.

Then, apply for a loan by submitting the KYC documents such as PAN Card and Aadhar Card.

The bank will verify your details, and upon successful verification, it will start your loan processing.

Next, the bank will ask the registrar (CAMS or Karvy) to mark a lien on the number of units against which you are taking a loan.

Upon the successful placing of the lien, the bank will receive a lien document from the registrar, and it will then release the funds. You can withdraw the money as and when you want, and the bank will charge interest only on the funds withdrawn.

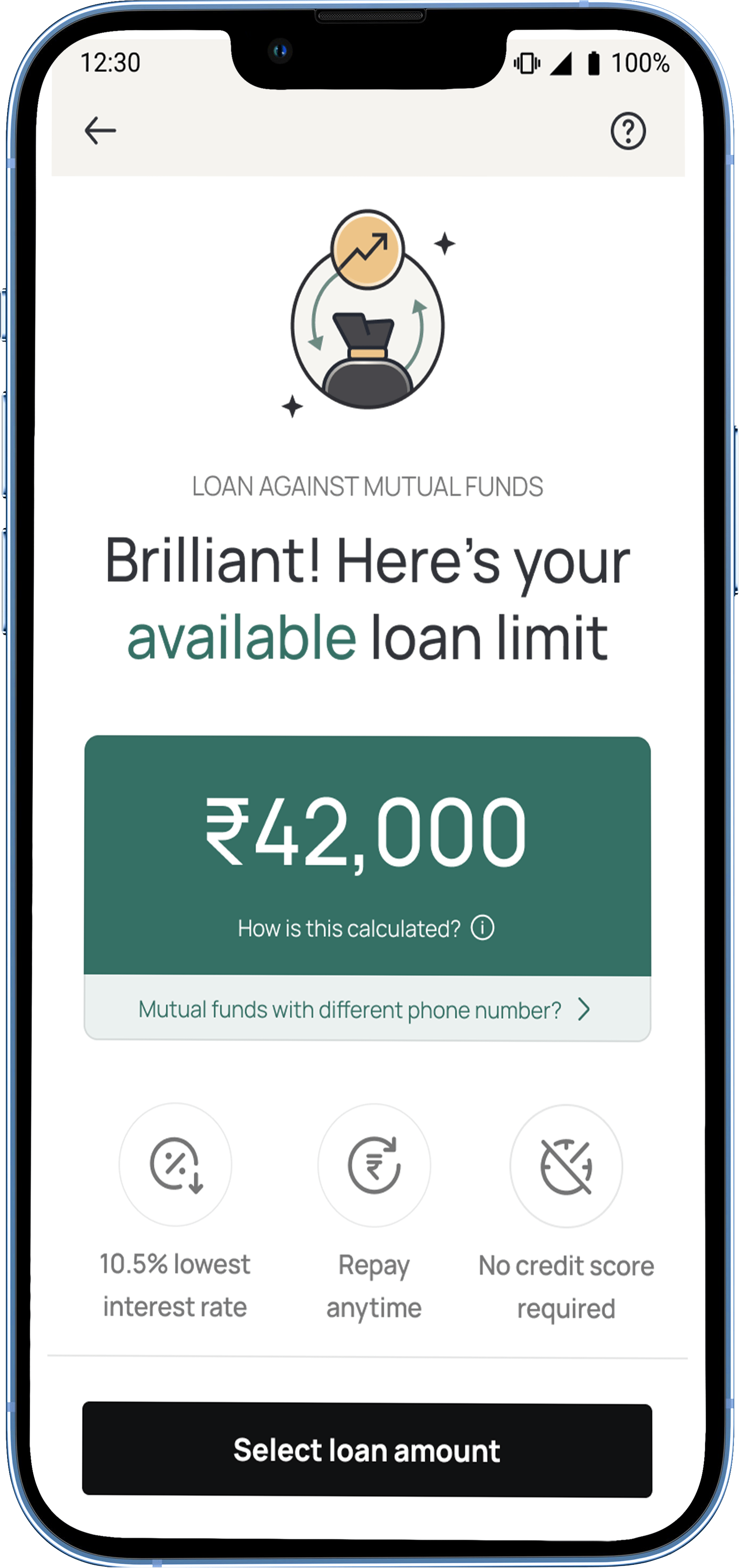

Get Loan Against Mutual Funds on Jupiter

- Get up to ₹2 crores with a Loan Against Mutual Funds

- No need to sell your funds

- Lower interest rate than Personal Loans

- No credit score required

- Your Mutual Funds keep earning returns

Benefits of availing of a loan

- Lower interest rates: A loan against mutual funds is a secured loan, so this means the interest rate on this loan is lower than unsecured loans such as credit cards and personal loans. Moreover, the interest rates can go lower based on the value of your mutual funds and the portfolio. A good portfolio can have a lower interest rate.

- Easy processing: A loan against mutual funds is given solely based on the securities you hold. The bank doesn’t check your credit score or ask for income proof, as the loan is given against the value of mutual funds. Hence these loans are easily processed, and the money is credited to your account within three to five business days. Hence, this makes an excellent alternative to borrowing money during emergencies.

- Continued returns: A loan against mutual funds doesn’t mean you are selling your units. You are still invested in them and will continue to earn returns and dividends on them. The bank has no claim on the returns or dividend payments if you pay the instalments on time. You can use the dividends you receive from their securities to pay off the loan instalments.

- Flexible repayment options: You can repay back the loan against mutual funds in two ways, through overdraft or demand.in an overdraft facility, the bank will limit the amount you can withdraw against the pledged mutual funds. The interest is charged based on the amount withdrawn. The banks adjust this limit every year based on the current value of the mutual funds. So, if the value of the fund increases, the borrowing limit also increases. In the overdraft facility, you can choose to pay interest every month and the principal at the end of the loan tenure. In the case of the demand facility, you will borrow the entire amount at once and pay the instalments (principal and interest) every month throughout the tenure of the loan.

Disadvantages of availing of a loan

- Low loan amount: The lender gets to decide the loan amount, interest rate, and tenure depending on the value of the mutual funds. Banks usually give only up to 50% of the current value of equity mutual funds and 80% of debt mutual funds as loans. Hence you won’t be getting a high amount of loan against your mutual fund investments.

- Restriction on selling mutual funds: You won’t be able to sell your mutual fund units that are placed under lien until you repay back the loan in full. In case your fund is not performing well, you won’t be able to rebalance your portfolio by selling the units. This can lead to a drastic fall in the overall portfolio returns.

- Limited banks and limited schemes: Not all mutual fund schemes qualify for a loan. Banks have a list of schemes against which they offer a loan. Only if you hold units of those schemes can you take a loan from the bank.

- Not suitable for home loans: A home loan’s interest rate is lower by 2-3% than a mutual fund loan. Moreover, banks offer limited amounts against mutual funds as loans, which is not sufficient for buying a home. Hence mutual fund loans are not suitable for buying a home.

Banks offering loans against securities and their interest rates

The following is a list of some of the top banks and NBFCs that offer loans against mutual funds. Last updated on 13th June 2023

| Bank or NBFC | Interest Rate | Minimum Processing fee |

| HDFC | 10-15% | 0.5% |

| SBI | 10-11% | 0.5% |

| Bank of Baroda | 9.90-11.25% | 0.35% |

| ICICI Bank | 6.5-19.5% | 2% |

| Axis Bank | Starting from 11.49% p.a | 0.5% |

| IndusInd Bank | 9-11.2% | 1% |

| Bajaj Finance | 8-15% | 4.72% |

| Tata Capital | 8-20% | Up to 5% |

Conclusion

A loan against mutual funds is a better option than redeeming it. This is because you will continue to earn interest, dividends, and returns, despite pledging them. Moreover, the interest rate on this loan is lower than personal and credit card loans, and the processing time is also much lower. However, it is important to note that a loan against fixed deposits or gold is cheaper than a loan against mutual funds. Hence it is best to evaluate all the options before you take a loan against mutual funds.

Frequently Asked Questions

Can I get a loan against my mutual fund?

Yes, you can get a loan against your mutual funds. Many banks, including SBI, ICICI, Axis, HDFC, and IndusInd, offer such loans. You can also approach an NBFC such as Tata Capital or Bajaj Finance to get a loan against your mutual funds. Before visiting a branch personally, do check their websites for eligible securities.

What is the interest rate for loans against mutual funds?

The loan against mutual funds from banks is usually in the range of 8-13%, and for NBFCs, it can go up to 20% per annum.

Can we take a loan against SIP?

Yes, you can take a loan against your mutual fund SIP. The bank decides the loan amount, interest rate, and tenure based on the value of the funds you hold and its portfolio. You can also negotiate with a bank to increase the loan value if you have a good credit score.

Can we keep mutual funds as collateral?

You can use your mutual funds as collateral to get a loan from a bank. Although not all banks give such loans, many major banks offer loans against mutual funds. You can go to your bank’s website to check whether they are giving a loan against mutual funds and the list of eligible schemes.

What is a loan against mutual funds and shares?

Instead of redeeming or selling your mutual funds and shares, you can take a loan against them. You will use these securities as collateral and take a loan from a bank. The bank will give a loan on 50-80% of the value of securities that you hold. The interest rates usually lie between 8-13% and are lower than personal and credit card loans. The best part about taking a loan against mutual funds is that you will continue to receive returns and dividends from it. However, you won’t be able to sell to pledged units till you repay back the entire loan.

How does a loan against a mutual fund work?

Taking a loan against mutual funds is similar to taking a personal or credit card loan but much simpler. The processing time and interest rates for this loan are comparatively lower. Even though you take a loan against your mutual funds, you can continue to invest and earn interest and dividends from them. However, you won’t be able to sell them till you repay the loan.

As you repay the loan, the bank will release the lien on the securities, which means you can sell them as and when you want. When you take a loan against mutual funds, the banks hold the right to sell them in case of default. This means that when you can’t pay your interest and principal, the bank will sell them to complete your loan.

What is the borrowing limit for mutual funds?

The minimum limit for taking a loan against mutual funds is Rs. 50,000, and the maximum is Rs. 20 lakhs in the case of equity funds and Rs. 1 crore for debt funds. The limit is higher for NBFC and can go up to Rs. 25 lakhs for equity funds and Rs 10 crores for debt funds.

Is a loan against securities a good idea?

Taking a loan against our securities is better than selling them in case of emergencies. This way, you can spread out your instalments over a period of time and still hold your investments. Since you will be invested in the scheme or security, it will grow in value, and you will be able to accumulate wealth for your financial goals.

What is the negative impact of taking a loan?

Taking a loan against mutual funds has several disadvantages. The banks will give only up to 50% of the value for equity funds and 80% for debt funds. You won’t get loans on all securities; banks have a list of eligible securities and schemes against which you can get a loan. Moreover, you will not be able to sell your mutual funds in case of underperformance, as the bank will hold a lien on it.

Will I continue to receive dividends if I take a loan against mutual funds?

You will continue to earn profits and receive dividends against your mutual funds even if you take a loan on them. The bank only holds a lien on them, which means that in case of default, the bank has the right to sell them. Until then, you can invest and receive dividends and interest on mutual funds.