Get salary accounts for your team See benefits

Table of Contents

ToggleIf you have joined a new organisation, you will be assigned a new provident fund (PF) account number. The amount accrued in your earlier PF account can either be withdrawn or transferred to the new PF account. For this process to go smoothly, you need a Universal Account Number (UAN).

If you are wondering how to generate your UAN online, the easy step-by-step guide in this article will help you out. You can also discover the benefits of a UAN and the various ways you can link your Aadhaar to your EPF account.

The UAN is a 12-digit exclusive identification number assigned by the Employees’ Provident Fund Organisation (EPFO), an organisation that provides universal social security coverage for all workers of India by way of provident fund, pension and life insurance.

This number is allocated to both the employer and employee so that they can make payment to the EPF account.

After a UAN is created for an employee, it remains unchanged throughout their term with the organisation. However, after switching jobs, they will receive a new identification number (ID) from the EPFO, which they have to link to the existing UAN or EPFO account.

For the company, the UAN remains constant for the entire tenure of the organisation till it stays in business.

Here are some advantages that UAN brings to the table:

Your employer is not involved at all during the withdrawal of funds from your PF account when you change a job. UAN ensures that the money is automatically passed on to your new account once your KYC verification is complete.

Before UAN, sending funds from the old PF account to the new one was done on a manual basis, which was a time-consuming process. With UAN, the UAN and KYC details can be given to the new employer for the transfer of PF funds, making the process much easier.

To avoid the lengthy process of transferring the EPF corpus fund, employees often preferred opening a separate PF account at their new workplace, thereby having several PF accounts. Since UAN makes these transfers easier, it centralises all your PF accounts across various companies and functions.

Due to the cumbersome process involved in PF transfers, many employees preferred to withdraw the PF amount but could not withdraw the employee pension. With UAN, your EPF and EPS accounts are both transferred automatically, giving you a higher lump sum amount after retirement.

With UAN, you can receive SMS notifications for every activity in your PF account, allowing you to easily keep tabs on your funds.

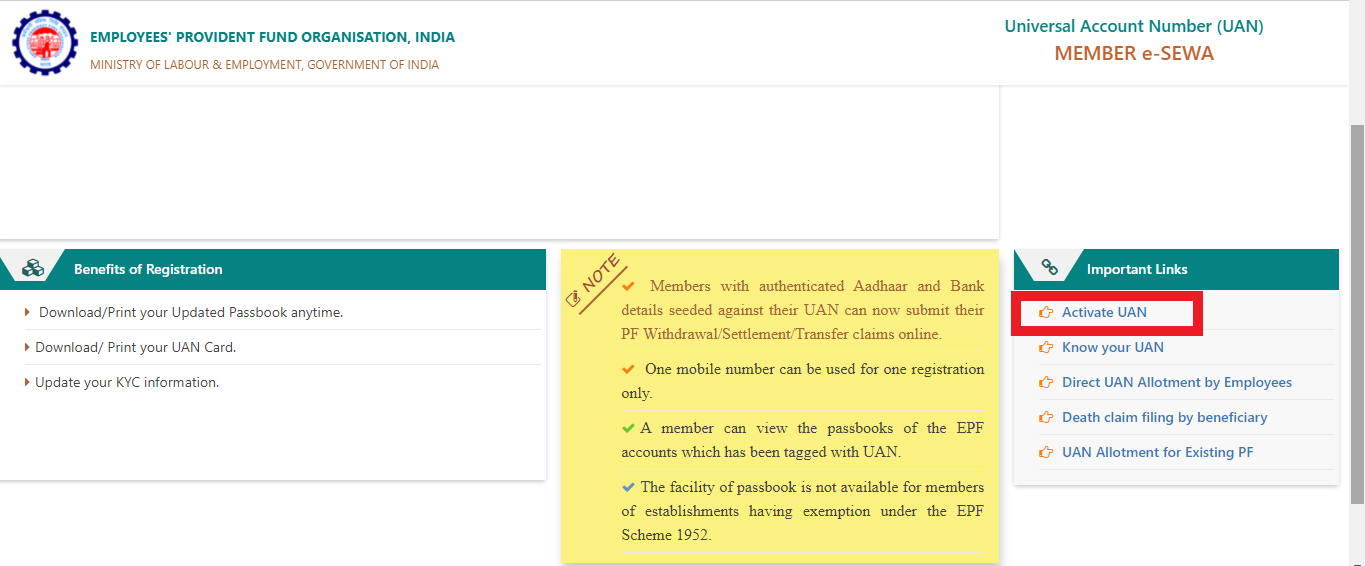

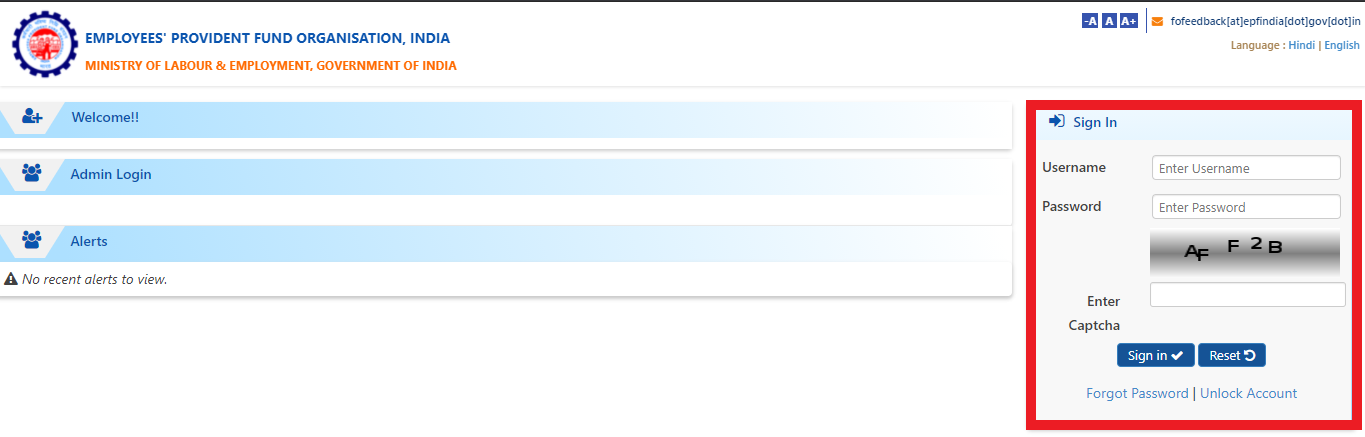

Let’s discuss how you can activate your UAN online.

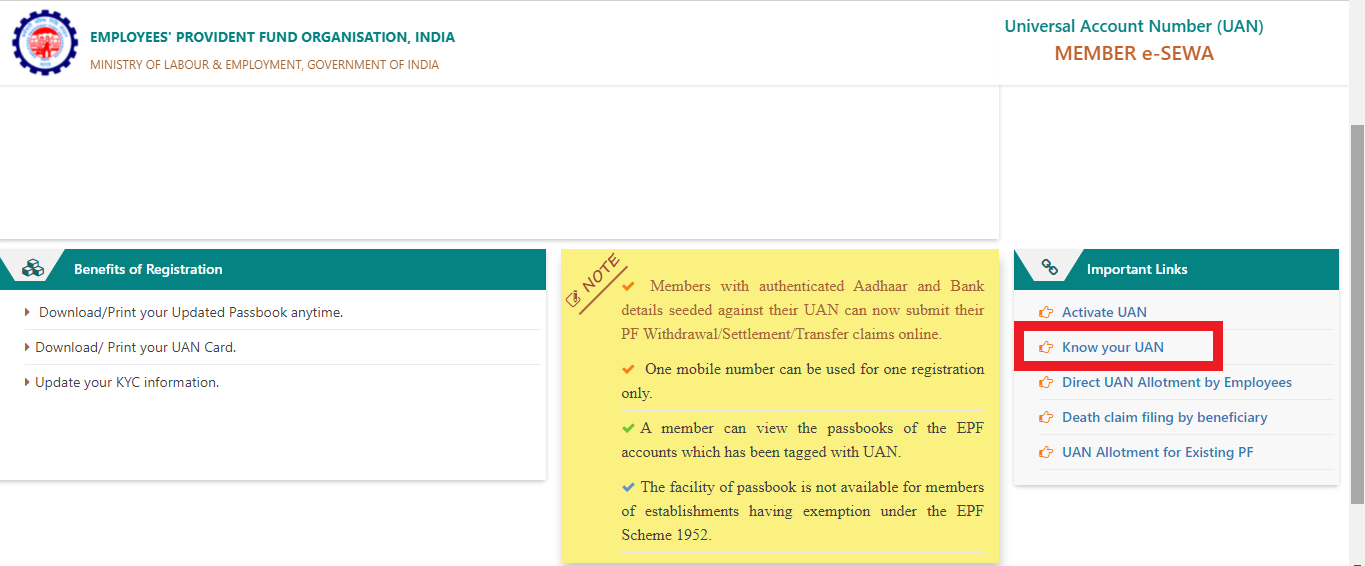

You need not reach out to the EPF office if you want to know your UAN or have forgotten it. Simply follow these steps:

There are different methods of linking your Aadhaar with your EPF account. A person can link their Aadhaar with an EPF account both online and offline. Here are 4 easy ways to go about it:

You can also link Aadhaar with your EPF account offline by visiting an EPFO office near you and apply in person. Here’s how you do it:

The Ministry of Electronics and Information Technology (MeitY) and the National e-Governance Division (NeGD) started UMANG (Unified Mobile Application for New-age Governance) to promote mobile governance in India.

Here are the steps to link your EPF Account using UMANG App:

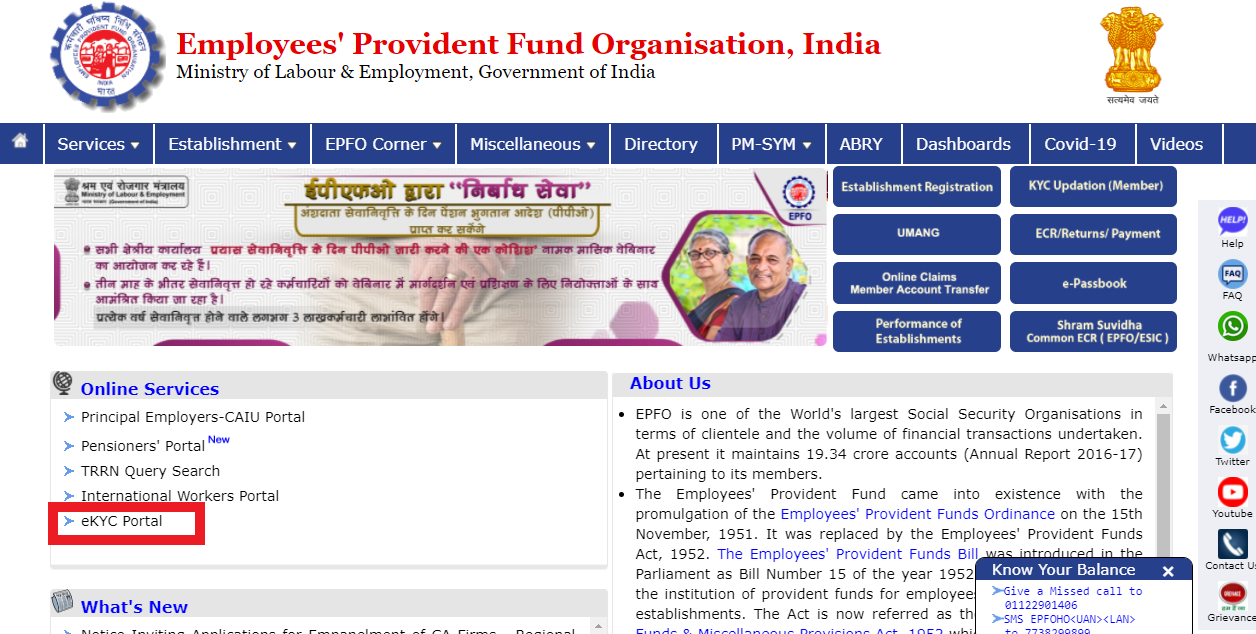

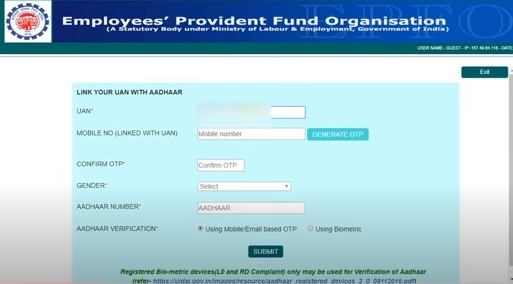

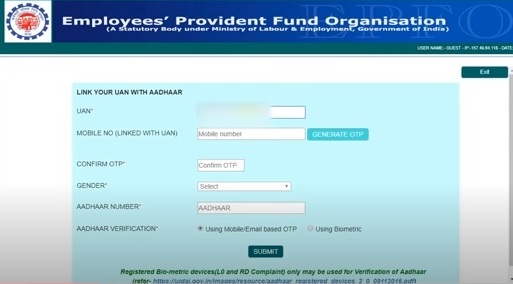

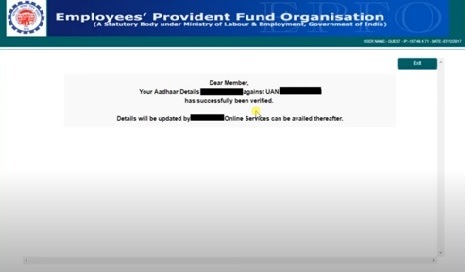

EPFO has made provision for linking EPF accounts with Aadhaar using OTP verification on the eKYC Portal of EPFO. Here are the steps to follow:

To know if your Aadhaar number is linked to your PF account, follow the steps mentioned below:

You need to provide the following documents at the time of UAN registration:

Yes, you cannot transfer funds or claim withdrawal if your Aadhaar is not linked with UAN. You have to mandatorily link your Aadhaar with UAN.

No, UAN has to be activated only once. There is no need to re-activate it every time you change jobs.

No, registering for a UAN is absolutely free of cost.

No, there is currently no provision to activate UAN through SMS. However, you can easily do it online via the EPFO member portal.

Priyanka Rao is a content strategist for Jupiter.Money, and specializes in writing on topics related to finance, banking, budgeting, salary & wages, and other financial matters. She has a passion for creating engaging content that resonates with audiences across various digital platforms. In her free time, Priyanka enjoys traveling and reading, which allows her to gain new perspectives and inspiration for her work. With a keen eye for detail and a creative mindset, Priyanka is committed to creating content that connects well with her readers, enhancing their digital experiences.

Powerd by Issued by