Although it is no longer mandatory to link your Aadhaar number with a bank account, it is advisable to do it. You may link the two either online or offline.

Online linking can be done via internet banking or the bank’s mobile application. However, you will need to complete the registration process with your bank prior to linking the Aadhaar card and bank account.

Before discussing the different ways in which such linking can be done, here are some reasons to do it.

Why You Need to Link Aadhaar Card With Bank Account?

- Several central and state government benefits are available only when the two are linked.

- Services, such as liquefied petroleum gas (LPG) subsidy are available when Aadhaar and bank accounts are linked.

- When Aadhaar is linked to a bank account, it enables seamless refunds after you file the income tax returns (ITRs).

- It reduces the possibility of fraudulent activities and protects your sensitive financial information.

Check Aadhaar Card Linked to Bank Account

Before we move ahead to link an Aadhaar Card to your bank account, we can do a quick check whether your bank account is linked to Aadhaar card or not.

Step 1: Go to the website of UIDAI, click ‘My Aadhaar’, and then click ‘Bank Seeding Status‘ under ‘Aadhaar services’.

Alternatively, you can also go through another link – https://resident.uidai.gov.in/bank-mapper

Step 2: You will be redirected to a login interface, there, you enter your Aadhaar details, fill up the captcha and then click on ‘Send OTP’. An OTP will be sent to your registered phone number.

Step 3: Login with the OTP received.

Step 4: Check the ‘Bank Seeding Status’, and you will be able to view your bank accounts linked Aadhaar card.

Step by Step Guide to Link Aadhaar Card to Bank Account

Below is the step by step process to link Aadhaar card to bank using different methods:

How to Link Aadhaar Card to Bank Account via Internet Banking?

The steps to link an Aadhaar card to a bank account via Internet banking are as follows:

- Visit the official website of the bank where you hold the account.

- Login to your account with your username and password.

- Select ‘Link Aadhaar Card’, ‘Aadhaar Card Seeding’, or ‘Update Aadhaar Card Details’ (these options may vary from one bank to another).

- Input the necessary details and ensure the Aadhaar number is accurate.

- You will receive a confirmation when the bank receives your request and thereafter your information is internally validated and verified by the bank.

- In case of any errors, you will get a notification on your registered email address and mobile number.

- If there are no errors, the linking will be successfully done, and you will receive a message and/or email confirmation.

Linking Bank Account with Aadhaar Through the Bank’s Mobile App

Most people use mobile applications as banks provide attractive features and services via their apps. Here is how you can use this facility to link Aadhaar to a bank account.

- Download your bank’s mobile app and log in to your account.

- Click on ‘Requests’, ‘Services’, or ‘Service Requests’ as seen in the bank’s application.

- Navigate to ‘Link Aadhaar’, ‘Update Aadhaar’, or other such options available on the app.

- Enter the bank account number you want to link and the required details along with the right Aadhaar number.

- Accept the Terms and Conditions and click on ‘Submit’ or ‘Confirm’.

How to Link Aadhaar with Bank Account Through Phone Banking?

If you are not tech-savvy and do not use Internet banking or the mobile application, you may complete the Aadhaar link to the bank account via phone banking. Here is how it can be done.

- To begin with, check with your bank if this facility is available.

- You may then give a missed call to the provided number.

- Once you receive a callback, enter your Aadhaar number.

- Finally, you will receive a message confirming the successful linking of your Aadhaar and bank account.

Link Bank Account With Aadhaar Through SMS

Some banks also allow you to process the ‘Aadhaar card link to bank account’ request by sending a short message service (SMS) to a given phone number. Here are the steps to proceed with this.

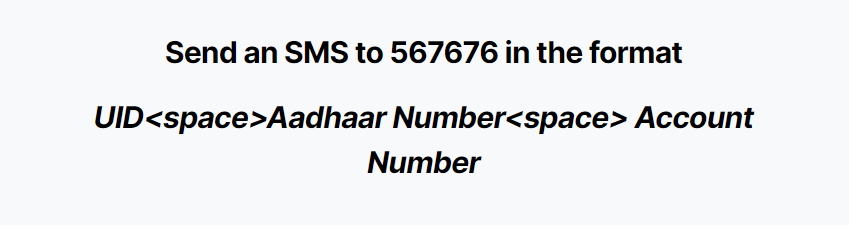

- Send an SMS in a specified format to the number given by your bank.

- You should receive an acknowledgment confirming the receipt of your request.

- After you provide the necessary details and these are successfully verified, the bank will send a confirmation message regarding the linking of your Aadhaar number and bank account.

For example, check the format for SBI bank account (Do remember that sending this message may incur SMS cost to you-

Link Aadhaar Card with Bank account at an ATM

Automated teller machines (ATMs) also provide the Aadhaar with bank account linking facility if you have an active debit card of the bank account. The steps to link these are as follows:

- Swipe your debit card at the ATM and enter the four-digit personal identification number (PIN).

- Choose ‘Services’ from the available options.

- Next, select ‘Aadhaar Registration’, ‘Aadhaar Linking’, or any other similar option provided by the ATM.

- Choose your account type, enter your 12-digit Aadhaar number, and click on the ‘Submit’ button.

- Once the bank verifies your details, you will receive a confirmation message for the successful linking of your Aadhaar and bank account.

Linking Bank Account With Aadhaar by Visiting Branch

If you do not have Internet banking to link Aadhaar number with a bank account online, you can do it by visiting the branch. Here is how:

- Fill out the form to link the Aadhaar and bank account.

- Enter all the required information accurately and submit the form along with a self-attested Aadhaar card copy.

- The bank will verify your details and then send a confirmation message.

Check Aadhaar Card Linking Status With Bank Online

Technological advancement has made it easy to check if your Aadhaar card is linked to the bank account successfully. It is a simple process and can be completed by following the below-mentioned steps:

- Visit the official website of the Unique Identification Authority of India (UIDAI).

- Click on the ‘Check Aadhaar and Bank Account Linking Status’ tab.

- On the mapper page, enter the Unique Identity (UID) or Virtual Identity (VID) and security code before clicking the ‘Send OTP’ (one-time password) option.

- Enter the OTP received on your registered mobile number and then click on ‘Login’.

- You will see the bank account linked to your Aadhaar card.

- If you have multiple accounts with the same bank, you need to visit the branch to check the Aadhaar card link to bank account status.

Check Aadhaar Card Linking status With Bank Offline

You can also check the Aadhaar and bank account linking status by using the Unstructured Supplementary Service Data (USSD) code if your mobile number is registered with the UIDAI. Here is how to do this:

- Dial 9999*1# from the registered mobile number.

- Enter your 12-digit Aadhaar number.

- Re-enter the Aadhaar number and click on ‘Send’.

If the linking has been successfully completed, you will see the status. If you cannot see the status, there is a possibility that the procedure is not completed.

Frequently Asked Questions (FAQs)

Is it compulsory to link your Aadhaar number to your bank account?

No, according to the Supreme Court orders, linking the Aadhaar number with the bank account is no longer mandatory.

How many bank accounts can you link to your Aadhaar number?

Yes, you can link as many bank accounts as you want with your Aadhaar number.

Can you link Aadhaar card with a bank account online?

Yes, you can link your Aadhaar number and bank account either via Internet banking or the bank’s mobile application.

What happens if you do not link your Aadhaar number and bank account?

While it is not compulsory to link the Aadhaar number and bank account, not doing it can result in the loss of government benefits and services like LPG subsidies and pension benefits.

Is it compulsory to link Aadhaar and bank account to avail of a personal loan or credit card?

No, it is not compulsory to link your Aadhaar card with your bank account to apply for a personal loan or a credit card.

How can you check if your Aadhaar is linked or not?

You can check the status linking your Aadhaar number with your bank account on the official website of UIDAI, which is www.uidai.gov.in.