Get salary accounts for your team See benefits

Table of Contents

ToggleWhen it comes to UPI, India leads the world in seamless digital payments. Millions of us already use UPI apps like Google Pay, PhonePe, Paytm, and Jupiter daily. But the real game-changer is the ability to link a credit card to UPI, and that’s where RuPay credit cards come in. To put it in numbers, NPCI stated that RuPay credit on UPI recorded Rs. 63,825.8 crore worth of transactions by October FY25. This makes RuPay network one of the tough contenders in the credit card network other than VISA and Mastercard.

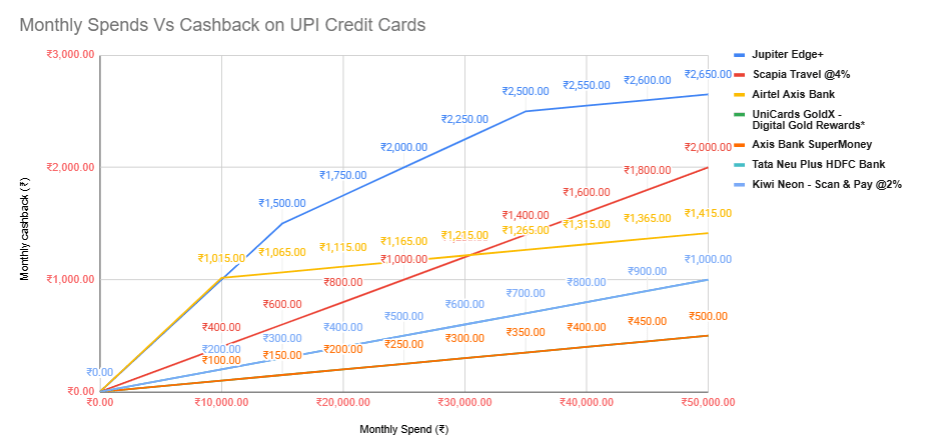

If you’ve been searching for the best UPI credit card in India, let me be direct: Jupiter Edge+ RuPay Credit Card is the smartest choice for 2025. It combines unbeatable cashback rates, RuPay UPI convenience, and premium lifestyle perks that no other card offers at this scale. Let the data talk for itself, see below.

We will go into comparison directly with multiple UPI credit cards in India. If you want to know what a UPI Credit card is, check below. We have explained what a RuPay Credit Card is.

| Monthly Spend (₹) | Jupiter Edge+ | Scapia Travel (4%) | Airtel Axis Bank | UniCards GoldX | Axis SuperMoney | Tata Neu Plus HDFC | Kiwi Neon (2% UPI) |

| 10,000 | 1,000 | 400 | 1,015 | 100 | 100 | 200 | 200 |

| 20,000 | 1,750 | 800 | 1,115 | 200 | 200 | 400 | 400 |

| 30,000 | 2,250 | 1,200 | 1,215 | 300 | 300 | 600 | 600 |

| 50,000 | 2,650 | 2,000 | 1,415 | 500 | 500 | 1,000 | 1,000 |

Why Jupiter Edge+ wins: Even at ₹50,000 monthly spend, it gives the highest cashback among all UPI credit cards. No competitor comes close.

| Credit Card | Joining Fee / One-time Fee | Annual / Renewal Fee | Is it Lifetime Free? |

| Jupiter Edge+ | ₹ 499 + GST | No annual fee | Yes (after paying the one-time joining fee) |

| Scapia Travel / Scapia Federal | None (zero joining fee) | None | Yes |

| UniCards GoldX (BOBCARD Uni GoldX) | None (zero joining fee) | None (zero renewal/annual fee) | Yes |

| Airtel Axis Bank | ₹ 500 (primary card) | ₹ 500 from 2nd year onwards; can be waived on spends ≥ ₹2,00,000 in a year | No (unless you meet the waiver condition) |

| Tata Neu Plus (HDFC Bank) | ₹ 499 + taxes (joining/membership fee) | ₹ 499 + taxes annually; waived off if you spend ₹1,00,000 in a year | No (waiver possible) |

| Axis Bank SuperMoney (RuPay) / Axis Bank SUPERMONEY | ₹ 0 (No joining fee) | ₹ 0 (No annual / renewal fee) | Yes – Lifetime Free Credit Card |

| Kiwi Neon – Scan & Pay | Membership fee of ₹ 999/year + taxes for Kiwi Neon subscription if opted. (This is above the base card) | Base credit card has no joining / annual fees, but if you opt for Kiwi Neon subscription, that costs ₹ 999/yr. | The base Kiwi credit card is lifetime free, but the Neon membership adds a paid subscription for additional benefits. |

Last Updated: 15th September 2025

A UPI credit card is simply a RuPay credit card linked to your favorite UPI app. Instead of paying from your bank account, the money is charged to your credit card. So, it is a RuPay credit card on UPI that can be linked to UPI apps for QR code and app-based payments, while still offering cashback, travel benefits, and lifestyle perks.

This means:

It’s UPI with the power of credit.

Just for your information, a RuPay Credit Card is a credit card issued on the RuPay network, India’s domestic card payment system developed by the National Payments Corporation of India (NPCI).

Unlike Visa or Mastercard, which are international networks, RuPay is made in India for Indian users, offering faster transactions, lower processing fees, and better acceptance across government services and UPI integration.

We’ve compared leading RuPay UPI credit cards across cashback categories, features, and benefits. Here’s why Jupiter Edge+ is the card I recommend without hesitation.

This structure is designed for everyday spenders who shop, travel, and pay bills.

Unlike generic perks on other cards, these are benefits you’ll genuinely use.

Here’s the best part: you can link your Jupiter Edge+ RuPay Credit Card directly inside the Jupiter app.

Other banks may allow UPI credit card linking, but Jupiter provides a native experience inside the same app where you already track your money. That’s true simplicity.

Scapia is a card designed for travel enthusiasts. It gives a flat 4% cashback (Scapia coins) on every transaction, with no complicated categories. These rewards can be redeemed for flights and hotels on the Scapia app, making it perfect for frequent flyers. Since it’s RuPay-based, you can link it to UPI and use it anywhere, from airport lounges to local cafes. If your biggest expense is travel, Scapia is the right UPI credit card for you.

If you’re an Airtel customer or heavy Amazon user, the Airtel Axis Bank Credit Card is a great pick. It offers:

It’s RuPay-enabled, which means you can link it to UPI for your daily merchant payments. The value here is clear if you’re already in the Airtel ecosystem and regularly shop on Amazon.

UniCards GoldX stands out with its unique digital gold reward system. Every cashback you earn gets credited as digital gold. While the raw cashback rate is lower compared to other cards, this approach is attractive if you want your spending to translate into long-term gold savings. With UPI linking, you can use it for daily QR payments and watch your gold balance grow.

Axis Bank SuperMoney is built around utility payments. It provides steady cashback and rewards on bills like electricity, broadband, and water. If a large share of your monthly budget goes into recurring bills, this card maximizes your UPI-linked savings. While not as exciting for shopping or travel, it fills the gap for consistent bill payers who want rewards on UPI auto-payments.

The Tata Neu Plus HDFC Bank card is all about the Tata ecosystem. It gives rewards in the form of NeuCoins, which you can use across Tata brands like BigBasket, Croma, Tata Cliq, Air India, and Taj Hotels. Linked with UPI, it extends these benefits to QR code spends while keeping Tata loyalty benefits intact. If you shop at Tata brands regularly, this is a natural choice.

Kiwi Neon is India’s first card designed specifically for UPI Scan & Pay. It gives a flat 2% cashback every time you scan and pay using UPI. This makes it perfect for small daily spends like groceries, chai, cabs, and local shopping, where UPI QR payments dominate. It doesn’t have premium perks like Prime or travel, but for people who live on UPI QR codes, Kiwi Neon is a simple and effective cashback tool.

If you want the best UPI credit card in India, go for Jupiter Edge+ RuPay Credit Card. Here’s why I recommend it over every other card:

Other cards like Scapia, Airtel Axis, or Kiwi Neon serve niche use cases, but Jupiter Edge+ is the all-rounder that maximizes both online and offline UPI payments.

A UPI credit card is a RuPay credit card linked to UPI apps for QR payments, while a normal credit card is used through swipes, taps, or online transactions.

Yes. You can use Jupiter Edge+ CSB Credit Card directly on Jupiter App or you can link on apps like Google Pay, PhonePe, Paytm, and other UPI apps.

Yes, you can link RuPay Credit Cards on Jupiter money and use it for scan & pay payments on QR.

UPI credit card payments at merchants (P2M) are free. Charges may apply only for peer-to-peer (P2P) transfers or may be disabled by default.

You earn 1% cashback on UPI QR payments, plus category-based higher rewards on shopping and travel.

The RBI has set a UPI credit card transaction limit of ₹1 lakh per day for most merchants.

Yes, because it combines the rewards of a credit card with the convenience of UPI. For QR and small spends, it’s more practical.

There is a one-time joining fee of ₹499, but no annual fee. The free Amazon Prime membership alone offsets this cost.

Only Jupiter combines high cashback rates, premium lifestyle perks, and native UPI integration in one app.

If you shop online, travel occasionally, and use UPI for daily spends, Jupiter Edge+ is the card that saves you the most money.

Priyanka Rao is a content strategist for Jupiter.Money, and specializes in writing on topics related to finance, banking, budgeting, salary & wages, and other financial matters. She has a passion for creating engaging content that resonates with audiences across various digital platforms. In her free time, Priyanka enjoys traveling and reading, which allows her to gain new perspectives and inspiration for her work. With a keen eye for detail and a creative mindset, Priyanka is committed to creating content that connects well with her readers, enhancing their digital experiences.

Powerd by Issued by