Get salary accounts for your team See benefits

Table of Contents

ToggleThis Tax Credit Statement form is an important document for taxpayers. It reflects the total tax paid to the Income Tax (IT) Department by you and much more. From November 2020, this statement includes details about special financial transactions, tax demands, completed and pending assessment proceedings, and refunds.

The Tax Credit Statement, also known as Form 26AS, is an annual statement that consolidates information about tax deducted at source (TDS), advance tax paid by the assessees with self-assessment tax, and tax collected at source (TCS). All this information is related to your Permanent Account Number (PAN).

Moreover, the form shows details on any sale or purchase of immovable property, cash withdrawals or deposits from savings accounts, and mutual funds.

You may claim the tax deducted as shown in this form at the time of filing your Income Tax Returns (ITRs) for the relevant financial year.

This form is issued under section 203AA of the Income Tax Act, 1961 and Rule 31AB. It is an important document that can be used for the following purposes.

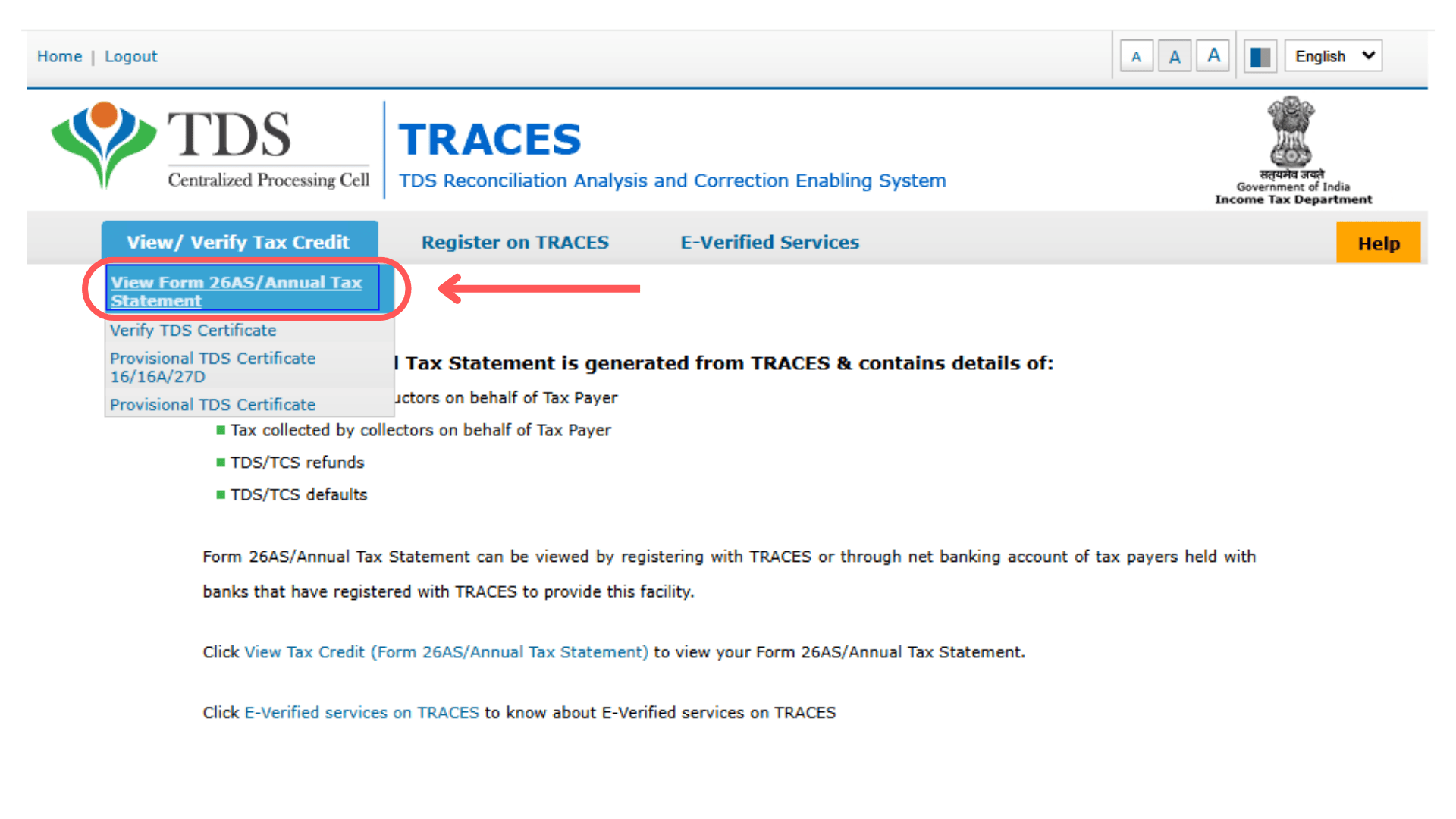

You may view Form 26AS by PAN no. on the TDS Reconciliation Analysis and Correction Enabling System (TRACES) portal.

Alternatively, the form can be viewed via Internet banking from Financial Year 2008–2009. The following banks allow you to view the form via net banking.

|

Axis Bank |

Bank of Baroda |

Bank of India |

|

Bank of Maharashtra |

Citibank |

City Union Bank Limited |

|

Corporation Bank |

ICICI Bank |

IDBI Bank |

|

Indian Bank |

Indian Overseas Bank |

Karnataka Bank |

|

Kotak Mahindra Bank Limited |

Oriental Bank of Commerce |

State Bank of India |

|

State Bank of Mysore |

State Bank of Travancore |

The Federal Bank Limited |

|

The Saraswat Co-operative Bank Limited |

UCO Bank |

Union Bank of India |

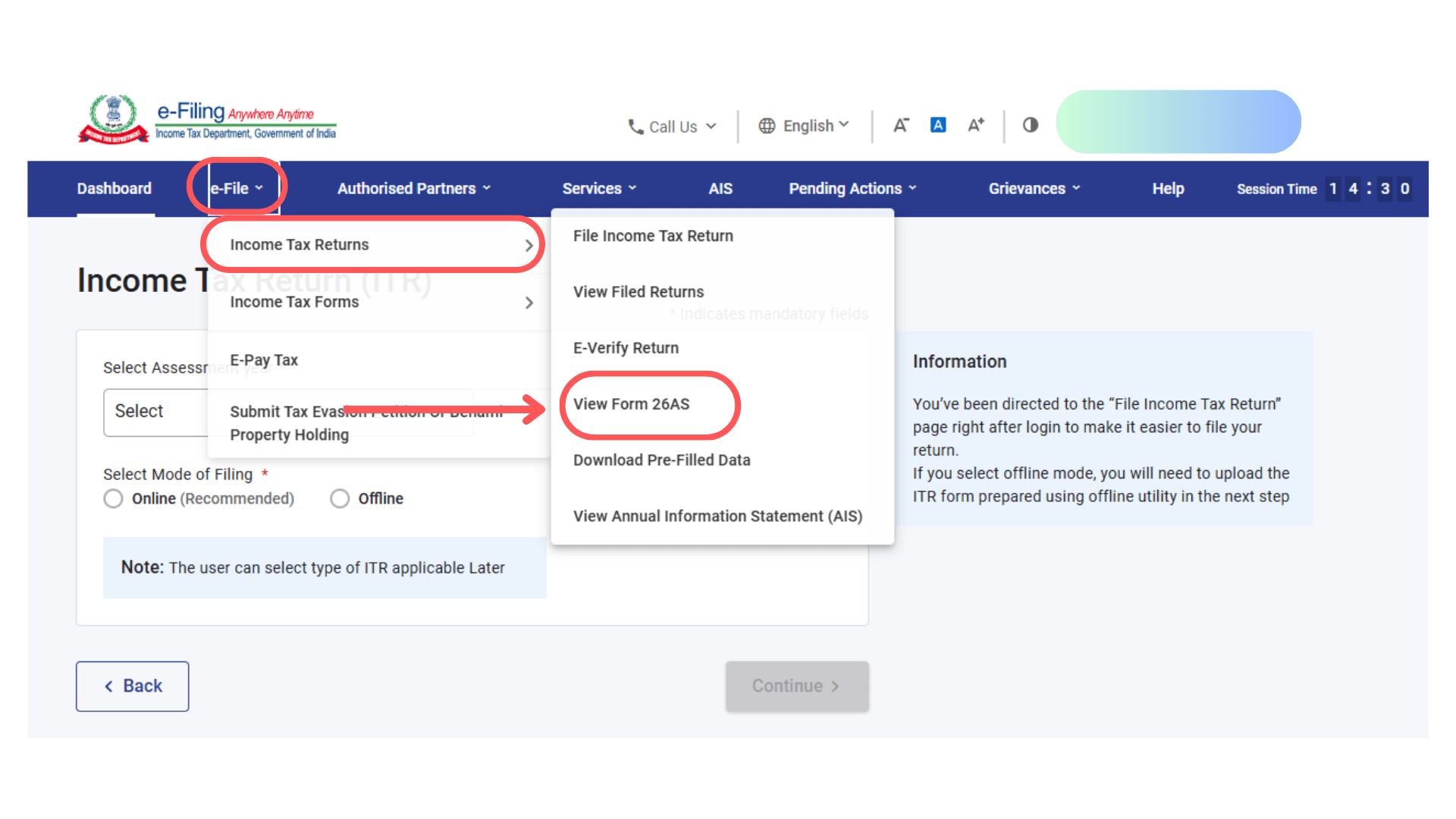

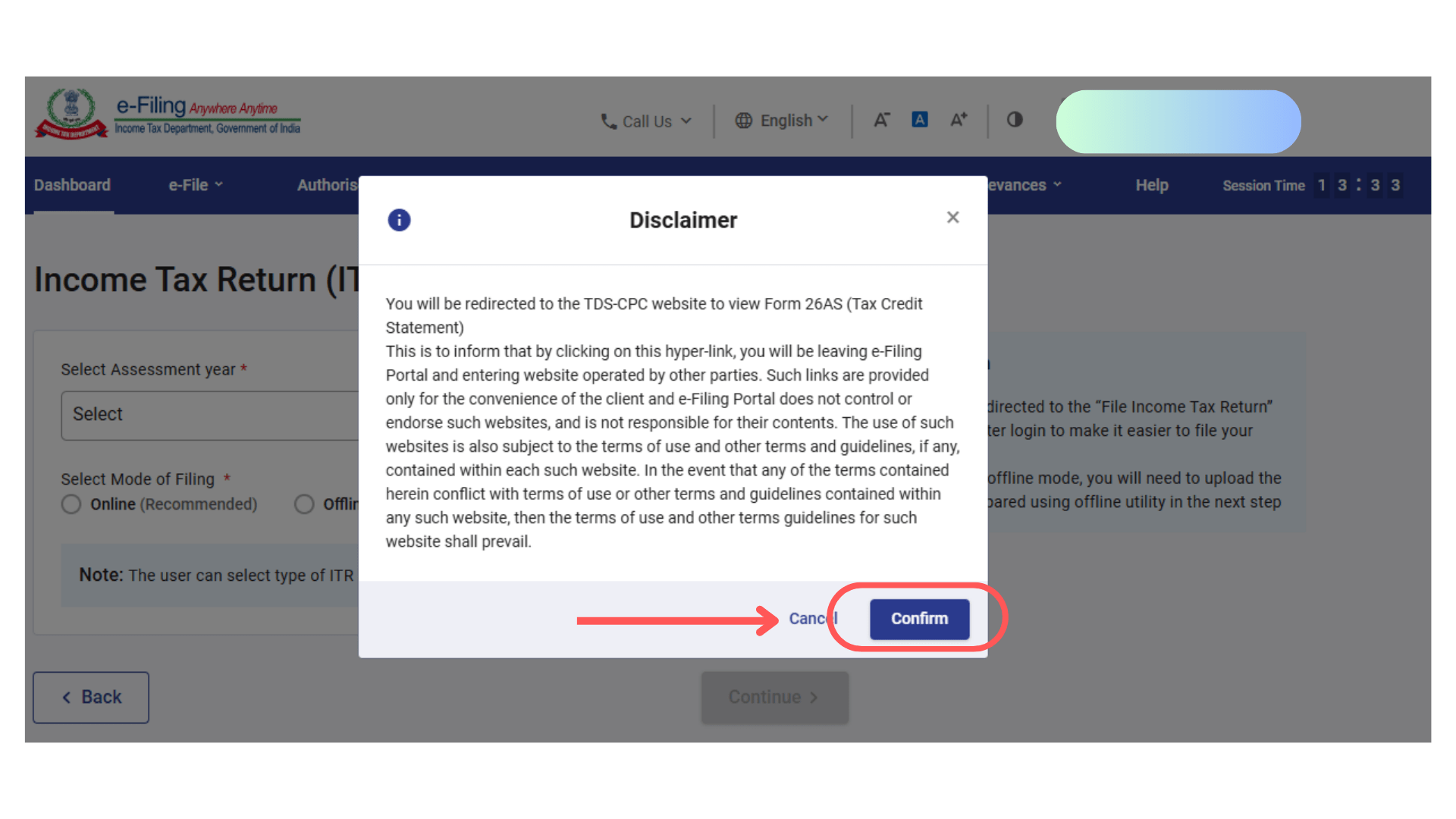

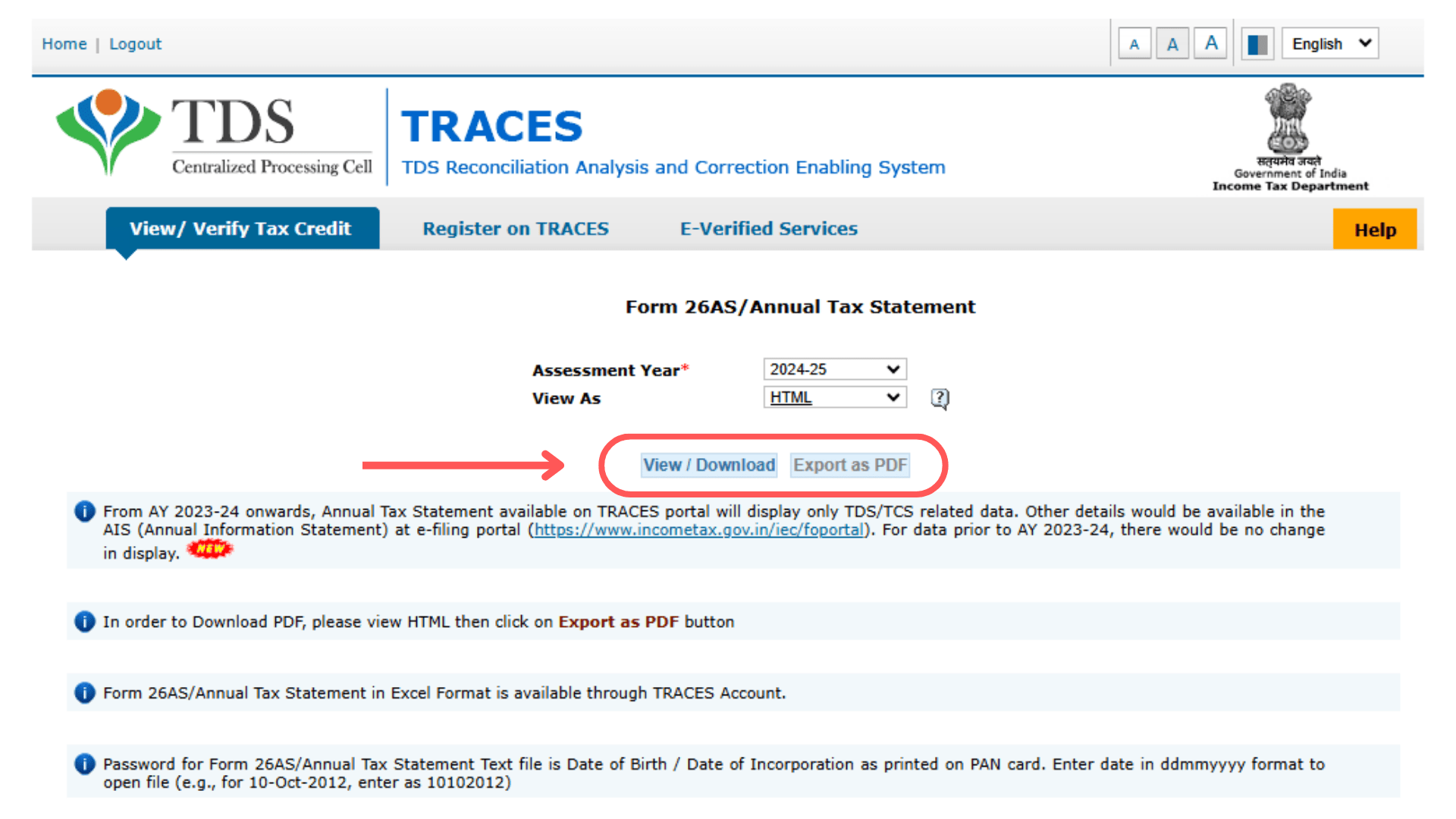

The Form 26AS download can be done via the TRACES website. Alternatively, you can use your login credentials on the income tax e-filing portal to download this form.

Here is the step-by-step procedure.

When you view Form 26AS before filing your ITR, ensure the information in the form is accurate. The following are the components of the form.

It shows the TDS related to your PAN. The deductors file quarterly TDS returns, which can be seen in this form.

The information in this section includes the name and Tax Deduction and Collection Account Number (TAN) of deductors, the total amount paid, total tax deducted, and total deposited tax against your PAN.

It comprises information about the income when no TDS is applicable; this is when you submit Form 15G or 15H.

If you have not submitted either of these forms, it shows ‘no transactions present’.

When you sell an immovable property during the previous year and deduct taxes on it, the amount is shown under Part A2.

This section shows the details of TCS by sellers of specified products when these are purchased by the assessees.

Additionally, vendor details like name and TAN of collector, the total amount paid, the total tax collected, and the total TCS deposited are shown here.

It comprises details of any tax paid, which includes self-assessment and advance taxes. Additionally, information related to the payment challans is seen in this part.

Information related to tax refunds, such as assessment year, payment date and mode, refund issued, nature and amount of refund, interest paid, and remarks are shown in Part D.

This section shows details of high-value transactions that ‘specified persons’ like mutual funds and banks must report. This part that reflects specified financial transactions (SFTs) was previously known as AIR.

This part is for buyers of immovable property and shows the details on the TDS amount deducted while buying the property.

Any defaults related to the processing of statements are shown in this section. However, it does not reflect any demands raised by the assessing officers (AOs).

Income Tax Form 26AS is a consolidated statement showing details related to TDS and TCS from different sources. The deductors deposit the tax deducted with the government.

Moreover, the form shows details about self-assessment or advance tax paid and high-value transactions executed by you.

This form can be viewed only if your PAN is mapped to your online banking account. To view the form, you can log in to your net banking account.

However, this facility is available only with certain authorized banks.

The Income Tax 26AS Form is updated when the central pay commission processes the TDS returns. The last date for filing fourth quarter TDS returns is 31st May and an additional seven days are needed for its processing.

On completing the processing, you can see the updated form with the latest TDS deposited related to your PAN.

It acts as proof of tax deducted and collected at source on your behalf. Additionally, it confirms that the deductors have deducted the accurate tax amount and deposited it with the government on your behalf.

The only way to rectify any errors on this form is to ask the deductor to file rectified TDS returns. You are not allowed to make any corrections to this form.

The TRACES 26AS form can be viewed from the official website. Alternatively, if your PAN is linked to your bank (which is authorized) you may see the tax credit statement via internet banking.

The Income Tax Department maintains the records for every taxpayer. It keeps records of tax paid and refunded against your income during the relevant financial year.

You can view the form as provided by the Income Tax Department under section 203AA via the income tax e-filing portal or internet banking.

This tax credit statement acts as proof that tax has been accurately deducted and collected on your behalf.

Additionally, it confirms that banks and employers have deducted accurate tax amounts on your behalf and deposited them in the government account.

The scope of the new form is wider and covers details received under the Double Taxation Avoidance Agreement (DTAA), penalty proceedings, and much more. It comprises the following two parts:

This could happen if the bank makes an error while making the data entry. You need to inform the bank about the error and have it rectified to reflect the accurate amount.

Yes, if the details are incorrect, you can update or modify the errors. You must select ‘Request for new PAN card and/or changes or correction in PAN data’ on the official website.

Priyanka Rao is a content strategist for Jupiter.Money, and specializes in writing on topics related to finance, banking, budgeting, salary & wages, and other financial matters. She has a passion for creating engaging content that resonates with audiences across various digital platforms. In her free time, Priyanka enjoys traveling and reading, which allows her to gain new perspectives and inspiration for her work. With a keen eye for detail and a creative mindset, Priyanka is committed to creating content that connects well with her readers, enhancing their digital experiences.

Powerd by Issued by