Get salary accounts for your team See benefits

Table of Contents

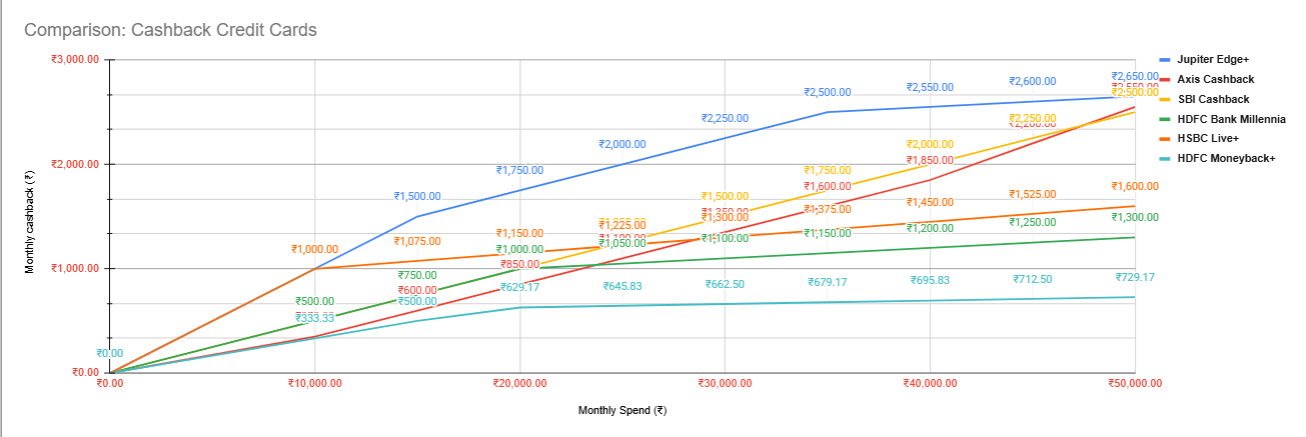

ToggleIf you want a credit card with best cashback rewards you need to compare how much you spend each month on different cards. It has been observed that the average Indian Credit Card spends in a month is around Rs. 17,000. This also makes sense when we see Integrated Annual report from SBI stating an average Credit Card spends of Rs.1,69 Lakh per card in a year.. Maximizing cashback rewards per monthly spends makes absolutely an important decision as the majority of the spending is around 17K to 25K in a given month. This article breaks down which credit card gives you the highest cashback based on your monthly spend and features.

A cashback credit card gives you back a certain percentage of whatever you spend as actual cash or statement credit rather than points. This means that each rupee you spend can return some rupees back depending on the category of spending such as groceries, online shopping, or travel. It is simpler than reward points schemes since there is no complex conversion.

| Monthly Spend (₹) | Jupiter Edge+ | Axis Cashback | SBI Cashback | HDFC Bank Millennia | HSBC Live+ | HDFC Moneyback+ |

| ₹0.00 | ₹0.00 | ₹0.00 | ₹0.00 | ₹0.00 | ₹0.00 | ₹0.00 |

| ₹10,000.00 | ₹1,000.00 | ₹350.00 | ₹500.00 | ₹500.00 | ₹1,000.00 | ₹333.33 |

| ₹15,000.00 | ₹1,500.00 | ₹600.00 | ₹750.00 | ₹750.00 | ₹1,075.00 | ₹500.00 |

| ₹20,000.00 | ₹1,750.00 | ₹850.00 | ₹1,000.00 | ₹1,000.00 | ₹1,150.00 | ₹629.17 |

| ₹25,000.00 | ₹2,000.00 | ₹1,100.00 | ₹1,250.00 | ₹1,050.00 | ₹1,225.00 | ₹645.83 |

| ₹30,000.00 | ₹2,250.00 | ₹1,350.00 | ₹1,500.00 | ₹1,100.00 | ₹1,300.00 | ₹662.50 |

| ₹35,000.00 | ₹2,500.00 | ₹1,600.00 | ₹1,750.00 | ₹1,150.00 | ₹1,375.00 | ₹679.17 |

| ₹40,000.00 | ₹2,550.00 | ₹1,850.00 | ₹2,000.00 | ₹1,200.00 | ₹1,450.00 | ₹695.83 |

| ₹45,000.00 | ₹2,600.00 | ₹2,200.00 | ₹2,250.00 | ₹1,250.00 | ₹1,525.00 | ₹712.50 |

| ₹50,000.00 | ₹2,650.00 | ₹2,550.00 | ₹2,500.00 | ₹1,300.00 | ₹1,600.00 | ₹729.17 |

Last updated: September 15th 2025

From this table Jupiter Edge+ consistently gives the highest cashback among these cards for almost every level of spend. Axis Cashback and SBI Cashback come closer at higher spends especially beyond ₹40,000. HSBC Live+ performs well in mid‐range spends. HDFC Millennia and HDFC Moneyback+ are moderate in returns.

| Credit Card | Joining Fee / One-time Fee | Annual / Renewal Fee | Is it Lifetime Free? |

| Jupiter Edge+ | ₹ 499 + GST one-time. | No annual / renewal fee (i.e. after the joining fee, there is no yearly membership fee). | Yes — it is lifetime free (no recurring annual membership). |

| Axis Cashback | ₹ 1,000 + GST. | ₹ 1,000 + GST annually. Waiver possible on spends of ~₹4,00,000 in previous year. | No (unless you meet the waiver criteria) |

| SBI Cashback | ₹ 999 + applicable taxes. | ₹ 999 + applicable taxes from second year. Can be waived if annual spends ≥ ₹2,00,000. | No (unless spend-based waiver) |

| HDFC Bank Millennia | ₹ 1,000 + applicable taxes. | ₹ 1,000 + applicable taxes annually. Annual fee gets waived if spends ≥ ₹1,00,000 in previous 12 months. | No (unless waiver condition met) |

| HSBC Live+ | ₹ 999. | ₹ 999 annually. Fee is waived if you spend over ~₹2,00,000 in a year. | No (unless you achieve the spend for waiver) |

| HDFC Moneyback+ | ₹ 500 + applicable taxes. | ₹ 500 + applicable taxes annually. Renewal fee waived if spends ≥ ₹50,000 in a year. | No (unless spend-based waiver) |

Jupiter Edge+ (Edge+ CSB Bank RuPay Credit Card) offers a very strong cashback structure especially for those who shop online and travel. You get 10% cashback on selected shopping brands like Amazon, Flipkart, Myntra, Ajio, Zara, Nykaa, Croma, Reliance Trends and more, with a monthly cap of ₹1,500 under the shopping category. You also get 5% on travel bookings through certain platforms, with ₹1,000 cap. On other expenses you earn 1% cashback. There is a ₹499 one‐time joining fee but no annual fee for many users. Also, because it is RuPay + UPI enabled you get convenience of paying via UPI and tracks both UPI and credit card spends. The “Jewels” reward system makes cashback redemption easy.

Axis Cashback Credit Card focuses heavily on online spends. It offers up to 7% cashback on online transactions depending on how much you spend online in a month: 2% for lower online spend threshold, rising to 5% and 7% for higher online spends. Offline and travel spends get base cashback (around 0.75%). There is also a small bonus on utility and bill payments. The card has a joining and annual fee (₹1,000 + GST) that can be waived based on yearly spends above ₹4,00,000. So if your spend pattern is heavy online this can be very rewarding.

SBI Cashback Credit Card gives 5% cashback on all online purchases without restrictions on merchants, plus 1% cashback on offline spends. There is a maximum limit of cashback earnings per monthly statement cycle (₹5,000) which means returns flatten after a certain point of spending online aggressively. It also offers auto credit of the cashback so you do not have to manually redeem. For someone who shops online often this card performs well especially in higher spend slabs.

HDFC Millennia focuses on cashback from popular online and entertainment brands. You get 5% cashback on brands like Amazon, Flipkart, Myntra, Zomato, BookMyShow, Sony LIV, Cult.fit and Uber among others, and 1% cashback on other spends. It also includes dining and entertainment as promotional categories. The fees are ₹1,000 + taxes both as joining and annual fee. So to get good value you need to use it often in those partner brand categories. If your spends are spread out or you spend a lot offline, portions of cashback will be lower.

HSBC Live+ gives 10% cashback on dining, food delivery and grocery spends, capped at ₹1,000 per month for those categories. All other eligible spends give 1.5% unlimited cashback. It also includes perks like four complimentary domestic airport lounge visits per year, a dining programme with discounts, and welcome benefits (cashback on meeting spend threshold early). There is a joining fee of ₹999 which can be waived if your annual spending exceeds ₹2,00,000. For someone whose major spends are on groceries, food delivery and restaurants this card gives strong returns in mid‐monthly spend ranges.

HDFC’s Moneyback+ is generally for lower to moderate spenders. It gives cashback on a mix of categories but the rates are lower compared to the cards above. It tends to perform better in lower spends although as your spend grows the returns are overshadowed by cards like Edge+ or Axis Cashback. Detailed features of Moneyback+ are not as aggressively structured towards high percentages in bonus categories.

If your monthly spend is around ₹10,000-₹20,000 and you spend significantly on groceries, dining or popular online brands then Jupiter Edge+ and HSBC Live+ are very strong contenders. If your online spending is very high (₹40,000 or more) then Axis Cashback or SBI Cashback can match, but still Edge+ is a clear winner till Rs. 50,000 worth of spends. For mixed offline + online + travel spends, consider how much you spend in bonus categories and whether joining/annual fees are justified.

Based on your data and current features, Jupiter Edge+ appears to be the best credit card for cashback rewards for many users. It gives the highest cashback across almost all spend levels, especially if you shop online heavily or travel. If your spending is more specific to groceries, food delivery and dining then HSBC Live+ might serve you better. If your online spends are very high, Axis Cashback or SBI Cashback are strong alternatives. Remember, each cards have their own caps and limits, in that case, Jupiter Edge+ still has an edge for maximum rewards.

Jupiter Edge+ is one of the top picks for many because it gives very strong cashback rates across online shopping, travel and everyday spends.

Most of the cards here give cashback automatically or as statement credit. Jupiter Edge+ uses “Jewels” which you can convert to cash or digital gold.

Some offers/apps give cashback for bill payments but most cards do not give full cashback for paying credit card bill amounts since that is not a spend category.

Check if the card has a joining or annual fee. If so, ensure your spending in bonus categories is large enough that added cashback outweighs those fees. Also check thresholds for fee waivers.

Priyanka Rao is a content strategist for Jupiter.Money, and specializes in writing on topics related to finance, banking, budgeting, salary & wages, and other financial matters. She has a passion for creating engaging content that resonates with audiences across various digital platforms. In her free time, Priyanka enjoys traveling and reading, which allows her to gain new perspectives and inspiration for her work. With a keen eye for detail and a creative mindset, Priyanka is committed to creating content that connects well with her readers, enhancing their digital experiences.

Powerd by Issued by