A loan is an amount borrowed from the lenders with an agreement to repay it within a pre-determined tenure. The lenders charge a certain rate of interest on the borrowed amount.

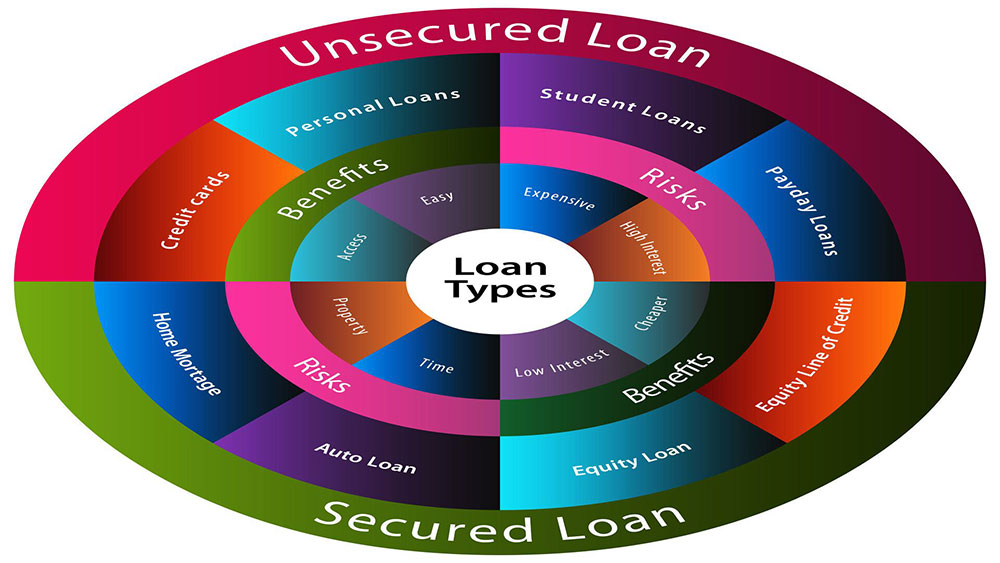

Generally, the principal and the interest amount are paid in equated monthly installments (EMIs). Banks and non-banking financial companies (NBFCs) offer different types of loans. The two most common types are secured loans and unsecured loans.

What are secured loans?

These loans are secured against an asset. The lender holds the title or deed of the security until you repay the entire borrowed amount. You may use an asset like a property or vehicle to secure the loan.

Alternatively, other assets like shares, fixed deposits (FDs), gold, arts, jewelry, investments, and much more can be used as collateral while availing of secured loans.

Since the lender creates a lien on the pledged asset, they can repossess it if you default on the repayment. This allows them to sell the asset to recover the overdue amount.

What are the different types of secured loans?

Financial institutions offer several types of secured loans such as the following.

Home loans

These allow you to buy or construct a home. The lender sanctions up to 80% of the total value based on your income, current liabilities, age, and other factors.

You may also opt for a top-up loan or home improvement finance to renovate or extend your existing home.

Loan against property (LAP)

You can pledge commercial, industrial, or residential property to avail of the funds. Lenders sanction between 60% and 80% of the property value, which may vary from one institution to another.

There are no restrictions on how you can use this money, which means you may utilize it for meeting wedding expenses or taking a dream vacation.

You may also use these funds for expanding your venture and for other business purposes.

Loan against securities

This type of loan allows you to capitalize your investments and pledge these to meet personal or business fund requirements.

Different types of investments, such as shares, mutual funds, FDs, and bonds can be pledged to borrow money.

Depending on the type of investment and other factors, lenders may sanction between 60% and 90% of its value.

Gold loans

For decades, people have invested in gold and the organized gold loan market has been expanding over the last few years.

You may pledge your gold jewelry, coins, or biscuits as the loan collateral. Lenders will sanction a certain percent of the value as a loan.

Compared to other types of finance, these are available for shorter durations and are recommended to meet short-term fund requirements.

What are the advantages of secured Loans?

Lower rate of interest

Collateralized loans offer a lower rate of interest than unsecured ones as the risk for the lender is reduced. A lower rate can significantly reduce your total cash outflow towards interest payment over the loan duration.

Higher loan amount

Depending on the type of asset offered as collateral, you may borrow up to 90% of the value as a loan. This helps you meet your fund requirements without any hassles.

Flexibility

Lenders offer flexibility in choosing the loan tenure as per your needs. You may opt for a shorter tenure with larger EMIs or a longer duration with smaller installments.

Additionally, you get convenience with features like partial prepayments, loan tenure extensions, and much more.

What are the disadvantages of secured loans?

Risk of loss of collateral

The lenders create a lien on the mortgaged asset. They can repossess it if you fail to make repayments on time. Therefore, there is a risk of losing your asset.

Impact on credit score

Any delay or default on the loan is reported by the lenders to the credit rating agencies.

This may negatively impact your credit score, which may make it difficult for you to qualify for another loan in the future.

Cumbersome process

Most lenders have complex documentation requirements, which make the procedure time-consuming and cumbersome.

Additionally, you need to sign several documents and even one mismatch may further delay the procedure.

Features of secured loans

- Loans are offered against the title of an asset

- Affordable rate of interest

- Flexible repayment options

- Customizable as per your requirements

- Quick loan approval

- No need for a guarantor

Documents required for secured loans

At the time of applying for collateralized loans, you will need to submit several documents, which may vary depending on the type of asset offered as security. Generally, the following documents are required by lenders.

- Identity proof

- Age proof

- Income proof

- Address proof

- Permanent Account Number (PAN) card

- Ownership proof

- Photographs

Eligibility criteria for secured loans

- Indian residents who are 18 years and older

- The minimum annual income requirement is INR 3 lakhs, which can vary from one lender to another

- The value of the collateral should be adequate to the loan amount

- For business loans, the venture must be operational and profit-making for the three previous years

What are unsecured loans?

Having understood what a secured loan is, let us now understand the meaning of unsecured or uncollateralized loans. These are the opposite of asset-backed loans and are provided without any collateral.

Lenders assume a higher risk with uncollateralized loans as they do not have the recourse of repossessing your asset to recover the overdue amount in case of default.

Therefore, the rate of interest on such loans is higher when compared to that on collateralized loans.

Generally, lenders sanction unsecured credit based on your repayment capabilities. They consider your current income and outstanding liabilities to determine your repayment capacity.

Additionally, they may review your savings, credit score, and investments to approve the loan.

What are the different types of unsecured loans?

As financial institutions do not hold any security, you will have to meet stringent eligibility norms to avail of such loans.

Factors like credit score, past relationship with the lenders, and good repayment history improve the chances of approval.

Here are some of the common types of unsecured loans.

Business loans

These are offered only to companies without any collateral. The borrowed funds can be used for any business purpose, such as working capital requirements, expansion, or other expenses.

Businesses may avail of a line of credit, which allows them to drawdown the funds as required.

Moreover, the interest is paid only on the amount that is utilized and not on the entire sanctioned limit. Unsecured business loans can help startups to meet their fund requirements.

Personal loans

This is one of the most common types of loans used by borrowers. Although the interest rate is significantly higher when compared to collateralized loans, if you have a good credit score, you may be eligible for a more affordable rate of interest.

The money borrowed as an unsecured personal loan can be used without any limitation.

Therefore, it is beneficial to pay for children’s education, medical treatments, home renovation expenses, or other emergency requirements.

Based on the purpose, personal loans can also be classified as follows:

- Wedding loans can be used to meet marriage expenses

- Education loan covers study-related costs like tuition fees, accommodation, and miscellaneous costs

- A debt consolidation loan can be used to consolidate multiple loans into a single credit facility; it combines various EMIs into one EMI with a more competitive rate of interest, thus reducing the repayment burden

Other unsecured loans

- Signature loans are given based on only your signature wherein you promise to repay the money on time. This type of finance is available from banks and NBFCs and needs to be repaid in monthly installments.

- Instant loans are available for salaried individuals. These are short-term loans given at significantly higher rates of interest and must be repaid when you get your next salary.

Documents required for unsecured loans

Salaried applicants must submit the following documents.

- Duly completed application form

- Salary slips for three or six months

- Identity and address proof

- Passport-sized photographs

If you are self-employed, you need to submit the following additional documents:

- Continuity of business proof

- Processing fees check

- Office address proof

Features of unsecured loans

- Easy application process with quick approval

- No requirement of collateral

- Minimal documentation required

- A larger loan amount may be offered to high-income borrowers

- Higher interest rates compared to collateralized loans

Eligibility criteria for unsecured loans

- Income stability with a regular employment record

- You should have been in the job for at least two years or must have five years of income if you are self-employed

- Salaried applicants should be aged between 21 and 60 years, self-employed professionals should be between 25 and 65 years old

- Financial statements are required to determine eligibility

- Loan amount, tenure, and rate of interest are determined based on your credit score

- Repayment capability is estimated after considering your income and existing liabilities

Secured vs Unsecured Loans

| Feature | Secured Loan | Unsecured Loan |

| Definition | A loan that is backed by collateral (e.g., property, vehicle, etc.). | A loan that is not backed by any collateral. |

| Collateral Requirement | Required (e.g., home, car, savings, etc.) | Not required |

| Interest Rates | Generally lower, as the risk to the lender is reduced | Generally higher, due to higher risk to the lender |

| Loan Amount | Higher amounts possible, depending on the value of the collateral | Typically lower amounts, based on the borrower’s creditworthiness |

| Repayment Period | Longer repayment periods available | Shorter repayment periods typically |

| Approval Time | Longer approval process, due to asset evaluation | Faster approval, as no collateral evaluation is needed |

| Risk to Borrower | Risk of losing collateral if the loan is not repaid | No risk of losing assets, but could lead to legal action and credit score damage |

| Credit Score Impact | Credit score matters, but collateral reduces its importance | Strongly reliant on credit score and history |

| Common Examples | Home loans, auto loans, mortgage loans | Personal loans, credit card loans, student loans |

| Use Cases | Large purchases, home buying, financing a car | General purposes, smaller purchases, consolidating debt |

| Eligibility Criteria | Generally stricter, based on collateral value | More flexible, primarily based on credit score |

Before you apply, you should understand the difference between secured and unsecured loans. The former is available against some collateral, which reduces the risk for the lenders.

It entails a lower rate of interest. In comparison, the latter is available without any collateral, which makes it riskier for the lenders. Moreover, it comes at a higher rate of interest.

While choosing between a secured loan and an unsecured loan, it is important to ensure you can repay the money on time to avoid any severe repercussions.

It is also advisable to borrow only what you can afford to repay without facing any liquidity crises.