Introduction to opening a bank account in India

Banks are no longer just the place to keep money and use the locker feature to safely keep jewellery and important documents. Nowadays, opening a bank account helps you invest in stocks, buy shares, have access to digital payment options, and even provide a copy of the passbook as identity proof. Many banks offer lucrative interest rates to customers who opt for a savings account or open a fixed deposit account. Each bank has its own set of benefits and offerings. But, the main criteria that prompt people to open a bank account is the security these banks provide when making online transactions or even oversea money transfers.

What is a bank account?

A bank account helps keep a record of how much money you have at a given time. When you go to deposit or withdraw money, your account details are updated accordingly.

Upon opening a bank account, you also get a debit card and mobile banking facilities. This removes the need to go to your bank branch every time you need to make a transaction. Want to withdraw money? Simply visit any ATM and use your debit card for the same. Debit cards, credit cards, and banks’ own UPI also help you make cashless payments whenever you purchase anything.

Before we go ahead in detail, let’s get you a summarized details on How to open a Savings Account.

Step-by-Step Guide to Opening a Savings Account

|

Step |

Online Method |

Offline Method |

|

1. Research and Choose a Bank |

|

|

|

2. Check Eligibility Criteria |

– Verify age, residency status, and other bank-specific requirements. |

|

|

3. Gather Required Documents |

– Prepare scanned copies of necessary documents such as:

*Some VKYC agencies will ask you to keep Original PAN and Aadhaar Card handy to be shown to the VKYC agent during verification. |

|

|

4. Visit the Bank’s Website or Mobile App |

– Navigate to the official website or download the bank’s mobile application. |

|

|

5. Fill Out the Application Form |

– Complete the online application form with personal details. |

|

|

6. Submit Documents |

– Upload scanned copies of the required documents. |

|

|

7. Complete KYC Process |

– Undergo Video KYC or schedule an appointment for in-person verification, as per the bank’s procedure. |

|

|

8. Initial Deposit |

– Transfer the minimum required deposit online, if applicable. |

|

|

9. Account Activation |

– Receive confirmation of account activation via email or SMS. |

|

|

10. Access Account |

– Set up internet banking and mobile banking services. |

|

We were compiling a list of queries that new users face around opening a bank account, and these questions on Reddit sums it up:

“Opening My First Ever Bank Account – Need Advice, Best Options & Mistakes to Avoid!”

byu/FreeExcuse1880 inCreditCardsIndia

Before we move ahead, let us inform you that Jupiter itself is not a bank and doesn’t hold or claim to hold a banking license. The savings account, bank deposits and cobranded VISA Debit Card are issued by Federal Bank – a scheduled commercial bank. All funds in the account are insured up to approved limits by DICGC. Your Savings Account and bank deposits are hosted by our partner bank and follows all security standards prescribed by the bank/regulator.

Jupiter offers a plethora of features tailored to meet your banking preferences:

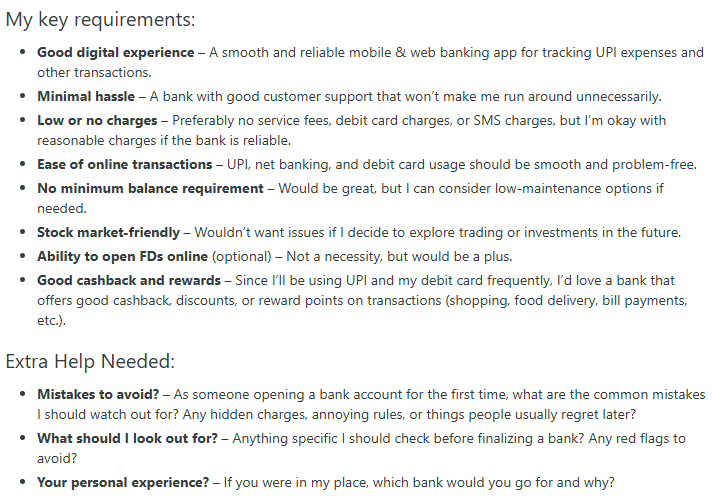

- Seamless Digital Experience: Jupiter provides a user-friendly mobile application on Android and iOS that facilitates effortless creation of a Savings account, tracking of UPI expenses and other transactions. The app offers real-time spending insights, allowing you to manage your finances with ease.

- Minimal Hassle: Jupiter emphasizes prompt customer support, ensuring that assistance is readily available whenever needed. This approach minimizes the need for unnecessary interactions, streamlining your banking experience.

- Low or No Charges: Jupiter is committed to transparency, offering an all-in-one savings account with no hidden fees. Services such as bill payments and gift cards are free from additional charges, providing a cost-effective banking solution.

- Ease of Online Transactions: The platform supports fast and secure UPI payments, enabling you to send and receive money, scan and pay, and manage transactions effortlessly.

- No Minimum Balance Requirement: Jupiter offers a Federal Bank Savings account with certain minimum balance requirements so as to cater better services to the end user, allowing you to maintain your account and having multiple investment avenues to secure your future.

- Stock Market-Friendly: Jupiter provides access to mutual funds, enabling you to invest and diversify your portfolio directly via the app.

- Ability to Open Fixed Deposits Online: Jupiter facilitates the opening of fixed deposits and recurring deposits online, allowing you to grow your savings conveniently.

- Attractive Cashback and Rewards: Jupiter offers a rewarding experience by providing up to 5X rewards on your spends. You can earn 1% rewards on transactions made using your debit card or UPI, and redeem these rewards as cash directly into your account.

Now over and above these points, we have more.

Pots – Intelligent Savings: Jupiter’s ‘Pots’ feature acts as a smart piggy bank, allowing you to set aside funds for specific goals. You can automate savings for multiple objectives, track progress in one place, and move money without any fees, ensuring a seamless savings experience.

Magic Spends – Automated Micro-Investments: This feature enables you to invest a predetermined amount every time you make a transaction. The investments can be directed into digital gold or mutual funds, promoting a habit of regular investing linked to your spending activities. You can see some coverage around the same here at The Economic Times.

Portfolio Analyser: Jupiter provides a Portfolio Analyser tool that allows you to track your mutual fund investments. This feature offers insights into your investment performance, helping you make informed financial decisions.

Networth Tracking: The app offers a ‘Networth’ feature that provides a comprehensive view of your wealth, allowing you to monitor the growth of your assets over time.

Comprehensive Customer Support: Jupiter emphasizes exceptional customer service, achieving an impressive 86% Customer Satisfaction (CSAT) score. We have been working on improving the support system which includes features like automatic ticket assignment and seamless integration with various communication channels, ensuring prompt and efficient assistance (Read more about it here – Source: Freshworks)

Eligibility criteria to open a bank account

To be considered eligible for opening a bank account, you need to:

- Be over 18 years of age

- Be a citizen of India

- Be able to maintain the minimum amount required by the bank

- In the case of foreign nationals, they must reside in India for over 180 days

In the case a minor requires to open a bank account, then the parents or the legal guardian must sign and register on the minor’s behalf. Some nationalized banks do have the option of minors having a joint account with a parent. This parent’s name is removed once the minor reaches 18 years of age.

Documents required to open a bank account

For opening a bank account, you need to provide certain documents that confirm your citizenship and your earnings. The set of documents requested are:

- Proof of Citizenship like AADHAR, Passport, or Voter card

- Proof of address like Voter card, Driver’s licence, AADHAR, or Telephone bill

- PAN card that links salary to the account and also helps with IT filing

- If salaried, payslips for the past six months will be beneficial

- Current passport size photographs for identity proof

- Some banks require an introduction letter from an existing account holder

How to open a bank account in India online

Online new account opening is as easy as creating a new Facebook account. If you want to know how to open a bank account online, you need to follow the given steps:

- Go to the bank’s website or app

- Go to the type of account you want to open

- Select the option for opening a new account

- Fill in the details like name, address, date of birth, employment status, etc.

- Attach the required documents to the file along with a photo

- Verify the data and apply

Once the bank receives it, they will call and send a representative with the new account kit and also verify the documents. In case you are opting for a Neobank like Jupiter, you can easily open an account with your PAN and AADHAR card numbers. OTP and codes will be sent to your registered mobile account.

How to open a bank account in India offline

If you find online account opening to be confusing or are still unsure about the type of account that will suit your needs, you can always visit the branch nearest to you to get the account opened. The process for opening a bank account offline is very similar to that done online. You visit the branch, understand the different types of accounts and get suggestions on which suits you best. Next:

- Fill in the form that the person in the bank gives you. Ask them to give a form for creating a Savings account in their bank.

- Provide copies of the documents required along with a photo of yours

- Show your original documents for verification

- Once the person checks the originals along with the photocopies, they will ask you to sign the photocopies of your documents for self-attestation

- Give a cheque or make a direct deposit when opting for an account that requires the maintenance of a minimum balance

- Collect the new account kit that will contain the debit card, welcoming letter, password to the newt banking and mobile banking portals, and a benefits brochure

You are all set to use your new bank account.

Types of banks in India

Banks are considered to be financial institutes responsible for regulating the economic status of an individual and also dealing with loans.There are primarily three types of banks and their roles vary based on the types of services they provide.

Central Bank

The Central Bank is responsible for regulating the other banks. In India, this role is on the RBI or Reserve Bank of India. Central banks usually do not let other citizens open a direct bank account but they respond to grievances and compliance issues related to the banks they oversee.

Cooperative Banks

Cooperative Banks are governed by the laws of either the state or the nation. Some examples of Cooperative Banks are Saraswat Co-operative Bank, Cosmos Co-operative Bank, and Bharat Co-operative Bank. These banks help people from the lower strata of society to become financially stable.

Commercial Banks

Commercial Banks are regulated by the Banking Regulation Act of 1949 and the core interest of these banks is usually to make a decent profit. They function either as public sector banks (Bank of India, State Bank of India, Punjab National Bank, etc.), private sector banks (HDFC Bank, Axis Bank, Federal Bank, etc.), or foreign banks (HSBC, Citi Bank, Standard Chartered Bank, etc.).

Things to consider before opening a bank account

The process for opening a bank account is simple and technology has made it possible to open an account within a few minutes. But, the first thing that you need to consider before opening a bank account is to know if that particular account is right for you. Here is a checklist for the same:

- The type of bank that suits your needs

- The account type that will benefit you the most

- Additional accounts that will help you save more

- Minimum balance required to be eligible for opening an account

- The rate of interest the bank offers, especially for savings account

- The deposit box or locker feature being offered

- The ancillary charges implemented once the free services quota are used up

Conclusion

Having a bank account is a crucial part of living in this age and day. You can link your bank account with a digital wallet and pay bills or recharge your phones from your phone. There are many myths and misconceptions surrounding banks and bank accounts. People often refrain from opening a bank account thinking that their money can be looted by hackers. But, banks do have strict policies regarding safeguarding client money and data. Hence, you can open a bank account with an easy mind.

If you are worried how to go about opening an account on Jupiter, you can read this comment by a user on Jupiter’s community forum: Link to the customer’s review

Frequently Asked Questions (FAQs)

Can you have more than one account with a bank?

Yes, you can have more than one account with a single bank or have accounts over multiple banks. As long as you provide your authentic data and the banks allow it.

What is the minimum amount required for opening a savings account?

This depends on the banks. Some offer a zero-balance savings account while others require at least 10000 rupees to be deposited and maintained for the same.

Does CIBIL score affect new bank account opening?

Some banks require you to maintain a CIBIL score of 700 while some allow people with low or no CIBIL score to open an account.

Can minors open a bank account, and what is required?

Minors typically need a co-signer or adult applicant to open an account, along with appropriate identification for both parties.

How long does it take to open a bank account?

The time frame varies; online applications may be processed quickly, while in-person applications might take longer, depending on the bank’s procedures.