Get salary accounts for your team See benefits

Table of Contents

ToggleAccording to the Income Tax Act, 1961, payees are required to pay a specified amount as Tax Deducted at Source (or TDS). It is applicable on professional fees, dividends, interest from securities, royalty, and commission.

Before the advent of the internet, TDS return filing was a challenging task. But thanks to the TDS e-payment system, the process has become a lot more convenient.

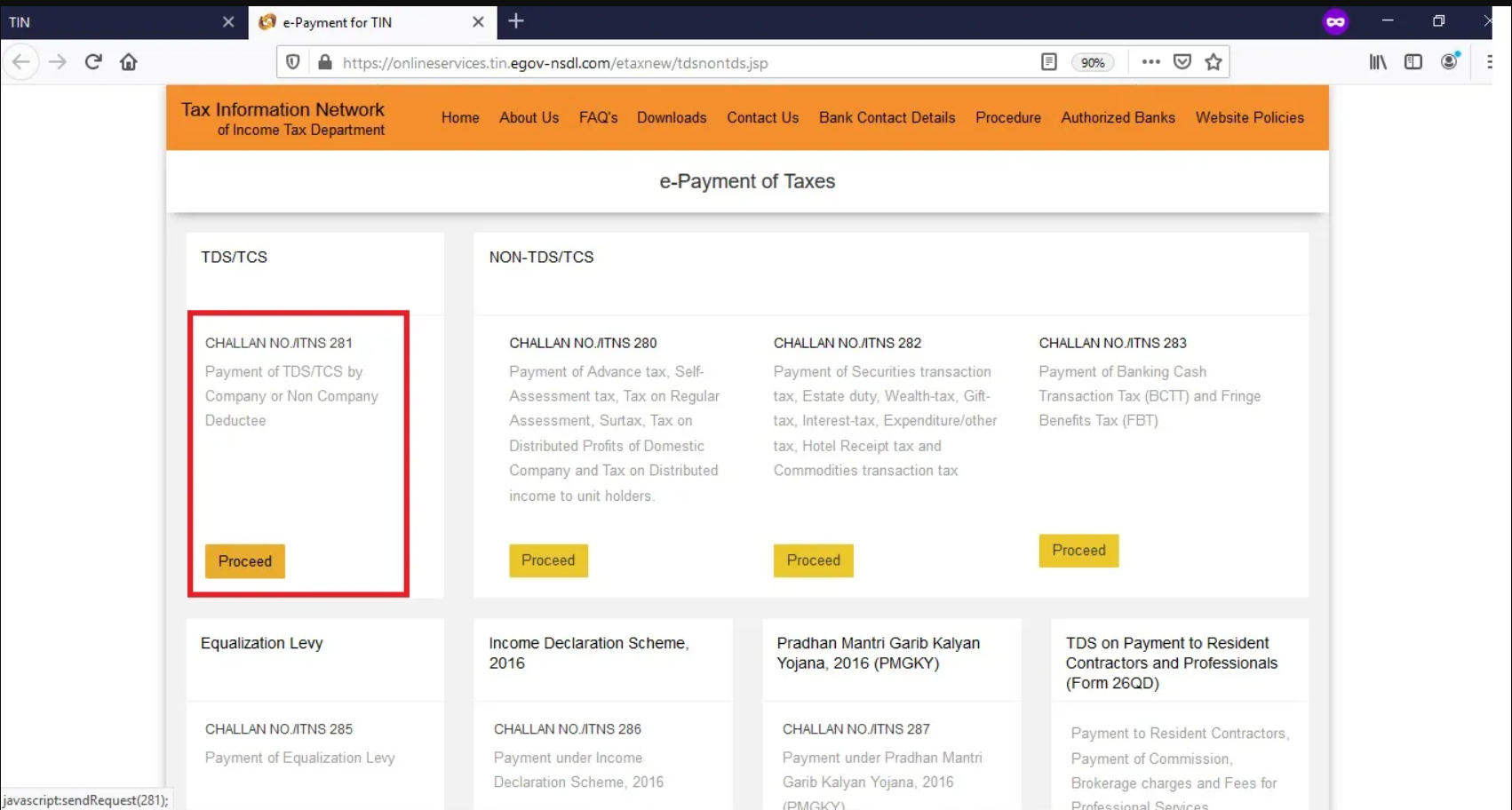

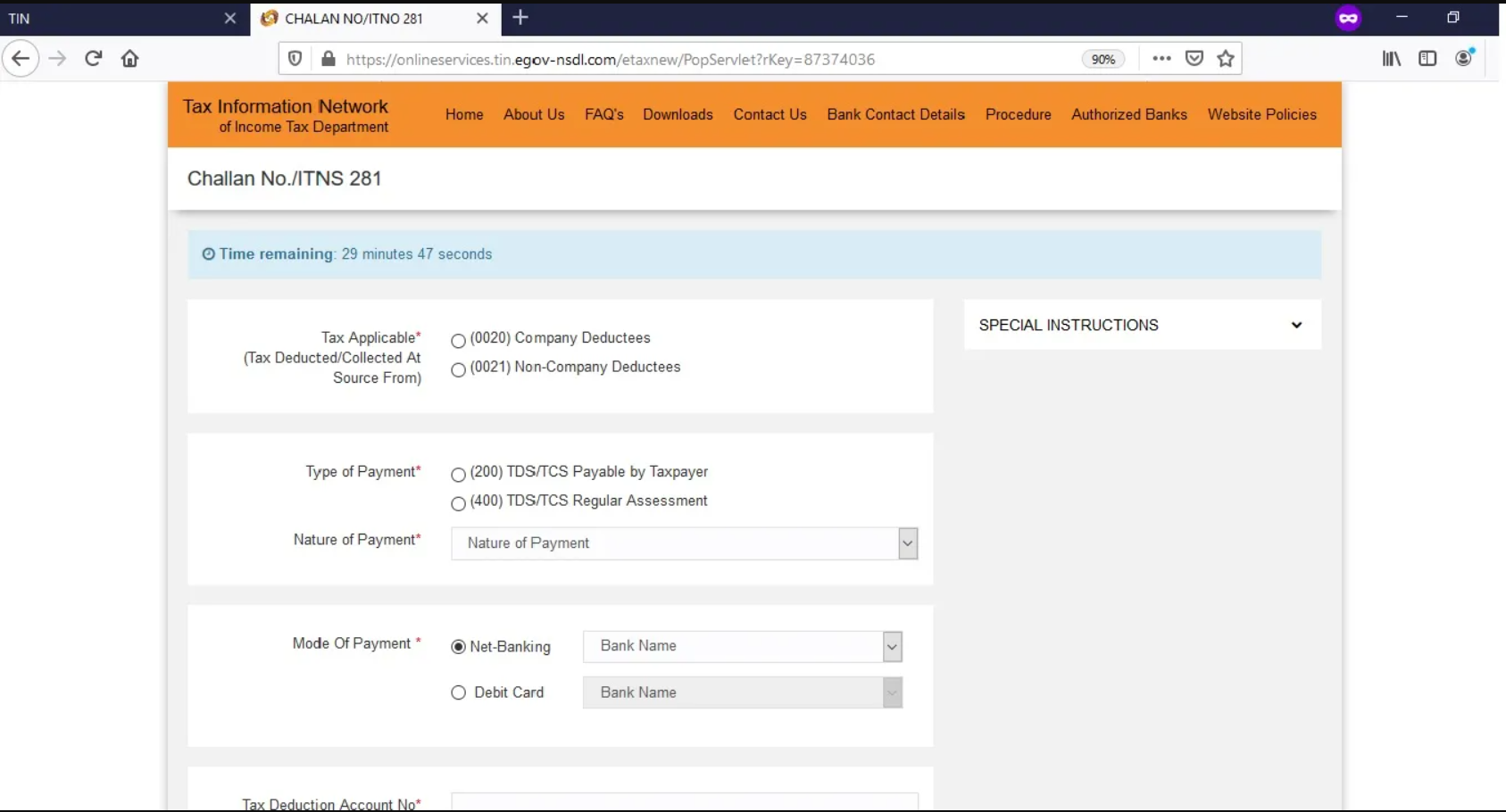

Using the official NSDL website, you can easily pay TDS online using the 8-step process outlined in the next section. Therefore, by choosing to deposit TDS online, you are saving a considerable amount of time and effort.

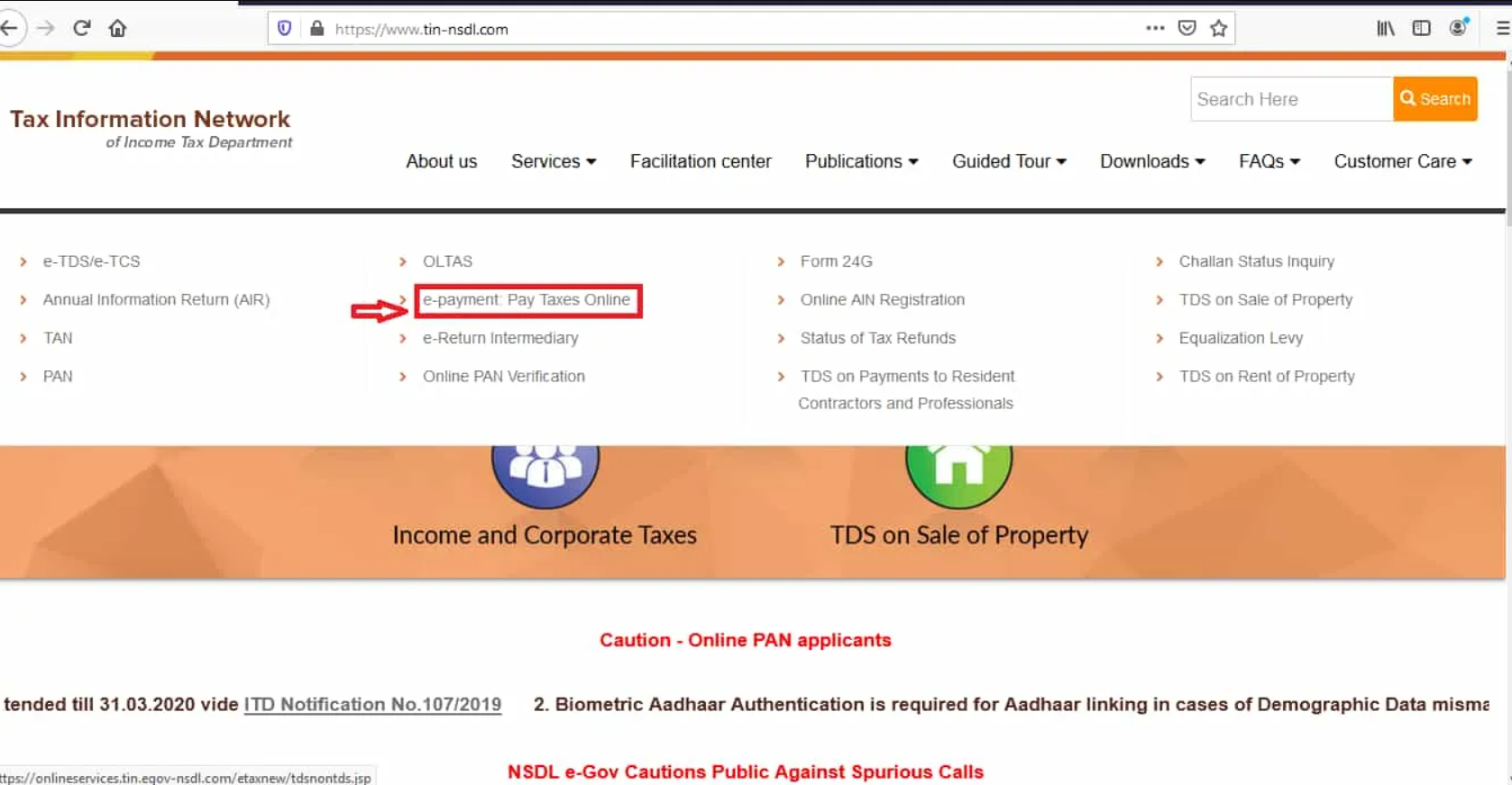

To make the TDS payment online, you need to visit the official website of National Securities Depository Limited (NSDL).

Next, input the captcha code and hit ‘Proceed’.

What happens if you don’t file TDS on time? Let’s find out:

Government assessees and other assessees have different due dates for TDS payment as shown below:

| Remittance of taxes without challan | Day of deduction |

| Remittance of taxes with challan | 7th of the following month |

| Taxes charged on perquisites (remitted by employer) | 7th of the following month |

| Taxes deductible in March | 30th April of the following year |

| Taxes deductible in other months | 7th of the following month |

You also have the option to make quarterly TDS payments, if permitted by an Assessing Officer and the Joint Commissioner.

Listed below are TDS return due dates for quarterly payments:

| First quarter, ending June 30th | July 7th |

| Second quarter, ending September 30th | October 7th |

| Third quarter, ending December 31st | January 7th |

| Fourth quarter, ending March 31st | April 30th |

Here are some advantages of TDS challan payment online:

Listed below are the steps to check your TDS payment status online:

Here’s another method of checking the TDS payment status:

You can use net banking to view your TDS payment status as well. That said, your net banking portal must have your PAN details for you to view the status successfully.

This is what happens if you delay TDS payment online:

In this case, you will be charged a 1% interest rate per month on the due amount. The duration is from the date when the tax was supposed to be deducted to the date when it is actually deducted.

If there is a delay after the deduction, you will be charged a 1.5% interest rate per month on the due amount. This interest is charged for every month (or a part of it), during which the TDS payment is delayed. It begins on the tax deduction date.

No, only your employer can issue Form 16. You cannot download it from the website.

Visit this site and log in to your account. Under ‘My Account’, you will find Form 26AS (or tax credit). Download the file in the PDF format.

If you own a PAN card, you can use your net banking account to check 26AS. First, ensure that your PAN card details are added to the internet banking account. Then, you only need to select Form 26AS to check the status.

Yes, it is. You can use your date of incorporation, date of birth, password, and user ID to log in to the e-filing website. Under ‘My Account’, you will find ‘View Form 26AS’ from the drop-down. Click on it to check the details.

Listed below are two methods to pay TDS through your bank:

Yes. While choosing the payment method, select ‘Credit card’. After the transaction is over, you will immediately receive an acknowledgement slip for the same.

This provision under the Income Tax Act, 1961 has been set up to prevent or reduce tax evasion. It is directly paid to the governing authority.

If you missed the deadline, you can still pay the delayed TDS by following the same steps for depositing TDS online. However, you will be charged either 1% or 1.5% interest on the due amount per month.

Priyanka Rao is a content strategist for Jupiter.Money, and specializes in writing on topics related to finance, banking, budgeting, salary & wages, and other financial matters. She has a passion for creating engaging content that resonates with audiences across various digital platforms. In her free time, Priyanka enjoys traveling and reading, which allows her to gain new perspectives and inspiration for her work. With a keen eye for detail and a creative mindset, Priyanka is committed to creating content that connects well with her readers, enhancing their digital experiences.

View all posts

Powerd by Issued by