Get salary accounts for your team See benefits

Table of Contents

ToggleRunning a business in India is a complex undertaking, and one of the most important aspects of any successful operation is payroll management. Payroll involves the process of paying employees for their work, as well as managing employee benefits, deductions, and records. But what exactly is payroll and how can you ensure that your payroll system runs smoothly? This article provides an overview of the basics of payroll in India and offers a comprehensive guide to managing payroll effectively.

Payroll is a term that refers to the process of managing and calculating employees’ salaries, wages, and other related benefits. It can be a complex task that requires careful attention to detail and accuracy. In today’s modern workplace, most businesses use software or outsourcing companies to handle their payroll needs.

There are various components that make up payroll processing. Firstly, it involves tracking employee hours worked and calculating the appropriate pay rates based on things like overtime and shift differentials. Additionally, deductions must be made for taxes, insurance premiums, retirement contributions, and any other relevant expenses.

Payroll also includes compliance with laws regarding minimum wage requirements, overtime rules, tax withholding procedures, and more. Companies must stay up-to-date with these regulations to avoid penalties or legal issues down the line.

To determine an employee’s pay in India, you can use the following equation:

Net Pay = Gross Salary – Gross Deduction

Gross Salary refers to the total income earned by the employee, which includes their basic salary, house rent allowance (HRA), dearness allowance (DA), various allowances, and any one-time payments or incentives like reimbursements, arrears, bonuses, etc.

On the other hand, Gross Deduction is the sum of different deductions, such as professional tax, employees’ state insurance (ESI), public provident fund (PPF), income tax, insurance, leave adjustments, and any one-time deductions like loan recovery.

By subtracting the total deductions from the gross salary, you cancalculate the employee’s salary, which is the actual amount they will receive.

Set up your payroll in 5 minutes

With sumHR, you will get automatic payroll calculations, accurate tax compliances & always on time results. sumHR is a cloud-based free payroll software that will reduce payroll chaos and delivers timely salary payments, for all sizes of business.

Determining the payroll of employees can prove to be a daunting task for any organization, given the numerous steps and components involved. Generally, the payroll process can be categorized into three stages, namely Pre-payroll, Actual payroll calculation, and Post-payroll. Let’s delve into each stage to gain a better understanding.

During the initial stage, you would typically set up policies, define various components, and collect payroll inputs from all relevant sources. This phase can be further broken down into the following steps.

At the heart of any payroll process lies the need to establish clear policies pertaining to attendance, leave, benefits, and payroll. These policies encompass all the factors that contribute to an employee’s salary. To ensure consistency in the payroll process, it is essential to have these policies pre-approved by the management. Since policy changes occur infrequently, there is no need to perform this step repeatedly in every cycle. Fortunately, with the advent of online payroll software, it is now possible to configure a wide range of policies and salary structures for employees in line with the specific requirements of the organization. This can significantly streamline the payroll process and increase efficiency.

After defining the policies, the next step in the payroll process is to gather all the necessary data from various departments and managers to calculate the employee’s salary. This data includes attendance records, leave details, performance evaluations, salary revisions, loan recoveries, transportation expenses, and income tax information. For larger organizations, this data can be voluminous, and manually collecting and processing it can be an overwhelming task.

After collecting all the required data, the next step is to double-check its accuracy and compliance with regulatory laws. For large data sets, statistical methods may be necessary to ensure accuracy. This step also involves verifying the count of active and inactive employees. This is a critical and proactive step in reducing errors and improving the accuracy of payroll processing. By performing this step diligently, the subsequent payroll calculations become a relatively straightforward task.

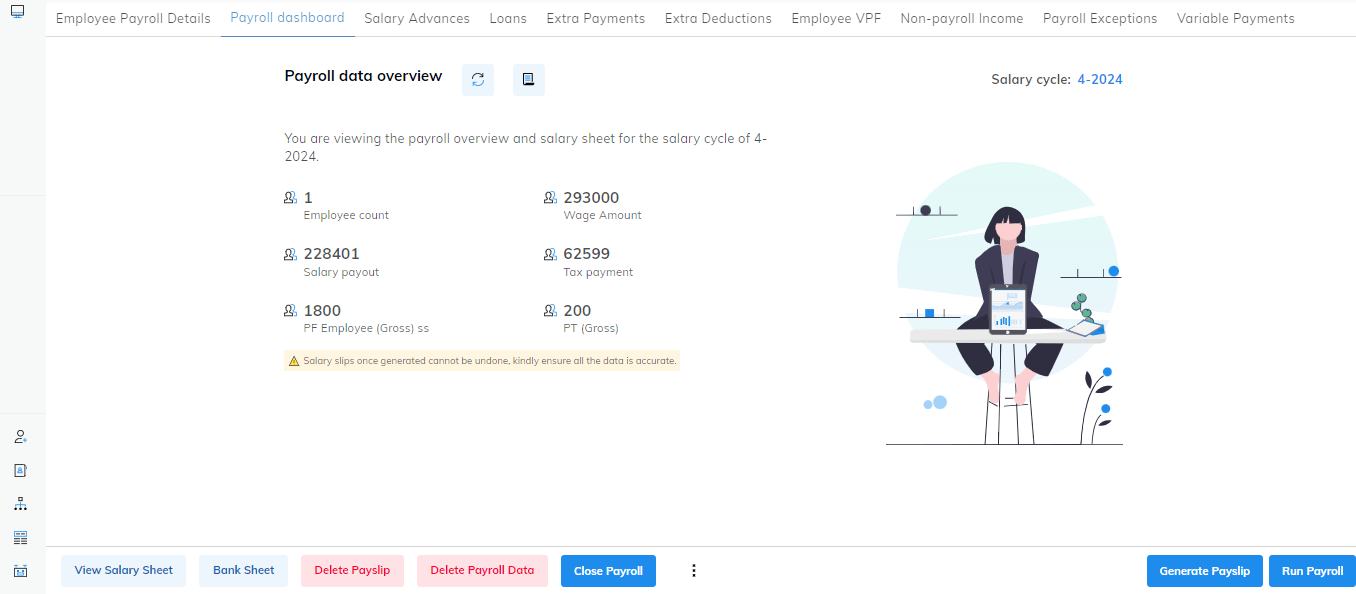

Once all the necessary data inputs have been collected and validated, the actual payroll process can begin. During this stage, the employee’s salary is calculated based on the income and deduction components. The deduction components can be categorized as either statutory or non-statutory.

During this step, all the previously collected data is input into the payroll system or Excel sheet. The outcome of this process is the calculation of addition and deduction components for each employee, based on various factors such as attendance, leave, and statutory laws. However, using an Excel-based method can be prone to errors, and as the organization grows, the verification and reconciliation of data become increasingly difficult and time-consuming.

In HR, statutory compliance refers to adhering to the regulatory laws established by the government. During payroll calculation, it is crucial to ensure that all statutory deductions are made in accordance with the laws, and that the appropriate amount is submitted to the relevant authorities.

While some of these regulations are uniform throughout India, such as the Employees’ State Insurance Fund (ESI), Provident Fund (PF), Tax Deducted at Source (TDS), Professional Tax (PT), and Gratuity, certain rules, such as professional tax, may differ from state to state. Failure to comply with these regulations may have severe financial implications for businesses.

After completing the actual payroll calculation, the next step is to reconcile the data of the current month with the previous month’s data to ensure its accuracy. This involves checking various details such as employee count, working hours, deductions, salary amount, overtime hours, and employee leaves. The purpose of reconciliation is to make sure that all the necessary data is included and that all the irrelevant data is excluded from the payroll processing. Some of the key aspects that are typically checked during reconciliation are:

After finalizing the payroll calculation and ensuring its accuracy through reconciliation, the next step is to release payroll, where employees’ salaries are paid out. Organizations have different methods of paying their employees, such as cash, cheque or bank transfer. Bank transfer is the most commonly used method where the salary is directly deposited into the employees’ bank accounts. However, preparing a bank funding file and submitting it to the bank for transactions can be a tedious process that requires bank ID, account number, salary total, etc.

To simplify this process, consider using Jupiter’s Pro Salary Account as the default salary account for your organization. Jupiter provides direct transfers without leaving the platform, and offers various other benefits. Contact Jupiter to learn more about how you can switch to their service today.

After paying the employees, the next step is to account for the payroll. This involves recording the transactions as expenses in the company’s financial records, which includes the employee’s earnings and deductions such as taxes. Cloud-based payroll applications typically offer integrated accounting solutions with third-party platforms such as ERPs to simplify this process. With these integrations, the payroll data can be automatically transferred and recorded in the accounting system, reducing the likelihood of errors and streamlining the accounting process.

Reporting in the context of payroll refers to the analysis of payroll data to identify trends and risks. HR and finance departments may require various reports such as department-wise employee cost and salary reconciliation reports after the monthly payroll is completed. As a payroll expert, it is important to extract relevant information from the payroll data to prepare and share these reports.

Non-compliance with statutory laws can have serious consequences for a business, including the imposition of fines and penalties, and in extreme cases, may even pose a threat to the company’s survival. To avoid such scenarios, it’s important to process payroll while ensuring compliance with all relevant statutory laws and regulations.

Gathering data for payroll processing is a crucial step that involves collecting information from various sources such as attendance registers, records of conveyance facilities availed, and data from the HR team on salary revisions. However, this process can be complicated and time-consuming. Traditionally, HR and payroll officers have relied on excel sheets to manage payroll, but this method has several limitations and hence it is recommended to find alternative software to make things easier.

Protecting employees’ confidential information is critical for any organization. Traditional payroll management methods can put such sensitive data at risk of being lost, mishandled, or even stolen. With confidential information such as Aadhaar number, PAN number, and bank account details required for salary processing, organizations must ensure the highest level of security and privacy to prevent unauthorized access or misuse of such information. Therefore, modern and secure payroll management systems are necessary to safeguard employee data and prevent data breaches.

Small businesses with a limited number of employees often opt for Excel-based payroll management. This method involves using a standard payroll calculation template on an Excel sheet, with set mathematical formulas that help the payroll officer compute the payroll. While this method is cost-effective, it has inherent limitations such as:

Outsourcing payroll is the process of delegating the responsibility of managing payroll to an external agency. Many organizations opt for this option if they do not have an in-house payroll team. They provide the payroll service provider with employee salary information, attendance, leaves, reimbursement details, and other relevant data on a monthly basis. The service provider then processes payroll and ensures compliance with statutory regulations. However, some businesses are hesitant to outsource their payroll function as it is a critical process and they prefer to have complete control and transparency over it.

To ensure smooth payroll processing, it is important to gather payroll inputs from various sources in a timely and efficient manner. This is where payroll software comes in handy, as it helps reduce the friction involved in getting the necessary inputs. In addition to automating payroll computation, there are advanced payroll management software available in the market that also offer features such as leave and attendance management, HR management, and employee self-service portal. Depending on the size of your business and specific needs, you can choose an appropriate payroll software solution for your organization.

Payroll management can be a complex process, but it doesn’t have to be. With the right partners, knowledge and technology, you can have an efficient payroll system in place that meets your organization’s needs. Payroll management is an important part of running any successful business in India, so make sure you understand your responsibilities and how to manage payroll effectively. Of course, if you need help with any aspect of payroll management then it may be worth considering outsourcing that task or working with a reliable partner.

A company’s payroll services are typically accessed through the Human Resources (HR) department. Payroll management is one of the many responsibilities that fall under the purview of the HR department. Their primary responsibility is to ensure the timely and accurate payment of employees. Additionally, they are responsible for addressing any payroll-related issues, such as errors or discrepancies.

The four different types of payrolls are:

Priyanka Rao is a content strategist for Jupiter.Money, and specializes in writing on topics related to finance, banking, budgeting, salary & wages, and other financial matters. She has a passion for creating engaging content that resonates with audiences across various digital platforms. In her free time, Priyanka enjoys traveling and reading, which allows her to gain new perspectives and inspiration for her work. With a keen eye for detail and a creative mindset, Priyanka is committed to creating content that connects well with her readers, enhancing their digital experiences.

View all posts

Powerd by Issued by