How to Link Credit Card to UPI?

Since UPI is the most favoured payment method for cashless transactions, the National Payments Corporation of India has allowed users to link their credit cards to their UPI app to make payments. Let’s see the process of linking credit cards to different UPI apps.

Here’s how to link Credit card on different payment apps

- Link UPI Credit Card to Jupiter

- Link RuPay Credit Card to BHIM UPI

- Link RuPay Credit Card to Paytm

- Link RuPay Credit Card to Google Pay

- Link RuPay Credit Card to PhonePe

1. Link UPI Credit Card to Jupiter

To link your credit card to Jupiter Money, follow the steps below.

- Open the Jupiter App. To open the app, click here: https://jptr.onelink.me/TOMp/credcrdblogs

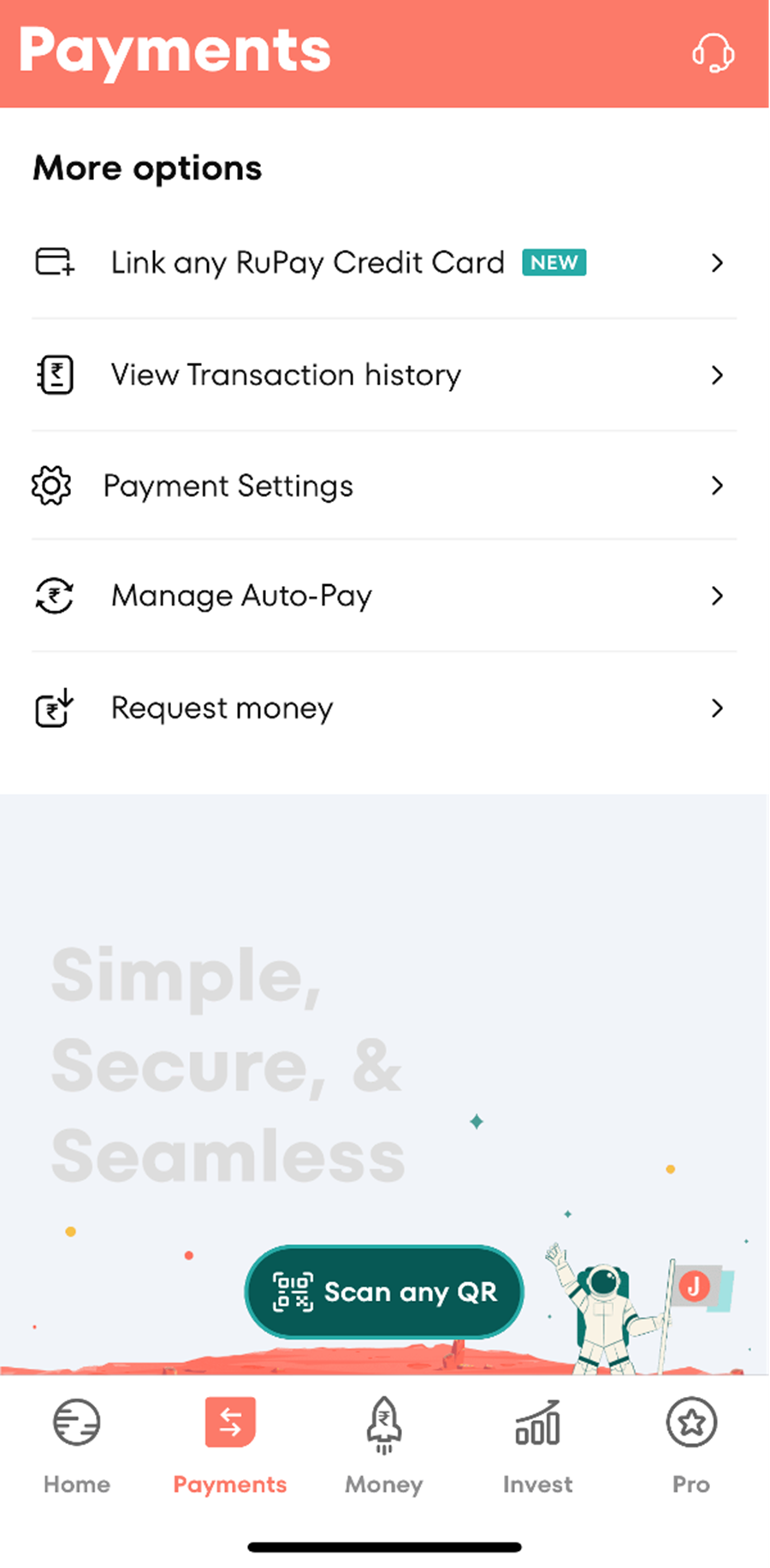

- Click on the ‘Payments’ tab at the bottom of the screen.

- Scroll down and click ‘Link any RuPay Credit Card’ under ‘More’ options.

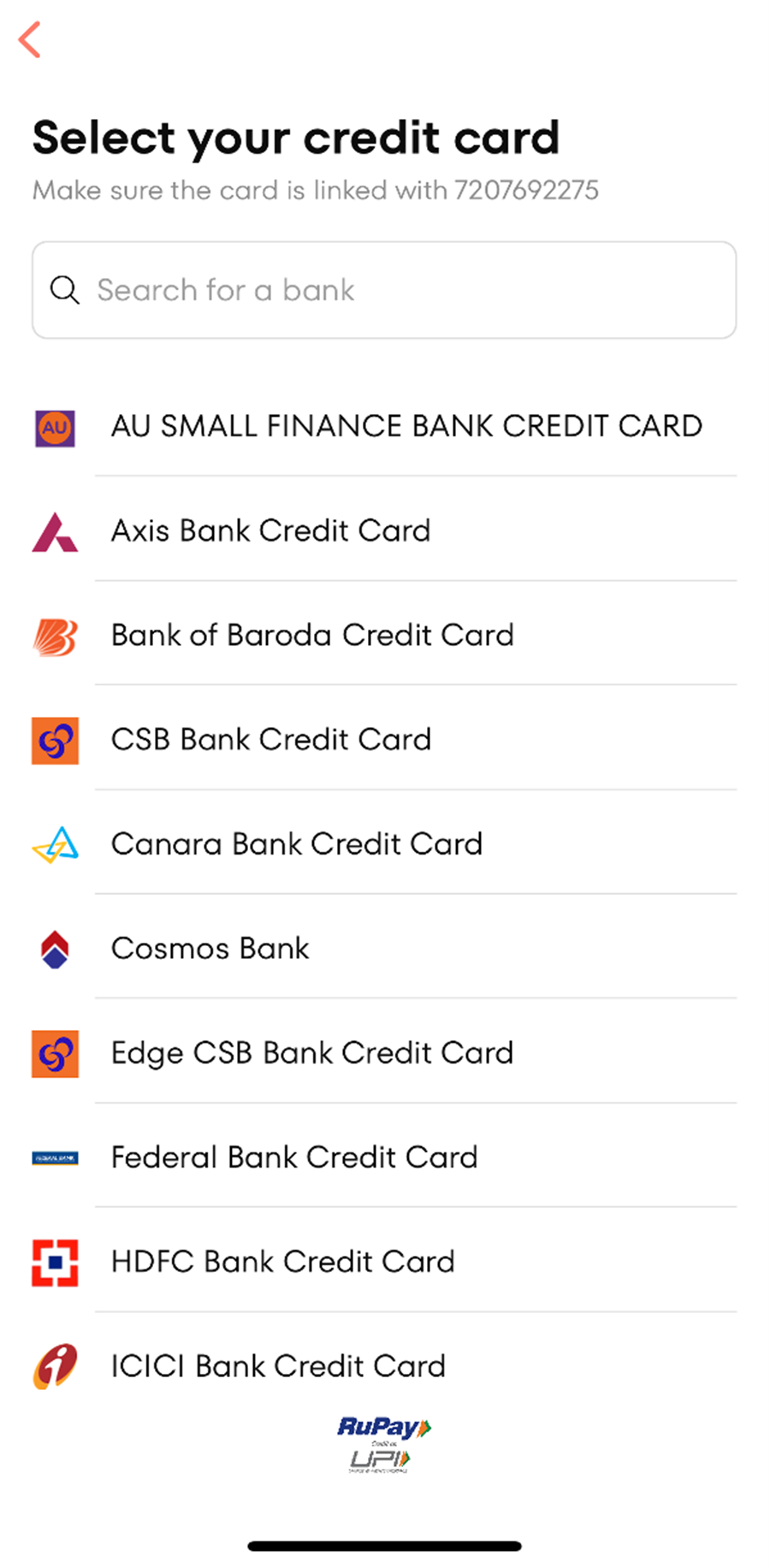

You will be directed to a new tab. Here, you have to select your card. Make sure your card is linked to the same mobile number that you use for your Jupiter App.

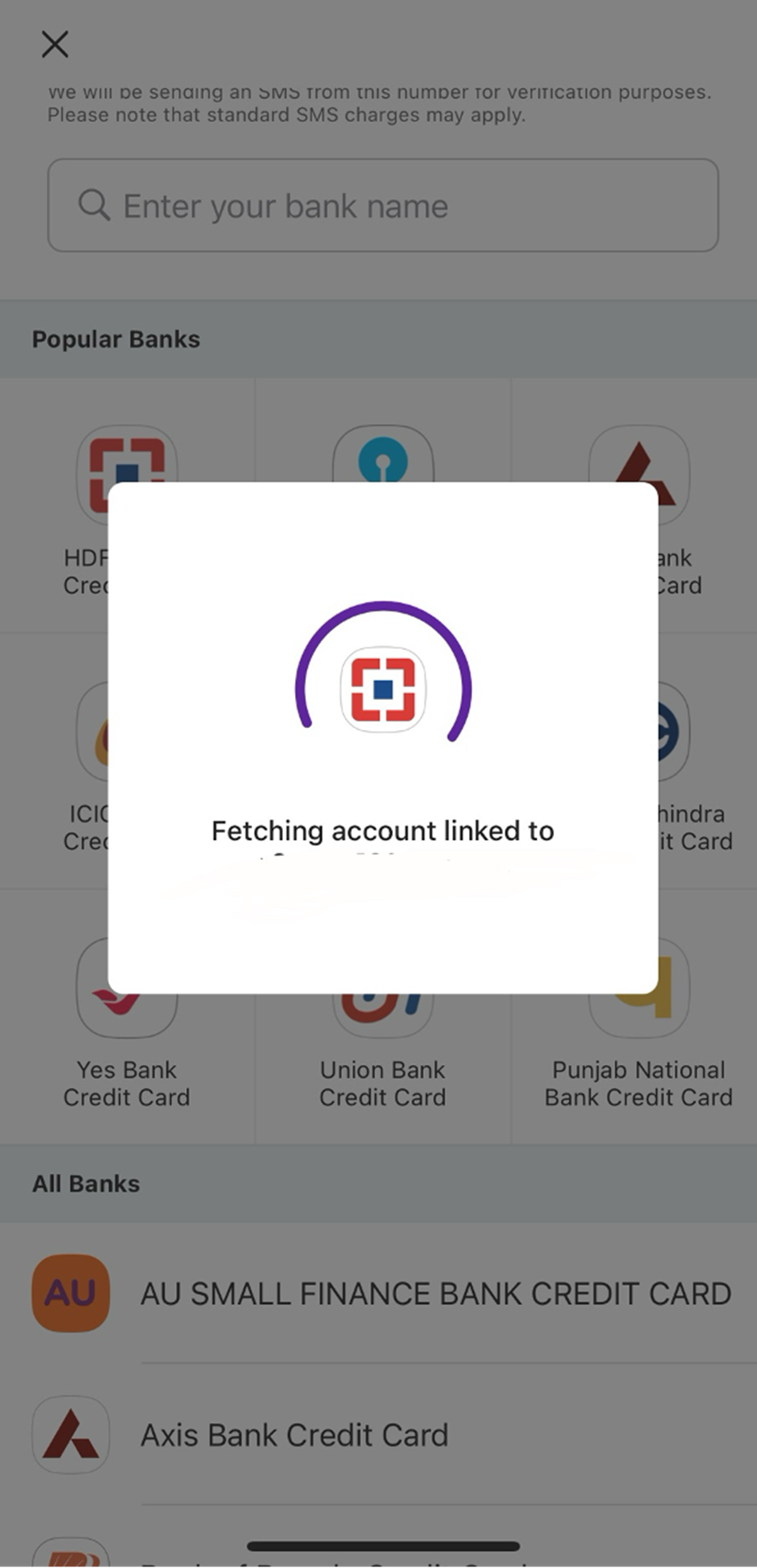

Jupiter will fetch your card details if you have any existing RuPay card with the option you selected in the previous step.

Do you want to get a RuPay Credit Card from Jupiter?

Join the waitlist here:https://jupiter.money/edge-upi-credit-card/

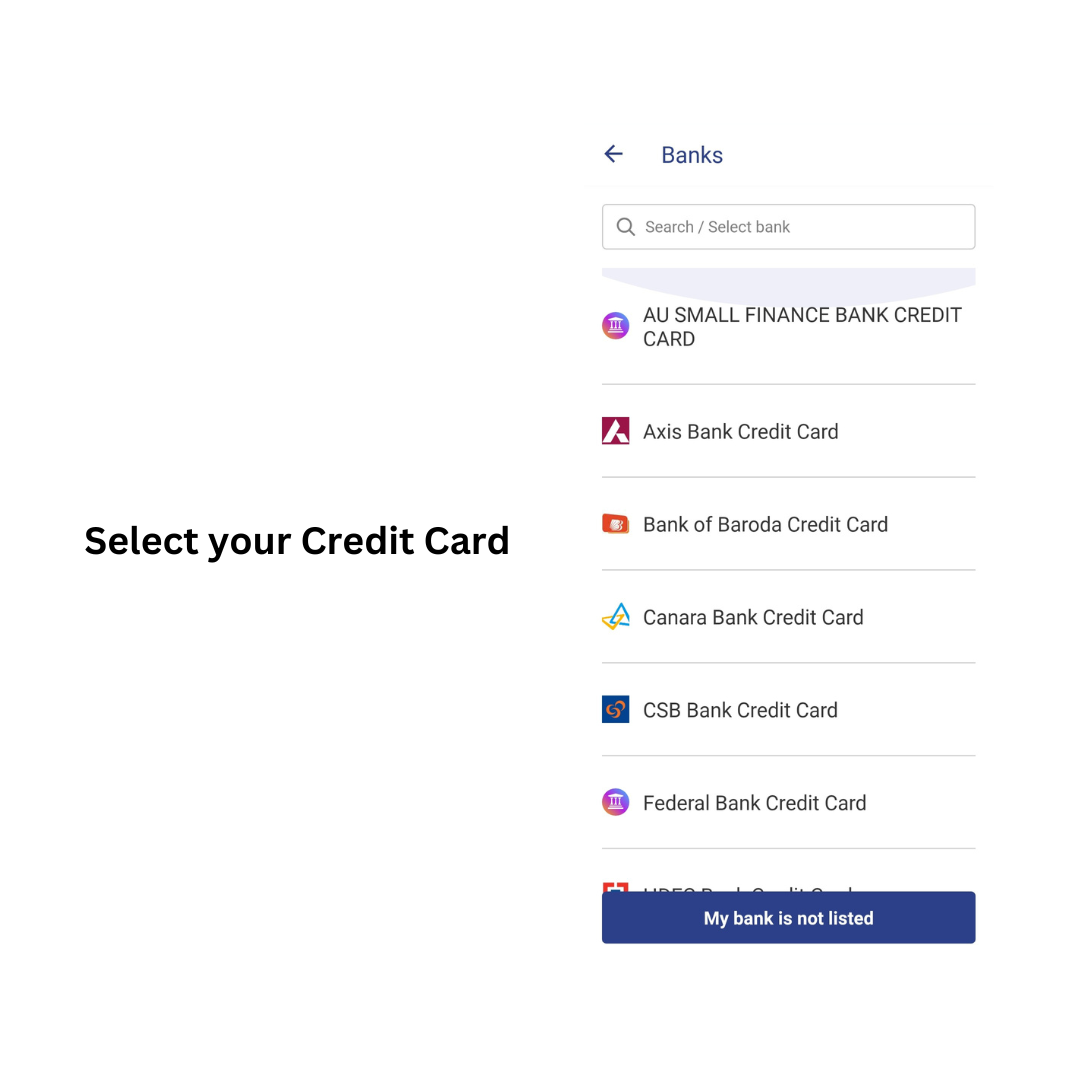

2. Link RuPay Credit Card to BHIM UPI

To link your RuPay credit card to the BHIM UPI app, follow the steps below.

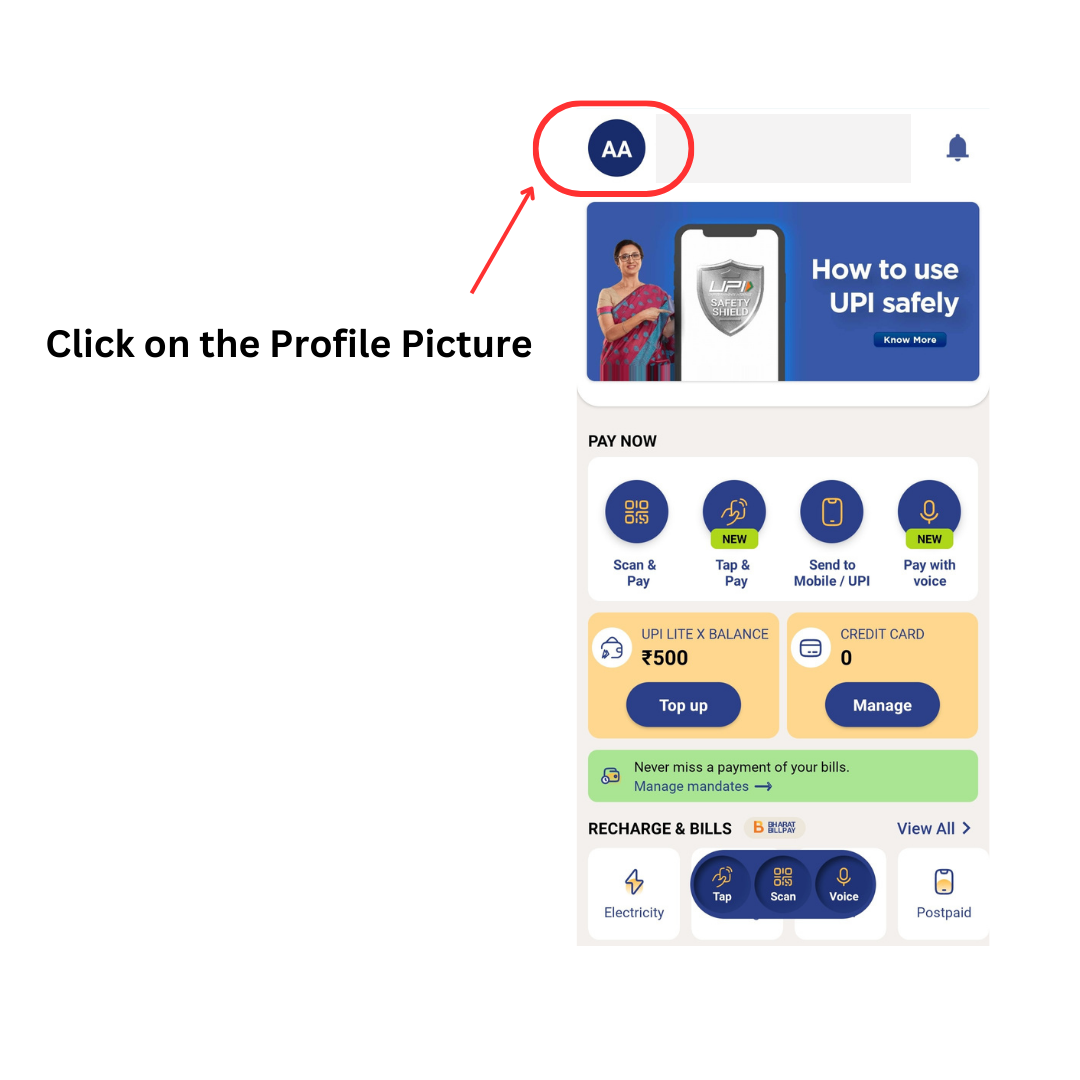

- Open the BHIP UPI app on your phone and enter the passcode.

- On the left corner, click on your name. You will find the current bank accounts that are linked to the UPI.

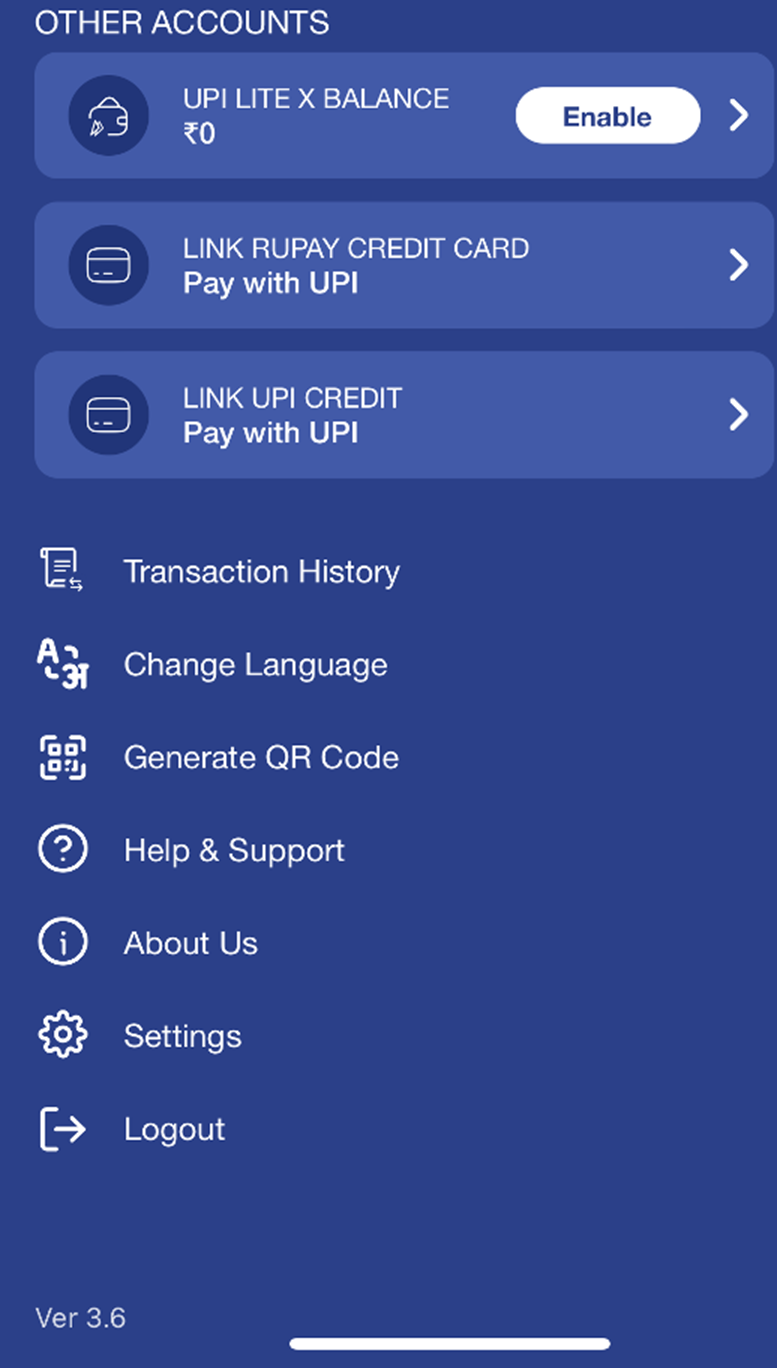

- Scroll down to find the section ‘Other Accounts’.

- Click on ‘Link RuPay Credit Card’

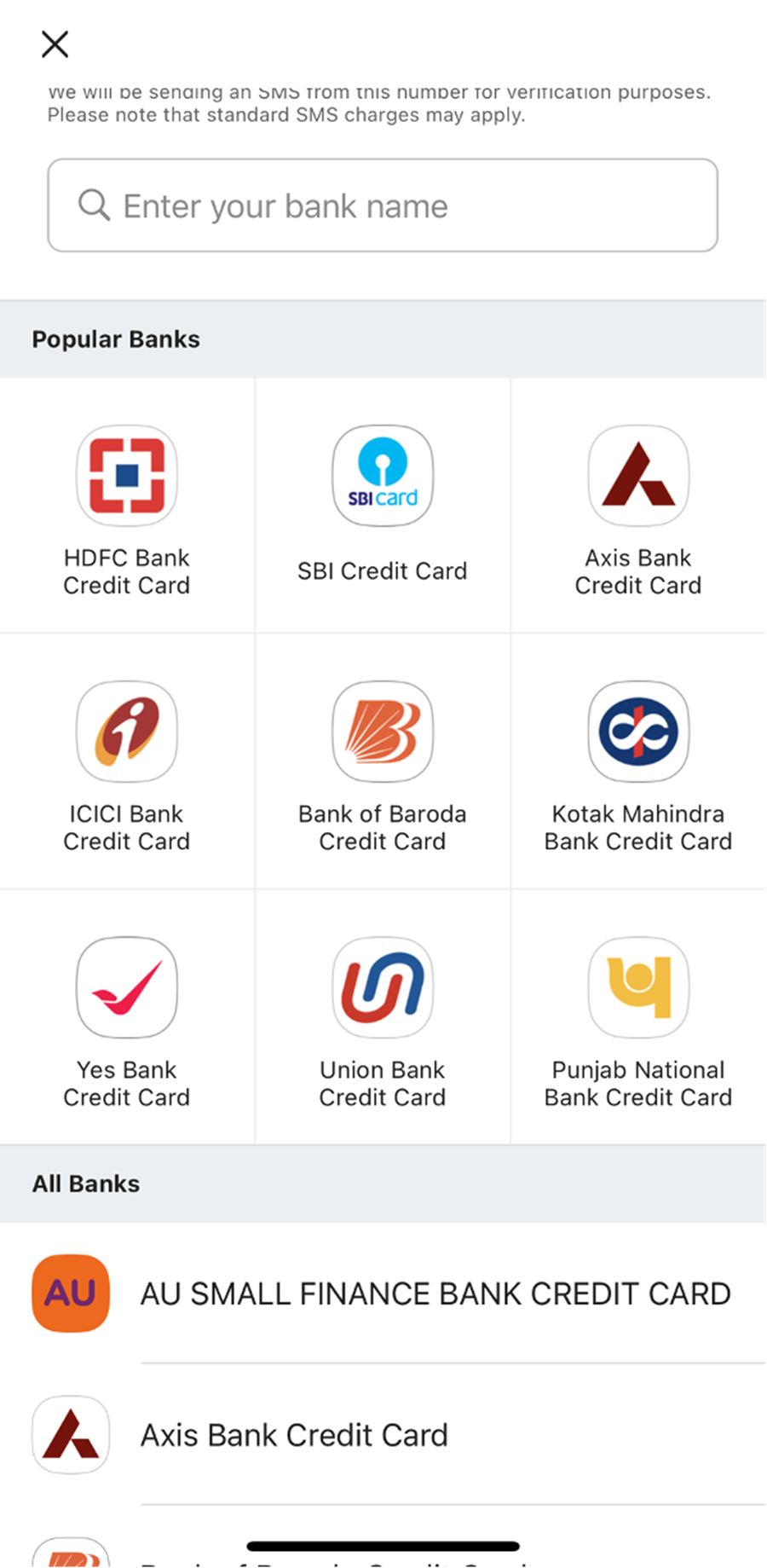

- You will be directed to a list of all banks or credit card issuers. Select your bank from the list.

- Next, select your credit card and click on confirm.

- Enter your card details as prompted by the app.

The app will directly fetch your RuPay Credit Card details.

You will receive an OTP for verification.

After verification is done, set your UPI PIN for the card.

Now, you can start using your credit card to make payments through the BHIM UPI app.

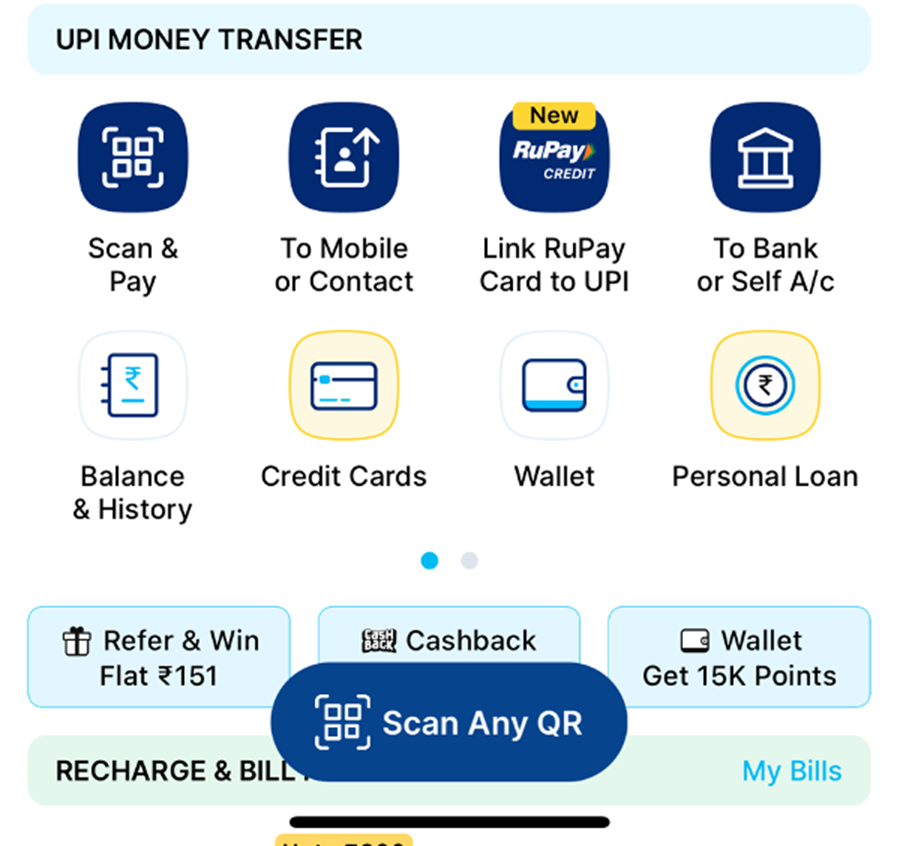

3. Link RuPay Credit Card to Paytm

To link your RuPay credit card to the Paytm app, follow the steps below.

- Open the Paytm application on your phone.

- Click on ‘Link RuPay Card to UPI’, which is on the home screen of the app.

- Enter the bank name that has issued you the Rupay card

- Now verify your card details with an OTP.

Paytm will automatically fetch the details of your RuPay credit card.

After verification, set the UPI PIN and start using your credit card to make payments through the Paytm UPI app. You can also add money to your Paytm wallet through a credit card.

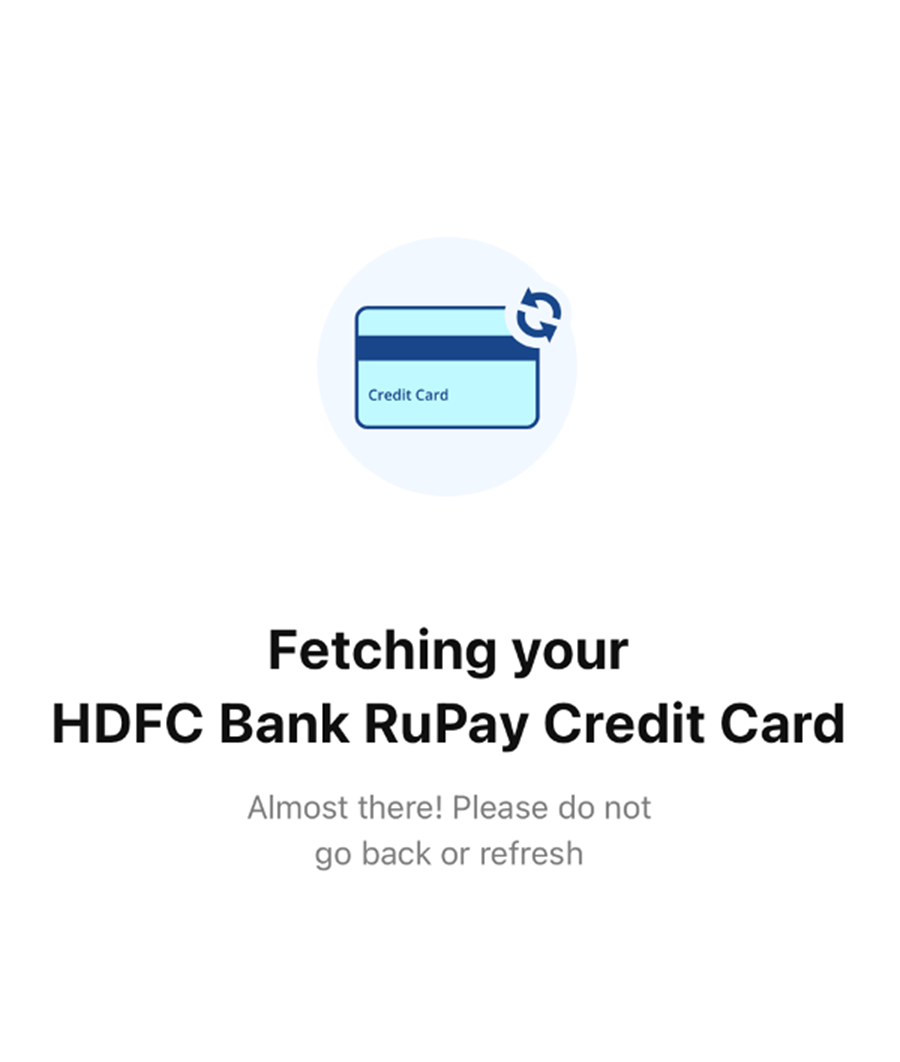

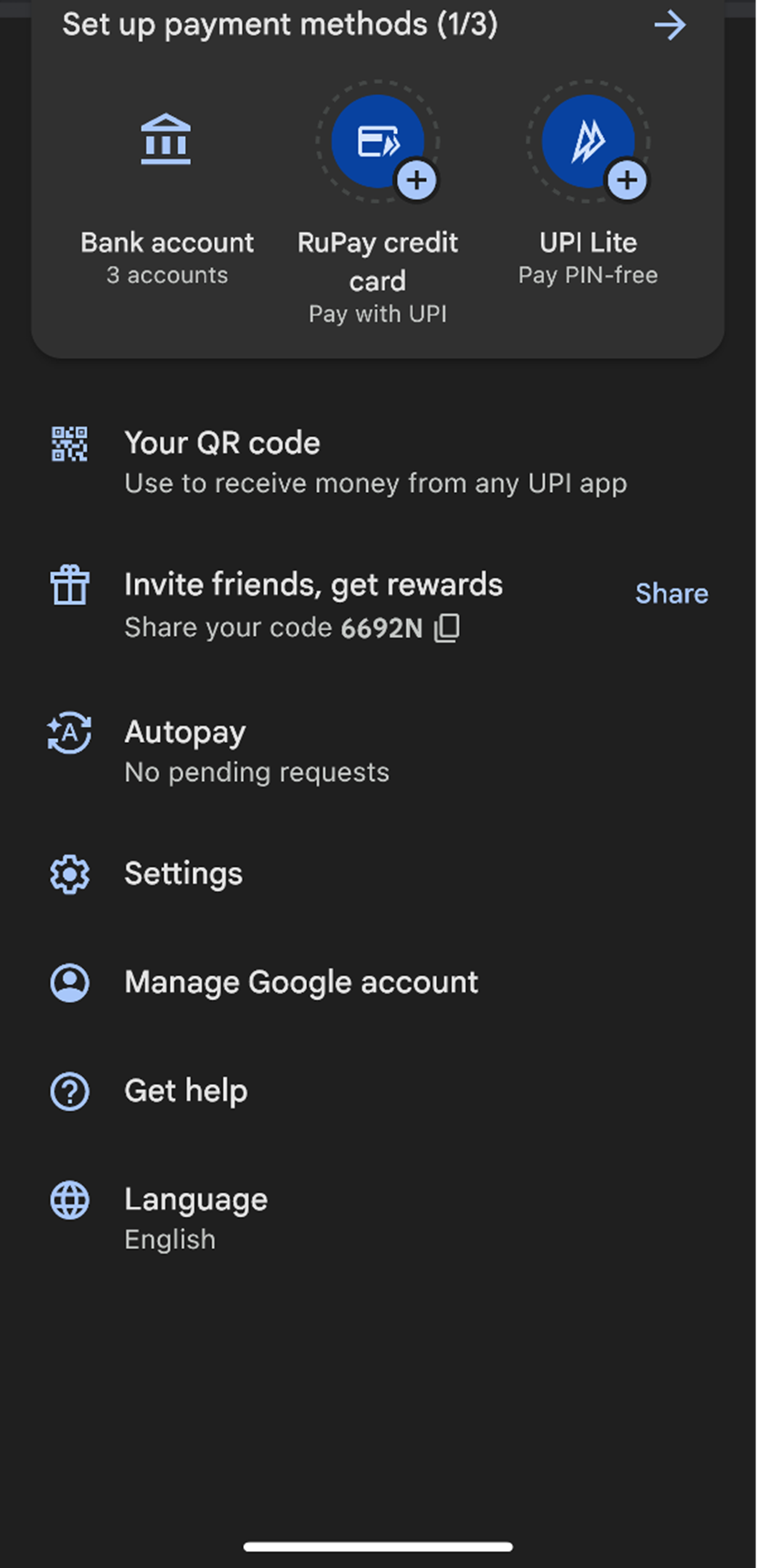

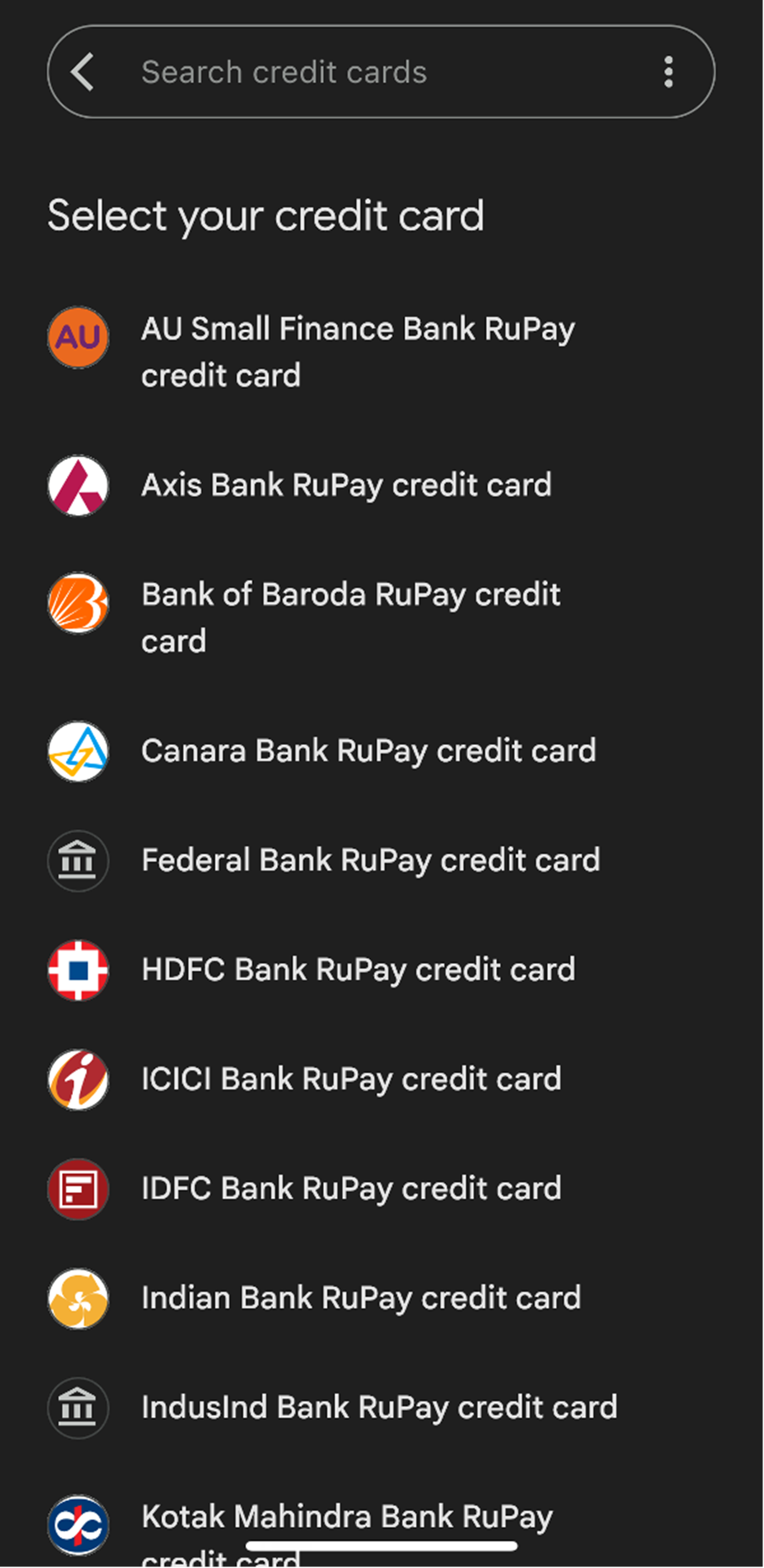

4. Link RuPay Credit Card to Google Pay

To link your RuPay credit card to the Google Pay app, follow the steps below.

- Open the Google Pay app.

- Enter your pin.

- Click on your image or profile in the top right corner.

- Under the section of ‘Set up payment method’, click on ‘RuPay credit card’.

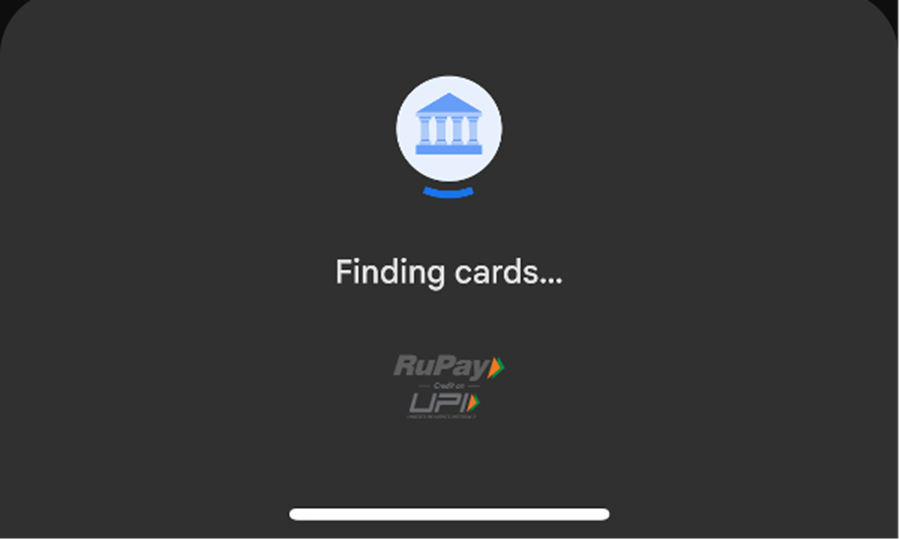

- Select your credit card from the list of cards given.

You will be directed to your profile, where you can set up a payment method.

The Google Pay app will find your credit card and fetch its details.

Once you see your card, please select it and verify it by entering the details asked and then entering an OTP.

After verification, you can activate the card and start using it to make UPI payments.

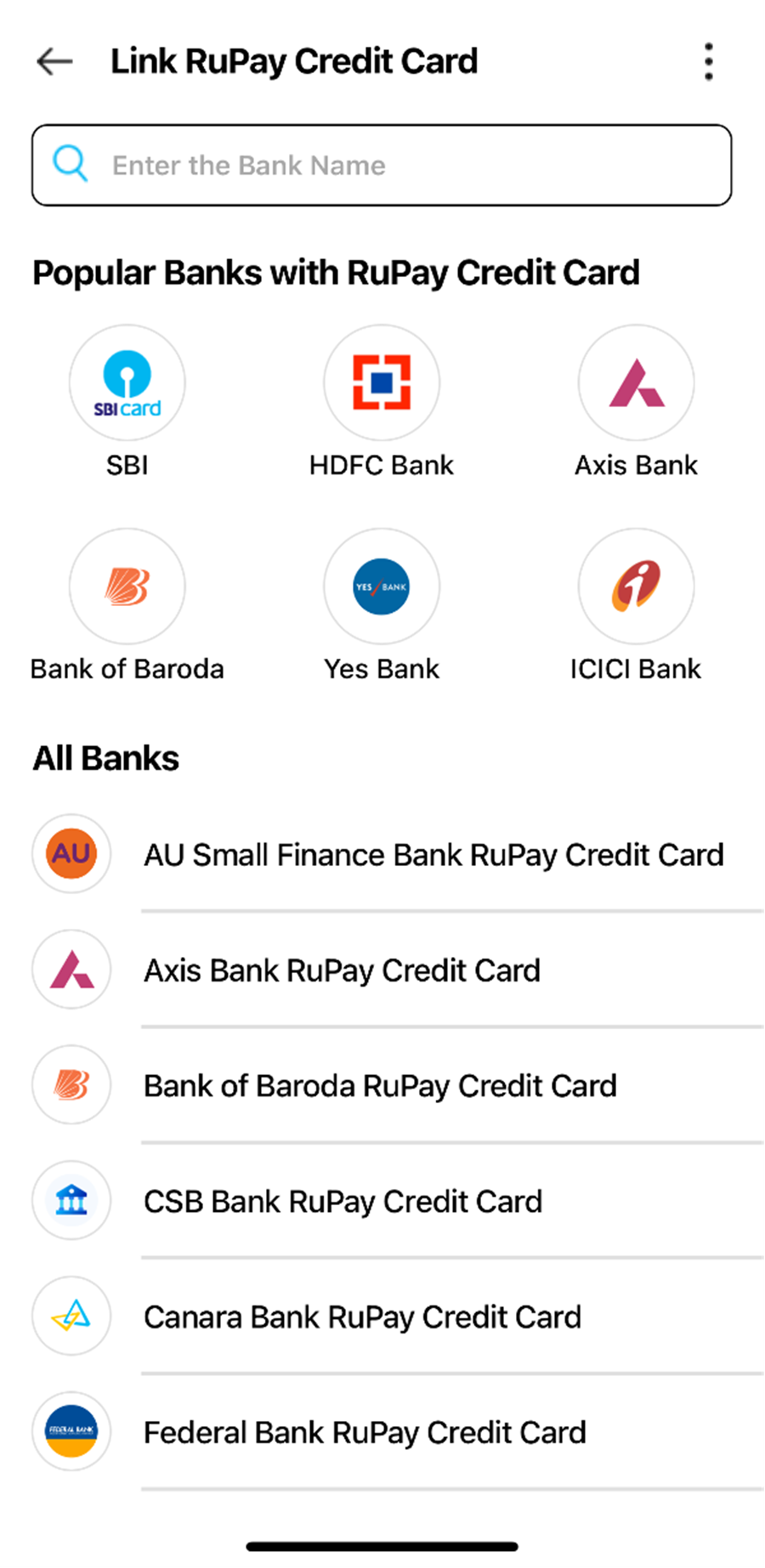

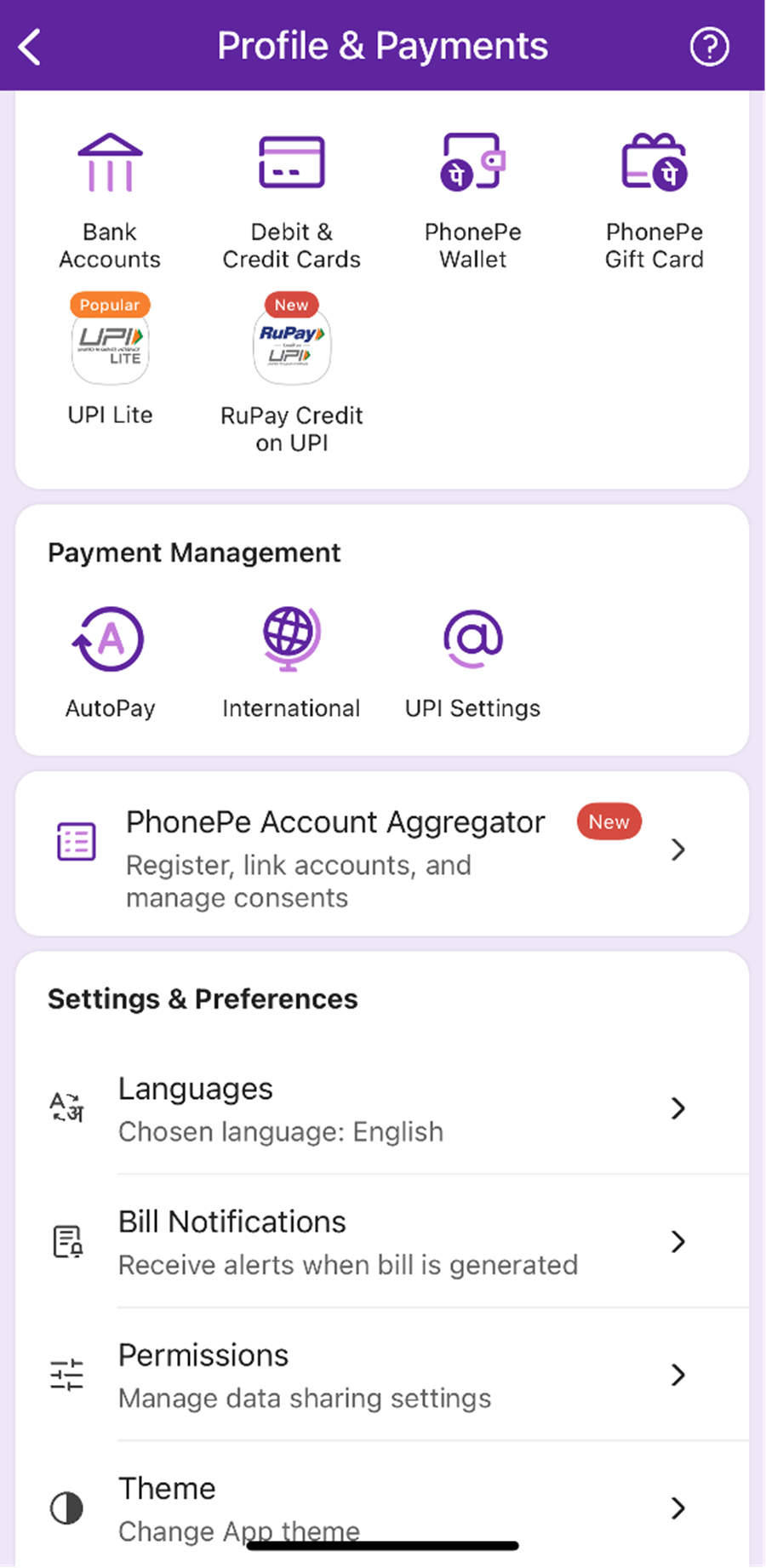

5. Link RuPay Credit Card to PhonePe

To link your RuPay credit card to PhonePe, follow the steps below.

- Open the PhonePe App and enter the pin.

- Select ‘RuPay Credit on UPI’.

- Click on ‘Add New Card’.

- Enter your bank name and select it.

- Enter the card details as asked by the app and click on ‘Proceed’.

- Verify your card with OTP.

- Set a UPI pin for your credit card to use the credit card to make UPI payments. You can also recharge your PhonePe wallet through a credit card.

Scroll down on the home screen to the ‘Payment Methods’ section.

Then, the PhonePe app will automatically fetch your card details linked to your mobile number.

What are the Benefits of Linking Credit Cards to UPI?

Linking your credit card to UPI comes with several benefits that make managing payments easier and more convenient. Here’s what you can expect:

-

A

Easier Access Everywhere

UPI is accepted almost everywhere, even in smaller stores or service providers that might not have PoS (Point of Sale) machines. Most places now have QR codes or mobile numbers for UPI payments, which makes it easy to use your credit card for purchases, no matter where you shop. This ensures you’re able to use your credit card for a wide range of transactions.

-

B

Quick and Simple Setup

Once you’ve linked your credit card to UPI, the process is done. There’s no need to worry about entering long passwords or remembering card details every time you want to pay. All you need to do is tap your phone a couple of times, and you’re ready to go. It’s a quick and simple way to make payments without any hassle.

-

C

Contactless Payments

Contactless payments are becoming increasingly popular, and linking your credit card to UPI lets you take full advantage of this. Unlike physical card transactions that require touching a machine, UPI payments allow you to make purchases by scanning a QR code and authenticating the payment, all without any physical contact. It’s faster, safer, and more convenient.

-

D

Earn More Rewards

Since UPI is used frequently for everyday transactions, linking your credit card allows you to earn reward points with every payment you make. The more you use it, the more points you can collect, and these points can be redeemed for perks like cashback, discounts, access to airport lounges, fuel waivers, and more. It’s a win-win situation where you get both convenience and rewards for making payments through UPI.

How to make UPI payments using a Credit Card?

Paying with a credit card via UPI is simple once you have everything set up. Here’s a clear, step-by-step guide to help you get started:

-

1. Set Up Your UPI Account

First things first, you need to have a UPI ID linked to your bank account. If you haven’t set up UPI yet, you can easily do it using apps like Google Pay, PhonePe, or Paytm. Just follow the instructions to create your ID and link it to your bank account.

-

2. Link Your Credit Card to UPI

To pay with your credit card, you need to link it to your UPI ID. Open your UPI app, go to the payment settings, and find the option to link a credit card. You’ll be asked to enter your credit card details, including the card number, expiry date, and CVV. Once that’s done, your card will be ready to use for UPI payments.

-

3. Choose the Credit Card Payment Option

When you’re ready to make a payment, open your UPI app and select the option to pay with UPI. Enter the recipient’s UPI ID or scan their QR code. Once the payment screen appears, you’ll usually see an option to select your payment method. Choose your credit card as the payment method.

-

4. Enter the Payment Amount

Next, type in the amount you want to pay. Double-check the details to make sure everything looks good before proceeding.

-

5. Authenticate the Payment

Once everything is set, you’ll be asked to authenticate the payment. This can be done with your UPI PIN, which is a 4-6 digit number you created when setting up UPI. Enter your UPI PIN, and the payment will be processed using your credit card.

-

6. Wait for Confirmation

After you’ve authenticated the payment, wait for the confirmation. The app will show a message once the payment is successful, and you’ll also receive a notification on your phone. You’ll get a receipt for the transaction, just like you would for any other payment.

How Integrating Credit Cards with UPI Has Helped Users?

By linking credit cards to UPI, the users will benefit in the following ways:

-

Convenience

Paying for transactions using credit cards by scanning QR codes through UPI makes payments convenient.

-

Economical

Merchants using UPI for their business need not worry about credit card fees as the payments will be received through UPI, making it economical for them.

-

Rewards

UPI will enable higher usage of credit cards. With this, the rewards and cashback will also increase.

-

Risk elimination

Linking credit cards can eliminate the risk of using physical cards. With two-factor association and biometric lock, credit card transactions will become safer than ever.

Things to keep in mind while using UPI with a credit card

- Your UPI PIN for the credit card must be different from the card PIN to ensure safety.

- Use your credit card on UPI to pay merchants.

- Set up UPI auto-pay to pay your credit card bills on time.

- When setting up your credit card with UPI, make sure you give permission to your UPI app to read your SMS, contacts, and call history.

- Keep your mobile number updated with your credit card issuer so linking your credit card to UPI will be easy.

- Always check your available balance and outstanding amount before initiating a payment.

- Never breach your credit limit while making payments using your credit card.

- Don’t share your UPI pin and OTP with anyone.

- Don’t make payments using your credit card from UPI to the following categories: person-to-person, digital account opening, lending platforms, mutual funds, cash withdrawal at ATM and any other categories as restricted by the bank or RBI.