The Indian banking system consists of commercial banks, which may be public scheduled or non-scheduled, private, regional, rural and cooperative banks. The banking system in India defines banking through the Banking Companies Act of 1949.

In this post, we take a look at the evolution of banking in India, the different categories and the impact of nationalised banks.

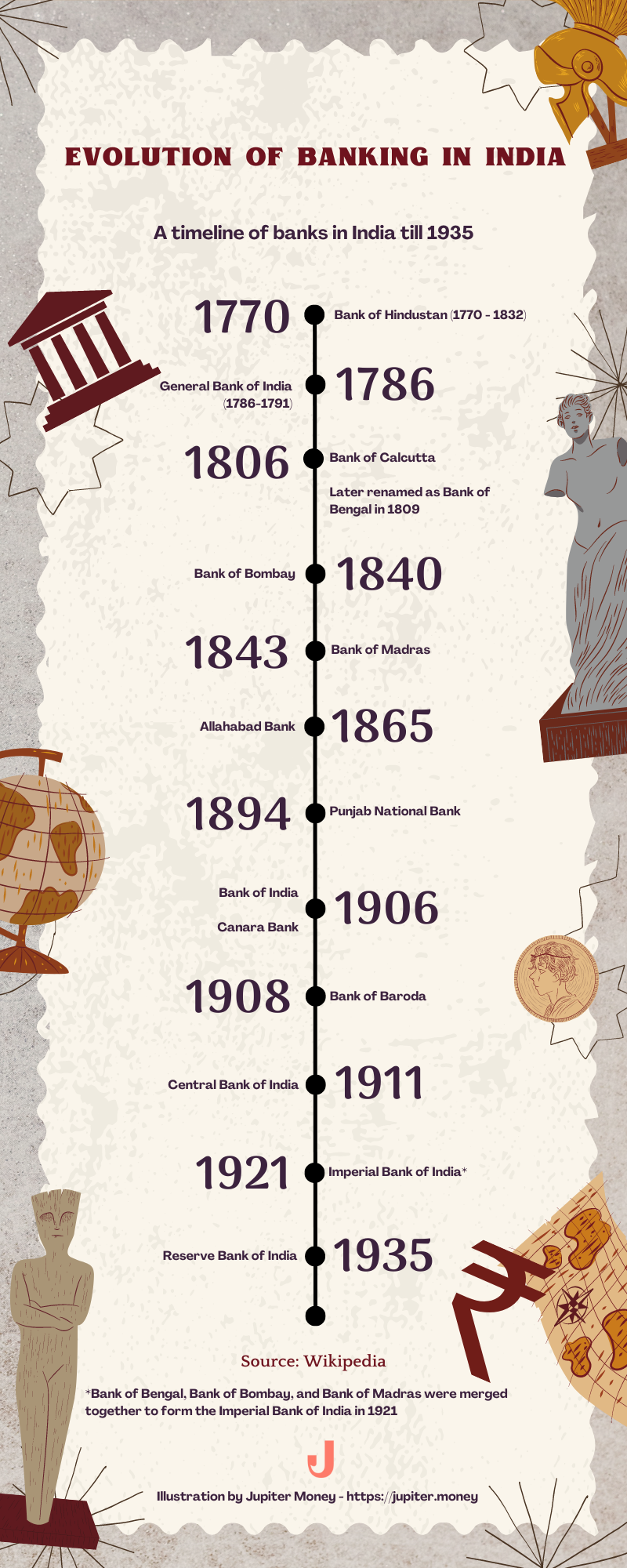

Phase 1: The Pre-Independence Phase (1770 to 1969)

There were almost 600 banks present in India before independence. The first bank to be established the Bank of Hindustan was founded in 1770 in Calcutta. It closed down in 1832. The Oudh Commercial Bank was India’s first commercial bank in the history of the evolution of banking in India.

A few other banks that were established in the 19th century, such as Allahabad Bank (Est. 1865) and Punjab National Bank (Est. 1894), have survived the test of time and exist even today.

Some other banks like the Bank of Bengal, Bank of Madras, and Bank of Bombay – established in the early to mid-1800s – were merged as one to become the Imperial Bank, which later became the State Bank of India.

Phase 2: The Post-Independence Phase (1969 to 1991)

After independence, the evolution of the banking system in India continued pretty much the same as before. In 1969, the Government of India decided to nationalise the banks under the Banking Regulation Act of 1949. A total of 14 banks were nationalised, including the Reserve Bank of India (RBI).

In 1975, the Government of India recognised that several groups were financially excluded. Between 1982 and 1990, it created banking institutions with specialised functions in line with the evolution of financial services in India.

- NABARD (1982) – to support agricultural activities

- EXIM (1982) – to promote export and import

- National Housing Board – to finance housing projects

- SIDBI – to fund small-scale industries

Phase 3: The LPG Era (1991 Till Date)

From 1991 onwards, there was a sea change in the Indian economy. The government invited private investors to invest in India. Ten private banks were approved by the RBI. A few prominent names which exist even today from this liberalisation are HDFC, Axis Bank, ICICI, DCB and IndusInd Bank.

In the early to mid-2000s, two other banks, Kotak Mahindra Bank (2001) and Yes Bank (2004), received their licenses. IDFC and Bandhan banks were also given licenses in 2013-14.

Other notable changes and developments during this era were:

- Foreign banks like Citibank, HSBC and Bank of America set up branches in India.

- The nationalisation of banks came to a standstill.

- RBI and the government treated public and private sector banks equally.

- Payments banks came into existence.

- Small finance banks were permitted to set up their branches throughout India.

- Banks began to digitalise transactions and various other related banking operations.

Reasons Why Banks Were Nationalised in India

To get a clearer picture of the impact of nationalisation on the banking industry and the general population, let’s understand why the government decided to nationalise banks:

- To Energise Priority Sectors: Banks were collapsing at a fast rate – 361 banks failed between 1947 and 1955, which converts to about 40 banks a year! Customers lost their deposits with no chance of recovering them.

- A Neglected Agricultural Sector: Banks favoured large industries and businesses and neglected the rural sector. Nationalisation came with a pledge to support the agricultural sector.

- Expansion of Branches: Nationalisation facilitated the opening of new branches to ensure maximum coverage of banks throughout the country.

- Mobilisation of Savings: Nationalising the banks would allow people more access to banks and encourage them to save, injecting additional revenue into a cash-strapped economy.

- Economic and Political Factors: The two wars in 1962 and 1965 put a tremendous burden on the economy. The nationalisation of Indian banks would give the economy a boost through increased deposits.

The Positive Effects of Nationalisation

The nationalisation of Indian banks was one of the most significant events in the evolution of banks in India. Today, India has 19 nationalised banks.

Here are a few ways that nationalisation benefited the economy:

- Increased Savings: There was a sharp increase in savings with the opening of new branches. As national income rose in the 1970s, gross domestic savings almost doubled.

- Improved Efficiency: The efficiency of banks improved with additional accountability. It also increased public confidence.

- Empowering SSIs: Small-scale industries (SSIs) received a boost resulting in a proportionate improvement in the economy.

- Financial Inclusion: The overall statistics of the banking sector and the Indian economy showed a marked improvement. It reflected on parameters like the share of bank deposits to GDP, the gross savings rate, the share of advances to DGP, and the gross investment rate from 1969 to 1991.

- Better Outreach: Banks were now no longer only restricted to metropolitan areas. Branches were opened in the remotest corners of the country.

- A Surge in Public Deposits: The increased reach of banks helped small industries, agriculture, and the export sector grow. This growth was accompanied by a proportionate increase in public deposits.

- Elevating the Green Revolution: The Green Revolution, one of the biggest priority items on the government’s agenda, received a boost thanks to the support that the newly-nationalised banks provided to the agricultural sector.

Drawbacks of Nationalisation

To provide an unbiased view on the subject, here are a few downsides of nationalisation:

- Socio-Economic Challenges: The banks couldn’t provide sufficient support to eradicate poverty or provide adequate financing to the grassroots levels of society. This was particularly obvious in rural India.

- Competition From Private Banks: Despite government support and increased impetus through a rise in deposits, public sector banks were never able to surpass private banks in performance.

- Failure to Achieve Financial Inclusion: Although financial inclusion was the major objective of nationalising banks, it was not adequately enabled. It was only achieved to a limited extent after the launch of a type of savings account called Jan Dhan Yojana.

List of Banks in India Before Independence

Here is a list of banks before Independence. The small, brief list bears testimony of how few banks existed during that era:

| Bank | Year Established |

| Allahabad Bank | 1865 |

| Punjab National Bank | 1894 |

| Bank of India | 1906 |

| Central Bank of India | 1911 |

| Canara Bank | 1906 |

| Bank of Baroda | 1908 |

Here’s a simple illustration of timeline of Banks in India

Types of Banks in India

As we wind down our discussion on the evolution of the Indian banking system, we should touch upon the types of banks that exist in India today. Here are the major categories of banks that you are likely to come across:

1. Public Sector Banks

The government holds the majority of the shares of a public sector bank. A prime example is the State Bank of India, with 58.6% of its shares allocated to the Government of India. We could also consider Punjab National Bank, of which the government holds a stake of 58.87%.

Public sector banks are further divided into nationalised banks and state banks and their associated organisations.

With nationalised banks, the government has complete control and regulates the bank in all respects. But the government also has the option to sell shares of these banks. When this happens, the government’s stakes are reduced.

Sometimes the government becomes a minority in such banks, and then that bank gets listed on the Indian stock market.

2. Private Sector Banks

Private sector banks are owned by private entities. They came into prominence in the 1990s. Due to the high-quality service that they offer, these banks present stiff competition to public sector banks.

3. Small Finance Banks in India

Some niche banks in India provide basic banking services like deposits, lending, and bank transfers. These are small finance banks and cater to the part of the economy that isn’t being serviced by regular banks, such as marginal farmers, small industries, and other parts of the unorganized sector.

Examples of these banks are Ujjivan Financial Services Pvt Ltd in Bangalore and Equitas Holdings Pvt Ltd in Chennai.

4. Payment Banks in India

Payment banks are a new model created by the RBI. These banks can accept restricted deposits but are not authorized to issue loans or credit cards. They offer both current and savings accounts and can also issue ATM cards or debit cards.

An example of a payment bank in India is Airtel Payments Bank, set up by Bharti Airtel. Such banks also have a major role to play in the evolution of e-banking in India as they offer online payment solutions like mobile payment apps.

The Indian Banking System Drives the Economy

Over the years, Indian banks have transformed the country’s bleak financial landscape to feed its growing economy. Even today, there is no doubt that the Indian banking system is what keeps the country’s economy afloat.

A prime example is the demonetisation of currency notes in 2016. Existing currency notes were demolished practically overnight, throwing the nation into chaos. Banks helped the economy recover from the shock by allowing people across the country to exchange defunct banknotes.

As the banking industry continues to evolve in India, so does its ability to provide robust support to a nation that is ever-hungry for financial development.

FAQs

When Bank of Hindustan was founded?

Bank of Hindustan was founded in 1770 in Calcutta.

Which was India’s first commercial bank?

The Oudh Commercial Bank was India’s first commercial bank in the history of Indian banking

What Are the Types of Banks in India?

These are the types of banks in India:

- Public Sector Banks

- Private Sector Banks

- Small Finance Banks in India

- Payment Banks in India