Credit cards have become a popular way to pay for things. They offer benefits like easy credit, discounts, rewards, and can help build a good credit history. However, like anything else, they have both advantages and disadvantages.

Credit cards have become increasingly popular in India. As of December 2024, there were over 10.1 Crore active credit cards. This is a large number, even compared to other countries. Innovations, better technology, easier ways to get a credit card, personalised offers, and improved mobile apps have all played a role in this growth. With positivity in growth, there comes some negative experiences too. Banks reported an increase in cases of credit card and internet frauds jumping from 6,699 cases worth Rs. 277 crore to 29,082 cases worth Rs. 1,457 crore.

As more people use credit cards, it’s important to understand how to use them wisely. The following sections will discuss the advantages and disadvantages of credit cards in more detail.

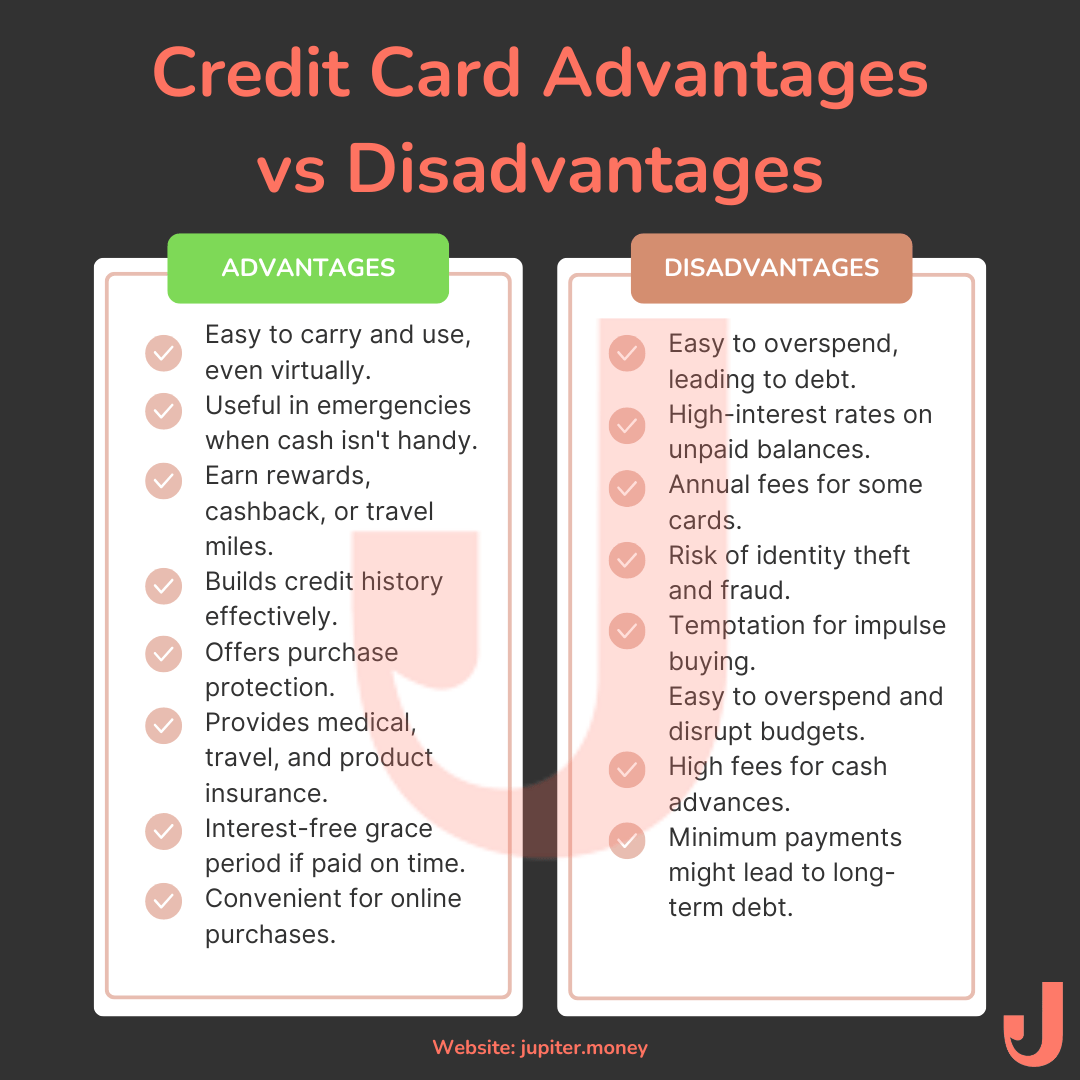

Credit Card Advantages and Disadvantages

| Advantages | Disadvantages |

| Convenience – Easy to carry and use. Some credit cards are available virtually. | Debt accumulation – Easy to overspend on purchases |

| Emergency funds – Useful in emergencies where liquid cash isn’t handy. | Interest rates – High interest rates are levied if balances aren’t paid back. |

| Rewards – Earn reward points, cashback, or travel miles. | Annual fees – Some cards charge yearly fees. |

| Builds credit history – Helps establish credit. | Fraud risk – Vulnerable to identity theft and fraud. |

| Purchase protection – Offers buyer protections for transactions | Impulse purchase – Temptation to impulse buy products |

| Insurance benefits – Certain credit cards offer medical, travel, and purchase insurance over products and services | Overspending – Easy to lose track of expenses and spoil the budget |

| Grace period: Interest-free period if paid in full before the due date | Cash advance fees – Very high fees for cash withdrawals |

| Accepted worldwide: Widely accepted for transactions by merchants across the globe | Impact on credit score if misused or if you miss out on repayments |

| Online shopping – Convenient for online purchases | Minimum payments – Can lead to long-term debt. |

| You can build rewards and perks over time | Dependency – Reliance on credit can lead to financial stress |

What Are the Disadvantages of Credit Cards?

There are always two sides to a coin. Although credit cards are an excellent financial tool, overusing them can be very harmful. Consider the real-life example of Scams like these: Increasing Credit Card limit scam and Credit Card Activation Scam which wreaked havoc in people’s lives. Credit Cards can even put you in a never-ending debt spiral and harm your finances if you aren’t careful when using them. Below are some of the reasons why you should be careful when using or applying for a credit card.

-

High-interest charges

If you fail to pay your credit card bill before the due date, the amount is carried forward, and interest is charged to it. Credit card interest rates can be as high as 3% per month, which aggregate to 36% per annum. If there is any unpaid amount, the interest aggregates and can become a burden on you.

-

Credit Card Fees

Even though credit card looks like a simple instrument, they have a lot of hidden costs which often go unnoticed by you. Some of the common costs are joining fees, renewal fees, and processing fees. If you end up paying your bill late, the banks charge a penalty and late payment fees on top of the interest on the bill amount. Sometimes, if you repeatedly pay your credit card bills late, banks can reduce your credit limit, which will affect your credit score.

-

Cash Advance Fees

When you withdraw cash using a credit card, you will be charged with high cash advance fees and interest rates, starting from the date of withdrawal. This makes it an expensive option compared to other cash alternatives.

Example: If you withdraw ₹10,000 using your credit card, you may incur a 3% fee (₹300) plus daily interest of 2-3%, significantly increasing the repayment amount over time.

-

Risk of Dependency

Credit cards can lead to a spending dependency, as they offer easy access to credit. This may encourage overspending, pushing users into a debt cycle that becomes hard to break.

Example: A user relying on a credit card for routine expenses may accumulate a ₹50,000 debt. Paying only the minimum amount each month results in long-term interest charges, inflating the total cost significantly. Slowly this debt will keep increasing and the charges associated with it will keep inflating as well.

-

It Can Harm Your Credit Score

Once you delay your credit card payments, you will end up in a never-ending spiral of debt. You will be charged an interest (which is, by the way, exorbitantly high) on the due amount, and on top of this, you will be charged late fees and penalties. Although you end up repaying after a few months, the damage is already caused as this becomes a remark on your credit history, and your credit score falls. A bad credit score can result in high-interest loans and lower credit limits.

-

Minimum Due Trap

Credit card companies and banks confuse people by telling them that they need to pay only the minimum due amount to continue using their cards. Most users believe the minimum due is their monthly bill and don’t realise the debt trap they are falling into. Banks surely allow you to use the card if you pay the minimum amount, but they charge interest on the rest, which aggregates to become a huge amount in a few months. Moreover, users might also think their bill is very low and end up overusing the card.

-

Repeated Calls from the Recovery Team

Banks do send constant reminders to credit card users to pay the bill amount. If you fail to do so, they charge interest and a penalty. However, after three months, they call you continuously to recover the dues. Repeated calls can be very annoying and can also increase your stress levels as you are constantly reminded of your debt.

-

Credit Card Fraud

Credit card frauds are quite common. They have been in existence right from the time credit cards were introduced in the market. Although banks have been taking steps to improve fraud prevention systems, hackers and fraudsters have found new ways to steal money. The cardholder is always under stress and tension every time he shops online or swipes in a store.

-

Easy to Overuse

The biggest harm credit cards can do is break your financial discipline. With every swipe, when you don’t see the bank balance going down, you tend to spend money recklessly, sometimes more than what you can afford. Credit cards have a tendency to tempt you with rewards and offers. Hence you end up using the card for all kinds of expenses, making you lose track of your spending. This will land you in a never-ending spiral of debt, and you might not be able to save money for the future.

What Are the Advantages of Credit Cards?

Credit cards are a very useful financial tool. Despite what all the personal finance experts say, credit cards are very beneficial and help manage your finances better, provided you use them responsibly. Read about this report where users who didn’t consider improving credit score and losing out more money on the table than they could have saved for spending on a credit product- CIBIL or credit score drop can cost you more on Home Loan. Following are some of the benefits why credit cards are considered good.

-

Credit Card Offers and Incentives

Credit cards are packed with incentives such as discounts, cashback, and offers. Every time you use a credit card, you accumulate reward points which translate into air miles, cashback, vouchers, and offers. You can use these incentives wisely to cover your expenses, flight tickets, and entertainment.

-

Build Credit Score

As a taxpayer, it is important that you have a credit score. In case you don’t have a credit score, one way to build it is through a credit card. Using credit cards effectively will help you build and improve your credit score. Having a good credit score will help you get loans easily with higher credit limits at low interest rates. Moreover, you will have higher bargaining and negotiating power than the ones with a low credit score. So this means if you want to purchase a car or home, you will be able to do it faster as your loan application would be approved easily. Moreover, you can also bargain to get a better price for the asset you are purchasing.

-

Track Expenses

Credit cards are a great way to track your expenses. They record all the transactions you do with them. At the end of the month, it sends you a statement through which you can make a budget or use it for tax purposes. Moreover, every time you spend using a credit card, you will be sent an alert regarding the amount spent and the limit left for you to spend.

-

Easy Access to Credit

This is possibly the biggest advantage of a credit card. It gives you easy access to credit as a credit card works on deferred payments. So, this means you can buy now and pay later. This comes in very handy in case of an emergency or unexpected expense. Moreover, your credit card lets you convert your unpaid bills into EMIs (equated monthly instalments) through which you can make big purchases such as television, refrigerator, and mobile phone and not create a dent in your savings.

-

Interest-free Credit

Credit cards come with an interest-free period during which the banks do not charge any interest on the credit limit you used. This period typically lasts for 45-60 days. If you pay the balance in full during this grace period, you need not pay interest on the money you used.

-

Easy Loan Approvals

You can also apply for personal loans through a credit card. Once you apply for a loan, the money will be credited to your bank account in no time. Having a good credit score and credit history will also help you in securing such loans immediately.

-

Purchase Protection

Credit cards often provide purchase protection to safeguard users against theft, damage, or loss of items bought using the card within a specified period. This benefit ensures users don’t bear the financial burden if something goes wrong with their purchase.

Example: If you buy a smartphone worth ₹50,000 using your credit card and it gets accidentally damaged within 90 days, purchase protection covers the repair or replacement cost, as per the card issuer’s terms.

-

Insurance Benefits

Many credit cards offer built-in insurance coverage, including travel insurance, accident insurance, and fraud protection. These features add a layer of financial security in case of unforeseen events.

Example: A traveler holding a premium credit card may receive free travel insurance, covering flight delays, baggage loss, or even medical emergencies during the trip. For instance, a delay of 6 hours on an international flight may entitle the cardholder to a compensation of ₹10,000.

Who Should Get a Credit Card?

- Stable income individuals: People who have a stable source of income are better suited for credit cards. This ensures they can make timely payments and manage their balances effectively.

- Building Credit: For individuals with little to no credit history, responsibly using a credit card can be a valuable tool to establish and build credit. This is quite a significant approach to build credit score for buying a car or home on a loan. There’s been a report too where users are looking to be aware of credit scores and improve their credit score’51 percent year-on-year increase in consumers monitoring their credit profiles in 2023-24.

- Capability to pay balances in full: People who have the discipline to pay off their credit card balances in full each month can benefit from rewards programs without accruing interest charges.

- Emergency preparedness: Having a credit card can serve as a financial safety net during emergencies when immediate funds are needed.

- Travelers: Certain credit cards offer travel rewards, such as airline miles or hotel points, making them advantageous for frequent travelers.

- Budget-conscious people: Credit cards can help individuals track expenses and make managing finances more efficient, especially when using features like spending alerts and budgeting tools.

- Online Shoppers: Credit cards offer security and protection for online purchases, making them a preferred option for those who frequently shop online.

Who Shouldn’t Get a Credit Card?

- People with unstable income: Those who don’t have a stable income source may struggle to make timely payments, which may lead to debt accumulation and financial stress.

- Impulsive spenders: People who are prone to impulse buying may find it difficult to control their spending with a credit card, leading to debt issues.

- Overspending: Individuals who tend to spend beyond their means and limits should avoid credit cards as they may easily accumulate debt and put them in credit risk list by the lenders.

- People who are already in debt: If someone is already struggling with debt and repayments, adding a credit card can exacerbate the problem and lead to a vicious cycle of debt.

- People who are clumsy with managing payments: Those who struggle with managing bills and payments may find it challenging to keep up with credit card payments, leading to late fees and negative impacts on credit scores.

- Young ones without financial literacy: Young adults who lack financial literacy and may not fully understand the responsibilities and consequences of using credit cards. They should wait until they are better informed before obtaining a credit card.

- People susceptible to fraud: Individuals who are not diligent about protecting their personal information and are susceptible to frauds should be cautious with credit cards as they can be a target for identity theft and unauthorized transactions.

Credit cards aren’t bad for your financial health. In fact, a credit card can be a useful tool to reduce your expenses by taking advantage of the rewards. However, you must be careful while choosing a credit card. Check the processing fees, rewards and offers, and terms and conditions before applying for a credit card. Once you get a credit card, use it wisely to avoid unnecessary fees and interest payments. Hope these advantages and disadvantages of Credit Cards will help you decide your next credit card.

Frequently Asked Questions