Get salary accounts for your team See benefits

Table of Contents

ToggleBefore you avail of a loan, consider whether the lender you have approached has a provision to prepay the loan. Sometimes, when you have an excessive inflow of cash, you can direct the extra funds to your loan and pay it off before the end of its tenure.

This is known as loan prepayment. However, most financial institutions levy a prepayment charge for this facility, and it varies between 0% and 5%, depending on the lender.

If you are looking to make a personal loan prepayment, take this step in the first half of your tenure to really maximize its benefit.

At the same time, look out for the lock-in period during which prepayments cannot be made. Most banks, under the personal loan partial payment, offer you the option of either reducing your Equated Monthly Installment (EMI) or the tenure of your loan.

As you may already know, the principal is the amount of loan that you have availed of from the lender.

It is the amount that is due to the financial institution upon which the interest rate is charged. Moreover, your EMI consists of two components – the principal and the interest.

Principal prepayment is nothing but the repayment of principal ahead of your regular loan repayment schedule.

You might wonder why anyone would want to prepay their principal, especially when the EMI is deducted from your bank account every month.

Well, if you prepay your principal, the interest component too will shrink because now the interest will be calculated on a smaller principal amount. Thus, you get to pay off your loan a little sooner than decided.

To clear off your personal loan a little sooner, you may either choose to pay off the outstanding principal in full or in part. The latter, where you pay the loan amount only partially, is referred to as a part prepayment.

If you pay off the loan in full, you will be charged a personal loan foreclosure charge. On the other hand, you will have to pay prepayment charges on your personal loan if you pay it partially.

In addition to the charges, you will be levied, you will also need to consider the lock-in period. Most banks do not let you prepay your loan, fully or partially, for a certain period.

But, once you are past this time and have some extra cash in hand, it is advisable to pay off your loan partially, if not fully. Doing so will help you to save a massive amount of interest that is levied on your outstanding principal.

However, before you take that call, consider the trade-off between prepayment charges and the saved interest amount, and only go ahead if it seems worthwhile.

As you bring down the interest amount, you also naturally reduce the burden of debt. The outstanding balance reduces, and you can use those funds elsewhere.

Otherwise, you would have to sacrifice your savings every month, especially if you are unable to manage your loan and the interest starts eating into them. So, if you have extra cash any time during the tenure of your loan, pay your loan back.

However, you probably can experience the full advantage of your personal loan prepayment only if you do it in the initial part of your tenure.

Whether you do full or partial loan prepayment, you are cutting debt out. Consequently, you can improve your credit score because it is impacted by how many outstanding loans you have and how much you owe.

And when you make a personal loan partial prepayment or do so in full, your credit score is increased and so are your chances of availing of another loan.

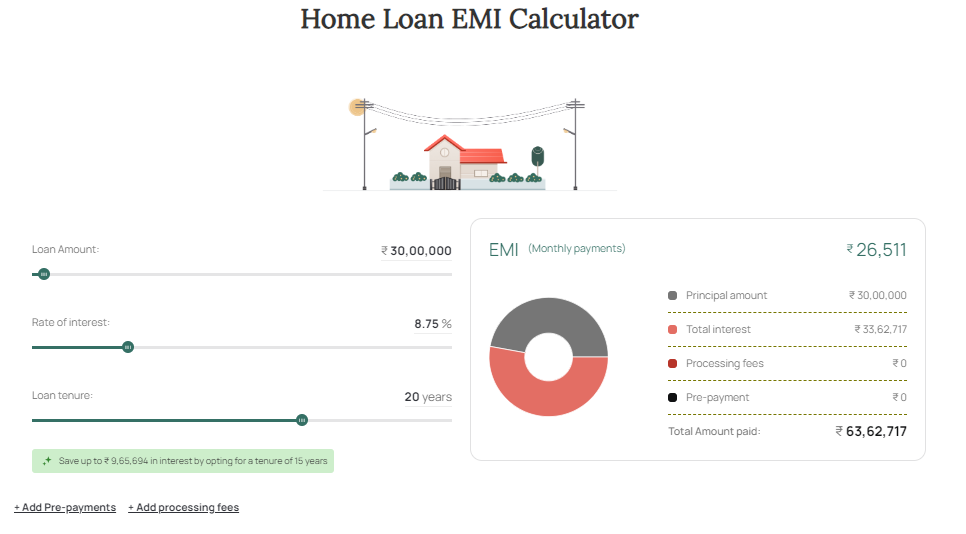

Free Home Loan EMI Calculator

Check your home loan EMI, prepayment and savings on interest with our free Home Loan EMI Calculator

While it can help you reduce your debt obligations and improve your credit score, you also need to consider the following drawbacks of personal loan prepayment.

You might save on interest, but you would have to pay the foreclosure or prepayment penalty levied by the lender for deciding to reduce your debt. This penalty is either charged as a percentage of the outstanding loan amount or a fixed amount.

Prepayment charges on personal loans are common; however, there are a few lenders that do not levy a prepayment charge. If you decide to pay off your loan through these financial institutions, you will save money.

When you have extra funds, you may choose to either invest them or use them to close your loan. Having liquid funds can always be helpful in case of emergencies or when you want to purchase something.

So, this decision completely depends on the situation you are in and how you want to manage your expenses.

Before you choose, remember to conduct extensive research. Select a lender who does not charge a prepayment penalty so that you can save some money by prepaying your personal loan.

Let us understand this with an example.

Let’s assume that Mrs. Sinha has a home loan with ABC Bank. The details are given below:

| Particulars | Details |

| Amount | INR 20,00,000 |

| Interest | 9% |

| Tenure | 20 years |

| EMI | 17,995 |

| Total Interest Amount (in 20 years) | INR 23,18,687 |

| Total Amount Payable (in 20 years) | INR 43,18,687 |

Mrs. Sinha has the option of either foreclosing this loan after a certain period or repaying it partially.

If she were to close it altogether, let’s say at the end of the 11th year, this is what she would end up paying and saving.

| Particulars | Amount |

| Opening balance (Principal) | INR 14,20,518 |

| Amount of prepayment | INR 14,20,518 |

| Amount of interest saved | INR 7,38,825 |

So, she can save approximately INR 7.50 lakhs and reduce her tenure by nearly 10 years if she forecloses the loan. Now, let’s see what could happen if she decides to increase her EMI by INR 5,000 every month.

| Particulars | Amount |

| Opening balance (Principal) | INR 14,20,518 |

| New EMI | INR 17,995 + INR 5,000 = INR 22,995 |

| Amount of interest saved | INR 2,44,067 |

| Reduction in tenure (years) | 3 |

An increase of just INR 5,000 in her EMI has helped her reduce her tenure by three years and save nearly INR 2.50 lakhs in interest.

Now that you understand personal loan prepayment better, let’s look at the general procedure to be followed.

As we already discussed, whether you are making a partial prepayment of your loan or foreclosing it, you might need to prepare for a related charge.

If you consider the bank’s perspective, the cost of borrowing is higher than the cost of lending. Once the financial institution lends you the money, it earns from the difference between the two amounts during the tenure of the loan.

If you prepay or foreclose the loan, there is a potential loss of income for them. So, they charge you a fee or penalty to make up for it.

So, should you make a personal loan prepayment? The answer to this question depends on a variety of factors some of which are the interest rate, the type of loan, the tenure, and the prepayment charges.

Do not get carried away by financial institutions that charge low prepayment fees. It is always advisable to compare your interest rate against the prepayment charges on the personal loan and choose the most affordable option.

It is a good idea to close your loan earlier than scheduled because it will help you save money and improve your credit score.

However, you must consider things like personal loan foreclosure charges. You may then accordingly decide on the right time to foreclose or prepay your loan.

Generally, all banks and non-banking financial institutions (NBFCs) allow this but not all of them provide the part prepayment facility. You also need to make sure to pay your EMIs promptly during the lock-in period.

This period is different for every lender and ranges anywhere between three and 12 months.

Yes, you most certainly can. Prepayment of your loan can also help you in bringing down your interest because it is now calculated on the reduced principal amount.

Prepayment of your loan is recommended at the earlier stages of your repayment cycle. That is how you can save more. If you prepay your loan now, you can still save but it will be a meager amount.

It can be done but it is not the most recommended practice. You might end up paying a bigger percentage of interest in your EMI.

So, make sure to look out for this information from your lender and then make an informed decision.

Priyanka Rao is a content strategist for Jupiter.Money, and specializes in writing on topics related to finance, banking, budgeting, salary & wages, and other financial matters. She has a passion for creating engaging content that resonates with audiences across various digital platforms. In her free time, Priyanka enjoys traveling and reading, which allows her to gain new perspectives and inspiration for her work. With a keen eye for detail and a creative mindset, Priyanka is committed to creating content that connects well with her readers, enhancing their digital experiences.

Aditya Padmawar is the Director of Products - Lending at Jupiter Money, where he oversees the development of innovative lending solutions to deliver seamless, technology-driven customer experiences. Leveraging his strong background in product management and technology, Aditya is instrumental in crafting efficient, automated product journeys that enhance Jupiter's lending offerings.

Before joining Jupiter, Aditya was the Head of App Product at Navi, where he used technology to build businesses from the ground up. His key achievements include reimagining the home loan product to address fundamental customer pain points, scaling the personal loans business at an industry-leading pace, and creating one of the best health insurance product experiences for Navi's customers.

Previously, Aditya was a Senior Product Manager at Ola, where he contributed to product innovation in the mobility sector. He also served as a Program Manager at Tata Administrative Services, leading strategic projects across various sectors. His early career includes working as a design engineer at Intel and interning at IBM.

Aditya holds an MBA from IIM Ahmedabad and a dual degree from IIT Bombay, where he developed a strong foundation in both business and engineering. His blend of technical expertise and business acumen enables him to drive impactful product strategies in the fintech space.

Powerd by Issued by