In terms of employment, people in India work in both the public and private sectors. Recent estimates indicate that 6.8 million people receive government pensions, including family pensions, and that out of India’s 40 million salaried workers, nearly 5 million work for the government. Dearness Allowance (DA) is one of the components that make up salary packages. Employers in the public and private sectors are given this allowance specifically to help with the rising cost of inflation. In this article, we will dig deeper into understanding Dearness Allowance (DA) in salary.

What is Dearness Allowance (DA)?

DA’s full form in salary per month is Dearness Allowance. Dearness Allowance (DA) is a cost-of-living adjustment allowance given to employees to compensate for the rising prices of goods and services in an economy. It’s a percentage of the basic salary that is adjusted periodically to match inflation rates. The allowance is calculated as a percentage of the regular salary to mitigate the impact of inflation. When filing an Income Tax Return (ITR), it is mandatory to declare the tax liability associated with DA. This salary component is applicable to employees in both India and Bangladesh.

Current Dearness Allowance Rate

As of March 28, 2025, the Union Cabinet has approved a 2% increase in Dearness Allowance (DA) for central government employees and Dearness Relief (DR) for pensioners, raising the rate from 53% to 55% of basic pay and pension. This adjustment is effective from January 1, 2025, and aims to offset inflation impacts. Source: The Times of India

This decision benefits approximately 48.66 lakh central government employees and 66.55 lakh pensioners, with an estimated annual financial impact of ₹6,614.04 crore on the exchequer. Hindustan Times+2The Times of India+2mint+2

The previous DA increase occurred in July 2024, when it was raised from 50% to 53% Source: The Economic Times

Dearness Allowance is a cost-of-living adjustment provided to government employees and pensioners to mitigate the effects of inflation. It is revised periodically based on the All India Consumer Price Index (AICPI).

For example, an employee with a basic pay of ₹40,000 will see their DA increase from ₹21,200 (at 53%) to ₹22,000 (at 55%), resulting in a monthly increase of ₹800.

It’s important to note that when DA reaches 50%, certain allowances linked to basic pay, such as House Rent Allowance (HRA), may be revised. However, specific details about these adjustments have not been provided in the current announcement.

These changes are designed to help central government employees manage the increasing cost of living. In short, this DA hike means that central government employees can look forward to a noticeable increase in their monthly salaries.

How to Calculate Dearness Allowance (DA) in Salary

Dearness Allowance is added to your salary along with basic salary and other components of the salary.

-

For Central Government employees

Dearness Allowance % = ((Average of AICPI (Base Year – 2016=100) for the past 12 months -115.76)/115.76) *100

“The Labour Bureau has changed the base year of the Consumer Price Index for Industrial Workers from 2001 to 2016. The link factor for the new series (2016=100) to the old series (2001=100) is 2.88.” – Source -

For Central Public Sector Company employees

Dearness Allowance % = ((Average of AICPI (Base Year – 2016=100) for the past 3 months -126.33)/126.33) *100

Check out more data about Consumer Price Index here. -

For Private sector employees

The specific formula for calculating DA in the private sector may not be publicly available or standardized across all private companies. Employees in the private sector are advised to refer to their company’s HR policies or consult with their HR department for detailed information on the calculation of Dearness Allowance specific to their organization.

Types of Dearness Allowance

There are two types of Dearness Allowance (DA) – Industrial Dearness Allowance (IDA) and Variable Dearness Allowance (VDA).

-

Variable Dearness Allowance (VAD)

Variable Dearness Allowance (VAD) is a type of financial support given to Central Government employees in India. This allowance is adjusted every six months based on the changes in the Consumer Price Index (CPI) to help combat the effects of inflation.

VAD consists of three main parts:

- Fixed Variable DA: This part of VAD remains unchanged unless the government decides to alter the basic minimum wages.

- Base Index: This index is also set for a specific period and does not change during that time.

- Consumer Price Index (CPI): The CPI is updated monthly and plays a significant role in determining the value of the VAD.

Because the CPI fluctuates, it directly impacts how much VAD employees receive.

-

Industrial Dearness Allowance (IDA)

The Industrial Dearness Allowance (IDA) is another type of allowance, but it is specifically for public sector employees. Unlike VAD, the IDA is updated quarterly, also based on the CPI changes. This ensures that the allowance reflects the current economic conditions and helps employees manage their living costs effectively.

Importance of DA in Salary Structures

Dearness Allowance (DA) is an important part of salary packages, as it helps employees cope with changes in living costs due to inflation. Here’s why DA matters:

- Financial Security: DA helps ensure that employees can maintain their purchasing power even when prices go up. This financial support makes it easier for them to manage their daily expenses.

- Boosting Morale: When employees see that their salaries include adjustments for inflation, it can improve their mood and motivation at work. Knowing their pay reflects current economic conditions helps them feel valued.

- Impact on Retirement: For those who have retired, DA also influences the amount of their pension. This can significantly affect their quality of life after leaving the workforce.

Differences in DA Across Various Sectors

| Aspect | Government Sector | Private Sector |

| Prevalence | Employee allowances are quite common in the government sector, where most workers receive them as part of their compensation. | In the private sector, such allowances are not as widespread, and many employees may not have access to them. |

| Consistency | The government sector tends to maintain stable allowances, ensuring that they are reviewed and updated regularly. | In contrast, private sector allowances can be inconsistent, with changes depending on individual company policies and practices. |

| Calculation Basis | These allowances are usually calculated based on the All India Consumer Price Index (AICPI), which reflects general inflation. | Private companies may have their own methods for calculating allowances, which may not always be linked to the AICPI. |

| Adjustment | Adjustments in the government sector are typically made every six months, providing a regular review process. | Adjustments in the private sector are often made annually and are at the discretion of the company, which can lead to less predictability. |

| Purpose | The primary aim of these allowances is to help employees cope with rising living costs and inflation, thereby maintaining their standard of living. | In the private sector, allowances may serve as a competitive advantage, helping companies attract and retain talented employees. |

| Regulation | Government policies mandate and oversee these allowances, ensuring compliance and consistency across the sector. | In the private sector, the establishment and management of allowances are determined by the HR and finance teams within each company, leading to variability. |

| Impact on Salary | Allowances form a significant component of overall compensation, greatly influencing total salary packages. | In the private sector, the role of allowances in overall salary can vary widely, with some employees receiving substantial amounts while others may not. |

What Is the Difference Between DA and HRA?

DA in salary is calculated as a percentage of the basic salary of a public sector employee. HRA is not calculated as a percentage of the basic salary. Let’s learn through table:

| Difference | Dearness Allowance | HRA |

| Availability | Only for Central Government and public sector employees | Available for both public and private sector employees |

| Calculation | A fixed percentage of the basic salary | Not calculated based on basic salary |

| Taxability | Fully-taxable with no exemptions | Partially taxable with certain exemptions under Income Tax |

| Revision | Periodically revised | Does not change unless the salary structure changes |

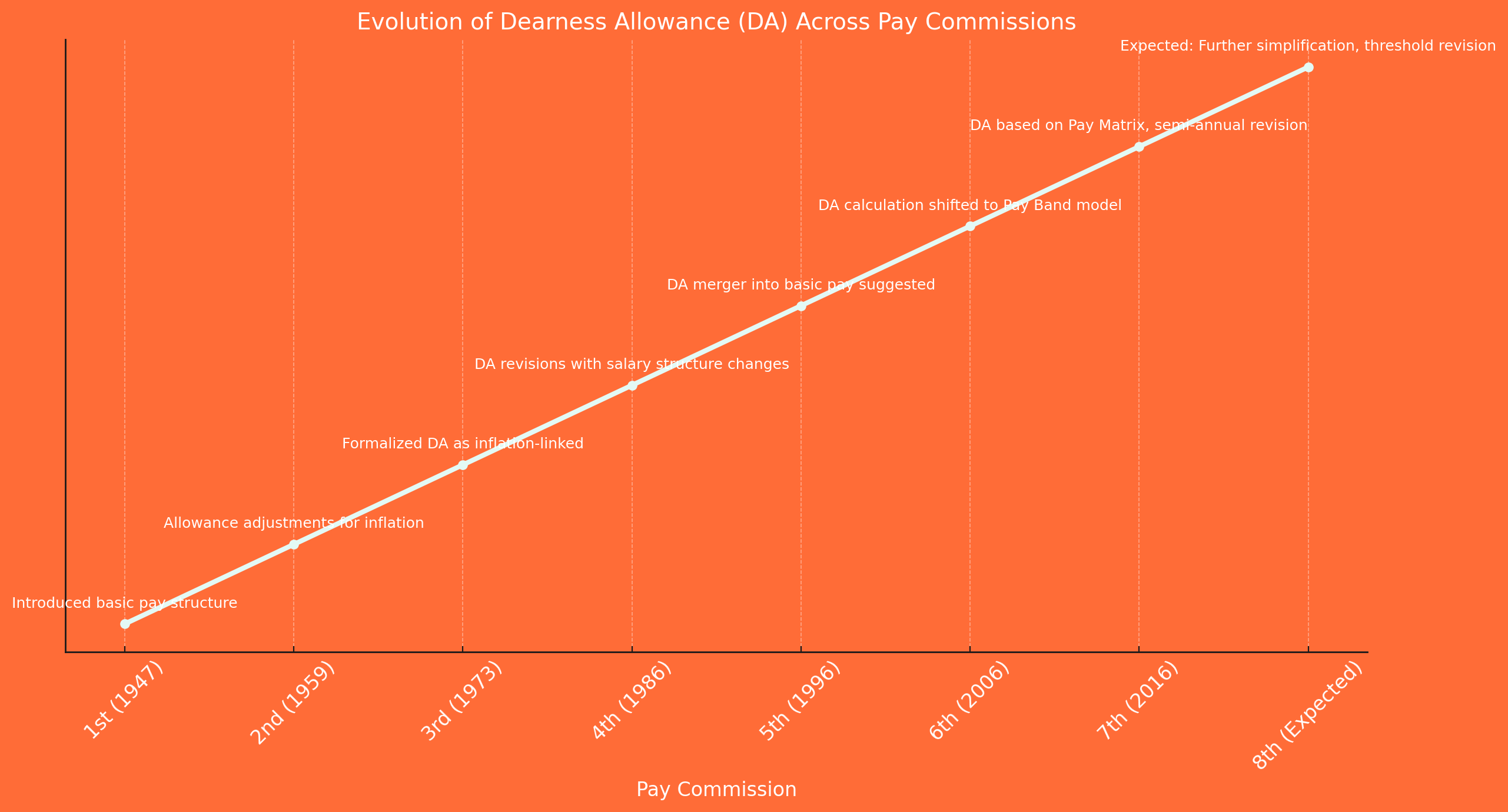

Role of Pay Commissions in DA Calculation

Pay commissions play an important part in figuring out Dearness Allowance (DA).

- Understanding the Economy: These commissions look at the current economic situation, taking into account things like inflation and the general cost of living. They want to understand how the economy is doing overall.

- Suggesting DA Adjustments: After analysing the economy, they suggest changes to the DA rates to make sure they fit with the current financial conditions. This helps ensure that employees and pensioners can maintain their purchasing power.

- Regular Reviews: Pay commissions usually review and make major updates to the DA calculation about every ten years. This helps keep the calculations in line with any changes in the economy.

- Effects on Government Budgets: The recommendations from these commissions also influence how the government allocates its budget. Changes in DA can affect a large number of employees and retirees, so it’s a significant consideration for government planning.

Let’s observe the history of various Pay Commissions in India

| Pay Commission | Year of Implementation | Chaired By | Key Highlights / Recommendations |

|---|---|---|---|

| 1st | 1947 | Srinivasa Varadachariar | Focused on post-independence salary structuring; introduced basic pay concepts. |

| 2nd | 1959 | Jagannath Das | Rationalized pay scales, increased allowances for inflation. |

| 3rd | 1973 | Raghubir Dayal | Introduced DA as a formal salary component linked to inflation. |

| 4th | 1986 | P.N. Singhal | Major salary revisions; improved benefits and retirement perks. |

| 5th | 1996 | Justice S. Ratnavel Pandian | Increased salary by 20–30%, recommended pension reforms. |

| 6th | 2006 | Justice B.N. Srikrishna | Introduced Pay Band system and Grade Pay; significant salary hikes. |

| 7th | 2016 (retrospective from Jan 2016) | Justice A.K. Mathur | Removed Grade Pay, introduced Pay Matrix, streamlined allowances, and hiked basic pay by ~23%. |

Closing Thoughts

Whether you’re a government employee, a public sector worker, or a pensioner, DA plays a significant role in your financial planning. With this guide, you should now have a comprehensive understanding of what is dearness allowance in salary, its types, importance, and how it’s calculated, empowering you to make informed decisions about your finances.

FAQs: