Tax on Foreign Remittance In India: Sending & Receiving Money

By Jupiter Team · · 6 min read

The world is shrinking with each passing decade. Not just governments and large corporations, but laypersons too transact globally in this day and age. We buy products from foreign e-commerce websites, purchase materials for manufacturing goods in our country, and send money for various other purposes.

You may have to send money to your family members for education, emigration, or for buying goods or services. Even stock markets have caught the retail fancy, and investing money in India, the USA, or any other country is now common.

However, such transactions involve a certain degree of complexity due to currency exchange and tax implications. It can also be an overwhelming process to understand the remittance procedure and taxation.

In order to save on taxes, it’s important to research before you make a transfer. In this blog, our effort is to give you all the information in order to save you time.

Tax On Money Received From Abroad To India

There is no tax on any amount you send to individuals who are your blood relation. These could include your parents, grandparents, siblings and children. Close family, like spouses and in-laws, are also included. However, if an NRI sends money to somebody who is not related by blood, then there is a tax implication. An amount over Rs 50,000 per year is subject to taxation in the hands of the receiver.

For an NRI who is sending money from the US, then blood relation does not make a difference. The sender will still have to pay a gift tax for sending an amount beyond $14,000.

In case you're trying to send money from the United Kingdom to India, you can send up to 3,000 GBP without attracting a gift tax. For wedding gifts, the exemption limit is 1,000 GBP per individual; this limit increases to 5,000 GBP for a child and 2,500 for a grandchild or great-grandchildren.

Different countries have specific limits for money transfers abroad. Therefore, it's important to check the limit each country has in order to avoid taxation.

If I send money from abroad to my parents, will they be taxed?

You had probably given this a lot of thought when you first moved abroad or wished to send money back home for the first time.

Any inward remittance or money sent to India by a family member will not be subject to any tax, provided such amount is used only for the following purposes:

- Living expenses

- Travel expenses

- Medical reasons

- Gift

- Education

- Donation or financial support

It’s only when your parents invest that money the income earned on such investments will be taxable. Hence, when you send the money to your parents, it will not be taxable.

As per Foreign Exchange Management Act (FEMA), any of the following family members can receive money; it will not be liable to tax.

- Spouse

- Siblings

- Sibling of the spouse

- Parents

- Lineal ascendant or descendant

(Lineal ascendant means father, grandfather, great grandfather and so on. Lineal descendant means son, grandson, great-grandson)

- Any ascendant or descendant of your spouse

- Spouse of the previous two categories of individuals

Also, there is no limit on the amount of money you can send to your parents. As per the FEMA rules, any amount sent as a gift to eligible relatives will be tax-free. Anybody outside the list will attract a tax liability if the amount exceeds Rs 50,000.

However, the rule is different when sending money from the United States. The relationship between the sender and receiver does not matter here. The maximum amount of tax-free remittance one can do USD 14,000. Beyond this amount, it would be subject to gift tax for the sender.

Similarly, other countries may also have their limits. It's important to check it country-wise while making a remittance.

Tax on Sending Money Abroad From India

An individual is required to pay Tax Collected at Source (TCS) on an outbound remittance. As per the amendments in the Finance Bill (2020), under the Liberalised Remittance Scheme (LRS), a 20% foreign remittance tax i.e. TCS is applicable (also 20% in the absence of PAN details) on payments of more than Rs 7 lakh. In case of an education loan repayment, 0.5% TCS (20% above Rs. 7 lakh, if no PAN details) will be levied on an amount exceeding Rs 7 lakh. An NRI or a foreign company is also subject to a surcharge and education and health cess.

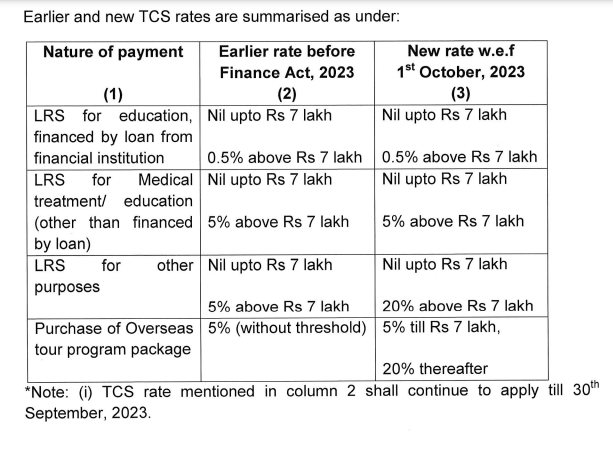

2023 Union Budget update in TCS mentions that after October 1, 2023, tax collected at source can go up to 20% without any threshold limit. The initial date set for these changes was July 1, 2023.

A resident individual may send up to $2.5 lakh in a year. An NRI with a Non-Resident Ordinary (NRO) account may send up to $10 lakh in a financial year. An individual with a Non-Resident External (NRE) account or a Foreign Currency Non-Resident (FCNR) Account does not have any such limits.

Here is a snapshot of rates on foreign remittance - Present Rate and Proposed Rate in Budget 2023-24

How is TCS collected?

When you send the money to a dealer, generally a bank, for transfer, it will deduct the tax while receiving the amount or while debiting, whichever comes earlier.

Suppose, in a financial year, you remit Rs 20 lakh. Based on this, a TCS of 5% will be deducted on Rs 13 lakh (Rs 20 lakhs minus 7 lakh). Therefore, Rs 65,000 will be collected as TCS.

Also, a health and education cess and a surcharge will be imposed in case the buyer is a foreign company or an NRI.

Also Read: How to save fees while sending money abroad?

Where is TCS not applicable on foreign remittances for resident Indians?

There are certain cases where the TCS is not applicable. This happens when the buyer is-

- Government (making payments or remittances for imports/purchases, etc.)

- An individual/organisation making a remittance on account of an overseas tour program package

Are the Tax exemption limits applicable in all cases?

The 5% TCS and the Rs 7 lakh exemption limit are applicable in all cases other than the following-

- Foreign Travel: If you’re sending money to buy a foreign travel tour package, you will not get an exemption of Rs 7 lakhs and will have to pay TCS on the total amount.

- Non-availability of PAN: TCS will be 10% instead of 5% in this case. Furthermore, the Finance Act, 2021, introduced two new changes in TDS and TCS rules. These rules apply to both residents and non-residents. A higher tax rate of 10 per cent is applicable if an individual has not filed Income Tax Returns for the last two years.

This higher tax rate is applicable for NRIs who have any permanent establishment in India. It is also applicable to resident individuals when they are sending money abroad to vendors for shareholder dividends, rent, etc. - Foreign education: Here, the students will have to pay 0.5% instead of 5% TCS. The exemption limit of Rs 7 lakh applies as long as the loan complies with the norms of Section 80E of the Income Tax Act.

Please note that the proposed tax rates are different than the present rate for certain use case. This will take effect after Ocber 1, 2023 as per the finance budget 2023-24.

Summary

While transferring money from or to India, it's important to know the tax implications and stay abreast of the latest changes by the governments of various countries. The tax rates differ for different categories of individuals and organisations and can make a huge impact on the net amount transferred. Therefore, making an informed decision will save some of your hard-earned money, which you can use for other fruitful purposes.

Jupiter is a digital banking platform that simplifies all your financial transactions and offers you a multitude of resources to help you save more.

In this article

Back to all resources

Back to all resources