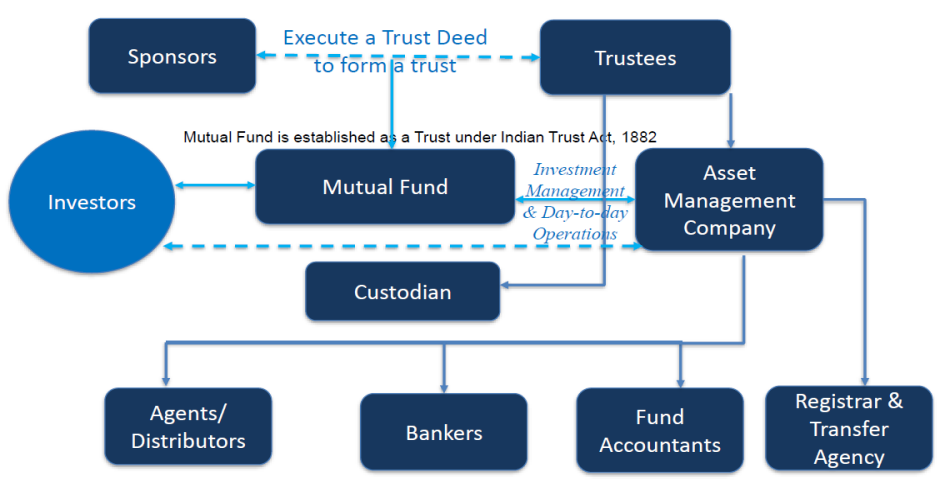

In India, mutual funds have a three-tier structure comprising a sponsor, trustee and asset management company (AMC). These three tiers are supported by other participants such as custodian, registrar and transfer agent, fund accountant, broker, dealer, and intermediary. The structure of mutual funds is regulated by the Securities and Exchange Board of India (SEBI) Mutual Funds Regulations, 1996. Hence, all the participants and entities involved in mutual funds are bound to follow the rules set by the SEBI.

Structure of Mutual Funds in India

As mentioned earlier, the structure of mutual funds has three tiers. Below are the functions of these three tiers of a mutual fund.

Source: https://www.bseindia.com/downloads1/PPT8_IntroductiontoMutualFundsInvesting.pdf

Tier 1: Sponsor

The sponsor forms the first layer in the structure of a mutual fund. A sponsor can be an individual or an entity whose primary objective is to earn money through fund management. The sponsor can execute the fund management through another associate company. Moreover, the sponsor can be a promoter of the associate company.

To become a sponsor of a mutual fund, a person or an entity must approach SEBI and seek its permission to set up a mutual fund. Once SEBI agrees to this, the sponsor must form a public trust under the Indian Trust Act 1882 and must register it with SEBI. Once the trust is registered, the sponsor can appoint a board of trustees (BOT) who will be responsible for adhering to the SEBI Mutual Funds Regulations and protecting the unit holder’s interests. Once the trustees are appointed, the sponsor can create an AMC under the Companies Act 1956.

- To become a sponsor, there is an eligibility criterion that must be fulfilled.

- The sponsor should have a minimum of five years of experience in the financial services industry.

- The net worth of the business must be positive in the last five years.

- The sponsor’s net worth must be higher than the capital contribution of the AMC.

- The business should have earned a profit in the last three out of five years, including the preceding year.

- The sponsor should be of sound mind and physically fit.

- The sponsor must contribute at least 40% of the net worth of the AMC.

- Existing or new mutual fund sponsors should not be convicted of any offence.

From the above eligibility criteria, it isn’t wrong to conclude that the sponsor’s role is vital for a mutual fund. Hence, sponsors should have high credibility and enough liquidity and must be faithful to return investors’ money in case of a financial collapse.

Tier 2: Trust and Trustees

The second layer of the mutual fund structure is the trust and trustees. The fund sponsor employs the trustees to protect and safeguard the investors. The trust is created through a trust deed, and the trust is registered under the Companies Act, 1956. The trustees are governed by the India Trust Act 1882. Trustees do not directly manage the securities and mutual funds. Instead, they oversee the entire fund management and ensure that the regulations are being followed by the AMCs.

A mutual fund house has at least four trustees, and the following are their duties.

- Trustees should check the work of AMC, including the back office system, dealing room, and accounting work, before the launch of a scheme.

- They must ensure that AMCs have not given any undue advantage to an associate, which is not in the best interest of the unit holders.

- Ensure the AMC performs its transactions as per the SEBI’s regulations.

- Take remedial steps in case the AMC doesn’t follow laws and regulations.

- Must review all transactions of the trust and AMC every quarter and report them to SEBI.

- Check customer’s complaints and how they are handled by the AMC.

- The trustee must submit a report with the details of the activities of the trust and the trustee’s certificate that they are satisfied with the AMC’s work to the board on a half-yearly basis.

- Must oversee and approve AMC’s request of floating a new fund, provided all the regulations are met.

From the above, it is clear that a trustee must act independently and ensure the investor’s trust and interests are maintained at all times.

Tier 3: Asset Management Company

The final tier of the mutual fund structure has asset management companies. They float mutual funds with different objectives based on the investor’s needs. The AMC also acts as a fund manager for the trust. AMCs must be registered with SEBI under the Companies Act, 1956. AMCs are appointed by the sponsor and are responsible for managing the portfolio of various mutual funds they float. The appointed AMC can be terminated by the vote of a majority of trustees or 75% of unit holders.

- To become an eligible AMC, the following criteria must be met.

- The board of directors must work under the supervision of the trustees and SEBI.

- AMCs shouldn’t undertake any other business apart from financial services.

- 50% of the directors of the AMC should not be related to the sponsor or trustees.

Following are the functions of the AMC

- AMCs must adhere to the investment scheme in line with the trust deed, provide all related information to the unit holders, and manage risk as per the guidelines of SEBI.

- AMCs are responsible for launching mutual fund schemes, receiving and processing applications of investors, sending refund orders, maintaining records, repurchasing and redeeming units, and issuing dividends and warrants. For this work, AMCs can choose to do it by themselves or hire a registrar and transfer agent (RTA).

- The fund managers of the AMC must manage the investments of investors. They are also responsible for selecting the securities, the price, time and quantity at which they will be bought or sold.

- AMCs must collect the net asset value (NAV) of each fund and submit it to the SEBI and AMFI daily. They must also prepare and distribute reports of the scheme and record accounting transactions regularly.

- Act as an intermediary between advertising agencies and collection centres.

- Mobilise the funds with the help of a lead manager and attract funds.

- Hire investment advisors who can analyse securities and market conditions and auditors to inspect and verify accounts of the firm. Also, hire legal advisors to undertake all the legal work of the scheme right from inception to launch.

Other participants in mutual funds

Every mutual fund has other participants that ensure the smooth running of the fund. There are seven participants that are important for a mutual fund, and the following are their roles and functions.

Custodian

A custodian is an entity registered with SEBI and is responsible for the safekeeping, transfer, and delivery of securities. They also help investors update their holdings and keep track of their investments. Custodians also manage the collection of dividends, interest, bonus issues, and other corporate benefits.

Registrar and Transfer Agent

Registrar and Transfer Agents (RTAs) are an intermediary between the fund managers and investors. They are SEBI-registered entities and process mutual fund applications, assist in KYC (know your customer), process investor requests, manage and provide periodic investment statements, and update investor’s records.

Fund accountant

A fund account is responsible for calculating the daily NAV of the different mutual fund schemes of the AMC. The AMC can either do this internally or appoint a third party.

Auditor

An auditor is responsible for checking whether the AMC is keeping all records of transactions and is doing its accounting work as per the law. They must also verify that the AMC is not undertaking any fraudulent activity when reporting its accounts. Auditors must take samples of transactions in a year to check whether the purchase and sale are done at the correct NAV and must cross-verify the same with the RTA.

Broker

Brokers act as a liaison between investors and AMCs. They are institutions registered with SEBI and hold a license to operate trading accounts through which investors can invest in the markets. Brokers keep track of the market and make reports to update investors about the best funds in the market.

Dealers

Dealers help AMCs to successfully place a deal of purchase and sale in the capital markets. They are also responsible for fulfilling the formalities of purchase and sale through brokers.

Intermediaries

Intermediaries are entities or individuals that can help investors buy and sell mutual funds. Banks, individual agents, distribution companies, post offices, or online platforms, anyone can be an intermediary. They are the important link between the investors and the fund house as they are the ones that help in mobilising the funds from investors to fund houses. Intermediaries also recommend to investors which funds to invest in, facilitate the transactions, and, in turn, take a small fee from the fund house for their service.

Example of the structure of the mutual fund

Sponsor – State Bank of India (SBI)

Trust – SBI Mutual Fund Trustee Company Private Limited

AMC – SBI Funds Management Limited

Custodian – HDFC Bank Ltd., SBI-SG Global Securities Pvt Ltd., Orbis Financial Corporation Limited

Fund Accountant – SBI-SG Global Securities Pvt Ltd.

RTA – Computer Age Management Services (CAMS) Limited

Auditor – M/s Chokshi & Chokshi LLP

Conclusion

All participants in the structure of mutual funds play an important role, and it is difficult to manage a fund even without one participant. Each of them has roles and responsibilities that are interlinked to each other. Mutual funds regulations define each of their duties clearly and ensure they perform their functions diligently, keeping investor’s interests in mind.

Frequently Asked Questions

What is the structure of a mutual fund?

A mutual fund has a three-tier structure consisting of a sponsor, trustee, and asset management company (AMC). The sponsor is the promoter of the fund who appoints the trustee and AMC. All of them have to be registered with the SEBI.

Who controls mutual funds in India?

The Securities and Exchange Board of India (SEBI) controls mutual funds in India through the Securities and Exchange Board of India (SEBI) Mutual Funds Regulations, 1996.

Who appoints a fund manager?

The AMC of the fund house is responsible for appointing the fund manager of a fund.

What is the difference between AMC and MF?

An AMC is an Asset Management Company or the fund house. It floats different mutual fund schemes as per investors’ needs and objectives. AMCs also manages the portfolios of investors and offer professional management services. MF is a mutual fund company, which is a type of asset management company. It only manages mutual fund investments. It is responsible for floating a mutual fund, appointing fund managers, overseeing the activities of the entire fund house and reporting them to SEBI on a regular basis.

What is the full form of RTA in mutual funds?

RTA are registrar and transfer agents. They act as an intermediary between the fund managers and investors. They are responsible for processing mutual fund applications, completing customer KYC, managing and providing periodic investment statements, and updating investor’s records. They also address investors’ grievances by acting as a link between the fund house and investors.