Get salary accounts for your team See benefits

Table of Contents

ToggleIn today’s world, where everything is digitized, shopping has become way easier than it was before. With one-click purchases, and same-day delivery options, the convenience of shopping has increased. However, with increased ease, people are overspending money. In their words, they are spending beyond their means. This is impacting their financial health and well-being. Read to find out why people overspend, its effects, and how to control it.

An act of spending more than what you have or plan for is overspending. In other words, it simply means you are living beyond your means. If you are unable to cover your expenses with what you earn, even though you earn enough to fund all your expenses, you are overspending.

Another example of overspending is you are unable to save enough for your goals as you have too many expenses. The feeling of never having enough money, having a low balance in your bank account, and using too many credit cards, are all signs of overspending.

Spending too much money unnecessarily is never good. It will create a dent in your finances and will not let you reach your financial goals. The first step to overcoming overspending is to understand where you are overspending. You may never realize it, but you might be overspending a lot more than you think. That one purchase you make might be an unnecessary expense, which you usually consider a necessity. Take a look at different kinds of overspending that most of us don’t realize that we are doing.

Using money in highly visible ways to improve your image is a sign of overspending money. If you are buying designer wear, expensive bags, or luxury cars for getting preferential treatment and to show off, then you are image spending.

If you are constantly looking for deals and discounts and base your purchases on them, you are bargain-hunting. Even if you don’t need that particular item, you will still end up purchasing it as it is available at a reasonable price. Here, you get more satisfaction from the discount than the product itself.

Using shopping as a distraction from negative feelings or getting a high feeling from a purchase is compulsive shopping. Signs of compulsive shopping include uncontrollable shopping and not knowing what, where and how much you spend during a shopping spree. If you have clothes or accessories that you aren’t using or have price tags on them, you most likely bought those items to crave your satisfaction.

Many don’t realize this but end up spending for others to win approval and acceptance and to fit in. For example, paying the bill at a restaurant which can be easily split, or buying gifts for friends and family without an occasion.

Spending money for the heck of it because you earn a lot and don’t know what to do is a sign of bulimic spending. One sign of this is that you mostly will most regret a purchase either immediately or later in life.

Spending outside your means once in a while is fine, but if it becomes a habit, the consequences can be disastrous. Following are some of the dangers of overspending.

When overspending becomes a habit, there is a high risk of you using debt. When you don’t have enough to spend, you will automatically start relying on credit cards to cover your expenses. Once you start using credit for day-to-day expenses, you will end up in a vicious debt trap.

When you start relying on credit cards for small expenses, you are using bad credit, which has high-interest rates. The higher the debt you use on a daily basis, the harder it will get to obtain credit. Moreover, when you want to apply for good credit, such as a home loan or car loan, it will be rejected as your credit looks unmanageable by your banker.

With overspending, you are constantly paying off your past expenses with your current income. Hence you won’t have anything left for the future. It is always better to set aside money for your future self, so you have enough to cover your future expenses. You can surely enjoy the present and spend money, but it shouldn’t go overboard. It is best if you balance both past expenses and future goals with your present income.

In case you don’t get a grip on your overspending, you will be in constant fear of repaying your bills and won’t be enjoying the things you spent money on.

If you don’t have spare money to set aside, you probably won’t have an emergency fund. An emergency can be anything, an unexpected hospital visit or car and house repairs. These emergencies can knock on your door anytime. Without an emergency fund, you will again rely on debt which will take you deeper into the current debt trap you are in.

Overspending can affect your physical and mental health as well. With overspending, there will be an increased amount of stress to pay your previous month’s bills and the EMIs (equated monthly instalments) of your debt. This can affect your mental health and can have repercussions on your physical health as well. For example, excessive stress can lead to several problems, such as sleep and eating disorders and high blood pressure. All these will increase your medical bill, which you probably won’t be in a state to pay.

Overspending can be more dangerous than you think. Hence it is better to break the cycle as soon as possible.

There are many different causes for overspending, and here and the most common ones.

Digital payments like debit cards, credit cards, and UPI (Unified Payments Interface) have made transacting easy. To add to this, the attractive offers and rewards they offer have lured consumers to switch to digital payments. When we used cash, we were cautious about how much and where we were spending. But with digital payments, we can hardly keep track of our expenses as we won’t take out cash from our wallets.

UPI and debit cards limit the spending to the balance available in our account. However, this is not the case with credit cards. With higher credit limits, spending has increased. In case you miss paying a credit card bill, the interest on the due amount is very high, and you end up paying more than what you’ve actually spent.

Our parents and grandparents were very disciplined with their finances. If they had to save a certain amount, they make sure they cut their expenses and set aside some amount every month to reach their goal. However, with the current generation, cutting down expenses is a difficult task, and hence saving is impossible.

One main reason for overspending is not having a financial plan and budget. You have to create a budget for your finances. A budget simply matches the income with expenses and savings. You need to have an upper limit for every expense, such as groceries, eating out, travel, and even fuel. If you don’t, then you end up overspending without even noticing where and how much you are paying.

Taking a loan for your home or higher studies is considered okay as you are building a valuable asset. However, taking a credit card loan or personal loan is not good. You aren’t building any valuable assets by spending your money dining out or going to the movies. Just because others are using credit cards doesn’t mean you use them too. The interest rates on credit cards are pretty high, and one missed payment can end up trapping you in debt for a lifetime. Moreover, you won’t be able to save your important financial goals like retirement or a house.

As you move up the corporate ladder, your income grows. The growing income is considered good as you will have more disposable income in your hands. However, growing income doesn’t mean you can increase your expenses too. Higher income should imply higher savings and not higher expenses. You should definitely improve your lifestyle, but the expenses shouldn’t be so high that you end up not saving at all. Save as much as you can so your future is secured.

Humans are never satisfied. Once their basic needs are met, they are on the lookout to satisfy higher-level needs. By going up the hierarchy of needs, you will never notice when the wants start becoming needs. Having a home is a basic need, but a luxury home is a want. Similarly, a high-end car, luxury watches, and designer clothes are all wants that end up becoming necessities for many. If you control the temptation of boosting your ego and impressing others, you can control your overspending.

As income increases, it is normal to upgrade your lifestyle. The problem arises if you upgrade it too much. There is nothing wrong when you buy a luxury car or move into a higher-rent apartment when you are earning enough. But the cost that comes with these luxuries is also high, for example, the high maintenance and repairs costs of the car or higher maintenance for the apartment. With lifestyle upgradation, you end up overspending a lot.

Sometimes your family or friends push you to overspend. For example, if you go shopping with your friends, you end up buying something which you never intended to in the first place only because your friend asked you to. This way, you end up overspending on things that you don’t need.

Your lack of patience can also lead to overspending. How is that? Let’s say you want to buy a waffle maker for your kitchen. Due to a lack of patience, you end up buying the first one you see. If you had looked around and waited for some time, you could’ve gotten a better deal or a less expensive one.

Emotional spending means buying a small treat for yourself when you want to celebrate something or lift your mood up when you are feeling down. It’s actually a good thing as you can remember the purchase to mark an event or distract yourself when you are feeling low. A small purchase is considered good, but if it goes overboard, you end up overspending, and your budget will go for a toss.

Buying goods without a prior plan or losing control during shopping can lead to overspending. Spending a lot on things that you do not need, having clothes in your wardrobe with a price tag on them, and feeling regret after buying something are all signs of compulsive buying.

When you are feeling bored at home, you end up going to a movie, going to a restaurant, or spending the day in a spa. Your boredom will definitely vanish, but so will your money. All the things that you do out of boredom have financial implications.

Overspending doesn’t happen only because of you. Sometimes people around you force you to overspend, and most of the time, you are unable to say no. For example, your child asking for an expensive toy, or your friends forcing you to join them for a trip you can’t afford. You can simply avoid the expense by saying no, but by not being assertive, you end up overshooting your budget.

Spending money makes people happy, and it’s not wrong to spend your money. But going overboard with it is not suggested. It can surely give you short-term happiness, but the consequences of it on your finances will end up giving you stress in the long term.

When you are dealing with the economic and financial side of money, it is also important to deal with the psychological side of money. This is because we end up spending a lot even when we know we shouldn’t. Our minds and thoughts get the best of us, and we end up making bad spending decisions.

Here are some psychological principles that could lead to overspending our money.

Retailers use FOMO to lure their buyers into making a purchase. In online shopping, they use ‘Limited Period Offer’ or ‘Only One Left’ to create a sense of fear among consumers that they might miss out on the product if they don’t buy it. This fear creeps into consumers’ brain, and ends up buying a product that they have been debating whether to buy or not.

Sellers usually use the consumer’s perception of price points to lure them into buying a product. This is called anchoring. Let’s say you visit a store and see the board flat 50% off. You pick up a dress worth Rs 2,000, and it is available at only Rs 1,000. Your mind will register the Rs 1,000 you are saving on that dress as the Rs 1,000 you are spending on it. This causes overspending on a product which you never intended to buy.

Social pressures such as eating out dinners, and going on expensive vacations with family and friends are high in the current generation. Trying to ignore these pressures is quite difficult, and we end up giving in to these pressures often and spending beyond our budget.

How we perceive self-care also causes overspending. As self-care is linked to self-worth, we don’t actually think twice before spending money on ourselves. For many going on a shopping spree, an expensive vacation, or dining out is the definition of self-care. Hence people overspend in the name of taking care of themselves. However, self-care should be beyond the usage of money. It should involve phycological, physical and lifestyle practices. Self-forgiveness, growth, learning, good sleep, nutritious food, exercise, work-life balance, hobbies, and time management are all self-care practices you should implement in your life.

Overspending is not just done by individuals, but businesses tend to do it too. Here are a few common areas where business overshoots their budget, which can lead to lower profits.

Telecom services: All businesses need telecom and internet services. But they don’t realize that the costs of such basic services are high. In such cases, it is best to find a service provider with lower costs or negotiate with them for the best price.

Utilities: Businesses overspend on utilities such as paper, stationery, or electricity. Taking small steps to reduce these costs can go a long way in saving money.

Data storage: Data is integral to any business. With the current digitalized era, it has gained even more importance. However, businesses spend a lot on data storage and management. By simply streamlining the data management process, they can save a lot of money.

Marketing and advertising: Marketing and advertising are important for all businesses, but they are one of the places where businesses overspend a lot. They think the costlier a strategy, the more effective it is. But that’s not always true. Businesses should choose a strategy based on how much return it will give rather than its costs.

The one question that we all should ask is ‘How do I stop overspending?’ Here are a few tips that will help you in controlling your habit of overspending.

The best way to stop overspending is to know what is causing you to spend so much. People tend to overspend when they are high with emotions or when they are bored. Not all have the same spending triggers. So, identify your spending triggers. The best to do this is to maintain a spending diary and note down all purchases, including the details such as time, cost, and your mood during the purchase. Once you understand your spending triggers, act on them.

If you want to buy anything, be it a small phone cover or a big electrical appliance for your home, wait for a few days to weeks. The reason behind waiting is to make sure you are not making the decision out of any emotion and also to control the urge to spend your money. Usually, after waiting for some time, the urge to buy the product reduces. Even after waiting for weeks, you still have the same urge to purchase it, then go ahead with the purchase.

Unsubscribe from emails of shopping websites or credit card offers. The rewards and deals they give for a limited time force you to buy a product which you might end up not using. They have the power to convert a want into a need, which will lead to overspending. You can also ask stores to remove you from their mailing list even if you receive emails after unsubscribing.

Technology has made things super easy for us. Take, for example, one-click buying; it has definitely made shopping easy for us. However, it is also the reason us spending money recklessly. So, turn off the one-click buying option from the websites you frequently purchase. This will help you reduce overspending.

Saving payment details on websites makes shopping easier. If you are unable to control the urge to buy, then it’s better to remove the saved card details from the websites you shop frequently. Moreover, if you come across a new website, checkout as a guest, so your information is not saved. This way, you are still purchasing what you want, but there is some time for you to think through your decision.

Many a time, you end up buying more than what you planned for, especially during grocery shopping. Hence it is best to make a list of items you need before going shopping. This way, you won’t purchase items unnecessarily and won’t miss out on the necessary things you need. If you feel this method is too restrictive, then include a certain amount for impulsive buying in your list. For example, you can allocate Rs 500 or Rs 1,000 based on your budget for impulsive shopping. But use this method only in the short term until you can control the urge to overspend.

Initially, when cash was the only means to spend, people were careful about spending money as they were physically taking out money from their pockets to buy something. But after credit cards and debit cards are introduced, people aren’t tracking their purchases which are leading to overspending.

To control this, go back to using cash. Start with a goal of one week, and increase it slowly to one month. This way, you can keep track of where you are spending and also reduce your purchases.

You must have tried all kinds of diets to lose weight, so why not try a diet to save some money? A spending fast or spending diet is the practice of not spending money beyond your basic living expenses for some time. Start by doing a spending diet for a day, where you will not spend a single rupee. Then slowly increase it to a week, a month, and even a year.

Here, you can spend money on your basic needs, such as rent, food, and grocery. But you have to avoid eating out, ordering food, movies, travel and all kinds of recreation. By following a spending diet, you will understand where you are spending your money. You can also save for emergencies or repay your debt. Moreover, you can distinguish between needs and wants and can also live on a budget. The best time to do a spending fast is during your or your loved one’s birthdays and festive season. This will kill the temptation to spend money on gifting.

When you are going out to have fun, do not take your cards. Instead, carry only cash, based on your budget. This is because when you are high with emotions, you end up buying something you might regret later. Hence it is better to go out to a fun situation on a budget so you won’t have the urge to overspend.

Have a separate bank account for savings and expenses. Transfer some amount to your savings account every month, and do not touch it. In fact, do not remember any of the account details and don’t save them in your phone so you won’t access them. Use a separate account for your expenses, so you have only a limited amount for your purchases. Stick to what you have in the account, and do not resort to overdrafts.

Make a budget for yourself. Take out your bank statement for the last six months and see how much you are spending on what. Separate your expenses based on needs and wants. Then stick to a rule such as 50-30-20 where 50% of your income goes for your needs, 30% on wants and 20% for savings. You can alter this by increasing your savings and reducing your wants. If you want to buy something that you haven’t allocated money for, check your budget before you spend your money.

By following the above tips, you can not only control your habit of overspending but also save enough for all your financial goals.

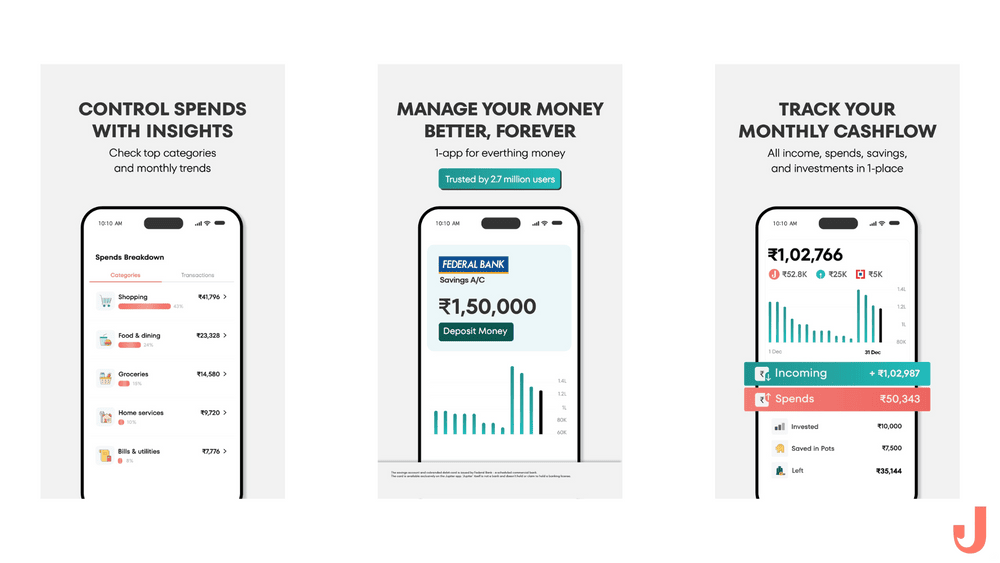

Use Jupiter as your UPI payment app. Jupiter app tracks expenses for you with spend categories. This way you know exactly where your money is being spent. Then you can choose how to optimize cost and your spending habits.

Get the Jupiter app to manage your expenses

Priyanka Rao is a content strategist for Jupiter.Money, and specializes in writing on topics related to finance, banking, budgeting, salary & wages, and other financial matters. She has a passion for creating engaging content that resonates with audiences across various digital platforms. In her free time, Priyanka enjoys traveling and reading, which allows her to gain new perspectives and inspiration for her work. With a keen eye for detail and a creative mindset, Priyanka is committed to creating content that connects well with her readers, enhancing their digital experiences.

Powerd by Issued by