Get salary accounts for your team See benefits

Table of Contents

ToggleThe Income Tax Department issues a Permanent Account Number (PAN) to all taxpayers. It is a unique identification

number that helps simplify the taxation system in the country by providing adequate transparency and information

in all financial transactions.

You may apply for a PAN card either with the National Securities Depository Limited (NSDL) or UTI Infrastructure

Technology And Services Limited (UTIITSL). Both these bodies process your PAN application within the same time.

It generally takes about 15 days to process your PAN card application. This period may increase if any

rectifications due to discrepancies are required. According to the Tax Information Network (TIN), the processing

time may increase to up to 25 days if your application needs any corrections.

When you submit your PAN card application, you will receive a 15-digit acknowledgement number. Using this, you

may track the PAN card application status three days after submitting your request. Moreover, you can find out

information about the dispatch date and expected delivery date with the acknowledgement number.

If your mobile number is registered with your Aadhaar card, you may follow these steps to track your PAN card

application.

You must complete the PAN card linking with the Aadhaar card procedure as soon as you get your PAN details.

As discussed above, when you apply for a PAN card, you receive a 15-digit acknowledgement number, which can be

used to track your application status.

It is also useful for downloading the ePAN card within a month of issuing a new or updated PAN card from the NSDL

or UTIITSL websites. Here are the steps to check the PAN card status.

More details on official website can be found here – https://www.pan.utiitsl.com/

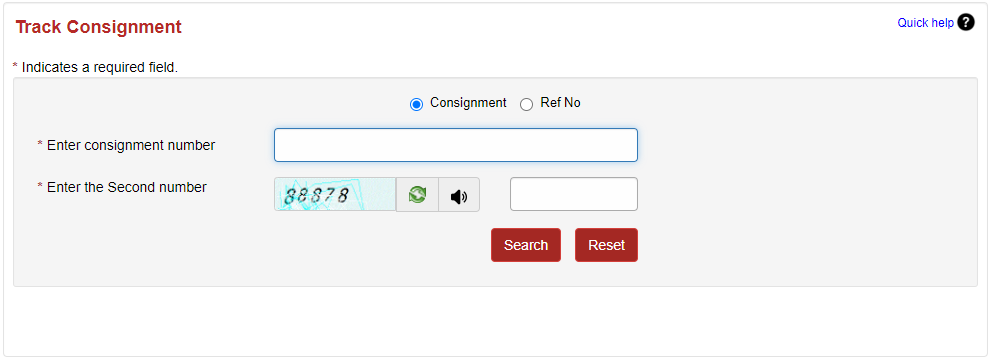

You may also track the PAN card status using the airway bill number i.e., the consignment number by following the

below-mentioned steps:

You can track your consignment through SMS. Type ‘POST Track <13 digit article number>’ and send it to 166 or 51969 to track the status.

If your PAN card is already dispatched, you will get the acknowledgement number, applicant name, dispatch

date, category, and expected delivery date

You may check the PAN card status by name and date of birth via these steps:

The PAN card status check using your mobile phone can be done either by making a call or sending a short message

service (SMS).

You may call the TIN call centre to check the status of your application request. Contact 020-27218080 from your

phone and follow the Interactive Voice Response (IVR) instructions. You will need the 15-digit acknowledgement

number to track the PAN card application.

Message your 15-digit acknowledgement number to 57575 to track the application status. Type NSDLPAN followed by

the acknowledgement number to receive an SMS showing the status of your PAN card application.

To check the UTI PAN card status, follow these steps:

You can also track the NSDL PAN card status on the official website by following the below-mentioned steps:

Generally, it takes approximately 15 days for the authorities to verify your application and dispatch the PAN

card to your stated communication address.

Yes, you can modify the communication address after your PAN card application by visiting the official NSDL

website and clicking on the ‘Apply for correction/change in PAN’ tab.

You may check the PAN status if you have applied for any modifications to the existing information. Visit the

official NSDL website and click on the ‘Apply for correction/change in PAN’ tab to check the application status

using the acknowledgement number.

To check the application status via SMS, send the message ‘NSDLPAN’ followed by the 15-digit acknowledgement

number to 57575.

To check your PAN application status, call the TIN helpline number on 020-27218080. You will have to provide the

15-digit acknowledgement number to the executive to know your application status.

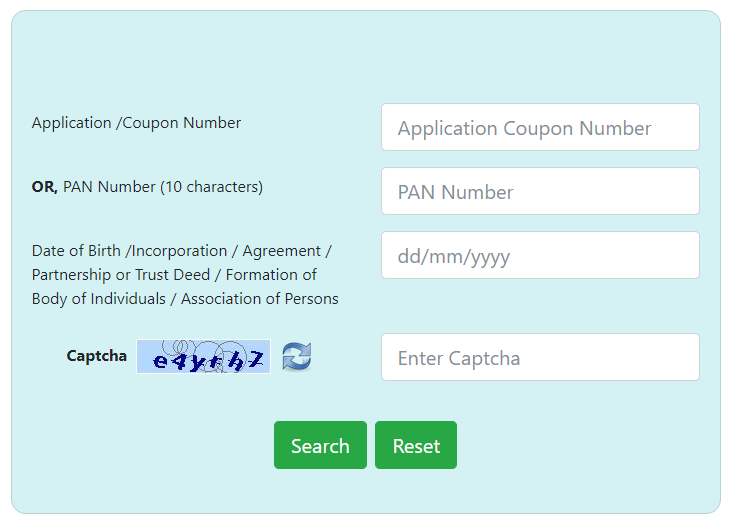

Visit the official UTIITSL website and enter the coupon number, date of birth, and captcha code to track your

application status.

Generally, you can check the application status after seven to 15 days from the date of applying.

If the application status shows a ‘record not found’ message, it implies that the Income Tax Department has not

processed your application and recorded it in their database. You may contact the TIN centre or the PAN card

office to check the status.

You may contact the All India Customer Care Centre on 033-40802999 between 9 a.m. and 8 p.m. on all days.

Alternatively, you may send an e-mail to utiitsl.gsd@utiitsl.com.

You can apply for a PAN card either with NSDL or UTIITSL.

The communication address for application at NSDL is as follows:

Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling, Plot No. 341; Survey No. 997/8,

Model Colony, Near Deep Bungalow Chowk, Pune – 411 016

The communication address for application at UTIITSL is as follows:

PAN PDC Incharge – New Delhi region

UTI Infrastructure Technology and Services Limited

1/28 Sunlight Building, Asaf Ali Road, NEW DELHI -110002

If the status shows ‘My application is being withheld from processing due to incomplete details/documentary

proof’, it means your details do not match the application form or you have not submitted the necessary

documents.

To proceed, you will have to rectify the discrepancies and/or submit the required documents to the Income Tax

Department.

This means that your application has been received and the information and documents are under verification. Your

application is processed once the verification procedure is completed.

You should wait for at least 15 days to receive your PAN card. During this time, you may track the status of your

application via the NSDL website using the 15-digit acknowledgement number.

If there is any further delay, you can contact the relevant authorities or the NSDL customer care executive on

the toll-free number 1800 222 99

Priyanka Rao is a content strategist for Jupiter.Money, and specializes in writing on topics related to finance, banking, budgeting, salary & wages, and other financial matters. She has a passion for creating engaging content that resonates with audiences across various digital platforms. In her free time, Priyanka enjoys traveling and reading, which allows her to gain new perspectives and inspiration for her work. With a keen eye for detail and a creative mindset, Priyanka is committed to creating content that connects well with her readers, enhancing their digital experiences.

Powerd by Issued by