Travel credit cards are designed to help frequent travellers save money on flight, train, and bus tickets and hotel bookings. You might have come across many credit cards which has multiple offers, but if you are a Hodophile (person who loves to travel), then you need a credit card that caters to your traveling needs. These credit cards offer other benefits, including airport lounge access, free flight tickets, air miles, and co-branded benefits.

Best Travel RuPay Credit Cards in India

| Credit Card | Joining Fees | Lifetime Free | Annual Fee Waiver Amount | Welcome Benefits | Cashback Features | Rewards | Other Features |

| IRCTC Bank of Baroda RuPay Credit Card | Rs 500 | No | No | 1,000 bonus reward points on a transaction of Rs 1,000 within 45 days | NA | 1% on transaction charges by booking train tickets on IRCTC.

40 reward points for every Rs 100 spent on IRCTC 4 reward points for every Rs 100 spent on grocery |

4 complimentary railway lounge access

1% fuel surcharge waiver |

| Yatra SBI Card | Rs 499 | No | Yes, provided annual spend exceeding Rs 1 lakh | Yatra.com vouchers worth Rs 8,250 | Rs 1,000 off on domestic flight bookings and Rs 4,000 off on international flights

Flat 20% off on domestic hotel booking |

6 reward points on every Rs 100 spent on departmental stores, groceries, dining, movies, entertainment, and international spends. | Get 6 vouchers in a calendar year

1% fuel surcharge waiver Complimentary air accident cover of Rs 50 lakhs |

| IRCTC HDFC Bank RuPay Credit Card | Rs 500 | No | Yes, provided annual spend exceed Rs 1.5 lakhs | NA | 5% cashback on bookings done via HDFC Bank Smart Buy | 5 reward points for every Rs 100 spent on IRCTC

1 reward point for every Rs 100 spent on other categories 1% transaction cherges waiver on bookings done on IRCTC |

8 complimentary railway lounge access per year |

| IRCTC SBI RuPay Credit Card | Rs 500 | No | No | Rs 350 bonus reward points for spending Rs 500 within 45 days | NA | 1 reward point for every Rs 125 spent on non-fuel purchases

Save 1% on transaction charges on railway ticket bookings on IRCTC |

1% fuel surcharge waiver

4 complimentary railway lounge access in a year |

Updated: 26th December 2023

Want to get a Credit Card which offers 5% cashback on UPI spends?

👉🏼 Join The Waitlist for Edge CSB Bank RuPay Credit Card

Best RuPay Credit Cards in India for Travel (in detail)

1. IRCTC Bank of Baroda RuPay Credit Card

- IRCTC Bank of Baroda RuPay Credit Card is a travel card that offers the following benefits.

- Joining fee Rs 500 plus GST, annual fee Rs 350 plus GST.

- One thousand bonus reward points on a single transaction of Rs 1000 or more within 45 days of issuance.

- Up to 40 reward points for Rs 100 train ticket booking on the IRCTC website and mobile app.

- Save 1% on transaction charges by booking train tickets on the IRCTC website and mobile app.

- Four reward points for every Rs 100 spent on grocery and departmental stores and reward points for every Rs 100 spent on other categories.

- Four complimentary railway lounge access per year (1 per quarter) at partner railway lounges.

- 1% fuel surcharge waiver on all fuel transactions between Rs 500 and 3,000

2. Yatra SBI Card

Yatra SBI Card is a travel card and has the following benefits.

- Round-the-year discount of Rs 8,250 on domestic flights immediately after getting the card.

- Get six vouchers in a calendar year.

- Get Rs 1,000 off on domestic flight bookings, provided the minimum booking is Rs 5,000.

- Get Rs 4,000 off on international flights provided the minimum booking is Rs 40,000.

- Flat 20% off on domestic hotel booking provided the minimum booking is Rs 3,000.

- Six reward points for every Rs 100 spent on departmental stores, groceries, dining, movies, entertainment, and international spending.

- 1% fuel surcharge waiver.

- Annual membership fee reversal from second year on annual spends of Rs 1 lakh.

You might also be interested in reading about:

- Best RuPay Credit Card in India

- Best RuPay Credit Card for Shopping and Reward Points

- Best RuPay Fuel Credit Card in India

- Best RuPay Fuel Credit Card in India

- How To Link Credit Cards To UPI?

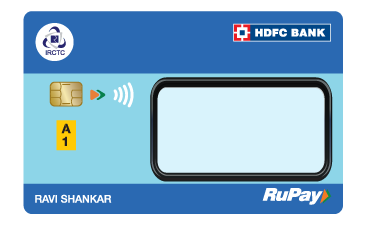

3. IRCTC HDFC Bank RuPay Credit Card

IRCTC HDFC Bank RuPay Credit Card has the following benefits.

- Five reward points for every Rs 100 spent on the IRCTC ticketing website and Rail Connect App.

- One reward point for every Rs 100 spent on all other spends.

- Additional 5% cashback on bookings done via HDFC Bank SmartBuy.

- Eight complimentary railway lounges every year.

- 1% transaction charges waiver on bookings done on IRCTC website and Rail Connect App.

4. IRCTC SBI RuPay Credit Card

IRCTS SBI RuPay Credit Card has the following benefits.

- Up to 10% value back.

- 1% transaction surcharge waiver.

- Railway lounge access.

How do travel credit cards work?

Travel credit cards work like a normal credit card, but, you get travel rewards or points for your spends. These rewards are usually called ‘points’ or ‘miles’. Usually these points are useful either for booking stays at hotels/ accommodations or for booking tickets from airlines, trains or buses. Other common benefits include lounge access at airports and railway stations, trip cancellation insurance, baggage delay or lost baggage insurance, discounts in rental car bookings, etc.

Do credit cards offer travel insurance?

Yes, some of the credit cards like Yatra SBI Card offers air accident insurance up to Rs. 50 lakhs with certain terms and conditions in place. Some selective credit cards offer insurance for trip cancellations, lost or delayed baggage, medical emergencies, accidental disability, and issues related to rental car insurance. You need to check with your credit card provider for these details as it is not clearly mentioned upfront.