Get salary accounts for your team See benefits

Table of Contents

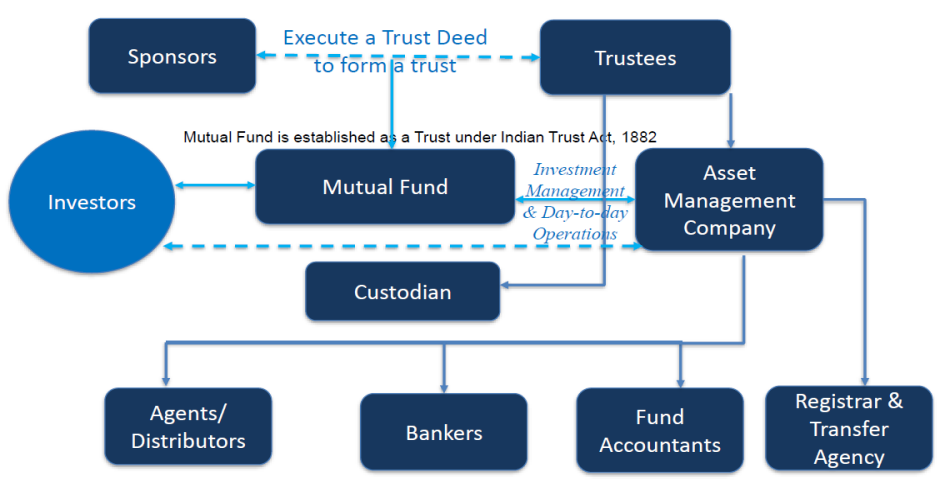

ToggleIn India, mutual funds have a three-tier structure comprising a sponsor, trustee and asset management company (AMC). These three tiers are supported by other participants such as custodian, registrar and transfer agent, fund accountant, broker, dealer, and intermediary. The structure of mutual funds is regulated by the Securities and Exchange Board of India (SEBI) Mutual Funds Regulations, 1996. Hence, all the participants and entities involved in mutual funds are bound to follow the rules set by the SEBI.

As mentioned earlier, the structure of mutual funds has three tiers. Below are the functions of these three tiers of a mutual fund.

Source: https://www.bseindia.com/downloads1/PPT8_IntroductiontoMutualFundsInvesting.pdf

The sponsor forms the first layer in the structure of a mutual fund. A sponsor can be an individual or an entity whose primary objective is to earn money through fund management. The sponsor can execute the fund management through another associate company. Moreover, the sponsor can be a promoter of the associate company.

To become a sponsor of a mutual fund, a person or an entity must approach SEBI and seek its permission to set up a mutual fund. Once SEBI agrees to this, the sponsor must form a public trust under the Indian Trust Act 1882 and must register it with SEBI. Once the trust is registered, the sponsor can appoint a board of trustees (BOT) who will be responsible for adhering to the SEBI Mutual Funds Regulations and protecting the unit holder’s interests. Once the trustees are appointed, the sponsor can create an AMC under the Companies Act 1956.

From the above eligibility criteria, it isn’t wrong to conclude that the sponsor’s role is vital for a mutual fund. Hence, sponsors should have high credibility and enough liquidity and must be faithful to return investors’ money in case of a financial collapse.

The second layer of the mutual fund structure is the trust and trustees. The fund sponsor employs the trustees to protect and safeguard the investors. The trust is created through a trust deed, and the trust is registered under the Companies Act, 1956. The trustees are governed by the India Trust Act 1882. Trustees do not directly manage the securities and mutual funds. Instead, they oversee the entire fund management and ensure that the regulations are being followed by the AMCs.

A mutual fund house has at least four trustees, and the following are their duties.

From the above, it is clear that a trustee must act independently and ensure the investor’s trust and interests are maintained at all times.

The final tier of the mutual fund structure has asset management companies. They float mutual funds with different objectives based on the investor’s needs. The AMC also acts as a fund manager for the trust. AMCs must be registered with SEBI under the Companies Act, 1956. AMCs are appointed by the sponsor and are responsible for managing the portfolio of various mutual funds they float. The appointed AMC can be terminated by the vote of a majority of trustees or 75% of unit holders.

Following are the functions of the AMC

Every mutual fund has other participants that ensure the smooth running of the fund. There are seven participants that are important for a mutual fund, and the following are their roles and functions.

A custodian is an entity registered with SEBI and is responsible for the safekeeping, transfer, and delivery of securities. They also help investors update their holdings and keep track of their investments. Custodians also manage the collection of dividends, interest, bonus issues, and other corporate benefits.

Registrar and Transfer Agents (RTAs) are an intermediary between the fund managers and investors. They are SEBI-registered entities and process mutual fund applications, assist in KYC (know your customer), process investor requests, manage and provide periodic investment statements, and update investor’s records.

A fund account is responsible for calculating the daily NAV of the different mutual fund schemes of the AMC. The AMC can either do this internally or appoint a third party.

An auditor is responsible for checking whether the AMC is keeping all records of transactions and is doing its accounting work as per the law. They must also verify that the AMC is not undertaking any fraudulent activity when reporting its accounts. Auditors must take samples of transactions in a year to check whether the purchase and sale are done at the correct NAV and must cross-verify the same with the RTA.

Brokers act as a liaison between investors and AMCs. They are institutions registered with SEBI and hold a license to operate trading accounts through which investors can invest in the markets. Brokers keep track of the market and make reports to update investors about the best funds in the market.

Dealers help AMCs to successfully place a deal of purchase and sale in the capital markets. They are also responsible for fulfilling the formalities of purchase and sale through brokers.

Intermediaries are entities or individuals that can help investors buy and sell mutual funds. Banks, individual agents, distribution companies, post offices, or online platforms, anyone can be an intermediary. They are the important link between the investors and the fund house as they are the ones that help in mobilising the funds from investors to fund houses. Intermediaries also recommend to investors which funds to invest in, facilitate the transactions, and, in turn, take a small fee from the fund house for their service.

Sponsor – State Bank of India (SBI)

Trust – SBI Mutual Fund Trustee Company Private Limited

AMC – SBI Funds Management Limited

Custodian – HDFC Bank Ltd., SBI-SG Global Securities Pvt Ltd., Orbis Financial Corporation Limited

Fund Accountant – SBI-SG Global Securities Pvt Ltd.

RTA – Computer Age Management Services (CAMS) Limited

Auditor – M/s Chokshi & Chokshi LLP

All participants in the structure of mutual funds play an important role, and it is difficult to manage a fund even without one participant. Each of them has roles and responsibilities that are interlinked to each other. Mutual funds regulations define each of their duties clearly and ensure they perform their functions diligently, keeping investor’s interests in mind.

A mutual fund has a three-tier structure consisting of a sponsor, trustee, and asset management company (AMC). The sponsor is the promoter of the fund who appoints the trustee and AMC. All of them have to be registered with the SEBI.

The Securities and Exchange Board of India (SEBI) controls mutual funds in India through the Securities and Exchange Board of India (SEBI) Mutual Funds Regulations, 1996.

The AMC of the fund house is responsible for appointing the fund manager of a fund.

An AMC is an Asset Management Company or the fund house. It floats different mutual fund schemes as per investors’ needs and objectives. AMCs also manages the portfolios of investors and offer professional management services. MF is a mutual fund company, which is a type of asset management company. It only manages mutual fund investments. It is responsible for floating a mutual fund, appointing fund managers, overseeing the activities of the entire fund house and reporting them to SEBI on a regular basis.

RTA are registrar and transfer agents. They act as an intermediary between the fund managers and investors. They are responsible for processing mutual fund applications, completing customer KYC, managing and providing periodic investment statements, and updating investor’s records. They also address investors’ grievances by acting as a link between the fund house and investors.

Priyanka Rao is a content strategist for Jupiter.Money, and specializes in writing on topics related to finance, banking, budgeting, salary & wages, and other financial matters. She has a passion for creating engaging content that resonates with audiences across various digital platforms. In her free time, Priyanka enjoys traveling and reading, which allows her to gain new perspectives and inspiration for her work. With a keen eye for detail and a creative mindset, Priyanka is committed to creating content that connects well with her readers, enhancing their digital experiences.

Vivek Agarwal is a dynamic leader with deep expertise in investment platforms and wealth management. At Jupiter Money, he spearheaded the Investments vertical, building in-house solutions for direct mutual funds, digital gold, and fixed deposits, scaling the platform to over 200,000 customers. He was an early adopter of SEBI’s Execution-Only Platform (Category 1) and managed key operational, compliance, and customer service functions.

Previously, Vivek co-founded Upwardly, a robo-advisory wealth management platform offering tailored investment and insurance solutions. As Chief Investment Officer, he pioneered dynamic asset allocation, goal-based investments, and motif-based portfolios. After Upwardly's merger with Scripbox, he led the integration of independent financial advisors into Scripbox, transitioning assets under management and customer relationships seamlessly.

His strategic leadership extended to setting up corporate treasury services for startups and MSMEs, and establishing verticals in insurance and bond sales, including Sovereign Gold Bonds. Vivek’s diverse experience and strategic vision continue to shape the financial services landscape in India.

Powerd by Issued by