Get salary accounts for your team See benefits

Table of Contents

ToggleYou may be wondering how to convert a Salary Account to Savings Account, because who wants to have a plethora of bank accounts right? Converting a salary account to a savings account can be an easy-to-do job if you follow the correct procedure.

A salary account works best for professionals, while a savings account is suitable for all. Account conversion is sometimes essential due to a switch in jobs. The Bank converts a salary account to a savings account if you do not receive any income continuously for the past three months. Similarly, You can convert a savings account to a salary account if the company agrees. The financial institutions ease the work for you and make the required changes in no time.

In many companies, when you start a new job, the employer gives you a salary account in a collaborated bank. However, when you switch from an old job to a new one, your old salary account is useless if the organization disapproves. This is where the question of “how to convert salary account to savings account” comes in. Hence, it would be best to ask for approval beforehand. If the employer rebukes the Bank, you should ask the Bank to convert the account. The Bank will help you convert your salary account to a savings account.

The answer to this question should be answered by your utility and features offered by a bank. In many banks, Salary account comes with these features:

So, if you are someone be okay with letting go of these features over better offers and services from a savings account of a different bank or the same bank, you can switch to a normal savings account.

Check with your organization: Before initiating the conversion of account, check with your company HR if they allow the conversion of the salary account to a savings account. Some organizations may have specific policies or tie-ups with banks that restrict the conversion. They will clearly inform you whether you can switch to a different account for a salary account, or convert it to savings account, or advise you to close the account and create a new one.

Contact the Bank: If your organization permits the conversion, you need to contact the bank where your salary account is held. You can visit the bank branch, use their app to connect with support, or contact their customer service through phone or email.

Submit a request: Inform the bank representative/ customer support about your intention to convert the salary account to a Savings Account. They will guide you through the necessary steps and provide you with the required forms or documents.

Submit the Documents: The bank will typically request you with certain documents for the conversion process. These may include:

Formalities: Fill out the necessary forms accurately and submit them along with the required documents to the bank. Ensure that you provide all the requested information and comply with any additional requirements specified by the bank.

Account Closure: If the bank requires the closure of the existing salary account before opening the savings account, they will guide you through the account closure process. Make sure to transfer any remaining funds from the salary account to the new savings account or withdraw them as per the bank’s instructions.

Activate the Savings Account: Once the conversion process is complete, the bank will open a new savings account for you. You will receive the account details, including the account number and any associated debit card, passbook, or online banking credentials.

Pro Tip:

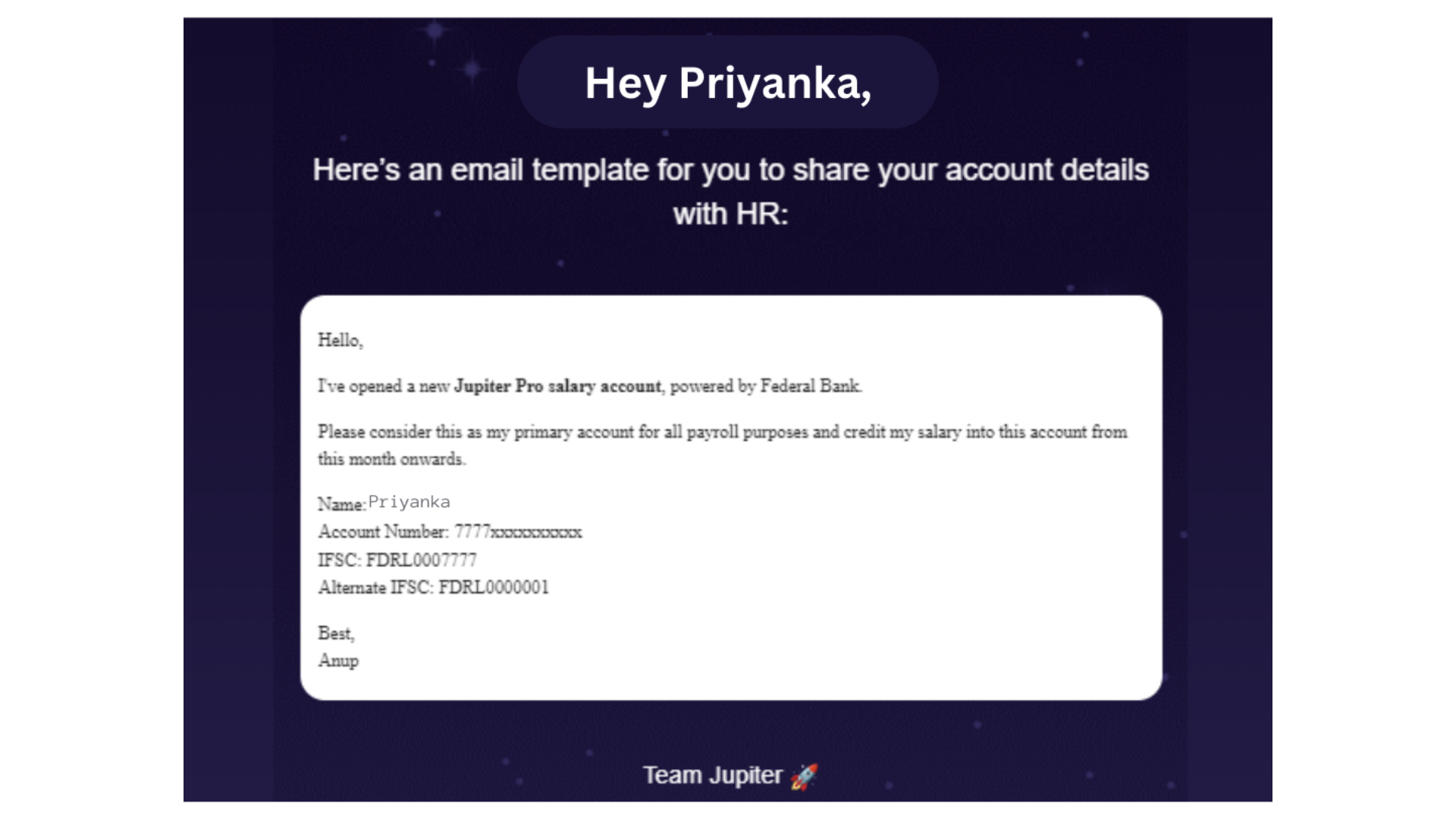

If you are converting your Salary account from one Bank to another, you can open a Salary Account with Jupiter – powered by Federal Bank.

Let me tell you how easy it is! Instant account in 3 minutes. We even provide you with an email template to forward it to your HR, so that you don’t have to worry much about what to type and share with the HR of your company.

Our Salary Account features include:

→ Earn up to 5% cashback on spends*

→ Get Personal Loans of up to ₹5,00,000*

→ Get advance on your salary with Mini Loans up to Rs. 75,000 at 0% interest

→ Save up to ₹3500 every month on Forex charges

More about it here: Salary Account by Jupiter – Powered by Federal Bank

If you want your HRs and management to check out our corporate salary account, they can check more details with our Corporate Salary Account powered by Federal Bank and use our free HRMS platform, sumHR to enhance your HRMS needs.

Whether you require another savings account or not is entirely your choice. Most of the organizations go for a salary account in a bank they have a tie-up with. If the employer does not hold a salary account in the same bank, there is no need for another savings account. You can convert the existing account to a savings account. You will now have a savings account and a new salary account. You will receive monthly payments in one account and can make various mutual fund or SIP investments or pay back your loans through the existing account. Switching the old account and a new salary account will help maintain a balance in your personal and professional life.

Discussed above, you may have very little advantage from a normal Savings Account over a Salary Account. If you do find an advantage of a Savings Account from the same bank or another bank, you can switch the accounts. Check the charges beforehand with the bank customer support so that you are fully aware of the benefits of the new account.

Switching your salary account to a regular savings account may require a minimum balance. It is because savings accounts have a minimum balance requirement. The Bank may levy penalties or fees if you do not maintain the required limit. However, the limit is sometimes higher than expected and varies from one bank to another. Thus, you should check it beforehand to avoid unbearable expenses.

Looking for a branch location is another primary requirement in salary account conversion.

Present-day banking has a digital solution to all your needs. You can avail the benefits from the comfort of your home. However, some tasks can only be done at the bank premises. It requires face-to-face interaction and cannot be completed online. Hence, looking for the branch location before making the conversion is essential. You should find a bank near your workplace or home to make it convenient.

Digital transactions might be on rise, but cash is still the king in the Indian economy. You should look for ATM density before converting the salary account with a particular bank to a savings account. ATM density shows the accessibility to ATMs. The Bank must have a widespread ATM network to easy accessibility and faster services.

Don’t forget to change your communication address!

While opening a salary account, we often enter our workplace address for any bank-related communications. However, converting the salary account to a savings account requires a change. If you fail to do so, all your information like credit/debit card bills and pins, an account password, chequebooks, etc., will be sent to your ex-office.

In addition to knowing how to convert salary account to savings account, you must also know that the salary account to savings account conversion is not a burdensome process. However, certain essentials need to be fulfilled. Different banks have different norms and conditions for the conversion process. Hence, you should get a detailed view of all its conditions. Before moving forward with a financial institution, checking the branch locations and minimum balance requirement is a must. Also, never forget to change your communication address. Committing such a minor mistake can lead to significant problems. Converting a salary account to a savings account will be easy if you go step by step. Checking the mentioned points will help you receive precise and faster results.

Yes, you can convert your existing savings account to a salary account. If the organization you work with has a tie-up with the Bank where you hold a savings account, the Bank can help you with it. It will convert the savings account to a salary account at the employer’s request.

A salary account automatically converts to a savings account if it continuously does not receive salaries for three consecutive months.

You can do it by contacting the Bank’s relationship manager or by visiting the Bank’s branch. Also, you can send a letter or mail asking for the change. The Bank will help you with the same.

Leaving your job will automatically convert your salary account to a savings account. The Bank converts the salary account to a savings account if there are no credits for three months continuously. However, if your new job has a tie-up with the same Bank, you can continue with the initial account. The Bank needs all the information about the new position for the same.

Majority of the Salary Accounts in India allow Zero Balance feature. Connect with customer care of the respective bank that you have your Salary Account with. They will guide you about the minimum balance requirements with your corporate salary account.

Priyanka Rao is a content strategist for Jupiter.Money, and specializes in writing on topics related to finance, banking, budgeting, salary & wages, and other financial matters. She has a passion for creating engaging content that resonates with audiences across various digital platforms. In her free time, Priyanka enjoys traveling and reading, which allows her to gain new perspectives and inspiration for her work. With a keen eye for detail and a creative mindset, Priyanka is committed to creating content that connects well with her readers, enhancing their digital experiences.

Colin D'Souza is currently the Vice President of Banking Programs and Strategy at Jupiter Money, where he oversees the development and execution of key banking initiatives. With a strong background in retail banking, sales, and strategy, Colin brings extensive experience in driving business growth and enhancing customer engagement across various financial products and services.

Before joining Jupiter, Colin was the Head of Corporate Salary Business at IDFC First Bank, having previously served as the Zonal Business Head for Retail Liabilities & Branch Banking. His leadership at IDFC First Bank focused on expanding the bank’s retail banking footprint and optimizing branch operations. Prior to that, he held senior roles at Citibank India, where he was Vice President and Regional Sales Head, responsible for the sales and distribution of consumer assets and liabilities, including services for high-net-worth individuals (HNI) and ultra-high-net-worth individuals (UHNI), as well as current accounts.

Colin also served as Vice President and Regional Sales Manager at HSBC, leading retail liability acquisitions and driving business development for investment and insurance products. Earlier in his career, he managed a cluster of branches at CitiFinancial, where he was responsible for credit, risk, and P&L management.

He holds a Post Graduate Diploma in Management from the Institute of Management Education and Research (IMER), adding a solid academic foundation to his professional expertise in banking and strategy.

Powerd by Issued by