But not everyone has that kind of money. So, people often opt for home loans to buy their house or invest in a property. Today, you can purchase a property by paying 10% to 20% as a down payment and get a loan for the remaining amount. You can then repay it over the next 30 years of your life.

Although the biggest challenge of availing of a home loan is its high interest rate, there is no reason to worry. Read on some simple tricks to lower the interest rate on housing finance.

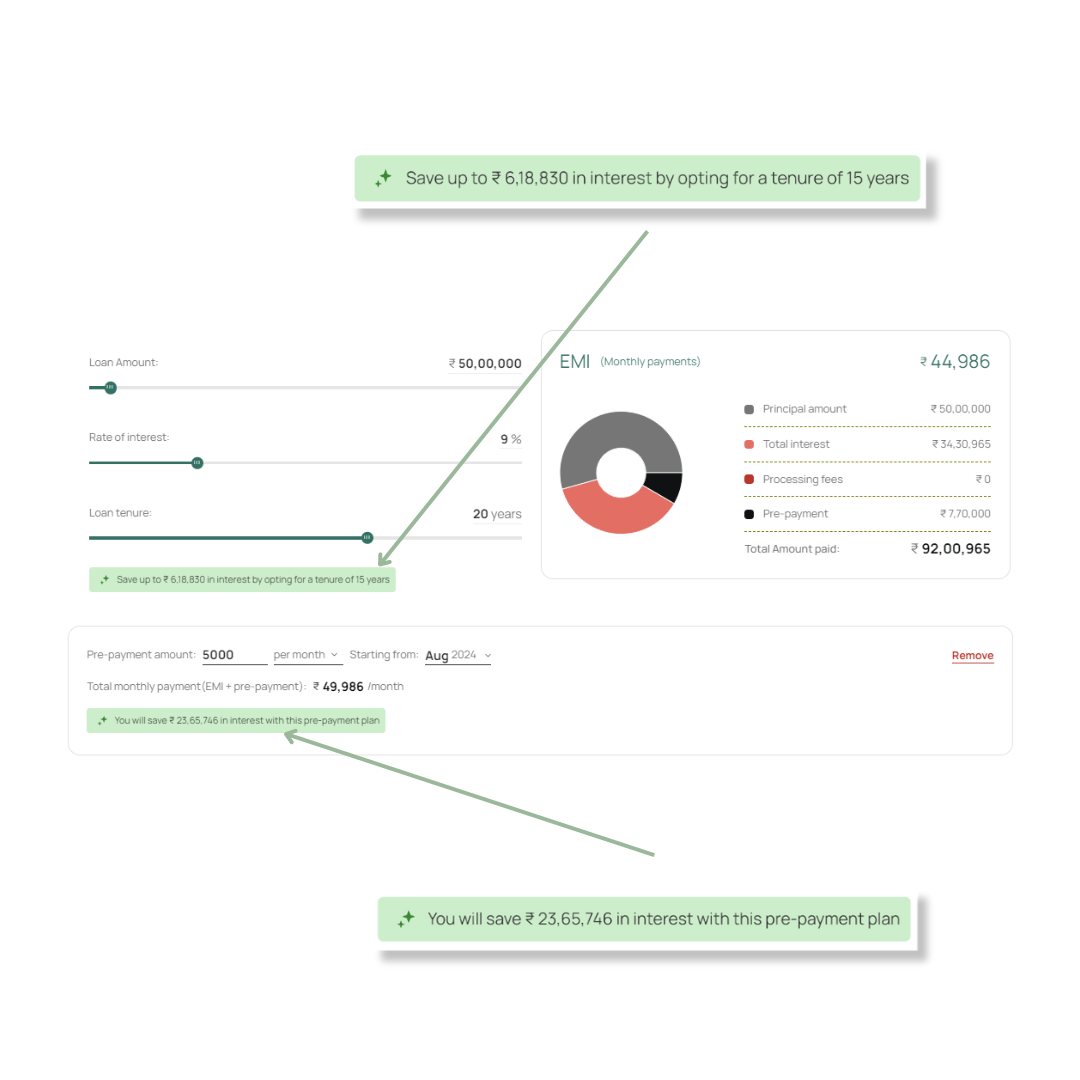

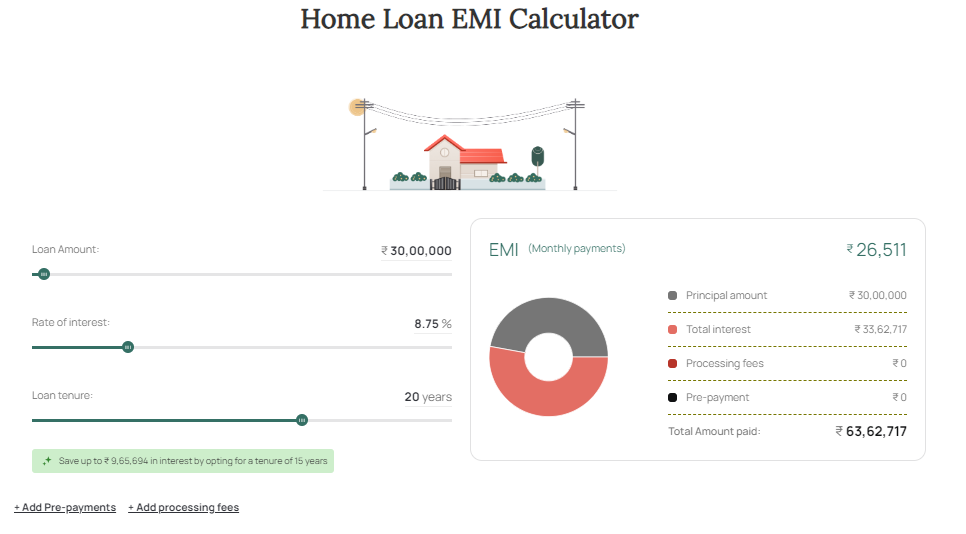

You can check how to save money on Home Loan, by using our Home Loan EMI calculator:

Free Home Loan EMI Calculator

Check your home loan EMI, prepayment and savings on interest with our free Home Loan EMI Calculator

Tips to reduce home loan interest payments

If you want to enjoy the lowest home loan interest rate, here are the six things you can do.

1. Choose a short tenure

The loan repayment tenure is an important aspect that helps you to lower your home loan interest rate. When you pay the loan amount over an extended period, the Equated Monthly Installments (EMIs) will be low. So, you might think that longer tenure is an affordable option. But the more time you take to repay the amount, the higher will be the total interest paid as the number of EMIs will be more. So, choosing a shorter repayment tenure might be inexpensive in the long run. Before getting a loan, you must compare both options in terms of the total cost.

2. Pay more as the down payment

One of the most effective ways to reduce loan interest is to pay a higher down payment amount. You may consider paying the least amount as a down payment to protect your savings, but that also means you need to take a significantly huge loan. When you opt for a higher down payment, the loan amount decreases, which directly lowers the payable interest. So, if you can manage to pay a substantial amount upfront, it is always better to do so rather than availing of a huge home loan.

3. Pay more than your regular EMI

Home loans have long repayment tenures, which means you have to keep paying the interest over an extended period. One way to counter that is by increasing the EMI amount over time. As you progress in your profession, your salary will increase, enabling you to pay a higher EMI. So, find out if your lender allows the option to increase EMI as that will let you repay the loan early, shortening the tenure. As already explained, a shorter tenure leads to a lower interest payment.

4. Take advantage of regular prepayment

Suppose you have taken a home loan of ₹50 lakhs with a repayment tenure of 20 years and an interest rate of 9% per year, you will have to pay ₹45,000 as EMI, which will lead to a total interest payment of around ₹58 lakhs. But you can avoid repaying the total amount of ₹1.08 crores with regular prepayments. When you pay an additional amount with the EMI to reduce the outstanding principal, it is known as prepayment.

Your loan amount stays the same, but your income will undoubtedly increase with time. Let us assume that you earn enough to make regular prepayments after three years of availing of the loan. So, if you start paying ₹2 lakhs every six months in addition to your EMI, the housing loan interest will be charged on the reduced outstanding balance only. You will be able to repay the entire loan amount in approximately 10 years, and the total due interest payment will be ₹28 lakhs. So, you can end up saving ₹28 lakhs in interest amount with regular repayments.

5. Opt for a home loan balance transfer

Opting for Home Loan Balance Transfer (HLBT) to another lender offering low-interest home loans can help you reduce the interest amount. This option allows you to transfer your outstanding amount from your current lender to another one offering a better deal. But before you choose HLBT, you must keep in mind the below points.

- The new lender must offer a lower interest rate than the current one.

- The new lender must not ask for high charges like processing and other fees.

- The new lender must offer additional benefits and features like home loan top-up.

- The new lender must allow you the same repayment tenure as the original loan, otherwise, you will end up paying more interest.

6. Be aware of special deals and offers

Most people do not know this, but it is possible to negotiate while getting a home loan, especially if you have a good credit history. A credit score of over 800 allows you to ask your lender for a low housing loan interest rate. They prefer customers with a high credit score as it lowers the risk of loan defaults. So, you can get a good deal on housing finance if you ask for it. Moreover, many lenders provide special offers like low interest rates during festivals. So, always look for such offers to enjoy the benefit.

How to cover one investment with another

As mentioned above, regular prepayments can lower your due interest for a ₹50 lakhs home loan to ₹28 lakhs. You can practically turn this into an interest-free loan by making other smart investment choices. For example, if you invest in a mid-cap mutual fund with ₹25,000 Systematic Investment Plan (SIP) option that offers 12% interest, after 10 years, you will earn an interest of ₹28 lakhs. You may use this amount to cover the payable interest on your home loan.

Things to consider when investing in properties

Investing in a property requires many considerations. The two most important ones to contemplate are as follows:

- Value appreciation: Before investing in a property, you must always determine its future price. The investment only makes sense if the property has the potential for long-term appreciation.

- Affordability: Investing in a property requires you to have a regular source of stable income and surplus amount. You will need considerable capital for the down payment, maintenance, and future renovations. So, ensure that you purchase a property only when you can afford it.

If you need a home loan to invest in a property, it is essential to find a suitable option. You must compare different lenders based on their home loan interest rates, tenure flexibility, additional benefits, reviews, and other aspects. Make sure you avail of housing finance only from the most reliable lender.