Get salary accounts for your team See benefits

Table of Contents

ToggleThe original value of all types of business assets can be expensed every year during their entire lifetime. These expenses are used to reduce the taxable income, which in turn decreases the tax liability for the companies.

The two primary methods of calculating the value of the different business assets are depreciation and amortization. A third mechanism for expensing such assets is depletion, which is an accrual method generally used by businesses extracting natural resources.

With loans, amortizing the borrowed amount focuses on spreading the loan repayments over its tenure.

Amortization is primarily the process of incrementally charging the cost of business assets over their expected life. As a result, these assets are shifted from the balance sheet to the profit and loss (P&L) account.

Amortizing is the gradual writing down of the cost of intangible assets over their useful life.

Some examples of intangible assets include franchise agreements, organizational costs, expenses incurred for issuing bonds to raise capital, copyrights, trademarks, patents, and licenses.

It is also applicable to other items like deferred charges and discounts on notes receivables.

The journal entry to record amortizing of intangible assets is debit to the expense account and credit to the accumulated amortized value.

If an intangible asset is considered to have an endless life, it is subject to a periodic impairment test, which results in the reduction of the asset’s book value.

The concept of amortizing is also applicable in terms of lending. The loan amortization schedule shows the starting value of the borrowed amount, minus the principal repayment and interest payable in each period, and the ending balance amount.

The schedule shows that during the initial loan tenure, a larger amount of the installment is paid towards interest due. The proportions of interest payments reduce as the borrowers continue repaying the principal amount.

Unlike depreciation, amortizing intangible assets is generally done using the straight-line method (SLM). This means the same amount is amortized in each period during the entire useful life of the assets. Moreover, assets that are amortized generally do not have any salvage or resale value.

In lending, the amortization table shows the series of loan repayments comprising principal and interest in each instalment over the entire tenure.

Calculating the amortized value is possible with spreadsheet packages like Microsoft Excel, advanced financial calculators, or online calculators. The schedule starts by showing the opening loan balance.

To determine the monthly instalment amount, the interest is calculated by multiplying the loan balance by the rate of interest and dividing it by 12.

The principal due in a particular month is the difference between the equated monthly instalment (EMI) and the interest for that period.

In the next month, the outstanding loan amount is the previous month’s opening balance minus the last principal payment.

The interest is then calculated on this amount. This entire process continues until all the principal payments are made and the outstanding loan balance becomes zero.

Having understood what loan amortization is and how it is calculated, the formula for estimating the monthly principal amount due on an amortized loan is as follows:

Principal amount = TMP – [(OLB x Interest Rate/12)]

Where TMP is the total monthly payment

OLB is the outstanding loan balance

The monthly instalment is pre-determined when borrowers avail of the loan. If borrowers want to calculate the approximate monthly payment to compare different loans offered by lenders, they may use the following formula:

Total payment = Loan amount x [I x (1+I/n) / (1+I)/n) – 1]

Where I is the monthly rate of interest

N is the number of payments

To derive the monthly rate of interest, individuals must divide the interest rate by 12.

Additionally, they need to multiply the number of years in the loan tenure by 12.

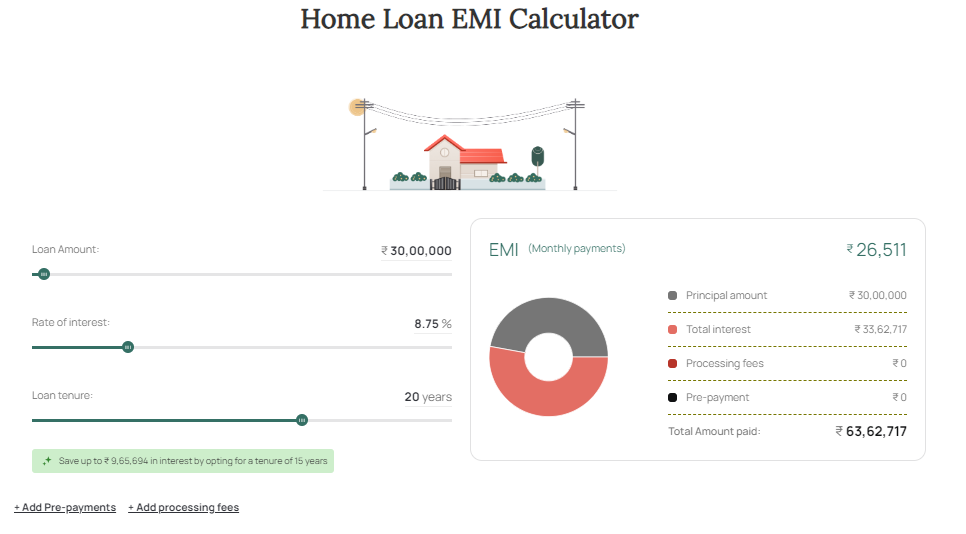

Calculate Amortization on our Free Home Loan EMI Calculator

Check your home loan EMI, prepayment and savings on interest with our free Home Loan EMI Calculator

Assume that a person borrows INR 3 lakhs as a car loan for a period of five years at an interest rate of 8% per annum. The monthly installment is calculated as follows:

Monthly interest rate = 8%/12 = 0.0067

Monthly amount = 300000 x {(0.0067 x (1.0067/60)} / {(1.0067/60) – 1} = INR 6083

The interest for the first month = 300000 x (8%/12) = INR 2000

The principal is = 6083 – 2000 = INR 4083

The monthly installment stays constant as the borrower continues paying the EMI, a higher portion of the EMI is adjusted towards principal repayment until the outstanding loan amount becomes nil.

Both these concepts are similar and try to capture the cost of holding business assets over a period.

However, the primary difference between the two is that intangible assets are amortized while tangible (fixed) assets are depreciated over their estimated useful life.

Generally, intangible assets are amortized at a fixed rate using SLM. However, there are multiple ways of calculating the depreciation of fixed assets, which include SLM, written down value (WDV) method, unit of production method, and much more.

Lenders provide different types of financing but not every loan works in the same way. Only installment loans are amortized, and borrowers pay the balance until it reaches zero.

The following types of loans are amortized.

Generally, such loans are available for a maximum tenure of seven years; however, some lenders may offer longer durations. A longer loan period means borrowers pay higher interest.

Additionally, there is a risk of an upside-down loan wherein the outstanding loan balance exceeds the car’s resale value due to depreciation.

These types of loans are generally available for a period of up to 30 years. The interest rate can be fixed, which means the amortized loan schedule is constant.

Borrowers can also opt for variable rates, which change the loan amortization. Most individuals do not keep the home loan for its entire duration and try to repay it earlier to reduce their interest outflow.

Personal finance is available for one year to five years and is offered by banks as well as non-banking financial companies (NBFCs).

Generally, these loans are repaid in fixed monthly installments and are used for debt consolidation or other personal requirements.

This concept is important because it helps companies and investors understand and predict their costs over a period.

In terms of lending, the amortization schedule clearly shows the installment amount that is assigned towards principal repayment and the interest. This can be beneficial in tax planning by taking advantage of the available benefits.

In accounting, amortizing the intangible assets reduces the company’s taxable income, which reduces its tax outgo. Additionally, it provides investors with a better insight into the company’s actual earnings.

Loan amortization schedule table

Now that you have an answer for what is amortization and know that this concept is useful for both accounting and lending purposes, it is important to remember that it is used in different ways for both purposes.

For accounting purposes, amortizing intangible assets means incrementally charging the cost of these assets over their useful lives.

On the other hand, for lending purposes, it means accurately recording the interest and principal components in the monthly instalment of a loan.

Irrespective of whether you are using it for accounting or lending purposes, amortizing refers to reducing the value (either of the asset or the borrowed amount) over a certain period.

Priyanka Rao is a content strategist for Jupiter.Money, and specializes in writing on topics related to finance, banking, budgeting, salary & wages, and other financial matters. She has a passion for creating engaging content that resonates with audiences across various digital platforms. In her free time, Priyanka enjoys traveling and reading, which allows her to gain new perspectives and inspiration for her work. With a keen eye for detail and a creative mindset, Priyanka is committed to creating content that connects well with her readers, enhancing their digital experiences.

Powerd by Issued by