Currently, money transfer is one of the most popular services in the world. It allows you to send money from one place to another, even in real-time, owing to which online money transfer systems are becoming a common source of remittance in India. The market is expanding with the introduction of apps daily.

Sending money online is very easy and convenient. You can always use these sites from the comfort of your home or office. So, to help you experience a seamless transfer of funds from your location to India, here’s a curated list of the best apps for online money transfer in India.

| App Name | Key Features | Transfer Methods Supported | Transfer Speed | Rewards/Offers | KYC Requirements | App Website/Install Link |

| Jupiter | Rewards on UPI payments, lifetime-free credit card | UPI, Credit Card | Instant | Yes | Partial | Jupiter |

| BHIM | Simple UPI transfers | UPI | Instant | No | No | BHIM |

| UltraCash | Mobile payments at merchants, secure transactions | UPI, Bank Transfer | Instant | No | Partial | UltraCash |

| PhonePe | Bill payments, QR code, Cashback | UPI, Bank Transfer | Instant | Yes | Partial | PhonePe |

| Paytm | Mobile recharge, Shopping, UPI | Wallet, UPI, Bank Transfer | Instant | Yes | Full for wallet | Paytm |

| BHIM Axis Pay | UPI transactions, linked with Axis Bank accounts | UPI | Instant | No | No | BHIM Axis Pay |

| Google Pay | Rewards, Bill pay, Split bills | UPI, Bank Transfer | Instant | Yes | No | Google Pay |

| PayPal | International payments, widely accepted globally | Bank Transfer, Card | Instant | No | Full | PayPal |

| Amazon Pay | Shopping, Bill pay, Gift cards | Wallet, UPI | Instant | Yes | Partial | Amazon Pay |

| Mobikwik | Mobile recharge, Bill payments, UPI | Wallet, UPI, Bank Transfer | Instant | Yes | Full for wallet | Mobikwik |

| Freecharge | Mobile recharge, Bill payments, UPI | Wallet, UPI, Bank Transfer | Instant | Yes | Full for wallet | Freecharge |

| PayUMoney | Payment gateway for merchants, online payments | Wallet, Bank Transfer | Instant | No | Full | PayUMoney |

| Yono (By SBI) | Banking services, Bill payments, Shopping | UPI, Bank Transfer | Instant | No | Full | Yono (By SBI) |

| BHIM SBI Pay | UPI transactions, linked with SBI accounts | UPI | Instant | No | No | BHIM SBI Pay |

| Pockets | Digital wallet by ICICI Bank, Bill payments, Shopping | Wallet, UPI, Bank Transfer | Instant | Yes | Full | Pockets |

| Payzapp | Digital payments by HDFC Bank, Bill payments, Shopping | Wallet, UPI, Bank Transfer | Instant | Yes | Full | Payzapp |

| Airtel Thanks | Mobile recharge, Bill payments, Airtel services | Wallet, UPI, Bank Transfer | Instant | Yes | Full for wallet | Airtel Thanks |

| Ola Money | Ride payments, Bill payments, Shopping | Wallet, UPI | Instant | Yes | Full for wallet | Ola Money |

| MyJio | Jio services payments, Bill payments, Shopping | Wallet, UPI, Bank Transfer | Instant | Yes | Full for wallet | MyJio |

| Western Union | International money transfers | Bank Transfer, Cash Pickup | Varies | No | Full | Western Union |

| WhatsApp Pay | UPI payments within WhatsApp chats | UPI | Instant | No | No | WhatsApp Pay |

| Kotak811 | Digital savings account, UPI, Bill payments | UPI, Bank Transfer | Instant | Yes | Full | Kotak811 |

| Paysend | International money transfers to cards and bank accounts | Card Transfer, Bank Transfer | Instant | No | Full | Paysend |

| BOB इ Pay | UPI transactions, linked with Bank of Baroda accounts | UPI | Instant | No | No | BOB इ Pay |

| YES PAY Next | UPI transactions, linked with Yes Bank accounts | UPI | Instant | No | No | YES PAY Next |

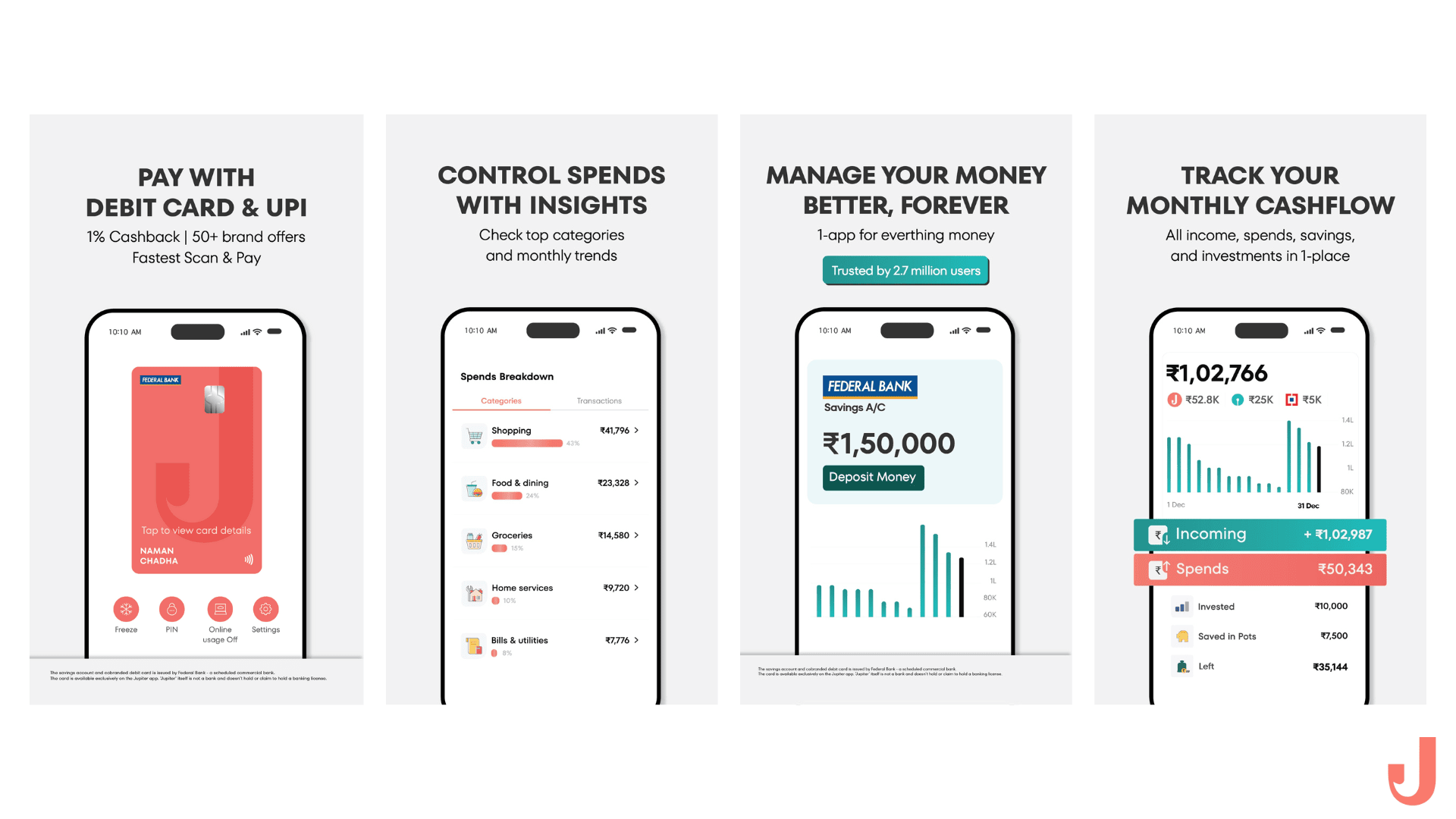

1. Jupiter

The features offered by Jupiter, money transfer services, are as follows:

- Insights providing real-time expenditure analyses

- Putting your saving funds in Pots on autopilot

- Networth to track the growth of your wealth

- Portfolio Analyzer to track your mutual funds

- No charges on Online Payments (NEFT/RTGS/UPI)

Play Store Ratings: 4.4

2. BHIM

The features offered by BHIM online money transfer services are as follows:

- Quick code scan and pay features

- Save your beneficiaries for quick access

- Keep a history of your transactions

- Create, change or reset your UPI PIN

Play Store Ratings: 4.0

3. UltraCash

The features offered by Ultracash, money transfer services, are as follows:

- No cash, card or wallet required

- Quick and easy to use

- Get credit, loyalties and offers

- Pay bills and recharge mobile numbers online

- Supports all major cards and banks

Play Store Ratings: 3.9

4. PhonePe

The features offered by Phonepe money transfer services are as follows:

- The interface is easy to understand

- Merchant payment and fund transfer are easy via QR scans

- Bill payments and mobile recharges quickly

- Bill autopay option is available

- You can get rewards and cashback.

Play Store Ratings: 4.2

5. Paytm

The features offered by Paytm money transfer services are as follows:

- Easy wallet setup

- The mobile recharge and bill payment process is easy and quick

- Merchant payment and fund transfers can be made via QR scans

- Financial investment options are available

- Movie and travel tickets are available

Play Store Ratings: 4.6

6. BHIM Axis Pay

The features offered by BHIM Axis money transfer services are as follows:

- Account number and QR code scan

- Send money via virtual payment ID

- Collect money via virtual payment ID

- Transfer money via mobile number

- Easy interface to use

Play Store Ratings: 3.9

7. Google Pay

The features offered by Google Pay money transfer services are as follows:

- Contactless payments are available.

- Purchase products online or through applications.

- Transfer cash to relatives and friends.

- Make group contributions and bill splitting.

- Pay for public transportation.

Play Store Ratings: 4.4

8. PayPal

The features offered by PayPal money transfer services are as follows:

- Easy-to-use interface

- Global transactions are a breeze

- PayPal Buyer Protection significantly increases shopper confidence

- Multiple currencies are supported

- Cloud integration is supported

Play Store Ratings: 3.7

9. Amazon Pay

The features offered by Amazon Pay money transfer services are as follows:

- Real-time transaction

- Easy-to-understand interface

- Amazon Pay Later offers easy transfer of one-time payments to instalments

- Transfer money from the online wallet to the bank account

Play Store Ratings: 4.1

10. Mobikwik

The features offered by Mobikwik money transfer services are as follows:

- Quick cash transfer

- Online shopping features are available

- Quick mobile recharge

- Exciting offers are available

- Hassle-free cash pickups and deposits

Play Store Ratings: 4.4

11. Freecharge

The features offered by Freecharge money transfer services are as follows:

- Hassle-free money transfer

- Easy cheque submission to the bank

- Secure payments powered by Axis Bank

- Easy UPI account setup process

Play Store Ratings: 4.2

12. PayUMoney

The features offered by PayUMoney money transfer services are as follows:

- Easy recurring payment setup via subscription feature

- International payments

- Same-day settlements are available

- Easy payouts

- Quick and accessible PayU Assist customer service

Play Store Ratings: 3.3

13. Yono (By SBI)

The features offered by Yono SBI money transfer services are as follows:

- Beneficiary information for the most often used Fund Transfers would be auto-populated

- Beneficiary registration and following fund transfers take place in the same work process

- A clever search tool allows the user to search for a specific Recipient from the complete Beneficiary List

- Using the clever search capability, the user may look for the Beneficiary’s IFSC code.

Play Store Ratings: 4.2

14. BHIM SBI Pay

The features offered by BHIM SBI money transfer services are as follows:

- Quick cash transfer

- Easy to use and understand interface

- QR scan options are available

Play Store Ratings: 4.1

15. Pockets

The features offered by Pockets money transfer services are as follows:

- Easy wallet creation

- Shop anywhere with VISA

- Transfer money instantly

- Awesome deals

- Quick customer services

Play Store Ratings: 3.5

16. Payzapp

The features offered by Payzapp money transfer services are as follows:

- Transfer money via QR scans

- Easy interface

- Money transfer is hassle-free

Play Store Ratings: 4.6

17. Airtel Thanks

The features offered by Airtel Thanks money transfer services are as follows:

- Settle bills online

- Send money instantly

- Explore multiple offers

- Quick customer service

Play Store Ratings: 4.3

18. Ola Money

The features offered by Ola money transfer services are as follows:

- Seamless money transfer experience

- Pay for anything online

- Safe transactions

Play Store Ratings: 2.2

19. MyJio

The features offered by myJio money transfer services are as follows:

- Make everyday payments online

- Get Aadhaar-based banking facilities online

- Quick transactions

Play Store Ratings: 4.4

20. Western Union

The features offered by Western Union money transfer services are as follows:

- International transactions are supported

- Online registration is quick and easy

- Send money online instantly

Play Store Ratings: 4.6

21. WhatsApp Pay

The features offered by Whatsapp pay money transfer services are as follows:

- The simple setup process for fast money transfers

- Everything from money transactions to receipts in one place

- Direct bank transfer

Play Store Ratings: 4.2

22. Kotak811

The features offered by Kotak811 money transfer services are as follows:

- Simplified beneficiary registration

- Set up ‘favourite’ beneficiaries

- Easy interface for beginners

Play Store Ratings: 4.2

23. Paysend

The features offered by Paysend money transfer services are as follows:

- Global coverage

- Fund transfer is fixed and shown before the transaction

- Instant transaction processing

- Bank-level transaction security

Play Store Ratings: 3.6

24. BOB इ Pay

The features offered by BOB इ Pay transfer services are as follows:

- Money may be sent and received quickly

- Request for agent and bulk collection

- Safe and reliable fund transfer processes

- 24-hour availability of customer service

Play Store Ratings: 4.1

25. YES PAY Next

The features offered by Phonepe money transfer services are as follows:

- Mobile recharge and bill payments are made instantly

- Vouchers are available for purchases

- Transfer funds online and instantly.

Play Store Ratings: 4.7

Conclusion

With hundreds of online money transfer apps available to users globally, it’s evident that the market is here to stay and is bound to grow bigger every day. As far as India is concerned, this is the perfect time for the market to grow and expand into other sectors.

And with the money transfer market growing in leaps, it’s no surprise that more and more apps are being introduced. No matter what the consumer demands, a solution is created instantly.

All that’s left is to do a background check and read reviews to find the best app that fits the individual. So the next time money needs to be sent home from abroad, or tuition fees need to be paid at the last second, consider doing so digitally.