A company raises funds to run and expand its business either from its shareholders or from creditors. It can raise short or long-term debts from the creditors. While taking debt isn’t wrong, it is important to assess a company’s ability to repay its debt, especially the long-term ones. Solvency ratios are an important indicator to determine a company’s long-term financial health and how effectively it can pay back its debt. Read to find out more about the different types of solvency ratios and how to calculate them.

What are solvency ratios?

An investor must assess a company’s creditworthiness before investing in it, and solvency ratios help with the same. They help in assessing a company’s ability to repay its long-term debt obligations. By understanding whether a company can repay its long-term debt or not, you can assess its current financial health. Not just investors, lenders, suppliers, and even customers of a business can use this ratio to ascertain whether a company is able to fulfil its fixed financial obligations.

It is important to check the solvency ratios of a company from time to time to understand its financial stability. A business owner must also check the solvency ratios to decide whether the capital structure of the company needs a rejig or whether or not to take additional debt.

Solvency ratios also help in understanding how the financial obligations of a business affect its cash flows and also help in projecting future cash flows. They also help in evaluating the financial risk by assessing how a company distributes its cashflows to cover long-term liabilities.

Solvency ratios are calculated using several parameters, including the short and long-term debts, interest, and operating profits of a business. Let us now look at the different types of solvency ratios which are used to analyse a company’s financial health.

Types of solvency ratios

Interest coverage ratio

The interest coverage ratio is a solvency ratio that determines how well a company can pay its interest obligations. It is used by lenders, creditors, and investors to analyse whether the company is generating enough profit to pay its interest expense. The following is the formula to calculate the interest coverage ratio:

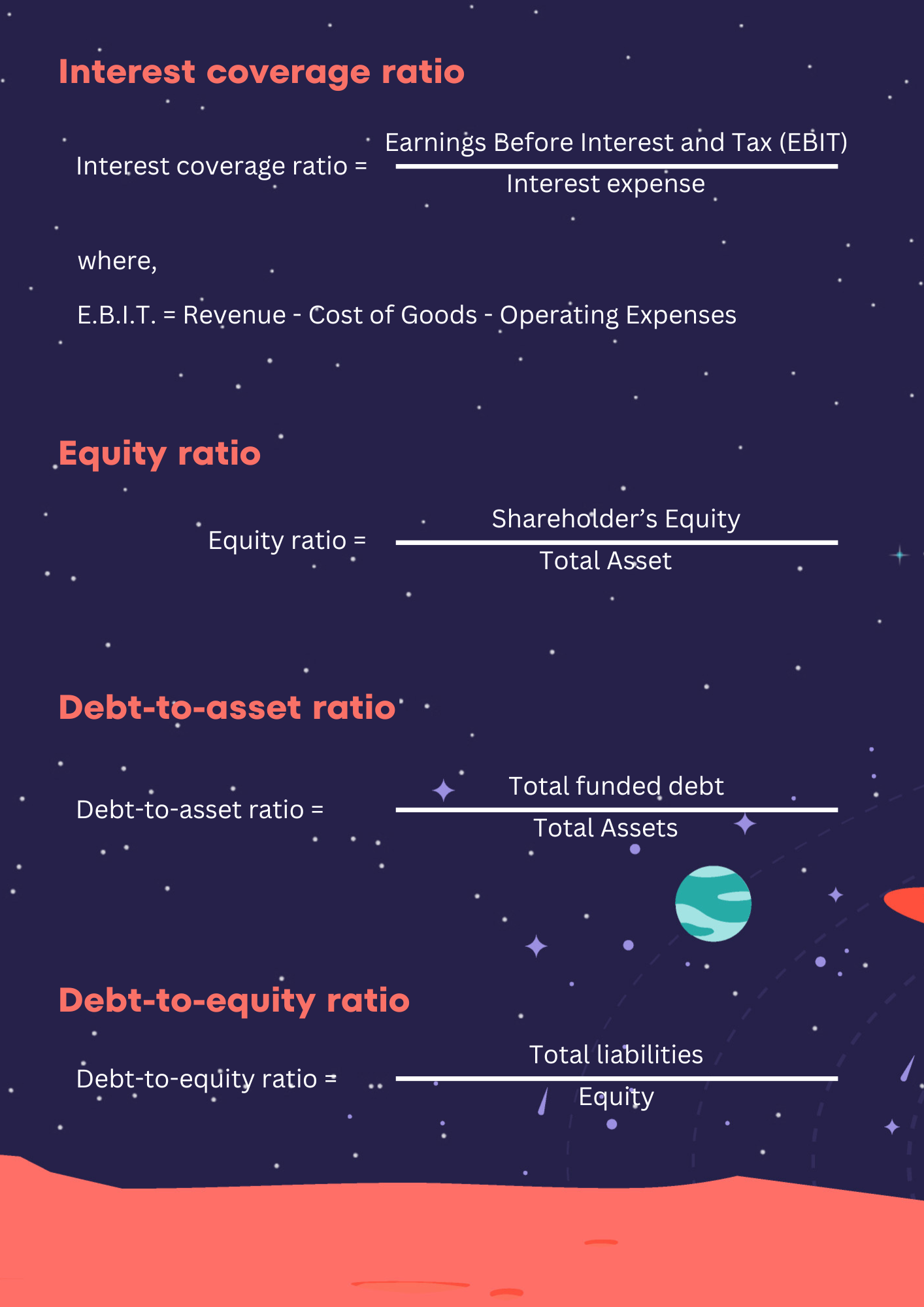

Interest coverage ratio = Earnings Before Interest and Tax (EBIT) / Interest expense.

Where EBIT is the operating profit of the company

Interest expense is the interest payable on short and long-term borrowings of the company.

Let’s understand this better with an example if a company has a revenue of Rs 100 crore, cost of goods of Rs 40 crore, operating expenses of Rs 10 crore, and interest expense of Rs 20 crore. Then, the interest coverage ratio is calculated as follows.

EBIT = Revenue (Rs 100 crore) – Cost of goods (Rs 40 crore) – operating expenses (Rs 10 crore).

EBIT = Rs 50 crore.

Interest coverage ratio = Rs 50 crore / Rs 20 crore

Interest coverage ratio = 2.5x

This means the company is able to generate 2.5 times the profits to meet the current interest expense. A high-interest coverage ratio is always better as it indicates good financial health and also gives the company enough room to accommodate the volatility in interest rate changes. In contrast, a low ratio indicates that the company is generating low operating profits to meet its interest payments and is more vulnerable to interest rate fluctuations.

Debt-to-equity ratio

The debt-to-equity ratio determines what is the proportion of total debt against the company’s equity. In other words, it tells the contribution of shareholders and creditors to the total capital employed by the company. The following is the formula to calculate the debt-to-equity ratio:

Debt-to-equity ratio = Total liabilities / Equity

Where, total liabilities are the total debt of the company, including short-term debt, long-term debt and other fixed payments.

Equity or shareholders equity is the total sum of money the company owes to the shareholders.

Let’s see how the debt-to-equity ratio is calculated. If a company has total liabilities of Rs 500 crores and its shareholders equity is Rs 1,500 crores. Then, the debt-to-equity ratio is calculated as follows:

Debt-to-equity ratio = Rs 500 crores / Rs 1,500 crores

Debt-to-equity ratio = 0.33

This means a company is using 33% of the capital from borrowed funds and the rest from its own funds. The debt-to-equity ratio is a metric that helps determine the financial health of a company. It tells how much debt the company is using to fund its business. If it uses high debt, then the shareholders are at high risk. This is because creditors have the primary right to the company’s assets in case of liquidation.

Moreover, a high debt indicates high fixed expenses such as interest, which means the profits of the company are lowered. The ideal debt-to-equity ratio is around 2x or lower. Anything higher will indicate that the company is overleveraged. If the ratio is below 1x, then the company’s financial health is excellent.

The debt-to-equity ratio is mostly used by prospective investors and creditors to assess the company’s financial health.

Equity ratio

The equity ratio is a solvency ratio that measures the value of assets financed using owners’ capital or shareholder’s equity. In other words, it measures whether the assets the company uses are funded through borrowed capital or owner’s capital. The following is the formula to calculate the equity ratio:

Equity ratio = Shareholder’s equity / Total assets

Where equity or shareholders equity is the total sum of money the company owes to the shareholders.

Total assets are the sum total of fixed and current assets of the company.

Let’s see how the equity ratio is calculated with the help of an example. If a company’s assets are Rs 15,000 crores, and its shareholder’s equity is Rs 7,000 crores. Then, the equity ratio is calculated as follows:

Equity ratio = Rs 7,000 crores / Rs 15,000 crores

Equity ratio = 0.58

This means the company funds its assets primarily through equity. Hence, it funds its assets through 42% debt and 58% equity. A company with an equity ratio below 0.5 is considered leveraged, and if it is above 0.5, then it is considered a conservative company as it funds the majority of its assets through its own funds. Conservative companies are less risky as they know how to manage their funds without taking on substantial debt.

This ratio holds importance to both investors and lenders. Investors prefer a less risky company over a leveraged company, and lenders are willing to give debt to companies that are under-leveraged. Moreover, if owner’s equity is used to buy assets, investors will be sure that the company is reinvesting their earnings into the company instead of taking debt or paying interest. A high equity ratio also reflects a company’s overall financial strength and its good solvency position.

Debt-to-asset ratio

Debt to asset ratio is a financial metric that helps us understand the degree to which the company’s operations are funded through interest-bearing debt. In other words, it tells us to what extent the company uses debt and whether it is over-leveraged or under-leveraged. The following is the formula to calculate the debt-to-asset ratio:

Debt to asset ratio = Total Funded Debt / Total Assets

Where total funded debt is the short and long-term debt that has interest obligations.

Total assets are the sum total of fixed and current assets of the company.

Let’s see how the debt-to-asset ratio is calculated with the help of an example. If a company’s total assets are Rs 15,000 crores, and the total funded debt is Rs 6,000 crores. Then, the debt-to-asset ratio is calculated as follows:

Debt-to-asset ratio = Rs 6,000 crores / Rs 15,000 crores

Debt-to-asset ratio = 0.4

This means that 40% of the assets are funded through debt. A high ratio would mean the company’s debt is high, which increases the risk for investors and potential lenders. Moreover, if the funded debt is high, interest obligations will also be high, and hence, the net profit will be lower.

The debt-to-asset ratio also tells the company’s debt repayment ability. A low debt will indicate there are higher chances of the company meeting its debt obligations. Moreover, investors can use this ratio to analyse the company’s solvency and whether or not it will meet its current and future debt obligations.

A high debt-to-asset ratio is not necessarily bad, as certain industries usually tend to have a high ratio. However, an increasing ratio isn’t a good sign as it would mean the company might default on its loan repayments at some point in the future.

A ratio of 1 would mean the company’s assets are funded through debt. If it is above 1, it would mean the debt is higher than its assets, and if it is below 1, it would mean the company’s assets are higher and has the potential to meet its debt obligation, even if the company has to liquidate its assets.

Advantages and disadvantages of solvency ratios

Knowing the advantages and limitations of solvency ratios will help you make better-informed decisions. Following are the advantages and limitations of solvency ratios.

Advantages of solvency ratios

Assess financial health: Solvency ratios assess the financial health of a business by evaluating the company’s ability to repay its long-term financial obligations. To do so, you must consider the total debt, assets, interest expense and shareholders’ equity and calculate the solvency ratios.

Evaluate performance: When solvency ratios are used in tandem with a company’s cashflows, it is easy to determine a company’s financial performance. They help in assessing a company’s capacity to earn revenues to pay off debt and interest obligations.

Aids in making investing decisions: Investors and creditors use solvency ratios to determine whether a company is worth investing in. Through the solvency ratios, you can also assess the risk in a company. If the ratio is favourable, it creates a positive sentiment, which, in turn, increases the share price of a company.

Limitations of solvency ratios

Irrational results: Solvency ratios do not show the entire picture of a company. A company may have a low debt and favourable solvency ratios. However, it could have poor cash management, with higher payables, which could ultimately make the company go bankrupt.

New funding: A company can obtain new funds from shares, bonds, or even bank overdrafts. However, this is not taken into consideration by solvency ratios. If the solvency ratios are poor, then it doesn’t mean the company cannot raise funds anymore to run its business.

Needs to be used along with other ratios: You can never use solvency ratios in isolation. It has to be used along with other ratios to determine the accurate financial position and health of a business.

Extensive and time-consuming process: There are four kinds of solvency ratios, and calculating them can be a time-consuming process. Moreover, you cannot make a decision based on one year’s data. You must calculate solvency ratios for a certain period of time to understand the pattern. Moreover, data regarding the debt of private companies is not easily available, making the calculation of solvency ratios even more challenging.

Conclusion

To conclude, although solvency ratios give you a picture of a company’s financial health and its ability to repay debt, you cannot rely solely on them. You must use other financial metrics, such as cashflows and profit and loss ratios, to ascertain a company’s financial position.

Frequently Asked Questions

What is the solvency ratio and its types?

Solvency ratios are financial ratios that help in assessing a company’s ability to repay a loan and its creditworthiness. There are four different types of solvency ratios, namely, debt-to-equity ratio, interest coverage ratio, equity ratio, and debt-to-asset ratio.

How many solvency ratios are there?

Primarily, there are four different types of solvency ratios. They are the debt-to-equity ratio, interest coverage ratio, equity ratio, and debt-to-asset ratio. Each of them has a different purpose, but all of them together help in assessing a company’s ability to repay its loans and how much debt the company is using.

Is the current ratio a solvency ratio?

The current ratio is a liquidity ratio and not a solvency ratio. Liquidity ratios help in determining the company’s ability to repay short-term obligations such as account payables.

What are the factors affecting solvency?

A company’s solvency is affected by low cash flow, low profitability, high debt, and an increase in expenses.