Get salary accounts for your team See benefits

Table of Contents

ToggleBeing self-employed means you’re your own boss, managing your income and expenses on your own terms. While this independence is rewarding, it comes with unique financial needs. Unlike salaried employees with a steady paycheck, self-employed individuals often deal with fluctuating income, irregular cash flow, and business-related expenses.

Credit cards can be a helpful tool for managing these financial ups and downs. They offer a convenient way to cover expenses, build credit, and even access rewards or benefits tailored to business needs. Whether it’s buying supplies, paying bills, or handling emergencies, a credit card can make a big difference in how you manage your money.

However, applying for a credit card as a self-employed person can be tricky. Many banks prefer stable income proof, which isn’t always easy to provide when you run your own business or freelance. This creates challenges in getting approved for the right credit card.

In this guide, we’ll walk you through how to apply for a credit card if you’re self-employed and explore the options that work best for your lifestyle and financial needs. Let’s get started.

To apply for a credit card, one must be eligible. The following are the eligibility criteria for self-employed individuals to apply for a credit card.

Self-employed individuals applying for a credit card should be at least 25 years old. The maximum age limit for self-employed individuals to apply for a credit card is 65 years.

To be able to apply for a credit card, it is important to maintain a credit score of 750 or above.

A long credit history is important for self-employed individuals. This is because only individuals with a good and long credit history can be trusted with high credit limits and big loans. One way to build a good credit history is to ensure you repay your dues on time and never miss out on a payment. Only if you have a good credit history will your application be eligible. Moreover, the banks will also have the confidence that you have financial discipline.

Self-employed individuals must ensure they have a certain minimum income as specified by the bank to apply for credit cards. Banks usually check whether you are earning a certain level of income to repay your loans. Different banks have different minimum income levels, and you must check your bank’s criteria before applying for a credit card.

Looking for a credit card that offers more than just rewards?

Get the Edge CSB Bank RuPay Credit Card on Jupiter

Once you meet the eligibility criteria, you must keep the following documents ready to apply for a credit card.

Passport size photographs

Identity proof

Any government ID is considered valid identity proof. Banks accept PAN Card, Aadhar Card, Driver’s License, Voter ID or Passport as valid ID proof.

Address proof

Aadhar Card, utility bills and Passport are considered valid address proof.

Income proof

A valid proof of income for a self-employed individual is Form-16, Income Tax Returns, certified financial documents, and proof of business continuity,

Bank statements

As a self-employed individual, you must also provide six months of bank statements.

To apply for credit as a self-employed individual, you must follow the steps below.

There are so many credit cards in the market for self-employed individuals, and you must select the card that will suit your requirements.

Each credit card has different eligibility criteria. Ensure you check and qualify for the eligibility criteria of the credit card you selected.

Once you meet the eligibility criteria, prepare all necessary documents. Banks always specify the documents they need on their website.

You can visit the nearest branch of the bank or fill out the application form for the credit card online. Make sure you input all the necessary information correctly.

Once you fill out the application, submit it along with the documents. In the case of an online application, you can upload the documents. If you are physically submitting the application, attach a copy of all the documents.

Once you submit the documents, banks usually take a couple of days to review your application and make a decision. They will communicate their decision through email and text messages.

When choosing a credit card as a self-employed individual, it’s important to think about a few things that can make managing your finances easier. Here’s what you should consider:

Check how much credit the card provides and whether it suits your spending needs. A higher credit limit can be helpful, but make sure it matches your ability to pay off the balance.

Look at the interest rates for purchases and cash withdrawals. Lower rates can save you money if you ever need to carry a balance.

Some cards come with joining or annual fees. Make sure the benefits you’ll get from the card justify these charges.

Many cards offer rewards like cashback, travel points, or discounts on shopping. Choose one with rewards that fit your lifestyle and spending habits.

Be aware of extra charges like late payment fees, over-limit fees, or foreign transaction fees. These can add up if you’re not careful.

Good customer service can be a lifesaver if you run into issues. Look for a card provider known for being responsive and helpful.

Check if the card’s eligibility requirements align with your income and business structure. Some cards may have flexible options for self-employed individuals.

A card with strong security features, like fraud alerts and transaction monitoring, can help protect you from unauthorised charges.

Managing your credit card through an app or online platform can make tracking expenses, making payments, and accessing statements much easier.

Cards that support UPI payments can add convenience, letting you use your card in more places and for quick transactions.

The “best” credit card for a self-employed individual depends on their specific spending habits and financial goals. However, here are a few options that are generally considered good choices for self-employed individuals in India:

| Credit Card | Joining Fees | Lifetime Free | Annual Fee |

| Jupiter Edge CSB Bank RuPay Credit Card | NIl | Yes | NIl |

| IDFC Bank FIRST WOW Credit Card | NIl | Yes | NIl |

| HDFC Giga Business Credit Card | ₹500 + GST | No | ₹500 + GST |

| HDFC Bank BizGrow Credit Card | ₹500 + GST | No | ₹500 + GST |

| ICICI Bank Business Gold Credit Card | NIl | Yes | NIl |

| SBI SimplyCLICK Credit Card | ₹500 | No | ₹500 |

| Axis Bank Ace Credit Card | NIl | Yes | NIl |

Joining Fees

NIl

Lifetime Free

Yes

Annual Fee

NIl

The Jupiter Edge CSB Bank RuPay Credit Card is perfect for people who want to earn rewards on everyday purchases like shopping, dining, and travel. Whether you’re ordering food, booking your next flight, or picking up groceries, this card offers attractive cashback across multiple categories. It’s designed for users who want to make the most of their spending with minimal hassle.

Cashback & Rewards

Card Details

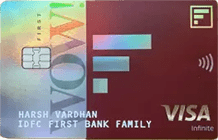

Joining Fees

NIl

Lifetime Free

Yes

Annual Fee

NIl

The IDFC FIRST WOW Credit Card is a great option for self-employed individuals looking for a flexible, no-hassle way to earn rewards and manage finances. This FD-backed credit card requires no income proof or credit history, making it an ideal choice for those who might not have a traditional credit profile. With excellent rewards on every spend and the ability to make UPI payments, this card offers a blend of convenience and value.

Cashback & Rewards

Card Details

Joining Fees

₹500 + GST

Lifetime Free

No

Annual Fee

₹500 + GST

The HDFC GIGA Business Credit Card is tailored for entrepreneurs, small business owners, and self-employed individuals who need a card that supports their business expenses. It comes with a host of business-related benefits, including cashback on essential purchases like software, accounting tools, and even tax payments. Whether you’re growing your business or need a card for large business purchases, this card offers plenty of ways to save.

Cashback & Rewards

Card Details

Joining Fees

₹500 + GST

Lifetime Free

No

Annual Fee

₹500 + GST

The HDFC Bank BizGrow Credit Card is designed specifically for business owners, freelancers, and self-employed individuals. It offers a wide range of benefits that help you save on business-related expenses while also providing rewards on everyday purchases. Whether you need to make tax payments, book travel, or purchase business tools, this card has your back with 10X cash points on select spends. Additionally, it provides a suite of business-focused perks like discounted travel bookings and insurance coverage, making it a valuable tool for your business needs.

Cashback & Rewards

Card Details

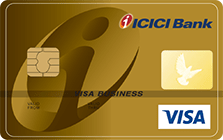

Joining Fees

NIl

Lifetime Free

Yes

Annual Fee

NIl

The ICICI Bank Business Gold Credit Card is a solid choice for small business owners who want to earn rewards on their everyday expenses. It comes with flexible benefits, including reward points on domestic and international spends, and is designed to help you save on both personal and business purchases. With added insurance and discounted rates, this card helps you manage your business expenses more efficiently.

Cashback & Rewards

Card Details

Additional Benefits

Joining Fees

₹500

Lifetime Free

No

Annual Fee

₹500

The SBI SimplyCLICK Credit Card is designed for those who love online shopping and want to make the most of their digital spending. It offers exciting rewards, discounts on your favorite e-commerce platforms, and a host of other benefits, making it a great choice for tech-savvy shoppers and regular online spenders. Whether you’re booking a movie ticket or shopping for gadgets, this card ensures you earn valuable rewards every time you shop online.

Rewards & Benefits

Card Features

Joining Fees

NIl

Lifetime Free

Yes

Annual Fee

NIl

If you’re self-employed and looking for a credit card that gives you great benefits, the Axis Bank ACE Credit Card could be a good fit. Here’s a breakdown of what it offers:

Cashback & Rewards

Card Features

Want a credit card that fits all your needs?

Find your perfect match with our Edge CSB Bank RuPay Credit Card on Jupiter

Getting a credit card when you are a self-employed individual can be slightly difficult but not impossible. You will have to give additional documentation, fit into the eligibility criteria, maintain a good credit score, and earn a certain level of income. Doing all this can seem challenging, but it can be very rewarding as these credit cards offer a host of benefits that can elevate your lifestyle and save a lot of money on regular expenses.

A self-employed individual can apply for a credit card just like any other individual. However, the documentation and effort required are slightly higher than those of regular credit card holders.

The minimum salary for a self-employed credit card can range between 14 lakhs to 25 lakhs per annum. However, each bank has a certain criterion, and it is best to check with the bank before you apply.

All major banks give credit cards to the self-employed. Some of the banks are SBI, ICICI, HDFC Bank, Axis Bank, Citi Bank, and AU Small Finance Bank.

Yes, self-employed individuals can get loans from any bank they choose. The documentation needs are slightly different in this case, but the process is pretty straightforward.

The age criteria for self-employed credit cards range between 25 and 65 years of age.

You can check the eligibility of the credit card and make sure you fit into the criteria. Then, check for features, fees, and interest rates and choose the card that suits your resources and requirements the best.

Yes, if you're self-employed, you can apply for a credit card. You'll just need to show proof of your income, like tax returns or bank statements.

You can use things like your Income Tax Returns, bank statements, or profit and loss statements as proof of income when applying for a credit card.

Priyanka Rao is a content strategist for Jupiter.Money, and specializes in writing on topics related to finance, banking, budgeting, salary & wages, and other financial matters. She has a passion for creating engaging content that resonates with audiences across various digital platforms. In her free time, Priyanka enjoys traveling and reading, which allows her to gain new perspectives and inspiration for her work. With a keen eye for detail and a creative mindset, Priyanka is committed to creating content that connects well with her readers, enhancing their digital experiences.

Priyanka Sharma is the Head of Credit Cards (Sr. Director Business & Product - Credit Cards) at Jupiter Money, where she leads the growth and development of the company’s credit card portfolio. She is responsible for driving strategic initiatives and enhancing customer experiences through innovative credit products. Priyanka’s leadership is shaping Jupiter’s approach to simplifying personal finance for its customers.

Prior to her role at Jupiter Money, Priyanka was an Engagement Manager at McKinsey & Company, where she provided strategic advice to clients across various sectors. Her expertise in business strategy, growth, and operations was built on her strong analytical skills and client-focused problem-solving abilities. Earlier in her career, she worked at ZS, a global business consulting firm, where she contributed to various projects, gaining significant experience in data-driven business decisions.

Priyanka holds a Post Graduate Programme in Management with a focus on Finance, Strategy, and Leadership from the Indian School of Business (ISB), where she graduated with distinction, earning a place on the ISB Dean’s List. This prestigious academic achievement underscores her deep understanding of financial strategy and leadership, which she continues to leverage in her fintech leadership role.

Powerd by Issued by