If you’ve been regularly following the news, you might have heard that it is now compulsory to link your PAN card with your Aadhaar card.

The last date for linking your PAN and Aadhaar cards is June 30, 2023. However, you have ample time left, provided you begin the process early on.

The Government of India has devised two key ways to go about it – via SMS and the Income Tax e-filing website. Here’s a simple guide to help you link your PAN card with Aadhaar and meet the deadline with ease.

Why You Need to Link Your PAN Card With Aadhaar Card

There are three main reasons to link PAN with Aadhaar card:

- If your PAN card is not linked with Aadhaar, it will be deactivated after June 30, 2021!

- Your income tax return (ITR) form will not be processed without your 12-digit Aadhaar number.

- In addition, linking your PAN with Aadhaar gives you the following advantages:

- You get a summarised detail of your taxes on a single page by logging onto the Income Tax portal.

- You won’t have to dispatch a separate IT verification form on the e-filing website. Rather, you can e-verify your returns using your Aadhaar card.

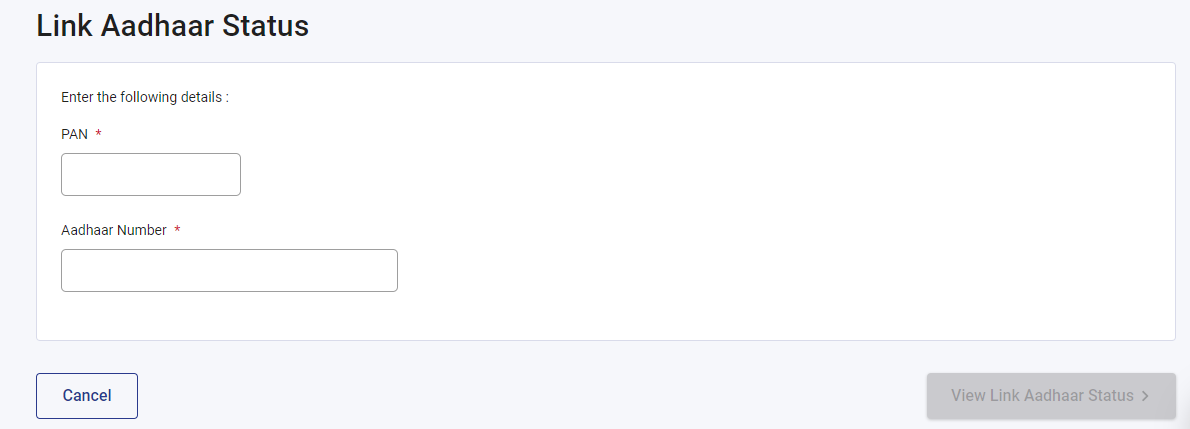

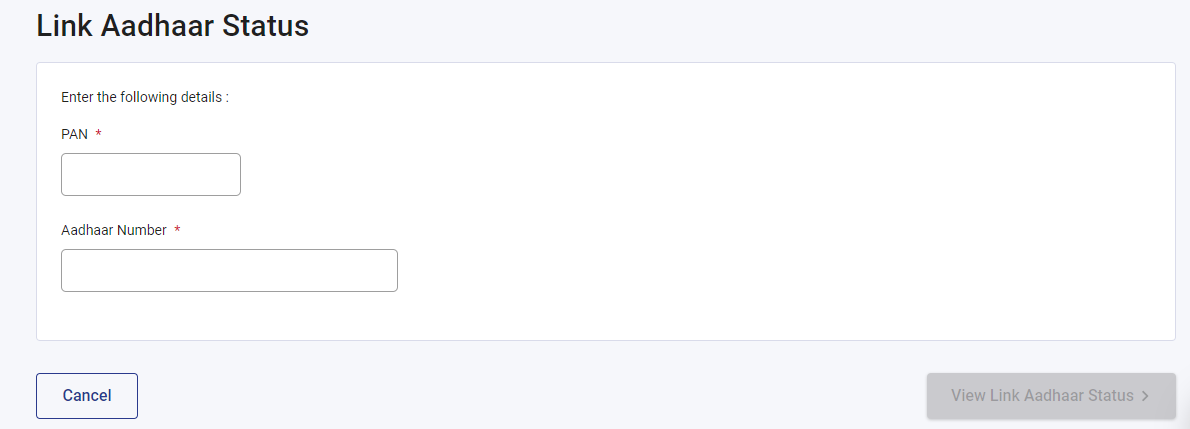

How to check my Aadhaar card is linked with PAN card?

You can check whether your PAN Card and Aadhaar Card are already linked. Follow the steps mentioned below:

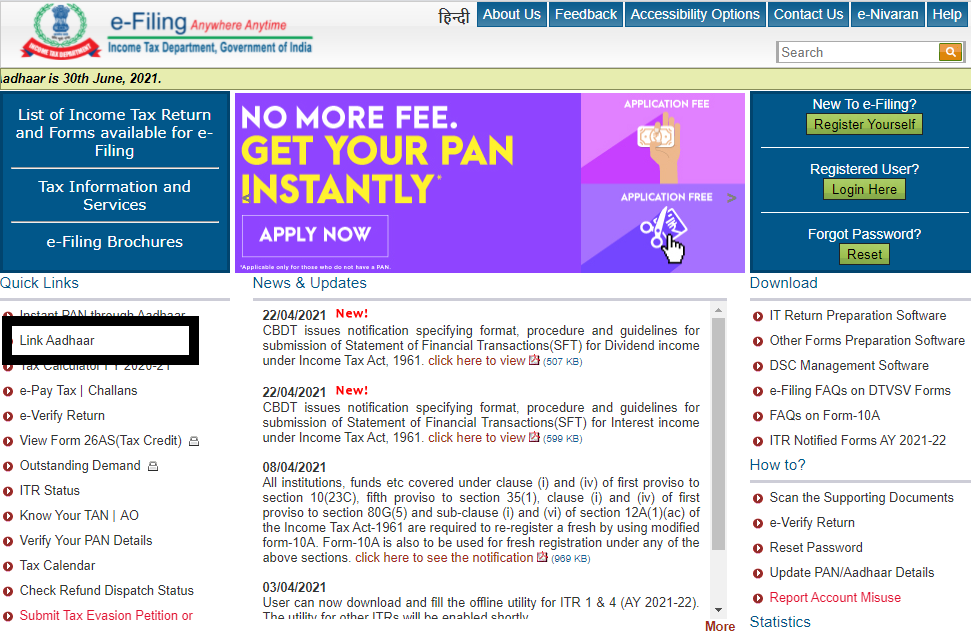

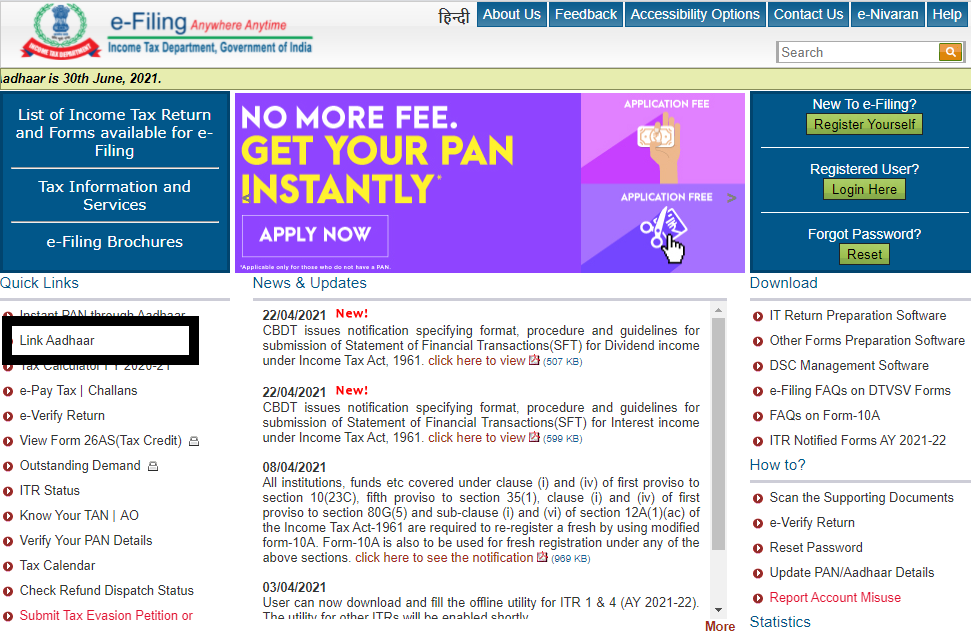

- The first step is to visit the e-filing Income Tax Department page.

- Enter both your PAN and Aadhaar Number.

- Click on the ‘View Link Aadhaar Status’ button.

- The status of your Aadhaar-PAN link status will appear on your screen.

If your cards are linked, you do not have to worry. However, if the details on your Aadhaar and PAN cards do not match, then you first need to correct this.

When Your Aadhaar and PAN Card Details Don’t Match

It is simple to link your PAN and Aadhaar card when the details on both cards match. However, in some cases, they do not match. For example, your name might not be spelt the same way on both cards.

To make sure they match, you will need to take action based on which card has the incorrect information.

- To make changes to your Aadhaar card, you will need to visit an Aadhaar Enrolment Centre.

- To make changes to the PAN card, the process is easier, as it is online. You can visit the NSDL PAN portal to make the changes.

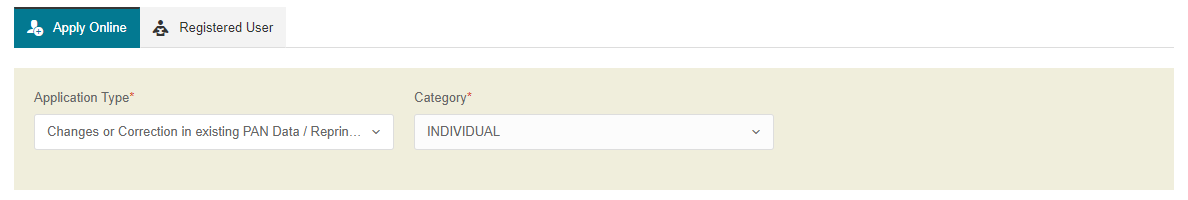

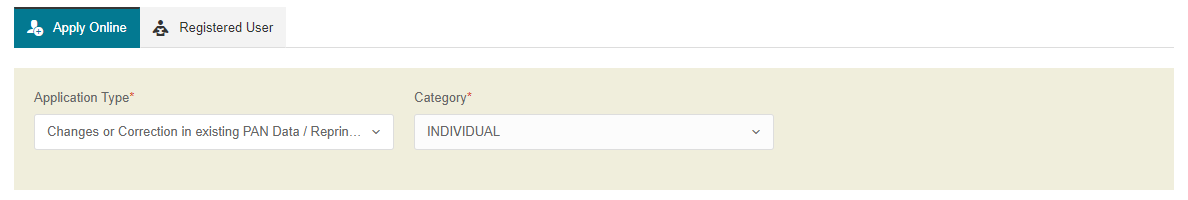

How to Make Changes to Your PAN Card

Here’s a step-wise guide to correcting the information on your PAN card.

- Visit the NSDL website, which redirects to the exact page from which you can correct name details.

- Under the ‘Apply Online’ tab, select your application type as ‘Changes or Correction in existing PAN Data’ from the drop-down menu. Select your category as ‘INDIVIDUAL’.

- Fill in the required details and upload signed digital documents that support the updation of PAN details.

- When your PAN details are correct, you shall receive an intimation via NSDL over email.

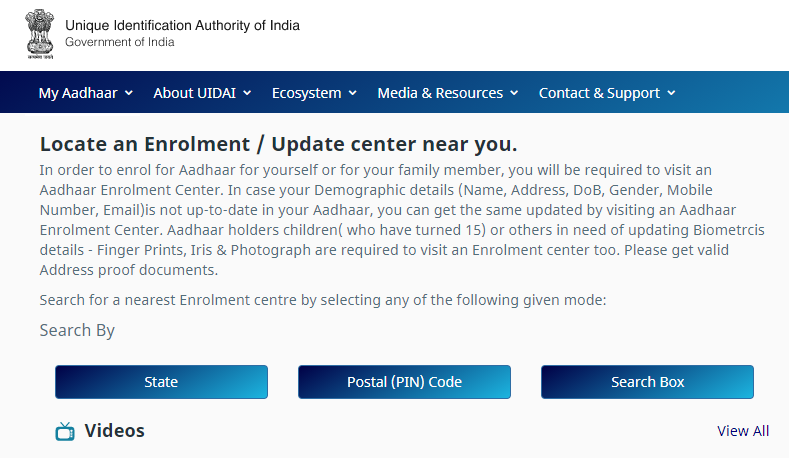

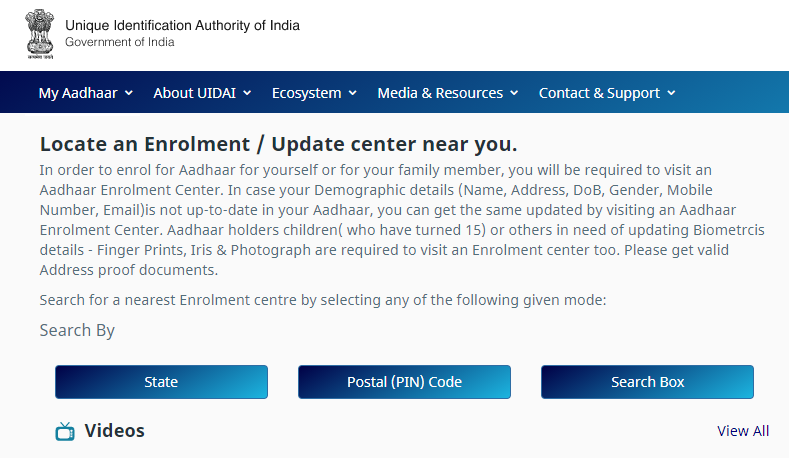

How to Make Changes to Your Aadhaar Card

Here’s a step-wise guide to correcting the information on your Aadhaar card.

- While you can rectify the details on your PAN card online, this isn’t possible for your Aadhaar card. Instead, you need to physically visit your nearest Aadhaar Enrolment Centre. A quick search on the UIDAI website will help you locate the nearest one.

- Carry a self-attested copy of identity proof with you.

- Fill out the Aadhaar Enrolment Form and submit it along with all the required documents.

- Don’t forget to ask for the acknowledgement slip that contains the update request number (URN), and keep it safe with you. Take a photograph to be on the safer side.

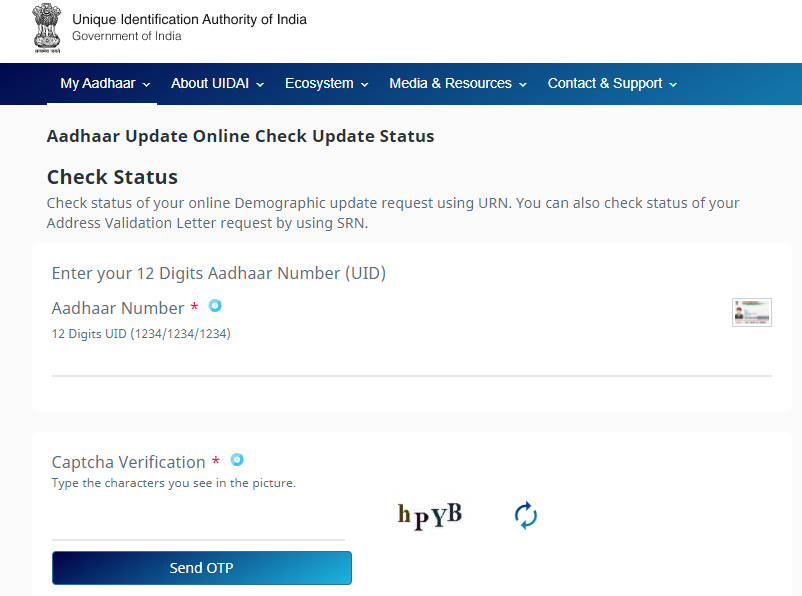

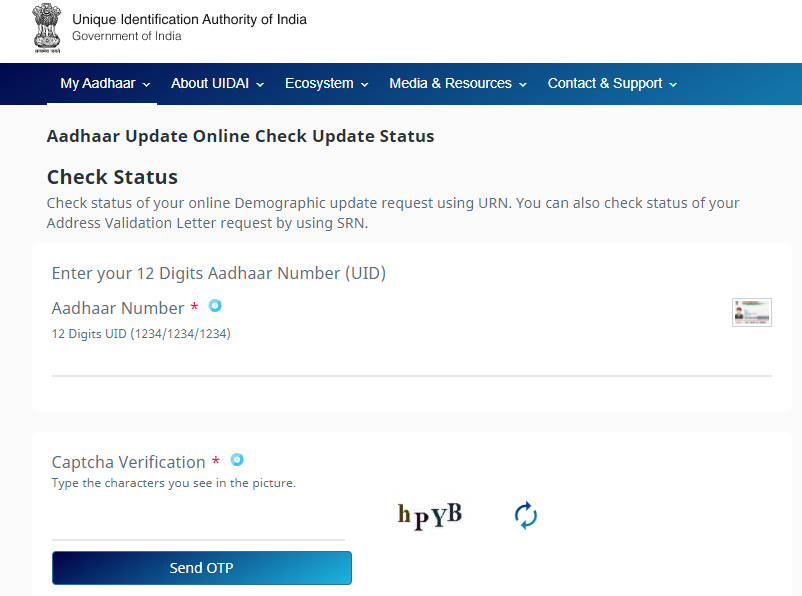

- You can log in with the URN to check the status of your update request.

- Click on the ‘Check Online Demographics Update Status’ option under the ‘Update Your Aadhaar’ menu.

- Once redirected to the following page, fill in the details accordingly.

Once the information on both documents is correct and matches, you can now link your Aadhaar with your PAN card.

Link Aadhaar Card With PAN Through e-Filing Website

- The first step is to visit the official Income Tax e-filing website.

- Click on the ‘Link Aadhaar’ option under quick links.

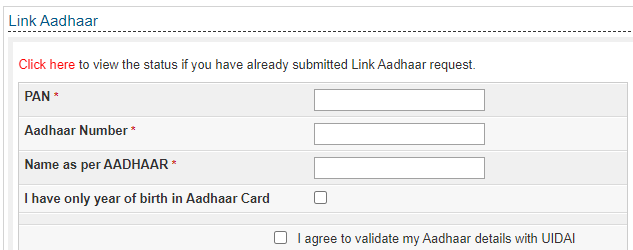

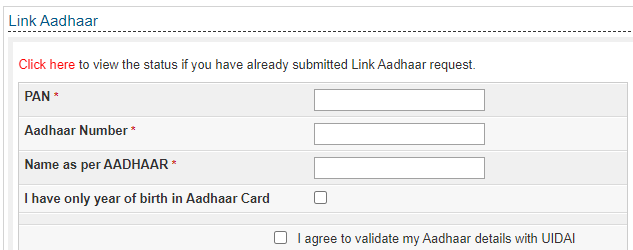

- Next, enter both your PAN card and Aadhaar number.

- Type your name as it is spelt on your Aadhaar card.

- If only the date of birth is written on your Aadhaar card, then you have to tick on the square.

- Next, tick the ‘I agree to validate my Aadhaar details with UIDAI’ box.

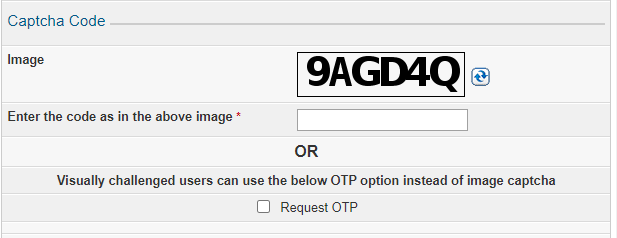

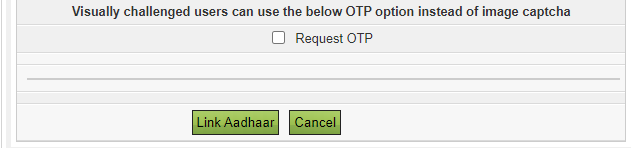

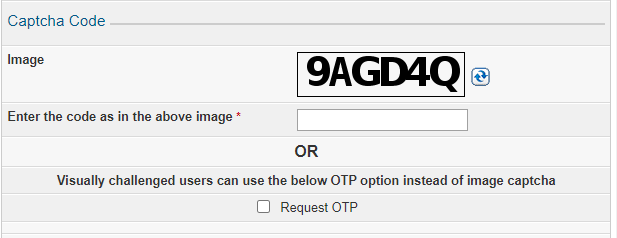

Carefully type the captcha code as it appears in the image for verification. If you have a visual impairment, you can request an OTP instead. (note: it says on the website that visually challenged users can use the OTP option instead of a captcha. Not sure how that process works, so we can omit this point.)

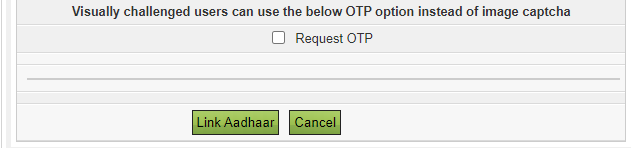

- Next, click on the button that reads ‘Link Aadhaar’.

Once done, wait for the pop-up message to appear indicating that your Aadhaar card is successfully linked with your PAN card.

How to Link Aadhaar With PAN Card Via SMS

- Type a message in the following format with correct details: UIDPAN<12 Digit Aadhaar> <10 Digit PAN></10>.

- Send the SMS to either 567678 or 56161. It must be from your registered mobile number.

Here’s an example:

If your Aadhaar number is 9687254711412 and your PAN is AJQCD2572T, you have to type UIDPAN 9687254711412 AJQCD2572T and send the message to 567678 or 56161.

FAQs on Linking Your PAN and Aadhaar Cards

1. What is the last date to link the PAN card with the Aadhaar card?

The deadline to link both your cards was June 30th, 2023.

2. What will be the consequences of not linking my PAN card with my Aadhaar card?

The Income Tax Department has urged taxpayers to link PAN with Aadhaar by May 31, 2024, to avoid higher tax deducted at source (TDS) or tax collected at source (TCS)

3. Can I still e-file my tax return if I do not have an Aadhaar card?

As per income tax department, you would be able to login to e-filing portal if your PAN is not linked with Aadhaar, but you will have limited access.

4. If my income falls below taxable limits, do I still need to link it?

Yes, you will still need to proceed with linking them. If not, your PAN card will be deactivated.

5. How many processes are there to link the cards?

Currently, you can link the cards by visiting the e-filing website or via SMS.

6. Why do I get a “failure to authenticate” message when I try to link my PAN card with Aadhaar?

You might have entered the incorrect OTP or captcha code. You can double-check the OTP or code and try again. Plus, some captchas are case-sensitive, so you should enter the text exactly as you see it.

7. Are there any cases when Aadhaar-PAN linking is not necessary?

Yes, there are four cases when this is the norm. You need not worry about linking the two documents if you are:

- A foreign national living in India

- A Non-resident Indian

- A resident of Jammu & Kashmir, Meghalaya, and Assam

- A senior citizen older than 80 years (as of this financial year)

8. Must I make an account on the e-filing website?

Every taxpayer must make their account with the Income Tax Department to file their e-returns.

9. Do I need to submit any documents for when linking my PAN and Aadhaar card?

No, you need not submit any documentary proof. If the details on both cards match, it is a pretty straightforward process.

10. What are the top details to be checked with the Aadhaar card to the PAN card?

Here is a quick list of details to check:

- Name

- Gender

- Date of birth

If you notice any discrepancies, get them rectified by following the steps mentioned above before proceeding to link both documents.

11. My name is spelt differently on both cards. How do I go about linking them?

If your name is spelt differently on both cards, just follow the step-wise process mentioned in this article, get the name corrected and then proceed to link the two documents.

12. My old mobile number is registered with my Aadhaar card. Is there a way to upgrade it?

You can physically visit the nearest Aadhaar Enrolment Centre and get your mobile number updated.

13. Can I link my Aadhaar with PAN now?

Yes, if you want to link your PAN and Aadhaar card post the deadline, you will be required to pay a penalty of Rs. 1,000.

Author

Priyanka Rao is a content strategist for Jupiter.Money, and specializes in writing on topics related to finance, banking, budgeting, salary & wages, and other financial matters. She has a passion for creating engaging content that resonates with audiences across various digital platforms. In her free time, Priyanka enjoys traveling and reading, which allows her to gain new perspectives and inspiration for her work. With a keen eye for detail and a creative mindset, Priyanka is committed to creating content that connects well with her readers, enhancing their digital experiences.

Issued by