Get salary accounts for your team See benefits

Table of Contents

ToggleSince UPI is the most favoured payment method for cashless transactions, the National Payments Corporation of India has allowed users to link their credit cards to their UPI app to make payments. Let’s see the process of linking credit cards to different UPI apps.

Here’s how to link Credit card on different payment apps

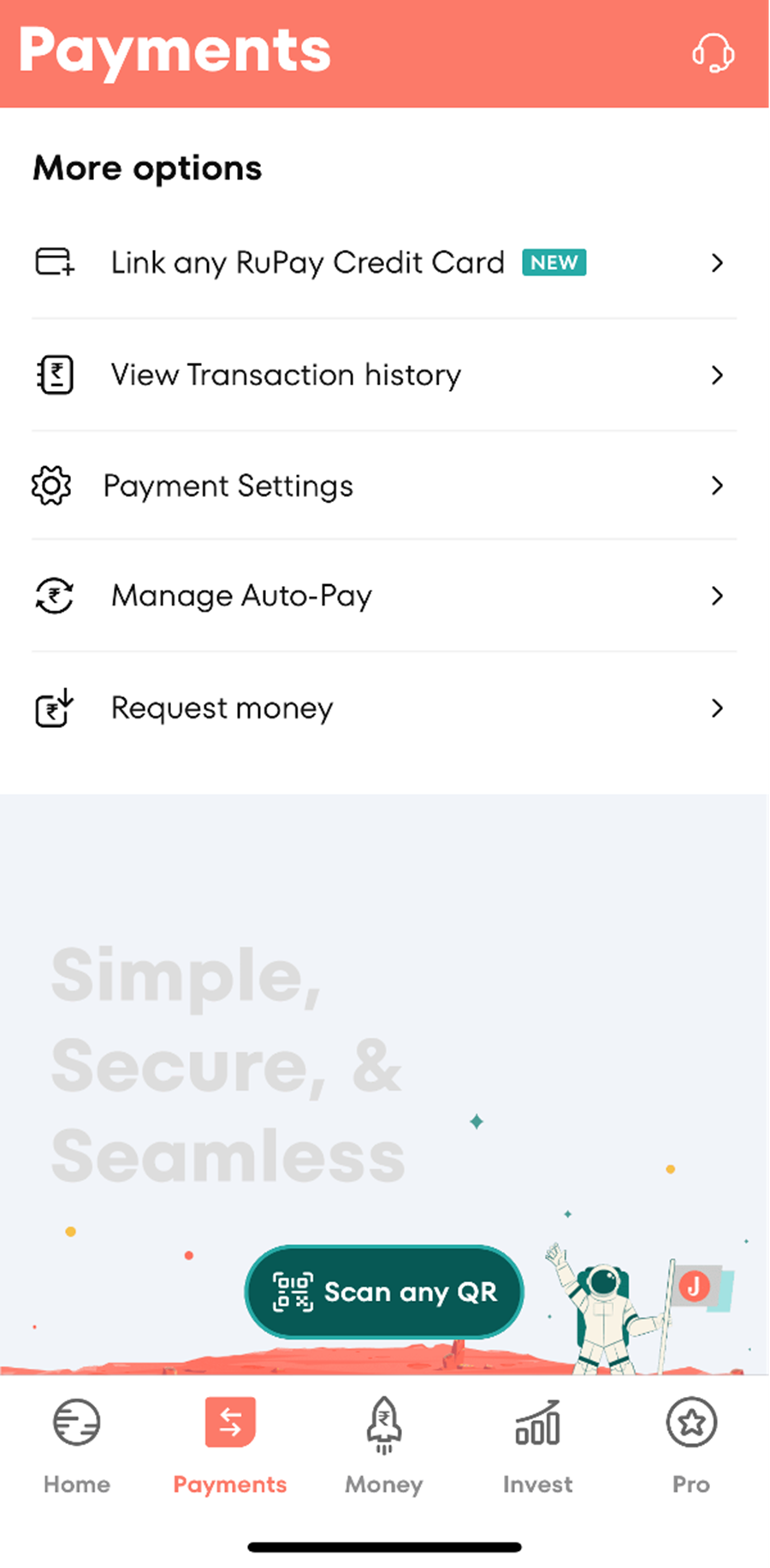

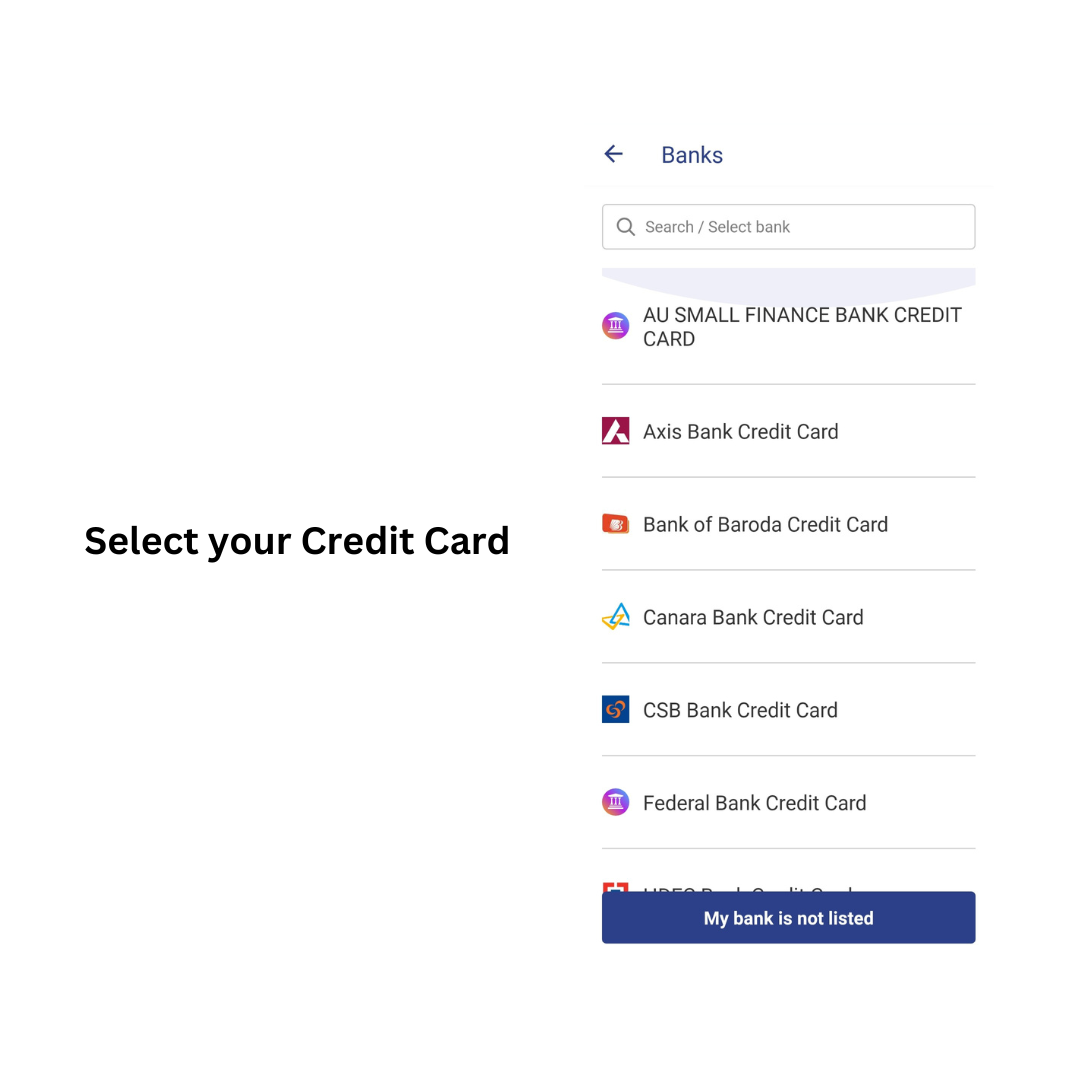

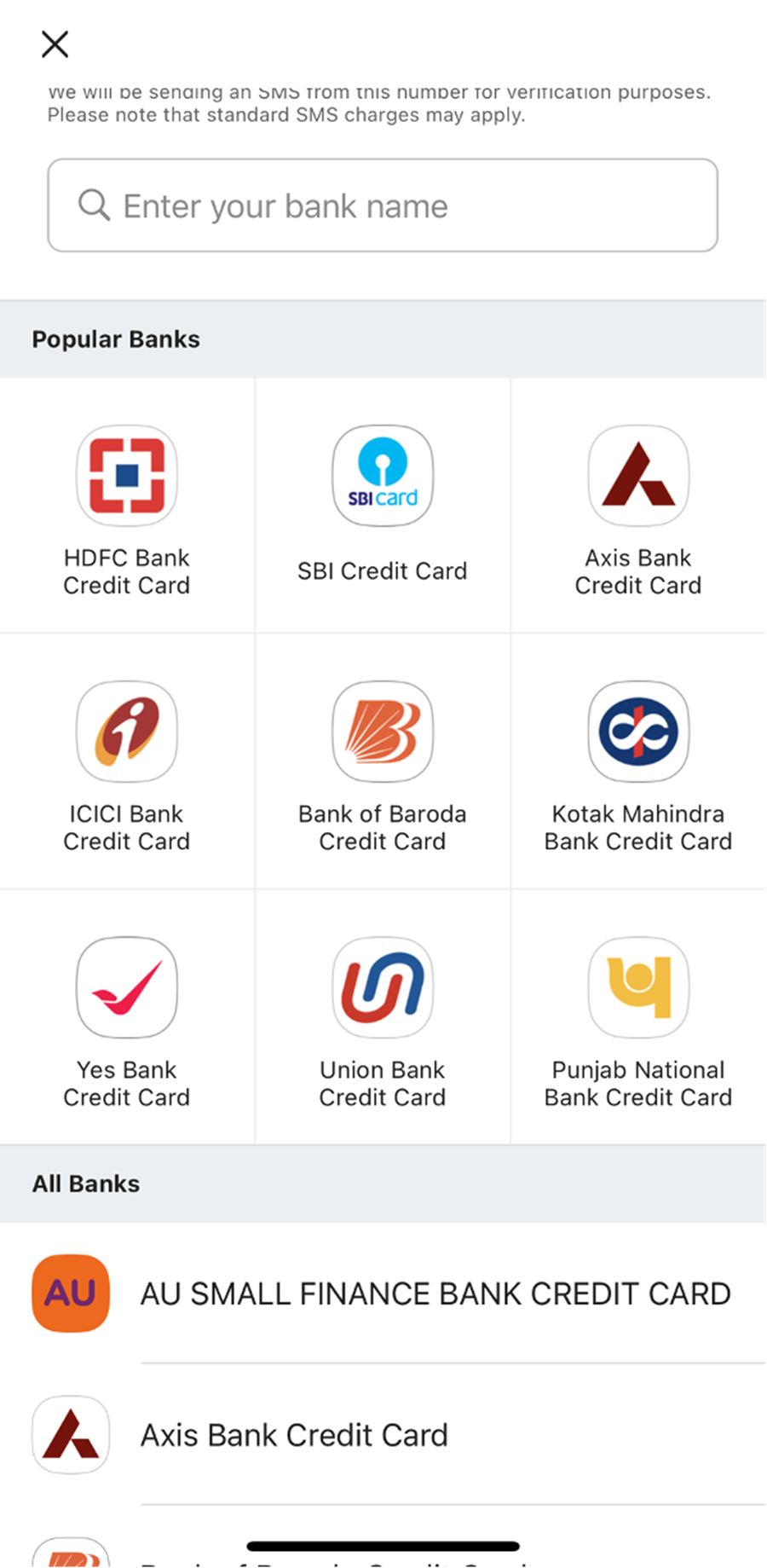

To link your credit card to Jupiter Money, follow the steps below.

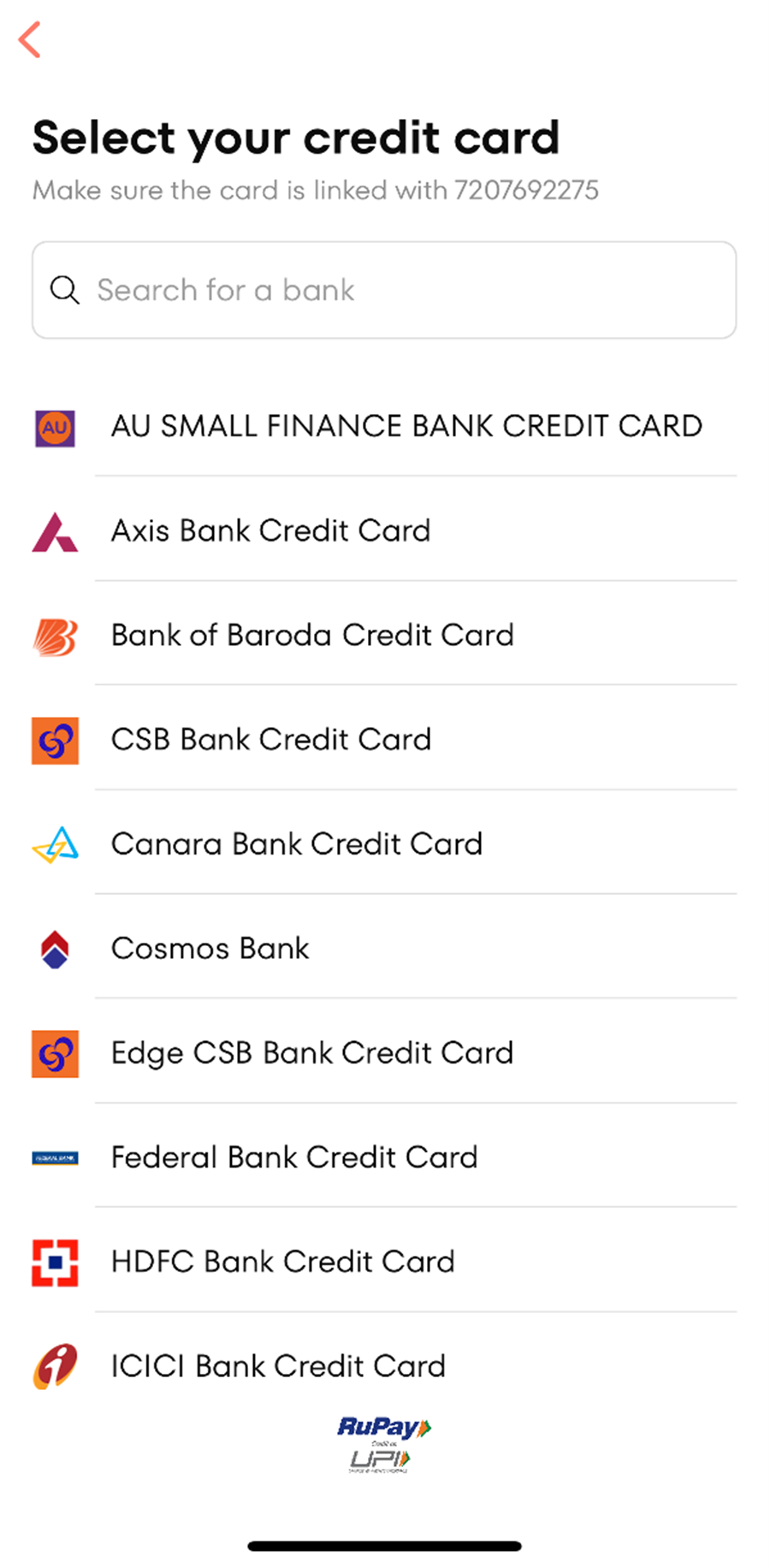

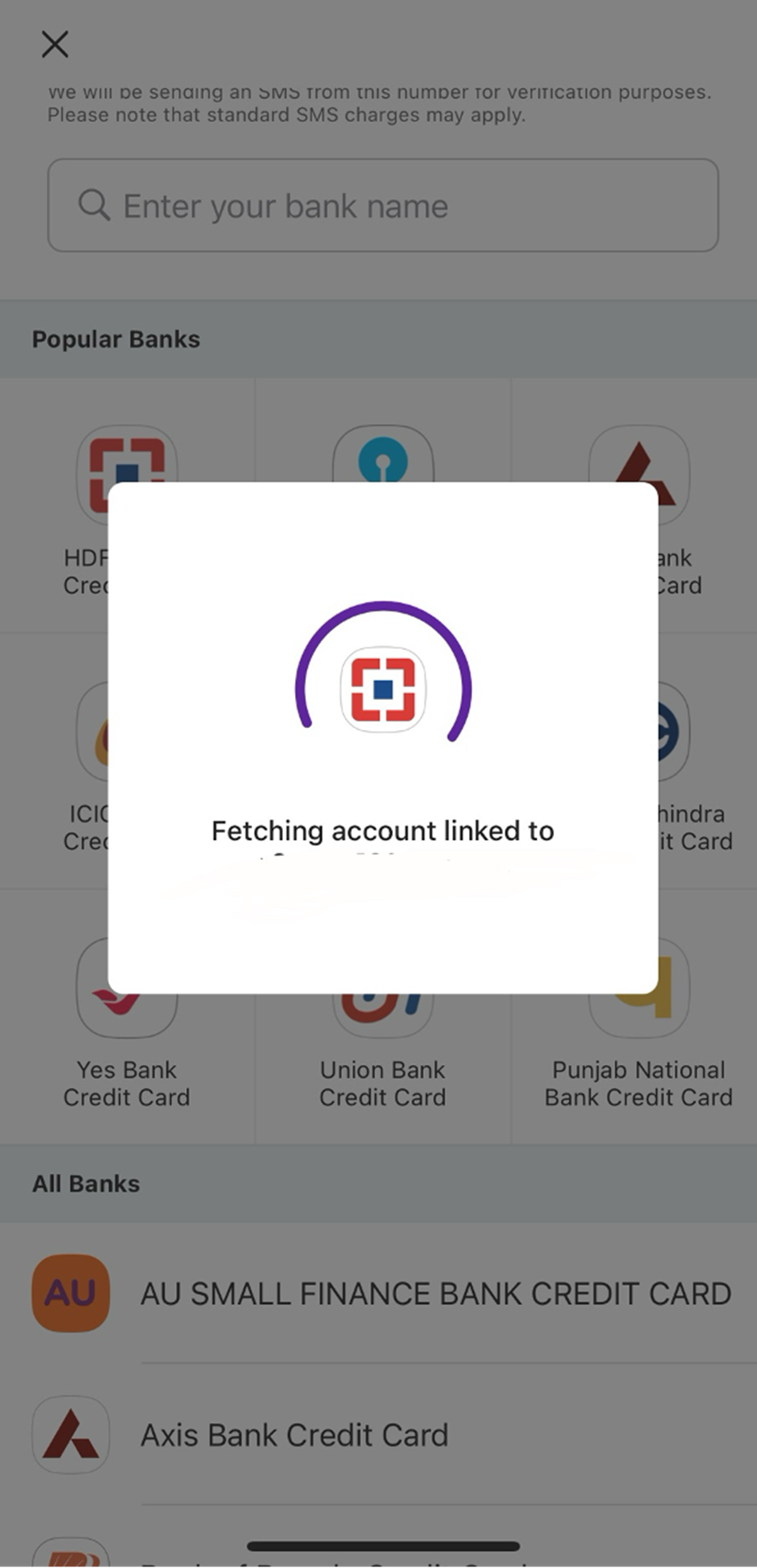

You will be directed to a new tab. Here, you have to select your card. Make sure your card is linked to the same mobile number that you use for your Jupiter App.

Jupiter will fetch your card details if you have any existing RuPay card with the option you selected in the previous step.

Do you want to get a RuPay Credit Card from Jupiter?

Join the waitlist here:https://jupiter.money/edge-upi-credit-card/

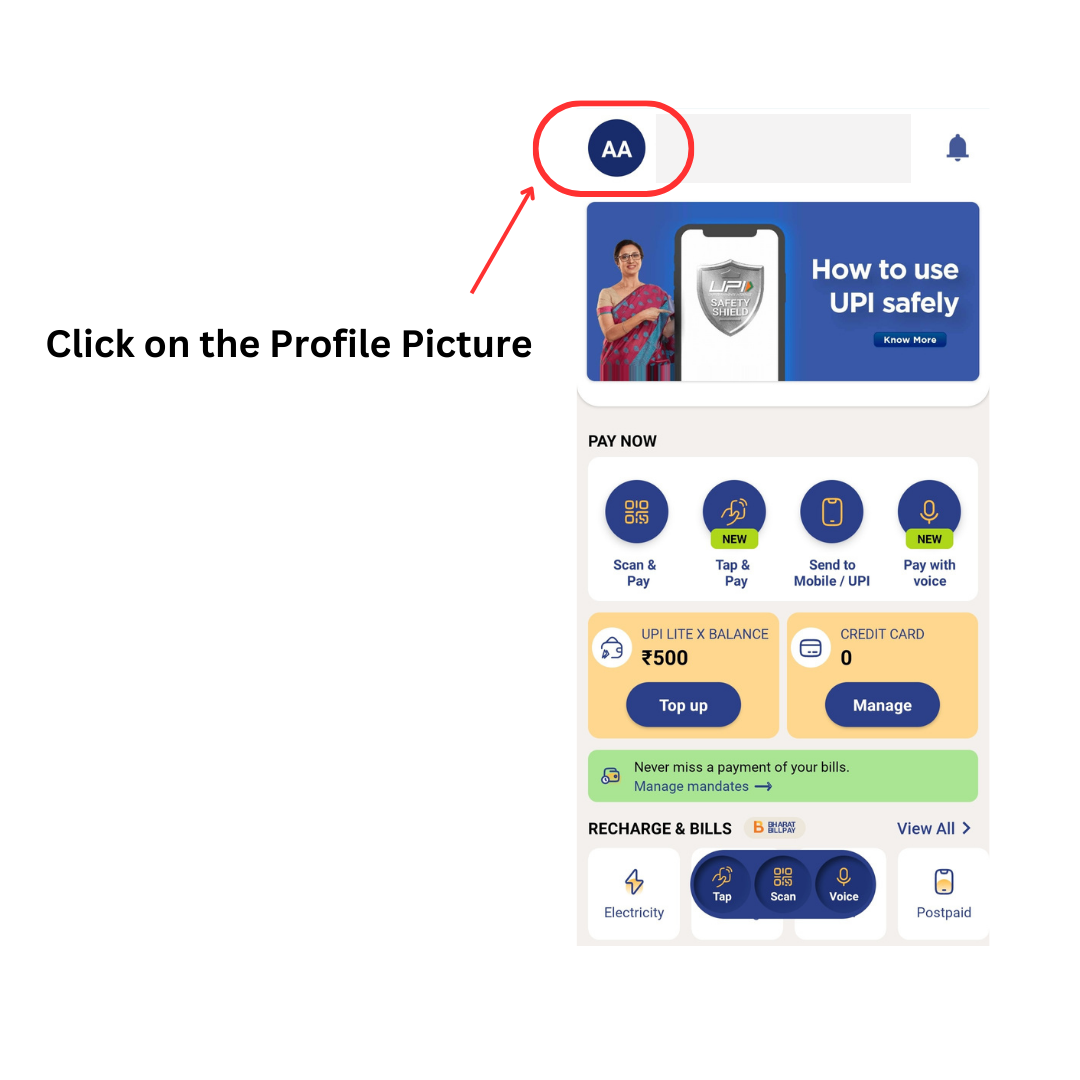

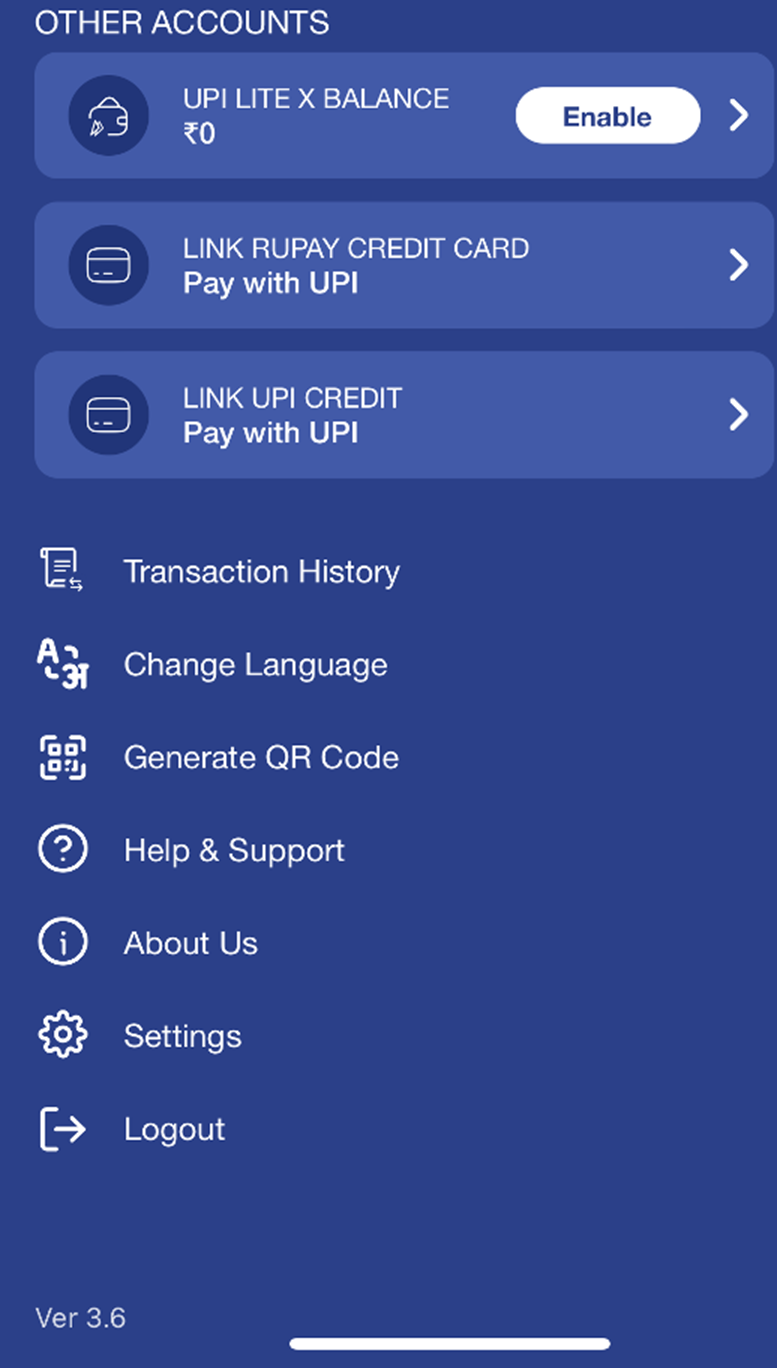

To link your RuPay credit card to the BHIM UPI app, follow the steps below.

The app will directly fetch your RuPay Credit Card details.

You will receive an OTP for verification.

After verification is done, set your UPI PIN for the card.

Now, you can start using your credit card to make payments through the BHIM UPI app.

To link your RuPay credit card to the Paytm app, follow the steps below.

Paytm will automatically fetch the details of your RuPay credit card.

After verification, set the UPI PIN and start using your credit card to make payments through the Paytm UPI app. You can also add money to your Paytm wallet through a credit card.

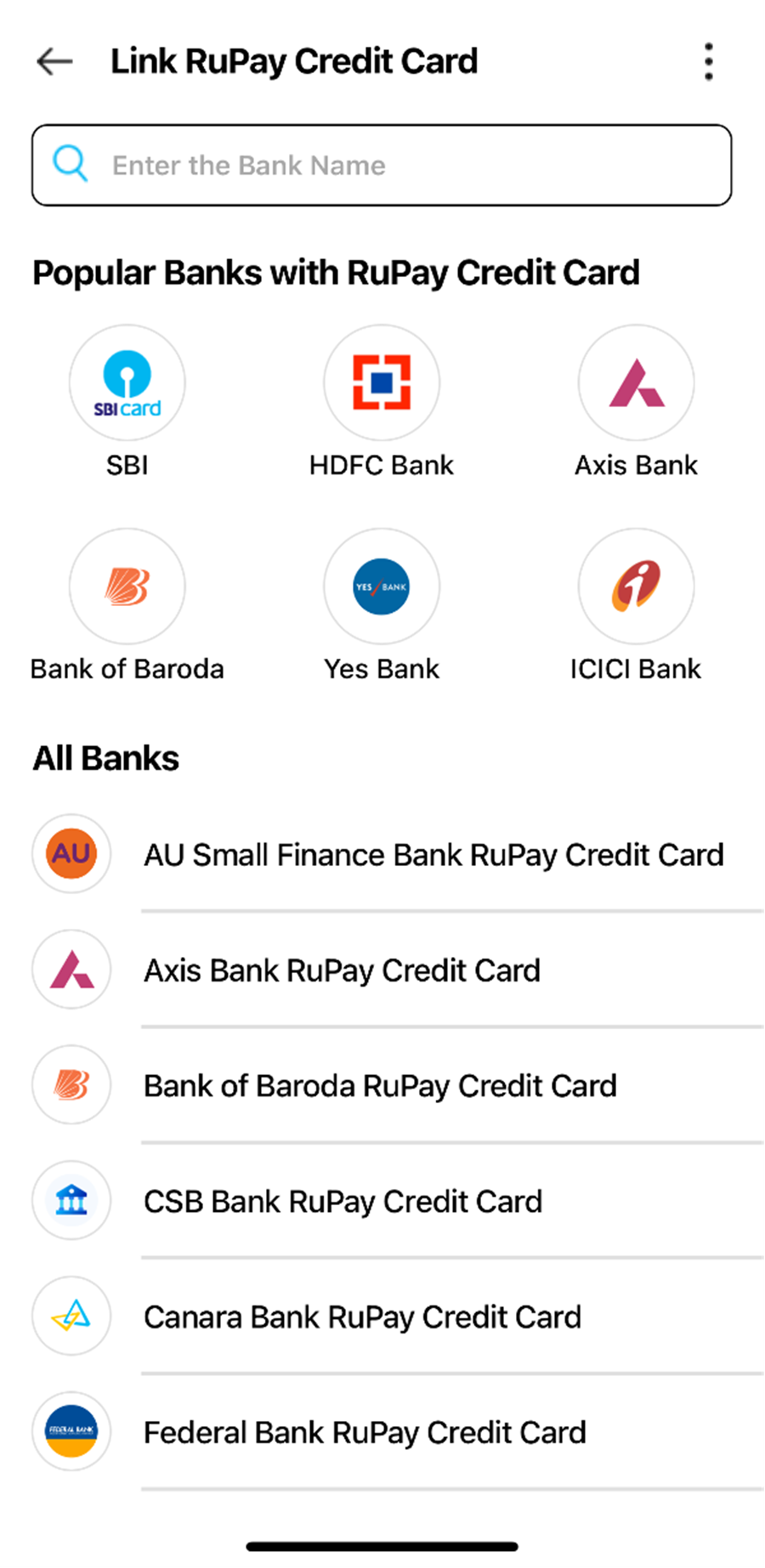

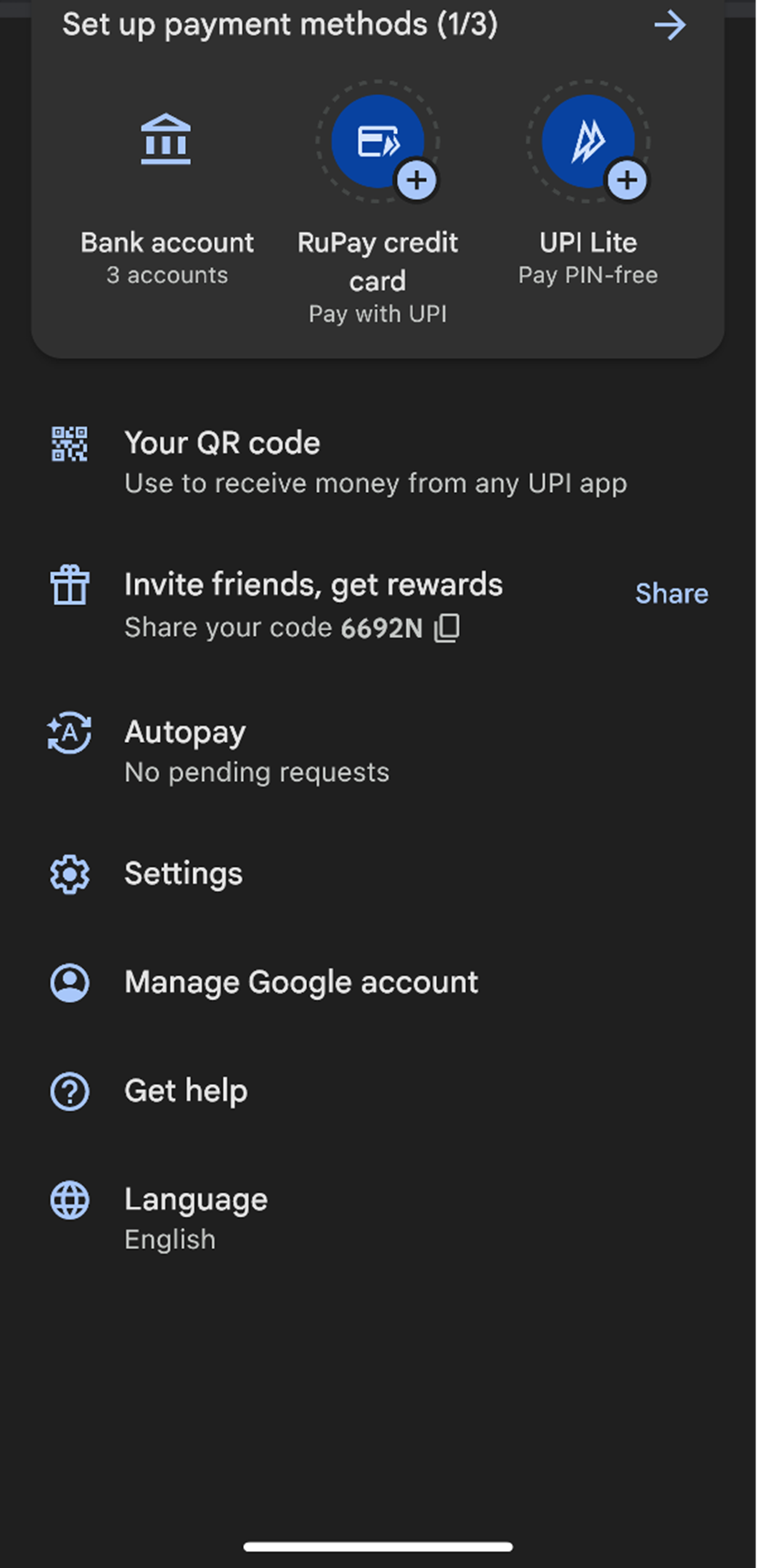

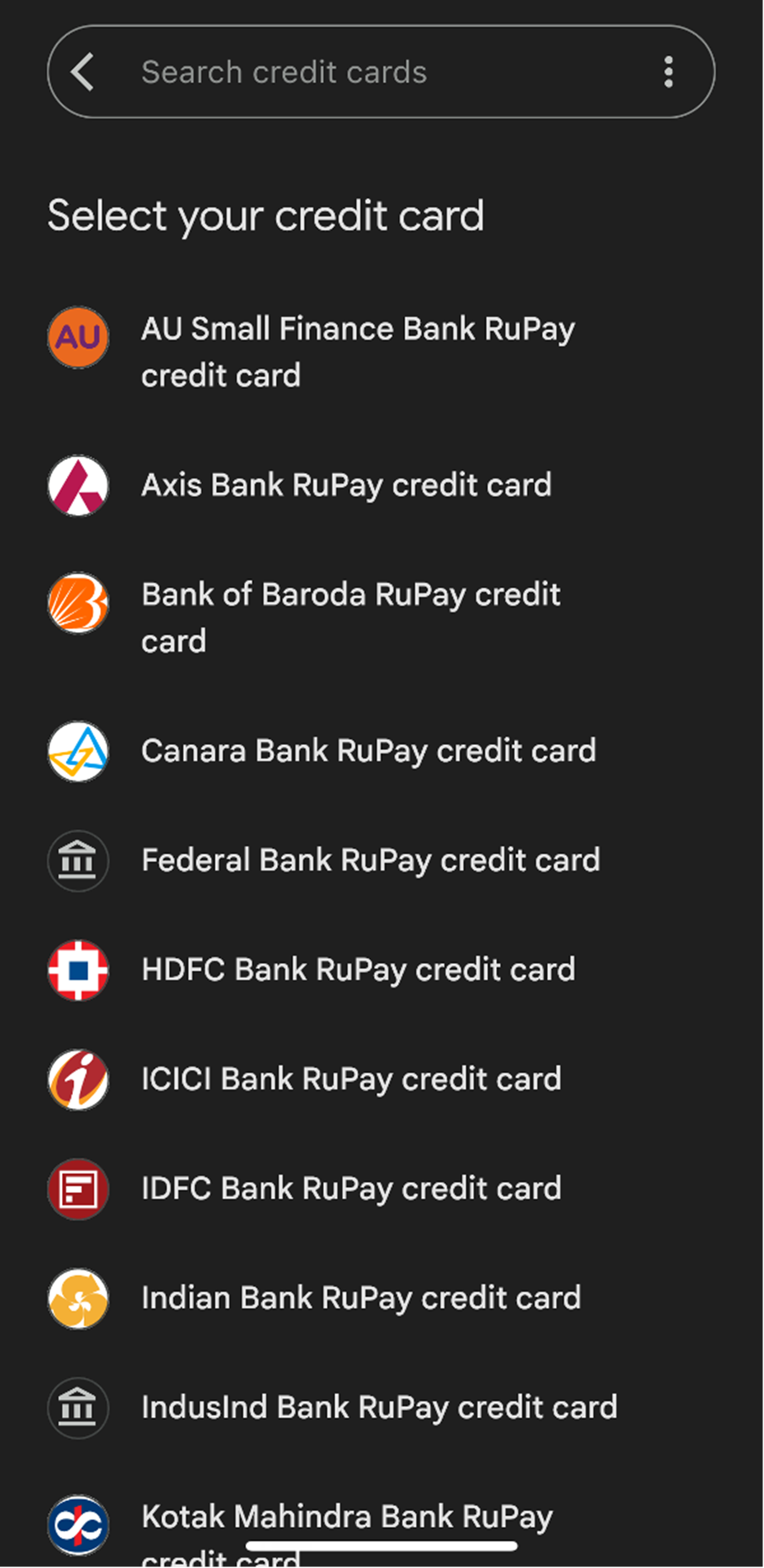

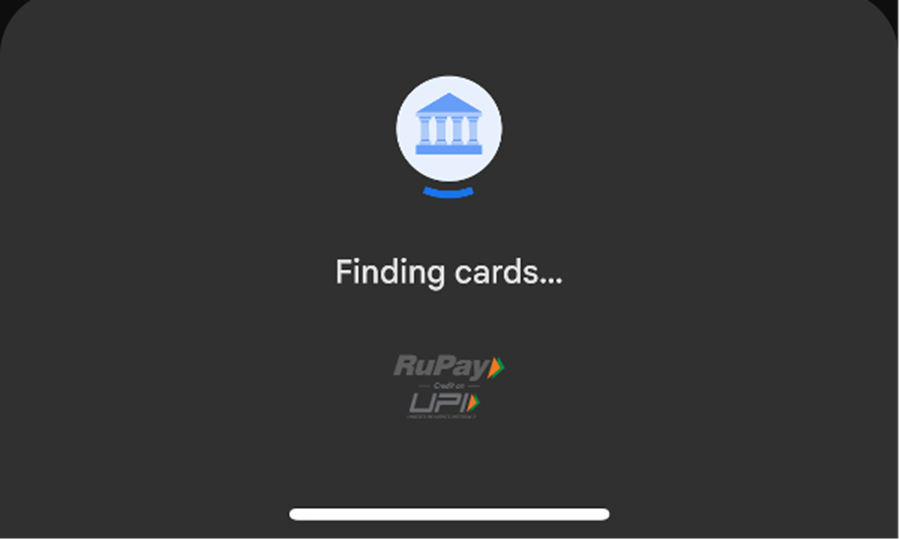

To link your RuPay credit card to the Google Pay app, follow the steps below.

You will be directed to your profile, where you can set up a payment method.

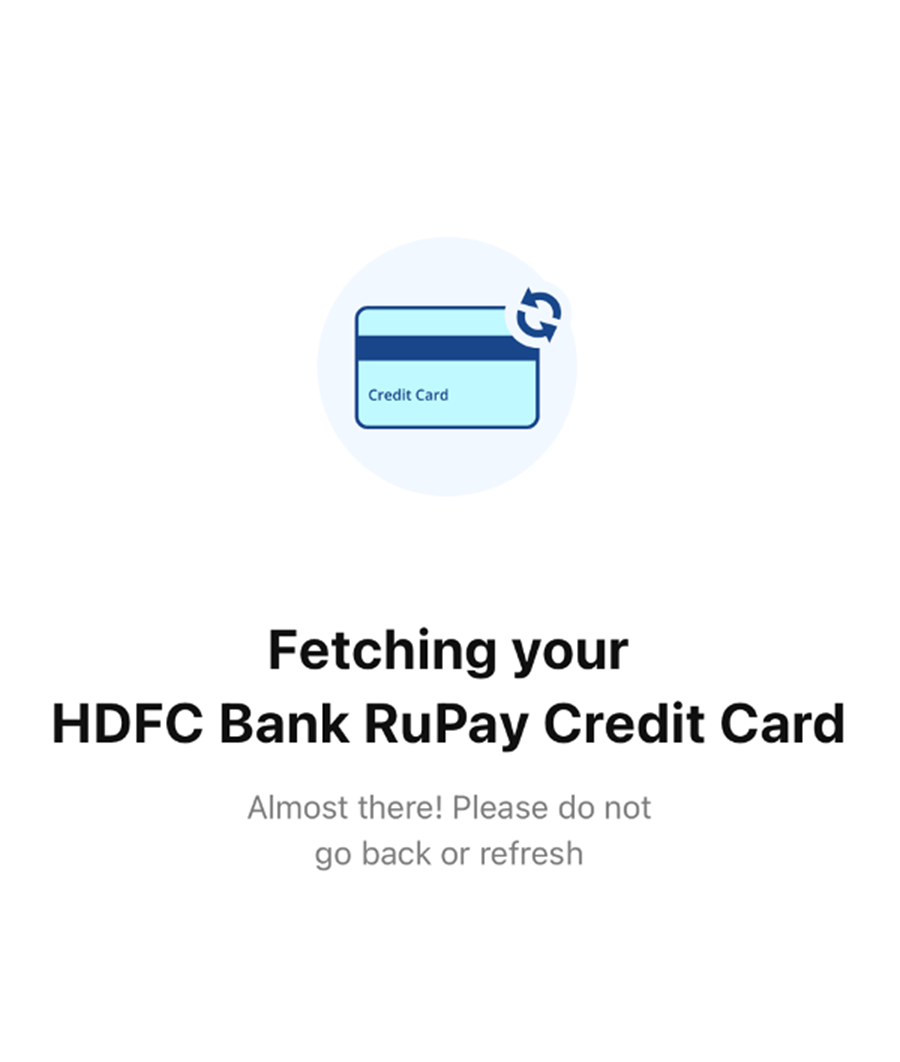

The Google Pay app will find your credit card and fetch its details.

Once you see your card, please select it and verify it by entering the details asked and then entering an OTP.

After verification, you can activate the card and start using it to make UPI payments.

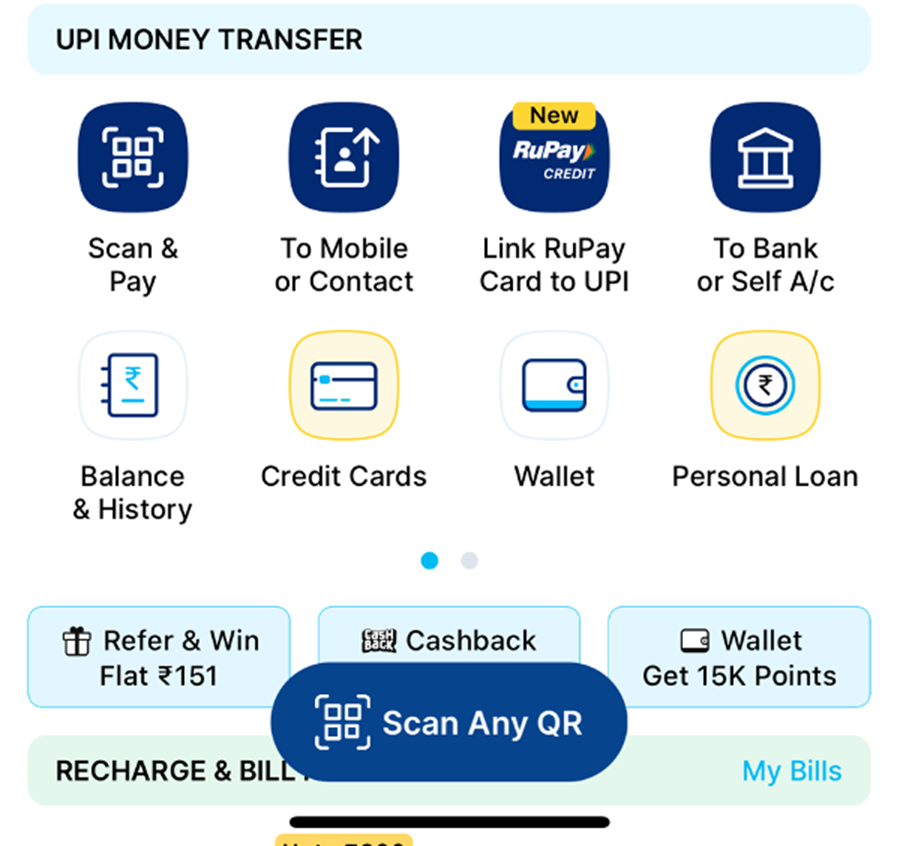

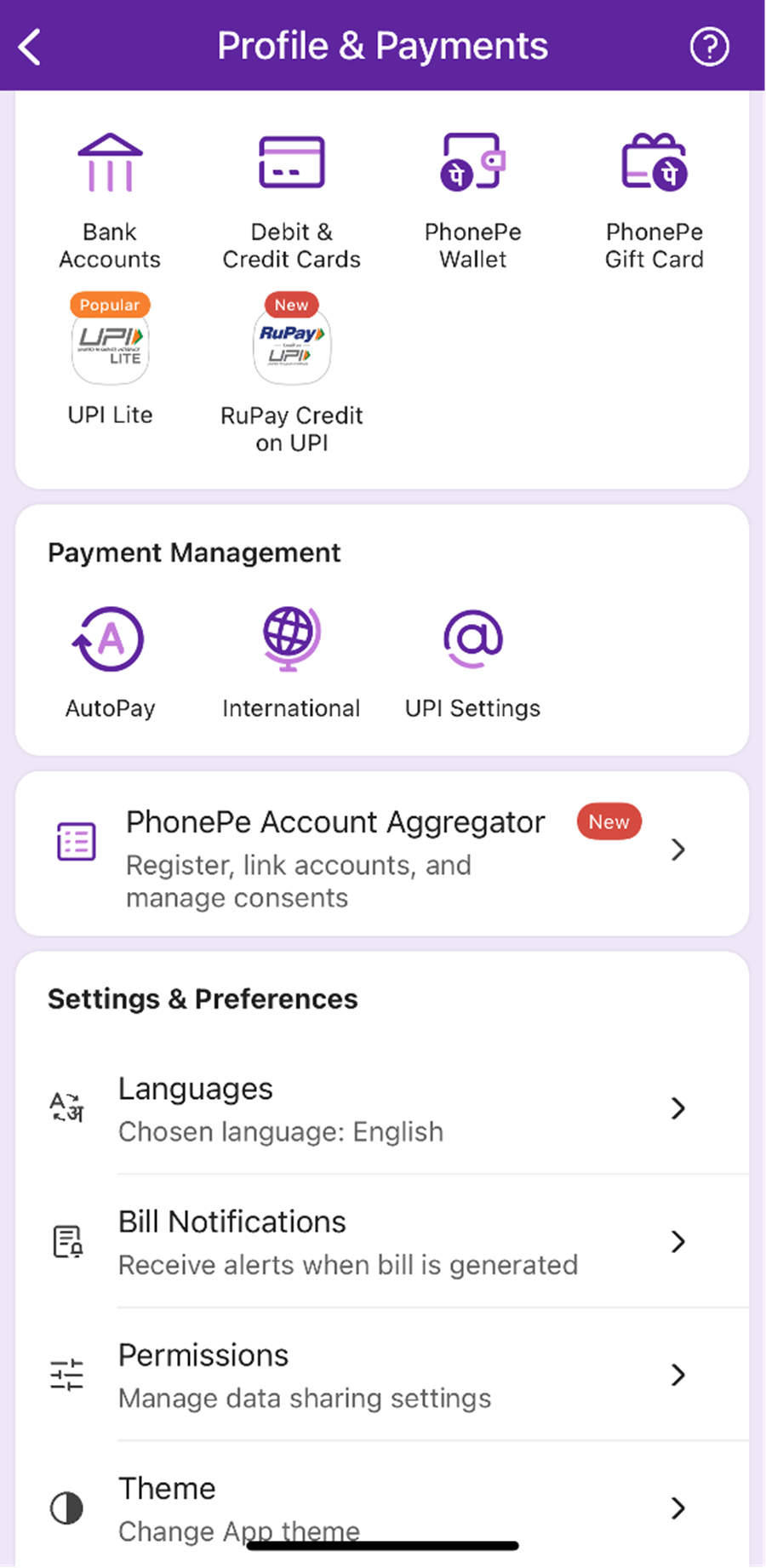

To link your RuPay credit card to PhonePe, follow the steps below.

Scroll down on the home screen to the ‘Payment Methods’ section.

Then, the PhonePe app will automatically fetch your card details linked to your mobile number.

Linking your credit card to UPI comes with several benefits that make managing payments easier and more convenient. Here’s what you can expect:

UPI is accepted almost everywhere, even in smaller stores or service providers that might not have PoS (Point of Sale) machines. Most places now have QR codes or mobile numbers for UPI payments, which makes it easy to use your credit card for purchases, no matter where you shop. This ensures you’re able to use your credit card for a wide range of transactions.

Once you’ve linked your credit card to UPI, the process is done. There’s no need to worry about entering long passwords or remembering card details every time you want to pay. All you need to do is tap your phone a couple of times, and you’re ready to go. It’s a quick and simple way to make payments without any hassle.

Contactless payments are becoming increasingly popular, and linking your credit card to UPI lets you take full advantage of this. Unlike physical card transactions that require touching a machine, UPI payments allow you to make purchases by scanning a QR code and authenticating the payment, all without any physical contact. It’s faster, safer, and more convenient.

Since UPI is used frequently for everyday transactions, linking your credit card allows you to earn reward points with every payment you make. The more you use it, the more points you can collect, and these points can be redeemed for perks like cashback, discounts, access to airport lounges, fuel waivers, and more. It’s a win-win situation where you get both convenience and rewards for making payments through UPI.

Paying with a credit card via UPI is simple once you have everything set up. Here’s a clear, step-by-step guide to help you get started:

First things first, you need to have a UPI ID linked to your bank account. If you haven’t set up UPI yet, you can easily do it using apps like Google Pay, PhonePe, or Paytm. Just follow the instructions to create your ID and link it to your bank account.

To pay with your credit card, you need to link it to your UPI ID. Open your UPI app, go to the payment settings, and find the option to link a credit card. You’ll be asked to enter your credit card details, including the card number, expiry date, and CVV. Once that’s done, your card will be ready to use for UPI payments.

When you’re ready to make a payment, open your UPI app and select the option to pay with UPI. Enter the recipient’s UPI ID or scan their QR code. Once the payment screen appears, you’ll usually see an option to select your payment method. Choose your credit card as the payment method.

Next, type in the amount you want to pay. Double-check the details to make sure everything looks good before proceeding.

Once everything is set, you’ll be asked to authenticate the payment. This can be done with your UPI PIN, which is a 4-6 digit number you created when setting up UPI. Enter your UPI PIN, and the payment will be processed using your credit card.

After you’ve authenticated the payment, wait for the confirmation. The app will show a message once the payment is successful, and you’ll also receive a notification on your phone. You’ll get a receipt for the transaction, just like you would for any other payment.

By linking credit cards to UPI, the users will benefit in the following ways:

Convenience

Paying for transactions using credit cards by scanning QR codes through UPI makes payments convenient.

Economical

Merchants using UPI for their business need not worry about credit card fees as the payments will be received through UPI, making it economical for them.

Rewards

UPI will enable higher usage of credit cards. With this, the rewards and cashback will also increase.

Risk elimination

Linking credit cards can eliminate the risk of using physical cards. With two-factor association and biometric lock, credit card transactions will become safer than ever.

Only RuPay credit cards can be linked to UPI. Visa and Master Card credit cards can’t be linked to UPI. Moreover, at present, only credit cards from a few banks have this facility.

At present, only RuPay-based credit cards work with UPI. VISA, MasterCard and Amex credit cards are yet to be live on the UPI infrastructure.

Only RuPay credit cards of eight banks are live with UPI, and they are Punjab National Bank, Union Bank, Indian Bank, HDFC Bank, Canara Bank, Axis Bank, Kotak Mahindra Bank, and BFSL.

There is no limit on the number of transactions that can be carried through UPI using your credit card.

The maximum limit per card per day is Rs 1 lakh, and Rs 2 lakh in case of some special merchant category codes (MCC). However, the actual limit will be limited to the credit limit on your card.

Are there any charges for linking or for using linked Credit Cards on UPI from various apps?

UPI apps will not charge any fee for linking or carrying out transactions using credit cards.

Linking your credit card to UPI makes payments easier and faster. With just a few simple steps, you can pay directly from your card without any hassle. It’s a smooth, secure way to handle all your transactions—whether you’re shopping online or splitting a bill. Try it out and enjoy the convenience!

Priyanka Rao is a content strategist for Jupiter.Money, and specializes in writing on topics related to finance, banking, budgeting, salary & wages, and other financial matters. She has a passion for creating engaging content that resonates with audiences across various digital platforms. In her free time, Priyanka enjoys traveling and reading, which allows her to gain new perspectives and inspiration for her work. With a keen eye for detail and a creative mindset, Priyanka is committed to creating content that connects well with her readers, enhancing their digital experiences.

Priyanka Sharma is the Head of Credit Cards (Sr. Director Business & Product - Credit Cards) at Jupiter Money, where she leads the growth and development of the company’s credit card portfolio. She is responsible for driving strategic initiatives and enhancing customer experiences through innovative credit products. Priyanka’s leadership is shaping Jupiter’s approach to simplifying personal finance for its customers.

Prior to her role at Jupiter Money, Priyanka was an Engagement Manager at McKinsey & Company, where she provided strategic advice to clients across various sectors. Her expertise in business strategy, growth, and operations was built on her strong analytical skills and client-focused problem-solving abilities. Earlier in her career, she worked at ZS, a global business consulting firm, where she contributed to various projects, gaining significant experience in data-driven business decisions.

Priyanka holds a Post Graduate Programme in Management with a focus on Finance, Strategy, and Leadership from the Indian School of Business (ISB), where she graduated with distinction, earning a place on the ISB Dean’s List. This prestigious academic achievement underscores her deep understanding of financial strategy and leadership, which she continues to leverage in her fintech leadership role.

Powerd by Issued by