What is PPF Account? Eligibility Criteria, Steps to Apply

- Home

- Blog

- Personal Finance

- What is PPF Account? Eligibility Criteria, Steps to Apply

How Do Loans Work?

August 27, 2024Guide to Gross Domestic Product (GDP)

August 27, 2024Table of Contents

ToggleIntroduced in 1968, Public Provident Fund (PPF) is a government-backed scheme that offers stable returns over the long term. Investing surplus money in PPF helps build a corpus that can be used to meet your retirement needs or other financial goals.

It is one of the most popular schemes that is focused on investing small amounts regularly to create wealth. PPF has a tenure of 15 years, which can be extended by five years. In some instances, you may withdraw the funds from the account before the maturity date. Read on to know more about PPF.

Eligibility criteria for Public Provident Fund account

All Indian citizens are eligible to open only one PPF account. Minors can also open these accounts provided they are operated by their parents.

Non-Resident Indians (NRIs) cannot open this account; however, if there is an existing one in their name, it continues to remain active until its maturity. Further, NRI accounts cannot be extended at the end of 15 years.

Hindu Undivided Families (HUFs) are also not eligible to open an account. Moreover, the joint account opening is not available.

Steps to open a PPF account

You may open a PPF account online via the post office or bank’s website. Here are the steps to open an account online.

- Visit the bank or post office website and select the ‘Open a PPF account’ option

- Select ‘Self’ or ‘Minor Account’, as applicable

- Fill in the information and deposit amount

- Submit the application form and enter the one-time password (OTP) to open the account

The following documents along with the duly filled application form are required.

- Know-your-customer (KYC) documents

- Residential address proof

- Permanent Account Number (PAN) card

- Photograph

- Nominee Declaration form

- Signature proof

You can also open a PPF account offline by visiting the closest bank or post office.

What are the advantages of a PPF account?

Some of the PPF account benefits are as follows:

- Enjoy stable and risk-free returns based on the quarterly rate of interest declared by the Central Government, which is compounded annually

- Extend the tenure by five years with or without additional investments

- Get tax benefits of up to INR 1.50 lakhs are available under Section 80C of the Income Tax Act, 1961

- Avail of up to 25% of the accumulated corpus at the end of the second year as a loan between the third and sixth year

- Partially withdraw the amount after five years from the date of opening the account

How does a PPF account work?

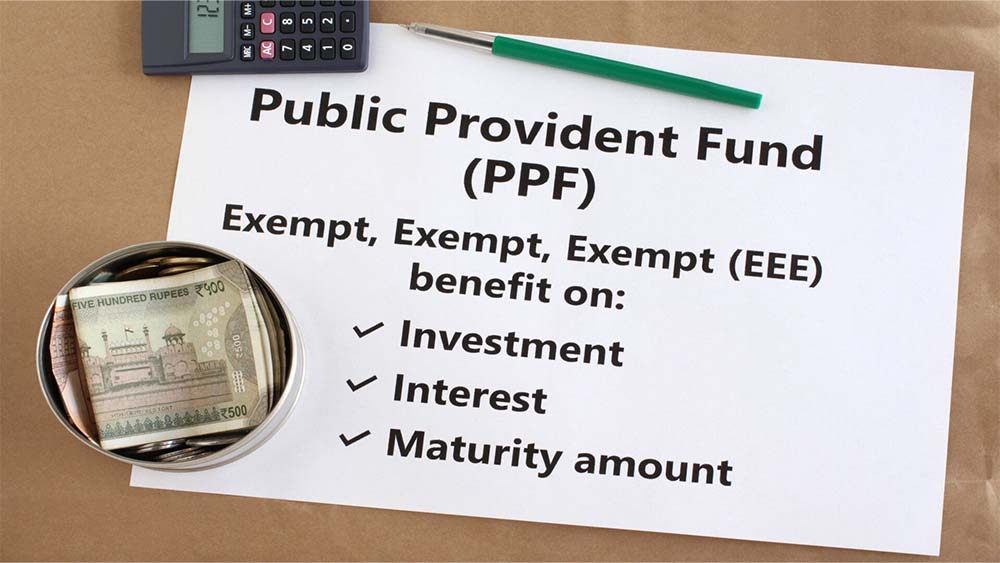

The PPF scheme is a long-term investment option offering an attractive interest rate. It is an exempt-exempt-exempt (EEE) scheme. This means that the investments, interest income, and maturity amount are also tax-free. You may deposit a minimum amount of INR 500 per year in this account.

The public provident scheme has a lock-in period of 15 years with the provision to extend it by an additional five years. The PPF amount is annually compounded based on the rate of interest declared by the Central Government. The interest also depends on the date on which you invest the amount.

What are the features of a PPF account?

- The account has a 15-year lock-in period during which you cannot completely withdraw the accumulated corpus; you may extend the investment tenure by another five years

- You may invest between INR 500 and INR 1.50 lakhs per year in this account either as a lump sum or in installments; you can make up to 12 monthly installments during the year

- A minimum of INR 500 per year must be deposited to keep the account active

- You may deposit the amount either by cash, check, online transfer, or demand draft

The interest rate on a PPF account

The rate of interest is declared by the government every quarter. Generally, the interest rate is higher than that offered by the commercial banks on their savings accounts, which is one of the best PPF benefits.

Historically, the rate of interest has varied between 7.60% and 8% per annum; currently, it is 7.10% and is compounded annually.

Withdrawal rules in PPF account

You cannot completely withdraw the balance from your account before the end of 15 years. On maturity, you can either withdraw the entire principal plus the interest or extend the tenure for another five years.

If you need funds before maturity, you may partially withdraw some amount from the seventh year onwards. You can withdraw up to 50% of the accumulated corpus at the end of the fourth year. Additionally, partial withdrawal is allowed only once in a financial year.

You must submit Form C comprising three sections along with the application for partial withdrawal at the closest branch of the bank or post office where you hold the account.

How to link Aadhar Card with PPF account?

You can link your PPF and Aadhar online by following the below-mentioned steps:

- Log in to your Internet banking

- Click on the ‘Registration of Aadhar Number’ option

- Input the 12-digit Aadhar number and click ‘Confirm’

- Select the PPF account and link it to the Aadhar number

To check whether it has been linked with Aadhar, you can click on the ‘Inquiry’ option on the homepage.

How much should you invest in PPF?

You can put between INR 500 and INR 1.50 lakhs per year in this account. It can be either a lump-sum or an installment-based investment. You may use the PPF calculator online to estimate the investment amount and returns.

Closing PPF account before maturity

Closing your account before maturity is allowed only in some circumstances. Your account should at least complete five years before it can be prematurely closed. The instances when premature closure is allowed are as follows:

- If you or your dependent parents or children suffer from a life-threatening ailment

- If the money is needed for your child’s higher education

- In case your residency status changes

The rate of interest is reduced by 1% if you close the account before its maturity.

Frequently Asked Questions (FAQs)

Is it compulsory to close the PPF account on maturity?

No, you can extend the account for an additional period of five years.

How many times can the PPF account be extended?

There is no restriction on the number of times you can extend your account; however, every extension is for five years upon the maturity of each block.

Can you close the account before its due date?

You may close the account after five years only if you meet the criteria for premature closure.

What are the tax benefits available?

The PPF tax benefits include the exemption of investments up to INR 1.50 lakhs per year. Additionally, the interest income and maturity amount are tax-free.

Author

-

Priynka Rao: Author

Priynka Rao: AuthorPriyanka Rao is a content strategist for Jupiter.Money, and specializes in writing on topics related to finance, banking, budgeting, salary & wages, and other financial matters. She has a passion for creating engaging content that resonates with audiences across various digital platforms. In her free time, Priyanka enjoys traveling and reading, which allows her to gain new perspectives and inspiration for her work. With a keen eye for detail and a creative mindset, Priyanka is committed to creating content that connects well with her readers, enhancing their digital experiences.

View all posts