Gold has been one of the first investment options for generations now. It is the first thing that comes to a person’s mind when they have excess cash. This is mainly because it is not just a wealth creator but also considered auspicious.

Investing in digital gold in India has become simple and accessible through various mobile applications. These platforms allow users to buy, sell, and store gold securely with minimal investment amounts. Here is the list of 16 Best Platforms to buy Digital Gold in India 2025 with their value proposition:

Apps to Buy Digital Gold in India 2025

| Platform | Value Proposition | Play Store / App Store Rating |

|---|---|---|

| Jupiter Money | Allows fractional digital gold investment with features like auto-invest, instant redemption, and a secure gold wallet. | Play Store: 4.4 / App Store: 4.7 |

| MMTC-PAMP Digital Gold | A highly trusted digital gold provider with 24K purity assurance and transparency in pricing and transactions. | Play Store: 4.5 / App Store: N.A. |

| Google Pay | Enables easy digital gold purchases directly in the Google Pay app with integration from MMTC-PAMP. | Play Store: 4.2 / App Store: 4.6 |

| Paytm | Offers digital gold investment via MMTC-PAMP and SafeGold, with real-time pricing and flexible redemption. | Play Store: 4.4 / App Store: 4.6 |

| PhonePe | Facilitates digital gold purchases via SafeGold with options for gifting and 24×7 buying/selling. | Play Store: 4.4 / App Store: 4.6 |

| 5Paisa | Online brokerage platform offering investment in digital gold along with mutual funds and stocks. | Play Store: 4.0 / App Store: 4.2 |

| Groww | Simplifies investing by allowing users to buy/sell digital gold and other assets through a single interface. | Play Store: 4.4 / App Store: 4.6 |

| Amazon Pay | Lets users buy digital gold within the Amazon app, in partnership with SafeGold. | Part of Amazon app – ratings not specific to gold feature |

| Airtel Payment Bank | Offers digital gold investment through SafeGold, directly accessible from the Airtel Thanks app. | Play Store: 4.3 / App Store: 4.4 |

| DigiGold | Standalone platform focused on secure and transparent digital gold buying/selling. | Play Store: 4.3 / App Store: N.A. |

| Jar | Helps users save and invest in digital gold through micro-savings, starting with spare change. | Play Store: 4.5 / App Store: 4.4 |

| Tanishq | Trusted jewellery brand that allows digital gold purchases via the Tata Digital Gold partnership. | Play Store: 4.3 / App Store: 4.6 |

| Spare8 | Offers cashback-to-gold conversion, helping users invest savings from rewards into digital gold. | Play Store: 4.4 / App Store: 4.5 |

| Gullak | Focuses on round-up savings and digital gold auto-invest to help build disciplined investing habits. | Play Store: 4.3 / App Store: 4.6 |

| Pluto Money | Personal finance app designed to guide users in saving goals, with options to invest in digital gold. | Play Store: 4.2 / App Store: 4.3 |

| FinPlay | Gamified personal finance platform integrating gold investment with financial education tools. | Play Store: 4.3 / App Store: N.A. |

1. Jupiter Money

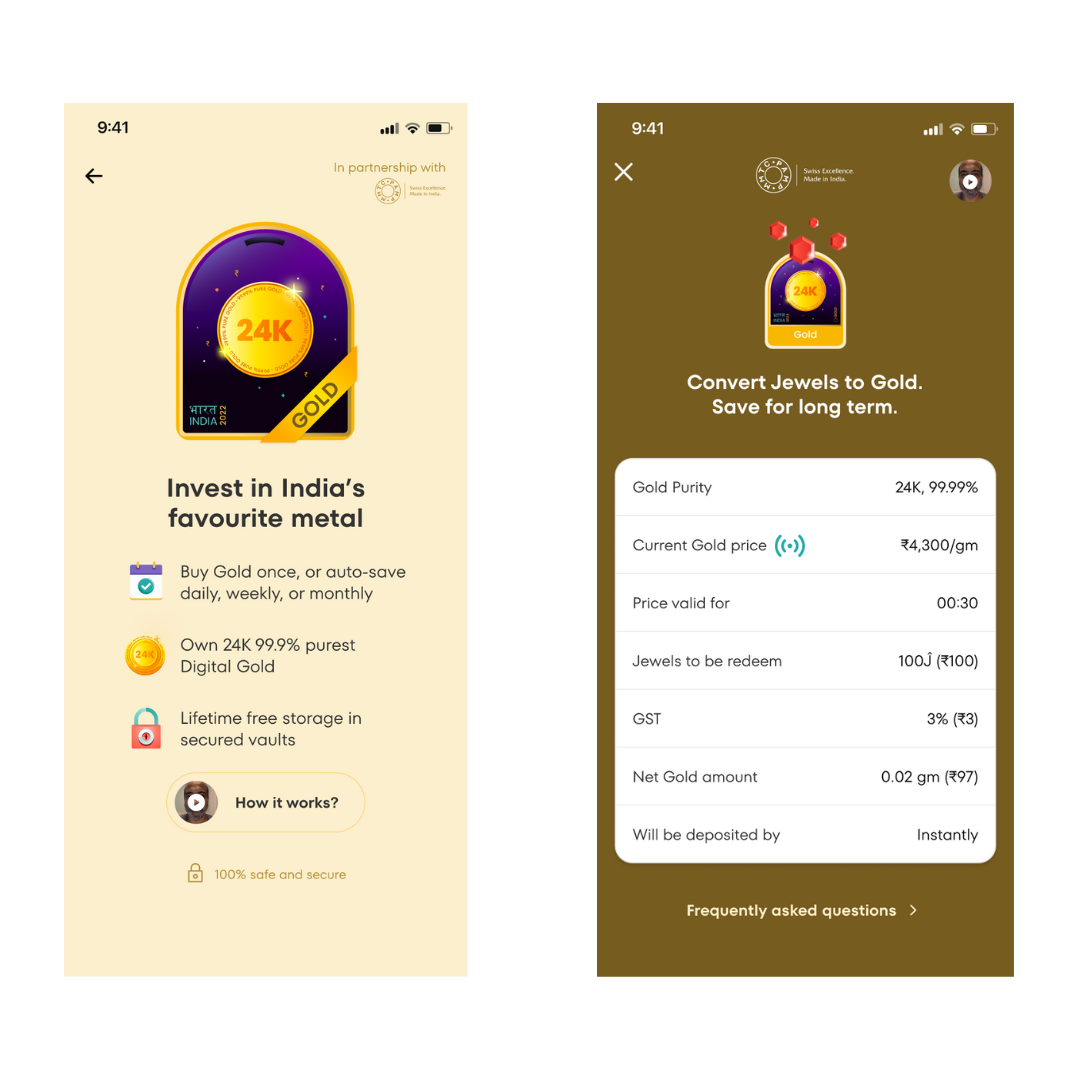

Jupiter Money is a personalised money management app that helps you take control of your finances. Apart from tracking your expenses and helping you save in pots, it offers a host of investment alternatives. One of them is digital gold which it offers by partnering with MMTC-PAMP.

Through Jupiter Money, you can invest in digital gold with 24K 99.9% purity. You can buy and sell your gold anytime and anywhere with just a swipe. The gold you buy is stored in secured vaults which are free for a lifetime.

The best feature of Jupiter Money is that you can set up an investing habit. You can auto-save a certain amount in gold every day, week, or month. The app also allows you to track your investment in gold and tell you the profit you have accumulated over time.

Jupiter’s digital gold platform offers a seamless way to start your gold investment journey with fractional gold purchases, allowing you to invest with as little as ₹1. Known as one of the best apps for gold returns, it provides competitive pricing and transparent insights. With its safe gold wallet and secure vaulting partner, your investments are protected. The app also supports instant gold redemption for added flexibility, while keeping gold storage charges minimal and clearly outlined. For hassle-free investing, Jupiter functions as a smart gold auto-investment app, helping you build long-term wealth effortlessly.

2. MMTC-PAMP Digital Gold

MMTC-PAMP is a joint venture between Switzerland-based bullion brand PAMP SA and MMTC Ltd, a Government of India Undertaking. The app allows you to invest in 24K 99.9% pure gold. You can invest in grams of gold or by the value of gold. Once you invest, an automated invoice is created and sent to you.

Moreover, the value of digital gold is reflected in your account. Simultaneously, the company stores the gold of equivalent weight in its highly secured vault, which will be in your name. The app also allows you to save daily, weekly, and monthly to increase your corpus in gold. You can buy, sell, and redeem your investment any time of the day. To redeem or convert your digital gold into physical gold, you must pay delivery charges, and the gold will be delivered to your doorstep.

3. Google Pay

Google Pay has partnered with MMTC-PAMP to sell digital gold on its platform. You can buy, sell, and exchange digital gold on Google Pay. The app allows you to invest in digital gold of 24K 99.9% purity. Once you buy digital gold, it will be deposited in your Gold Locker on Google Pay.

To convert digital gold to physical gold, you must pay delivery charges, and the gold coins will be delivered to your doorstep. The best part is that the app also allows you to gift gold to your friends and earn gold as a reward. Investing in digital gold with Google Pay is very secure, as all transactions will be done using your UPI PIN codes.

4. Paytm

Paytm is a leading payment app trusted by over 30 crore Indians. It offers a host of services, including money transfers, bill payments, and check credit scores. The app also allows you to invest in mutual funds, the National Pension Scheme (NPS), and digital gold of 24K 99.9% purity.

The app has partnered with MMTC-PAMP to sell digital gold through its platform. So, when you buy digital gold, it is stored in secured vaults of MMTC-PAMP. You can check your gold portfolio value on Paytm anytime. You can also sell, gift, or get delivery anytime you want. Moreover, you can also create a gold savings plan to save in gold at regular intervals.

5. PhonePe

PhonePe is another payment app. You can transfer, make bill payments, and buy insurance on it. You can also invest in mutual funds and digital gold. The company has partnered with MMTC-PAMP and SafeGold to offer gold of 24K 99.9% purity to its customers.

You can buy, sell, and convert your digital gold within minutes through your mobile phone. The app also offers bank-grade secure lockers to store your gold. You can get money instantly upon selling your digital gold. The app charges a minimal delivery fee to deliver your gold to you in the form of coins and bars.

6. 5Paisa

5Paisa is a user-friendly stock market trading app suitable for traders and beginners. The app also allows you to invest in digital gold with no hidden charges. They offer secure payments through debit cards, credit cards, and inbuilt wallets.

The minimum investment in digital gold is Rs 50, and once you buy digital gold, it is reflected in your portfolio. You can also sell the gold to get money instantly without any hassle.

7. Groww

Groww is a direct mutual fund and stock investing app. It allows you to invest in financial assets with zero paperwork within a few minutes. To provide gold to its customers, Groww has partnered with Augmont Gold. All transactions that you do for buying and selling digital gold will be directly done with Augmont Gold.

To buy digital gold, you must create an account with Groww. The platform doesn’t charge any account opening fees and allows you to buy gold in small denominations making investing in gold easily, convenient, and affordable.

8. Amazon Pay

Amazon, one of the most used shopping platforms, also allows you to buy digital gold through Amazon Pay. It has partnered with SafeGold to sell gold on its app. You can go to your Amazon app and type ‘Digital Gold’ or go to the Amazon Pay page to buy digital gold.

The gold you purchase is stored safely in highly secured vaults. You can check the value of your gold on the app whenever you want. The minimum amount of investment is Rs 5, whereas the maximum is 30 grams of gold. You can sell the gold any time after 24 hours of purchase. Once you sell the gold, you will get the money instantly.

9. Airtel Payment Bank

The Airtel payments back also allow you to buy digital gold of the highest purity (24K 99.9%) on its platform. However, to purchase digital gold, you must have an Airtel payments bank savings account. The minimum amount of investment is Rs 1. You can also buy in grams of gold.

You can sell the gold anytime or even get it delivered to your home. However, you can only get gold of either one gram or more. Anything below one gram cannot be delivered to your home. The app also allows you to gift gold to your loved ones.

10. DigiGold

DigiGold is one of the most trusted apps for buying digital gold and silver. It sells gold and silver of 24K and 99.9% purity. You can buy gold and silver with a minimum amount of Rs 1 at live market prices. You can check the value of the gold you carry anytime in your wallet.

You can also start a no lock-in period SIP in gold with Rs 500. This means you can benefit from compounding through systematic investments. You can sell the gold anytime or even convert it to physical gold. The best part is that the app doesn’t charge any delivery fee and delivers the gold in 3-5 days.

The app also offers physical lockers for you to save your gold in a secure place. You can open the locker from the comfort of your home using their app with a single click.

11. Jar

The Jar is a daily savings app that lets you save money. It aims at making investing a habit. The app invests spare change from transactions in digital gold automatically. The minimum investment is Rs 1, which can be redeemed whenever you want into your e-wallet.

It also asks investors to play a game of spin the wheel for every transaction, invests the cashback you receive in digital gold, and gives live updates of the portfolio’s value. So, with every spend, you save some money and invest it in gold which will create wealth for you.

You can buy and sell the gold anytime you want. Additionally, you exchange it for physical gold coins or bars when you have accumulated enough.

12. Tanishq

A Tata product and one of the biggest jewellers also offers digital gold. Tanishq has partnered with SafeGold to offer digital gold on its app and website. You can purchase digital gold of 24K purity for an amount as low as Rs 100.

You can sell the gold anytime or exchange it at any of its 350+ stores in India. The app doesn’t charge any additional fees for locker or transaction processing. Being a Tata Group company, it is one of the most trusted platforms for buying gold in physical and digital forms.

13. Spare8

Spare8 is a mobile application that allows you to invest in fractional gold. Unlike some other investment platforms, Spare8 assures that all the gold you invest in is backed by physical gold that is securely stored in insured vaults. This can provide peace of mind for those who are concerned about the security of their digital holdings. Spare8 also offers a user-friendly app that makes it easy to buy, sell, and track your gold investment. Additionally, there are no fees associated with buying or selling gold on Spare8, making it a cost-effective option for investors of all levels.

14. Gullak

Gullak is a mobile app designed to simplify saving and investing in 24k gold. Gullak offers unique features like “Save on Spends” which automatically invests a portion of your online transactions in gold, making it a seamless way to grow your investment. You can also set up daily micro-savings plans or choose from predefined goals for a dream house, wedding, or retirement. Gullak assures secured storage and provides the flexibility to withdraw your money anytime as cash or get physical gold delivered to your doorstep. They’ve partnered with trusted brands to ensure the security of your investments.

15. Pluto Money

Pluto Money is a platform that allows users to invest in digital gold and other assets. It offers a variety of features, including automatic investment plans, goal tracking, and portfolio rebalancing. One of the things that makes Pluto Money unique is its focus on making investing accessible to everyone. With a minimum investment amount of just ₹100, Pluto Money removes the barrier to entry for many potential investors.

In terms of security, Pluto Money claims to use world-class encryption and high-security infrastructure to protect user data and investments. You can download its mobile application to start investing.

16. Finplay

FinPlay is a community-driven platform that goes beyond just buying digital gold. It offers personalised investment recommendations for a variety of financial products including mutual funds, stocks, and bonds, allowing you to create a diversified portfolio tailored to your goals. They also provide educational resources and a secure platform to invest. You can start investing from as low as Rs. 100 by downloading and signing up on their app.

Things to keep in mind when investing in digital gold

- Minimum investment: The minimum investment varies across platforms. Some apps allow you to invest with just Rs 1, while others have a minimum limit of Rs 100.

- Maximum investment: The maximum amount you can invest in digital gold is Rs 2 lakhs.

Locker charges: Most apps don’t charge locker charges, but some do. So, it’s better to check locker charges before investing, as it gets deducted from the principal. - Maximum holding period: The maximum holding period for digital gold is five years. After that, you must either sell it or convert it into physical gold.

- Convertibility to physical gold: Not all apps have the facility to convert digital gold to physical gold. If you wish to convert your digital gold to physical gold, choose a platform with this option.

- GST: Digital gold has a GST (goods and services tax) of 3% which is deducted from the principal amount. Hence make sure you factor in GST when investing and selling digital gold.

- Taxes on capital gains: When you sell your gold, it is important to factor in taxation. The capital gains on gold are taxable at your income tax slab rate, irrespective of the holding period.

Top Ways to Invest in Gold

-

Physical Gold

One of the most straightforward ways to invest in gold is by buying physical gold. You can choose to purchase gold jewellery, bars, or coins based on your needs. While many people find physical gold to be a popular investment choice, there are challenges like storage and security to consider.

Most individuals opt to keep their gold in bank lockers, which usually come with an annual fee. Additionally, when buying physical gold, you should pay attention to factors like making charges and the purity of the gold, as these can impact your overall investment.

-

Gold Schemes (Saving Instruments)

Another good option for buying gold is through gold schemes offered by jewellers. These schemes function similarly to a Systematic Investment Plan (SIP). You can deposit a set amount of money each month for a specific period, like 6 months or 2 years. Once the scheme matures, you can use the total amount you’ve invested to purchase gold.

However, it’s wise to be cautious with this type of investment. Before committing, make sure to research the jeweller and understand their policies. If the returns from these schemes are comparable to traditional investments like fixed deposits (FDs), the potential risk may not be worth it.

-

Gold ETFs

Gold ETFs, or exchange-traded funds, are a popular way to invest in gold without actually buying physical gold. These funds are traded on the stock market, similar to stocks. To get started, you just need to open a Demat account, which may involve some brokerage fees. Investing in Gold ETFs gives you a way to benefit from gold’s market performance without the hassle of storage or security.

-

Sovereign Gold Bonds

Sovereign gold bonds are another investment option introduced by the Government of India in 2015. These bonds are managed by the Reserve Bank of India and aim to provide a safer alternative to owning physical gold. They typically have a lock-in period of five years and a total duration of eight years. One of the advantages of these bonds is that they don’t charge management fees, but keep in mind that while they are backed by gold, they can only be redeemed for cash.

-

Gold Mutual Funds

If you’re thinking about investing in gold, one option is to look into gold mutual funds. These funds manage your money by investing in gold exchange-traded funds (ETFs) for you. One of the benefits of gold mutual funds is that you don’t need a trading or demat account to sell them. You can easily redeem your investment directly on the asset management company’s website at the current net asset value (NAV). However, if you do have a trading or demat account, you can also buy and sell many gold mutual funds through stock exchanges.

-

Gold Fund of Funds (FOFs)

Gold fund of funds is another way to invest in gold, but they work a bit differently. These funds invest in a collection of other mutual funds, including those that focus on gold ETFs. While this option offers diversification, it comes with slightly higher risks and costs. This is because you’ll pay the expense ratios of both the individual funds and the fund of funds itself, making it a more expensive choice overall. Despite this, some investors appreciate the diversification that these funds can provide.

Conclusion

Digital gold is an excellent investment alternative to fight inflation and diversify your investment portfolio. However, when investing in digital gold, choosing an app that offers all features is best. For example, check if the app has a user-friendly interface and paperless KYC, allowing you to invest and sell within minutes without hassle. When you are investing your money through an app, make sure you are comfortable using it.

Frequently Asked Questions (FAQs)