Get salary accounts for your team See benefits

Table of Contents

Toggle

A salary pay slip is a document that every salaried individual receives from his or her employer, but not many are aware of its importance. Do common terms like gross salary, tax deductions, and reimbursements often leave you confused? Worry not! Here, we cover the crucial aspects related to a salary slip.

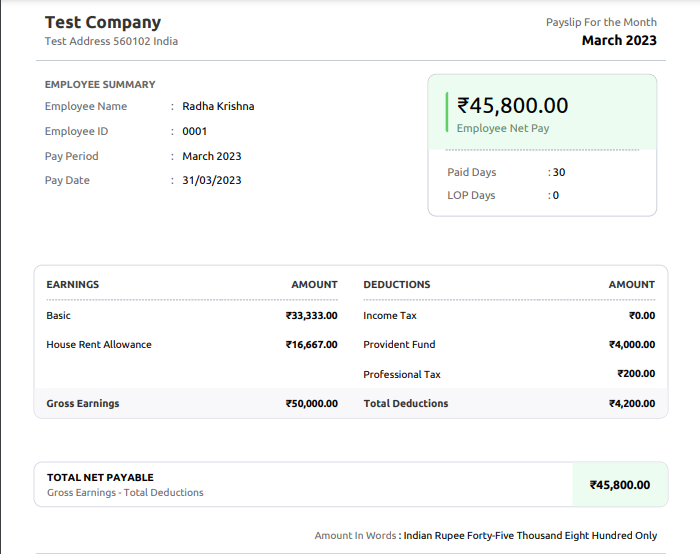

It is a document that every company is liable to provide to its employees every month. The salary payslip includes information regarding the employee’s deductions and basic salary for a given month. It works as proof of salary payment and is generally provided by employers as both soft and hard copies.

A pay slip gives you a clear picture of how much salary you get in hand, what kind of allowances and incentives your employer offers, and various other details. Additionally, you can use the document to know the available tax deductions. Here is a list of the main components of a salary slip / pay slip.

CTC is the total amount the company spends on an employee. It includes HRA, CA, medical expenses, gratuity, EPF, and other allowances. It depends on a variety of factors, which affect your net salary. You can consider CTC as the employer’s total spending on hiring an employee.

The gross salary is the amount you get before deductions. The employer subtracts gratuity and PF from this income. The gross salary is not reflected in the pay slip. It is only mentioned in your offer letter. Finally, the amount you receive after the tax and other deductions is known as take-home or in-hand salary. The in-hand salary is always lower than the CTC, as you receive it after deduction. Let us understand the differences with illustrations.

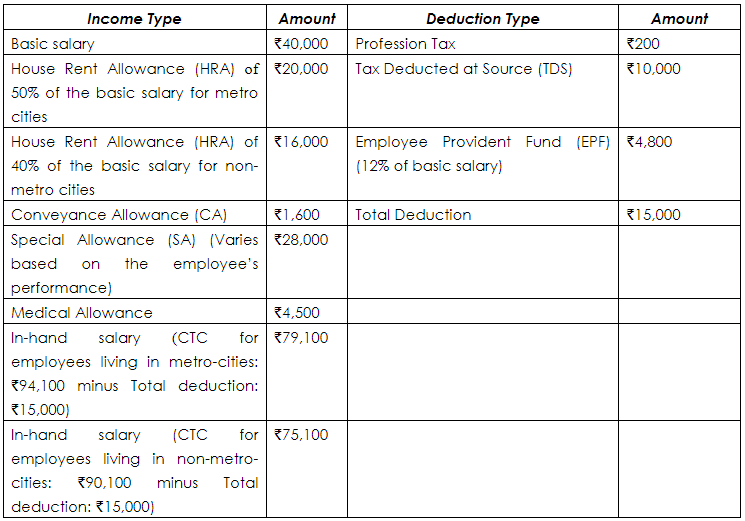

If you are based in Delhi and your CTC is ₹94,100 per month, then the value of the pay slip component will be as follows:

The income section of the pay slip includes components, like:

It is the basic element of your salary, constituting up to 50% of your total pay. At the beginning of your career, this section includes a higher amount, but as you grow and reach a higher designation, the basic component becomes lower to ensure that it remains less than your total allowance. It is advisable to negotiate for a higher basic pay.

DA is an allowance, which public sector employers pay to their employees to tackle the effects of inflation. As this amount is based on the cost of living, it may vary as per the location. DA is a specific percentage of your basic pay, and it is taxable.

The employee pay slip also includes HRA, which is the allowance employers pay to the employees who live in rented accommodation. If you are currently living in metro cities like Kolkata, Mumbai, Delhi, or Chennai, the HRA will be 50% of your basic pay. It is 40% for any other city.

CA is the sum companies pay to employees to travel for work. Until 2018, you could get a yearly tax exemption of up to ₹19,200, but now it is not available anymore. Instead, you get a standard deduction of ₹50,000.

Employers pay this allowance to every worker during their employment tenure to cover medical expenses. This also comes under the standard deduction.

Employers pay this amount for the travel expenses of yourself and your family during holiday leave. It generally covers only the railway and flight costs for traveling within India. You need to submit the proof of travel to receive the LTA. You can also get a tax exemption on the amount, but for only up to two holidays in a four-year block.

SA is another allowance included in your monthly pay slip, and its value depends on your work performance. Companies introduced this allowance to motivate their employees to perform better. The amount varies among employers. The entire SA is taxable.

The governments of states like West Bengal, Karnataka, Andhra Pradesh, Maharashtra, Telangana, Tamil Nadu, Assam, Gujarat, Chhattisgarh, Meghalaya, Kerala, Jharkhand, Orissa, Tripura, Madhya Pradesh, and Bihar charge this tax on every earning professional. The tax amount is generally about ₹200 a month.

Your employer deducts this tax from your income and submits it to the government. The amount depends on your income tax slab, and you can check it on the income tax e-filing portal.

Private sector employers may provide EPF as an investment avenue to their employees for savings and creating a retirement fund. As an employee, you need to contribute 12% of your basic pay. The employer contributes the same amount, too. Section 80C of the Income Tax Act, 1961 allows a yearly tax exemption of up to ₹1.5 lakh on your EPF contributions.

The employee salary slip is a legal employment document, and it serves a variety of purposes, such as:

It works as evidence of your employment. You need to submit its copy when applying for a travel visa. It is also required for any background check and as proof of salary claim.

The pay slip helps you with tax planning, which is an important part of your finances. With efficient tax planning, you can manage your tax outflow. Moreover, you can find out if you are eligible for any rebates or concessions according to the Income Tax Act, 1961.

The pay slip shows your current job designation and salary, both of which indicate your ability to repay a loan. So, lenders, as well as, credit card companies require you to furnish its copy to get a loan or credit card. You can also enjoy government subsidies on food grains, medical services, and other aids using this document.

Having understood the uses and importance of a pay slip, it is advisable to save its copies carefully for future requirements.

Issuing salary slips to the employees is a legal requirement as per Minimum Wage (Central) Rules, 1950. You can request your company to provide you with the salary statement/ slip. Nowadays, many employers provide you with monthly salary slips which is a digital copy; you can access the same via internal employee portal or ight be shared with you on email by your company. Some organisations provide printed salary statements/ certificates.

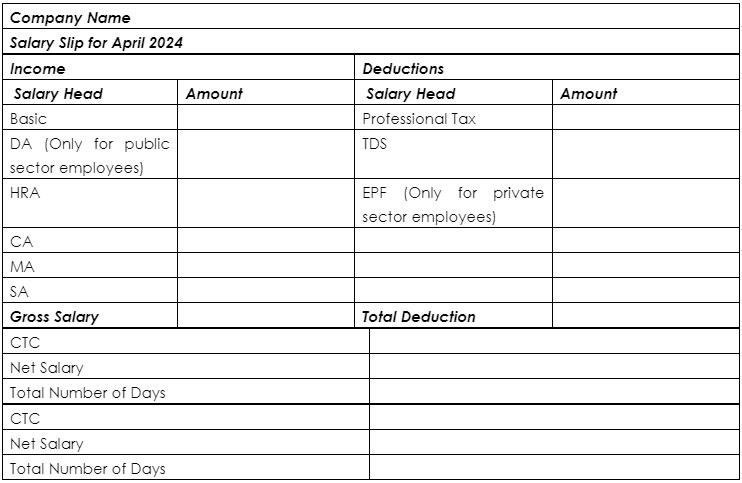

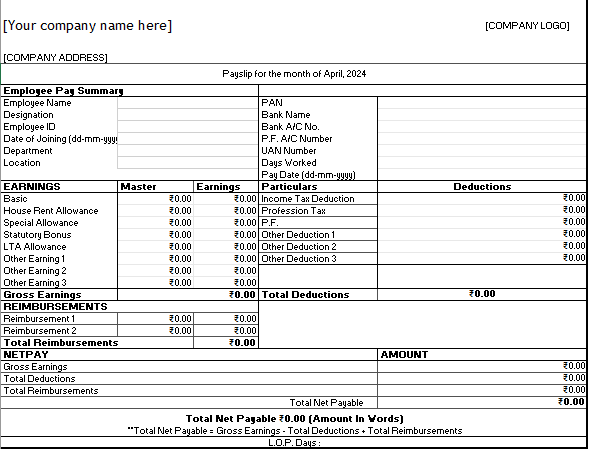

There are various salary slip formats available to download for free. We have created a free salary slip format which you can download for FREE here: Salary Slip Format in Excel, Word, and PDF. This includes detailed components where you can just add the values after calculations

These are the abbreviations for components of CTC (cost-to-company) in payslip, where DA means Dearness Allowance, SA means Special Allowance and CA means Conveyance allowance.

LTA is Leave Travel Allowance. This allowance can be used for tax exemption.

Salary slips/ Employee payslips act as a proof of income for the employee. It helps employee understand what the components of the remuneration and deductions are. You have the rights to demand salary slip from the employer and the employer has to oblige with the same.

Yes, Salary slip is confidential and it is a valid proof of income. You can choose to disclose it to anyone as per your wish.

Employee Provident Fund (EPF), or more commonly known as PF is a retirement savings scheme introduced by the Government for salaried class. You can choose to add some part of your basic pay of salary to this fund or 12% of basic pay to this fund and additional 12% will be added by your employer to this fund. Whatever amount you choose for PF deductions, the same amount will be added over and above your PF contribution by the organization.

No, Employee Provident Fund (EPF) and Public Provident Fund are two different savings scheme. For EPF, only salaried class can invest in this scheme and, for PPF, all citizens can invest in the scheme regardless of their employment status.

The Employees’ Provident Fund Organisation (EPFO) has stated the following regarding this – – The contributions are payable on maximum wage ceiling of Rs. 15000/- – The employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate.- To pay contribution on higher wages, a joint request from Employee and employer is required.

HRA is House Rent Allowance. This is paid to the employees who live in a rented accommodation by their organisation.

Priyanka Rao is a content strategist for Jupiter.Money, and specializes in writing on topics related to finance, banking, budgeting, salary & wages, and other financial matters. She has a passion for creating engaging content that resonates with audiences across various digital platforms. In her free time, Priyanka enjoys traveling and reading, which allows her to gain new perspectives and inspiration for her work. With a keen eye for detail and a creative mindset, Priyanka is committed to creating content that connects well with her readers, enhancing their digital experiences.

View all posts

Colin D'Souza is currently the Vice President of Banking Programs and Strategy at Jupiter Money, where he oversees the development and execution of key banking initiatives. With a strong background in retail banking, sales, and strategy, Colin brings extensive experience in driving business growth and enhancing customer engagement across various financial products and services. Before joining Jupiter, Colin was the Head of Corporate Salary Business at IDFC First Bank, having previously served as the Zonal Business Head for Retail Liabilities & Branch Banking. His leadership at IDFC First Bank focused on expanding the bank’s retail banking footprint and optimizing branch operations. Prior to that, he held senior roles at Citibank India, where he was Vice President and Regional Sales Head, responsible for the sales and distribution of consumer assets and liabilities, including services for high-net-worth individuals (HNI) and ultra-high-net-worth individuals (UHNI), as well as current accounts. Colin also served as Vice President and Regional Sales Manager at HSBC, leading retail liability acquisitions and driving business development for investment and insurance products. Earlier in his career, he managed a cluster of branches at CitiFinancial, where he was responsible for credit, risk, and P&L management. He holds a Post Graduate Diploma in Management from the Institute of Management Education and Research (IMER), adding a solid academic foundation to his professional expertise in banking and strategy.

View all posts

Powerd by Issued by