Get salary accounts for your team See benefits

Table of Contents

ToggleAre you tired of the hassle of carrying cash or juggling multiple cards for your daily fuel expenses? A fuel credit card can simplify your life and offer significant benefits.

In today’s fast-paced world, fuel expenses are a significant part of our daily lives. Whether you’re commuting to work, travelling, or simply running errands, having a reliable and efficient way to pay for fuel is essential. A fuel credit card can provide you with a convenient and rewarding solution.

In this blog post, we’ll explore the best RuPay fuel credit cards available in India for September 2025. We’ll delve into the benefits of using fuel credit cards, the factors to consider when choosing the right one, and the top contenders that offer the most value. Let’s get started.

| Credit Card | Joining Fees | Lifetime Free | Annual Fee Waiver Amount | Cashback Features |

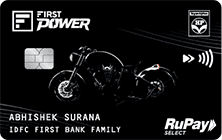

| IDFC First Power RuPay Select Credit Card | Rs 199 | No | ₹50,000 or more in a year | Up to 5% cashback on fuel purchases |

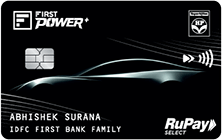

| IDFC FIRST HPCL Power+ Credit Card | ₹499 | No | ₹1,50,000 or more in a year | Earn cashback on your fuel purchases |

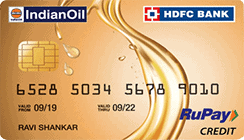

| HDFC Indian Oil Credit Card | ₹500 + Tax | No | ₹50,000 or more in a year | 5% Fuel Points on IndianOil Fuel Spends |

| IndianOil Axis Bank Credit Card | ₹500 | No | Nil | Fuel Spends In India at any Fuel outlet between INR 400 to INR 4000 to avail the offer |

| IndianOil Kotak Credit Card | ₹449 | No | ₹50,000 or more in a year | Enjoy a 4% discount on IndianOil fuel spends |

| ICICI HPCL Super Saver Credit Card | ₹500 + Tax | No | ₹1,50,000 or more in a year | Enjoy cashback on your fuel purchases at HPCL petrol pumps |

| ICICI Coral Credit Card | ₹199 + Tax | No | ₹50,000 or more in a year | Earn 2.5% cashback on fuel purchases at HPCL pumps (minimum transaction of Rs. 500) |

| HPCL ENERGIE RuPay BOBCARD | ₹499 | No | ₹50,000 or more in a year | Enjoy cashback on fuel purchases made at HPCL petrol pumps |

Joining Fees

₹199

Lifetime Free

No

Annual Fee Waiver Amount

₹50,000 or more in a year

Up to 5% cashback on fuel purchases

Looking for a credit card that rewards your love for road trips? The IDFC FIRST HPCL Power Credit Card might be a good fit. This card lets you earn savings on fuel purchases at HPCL pumps, making it a tempting option for frequent drivers.

Other Benefits Offered:

Joining Fees

₹499

Lifetime Free

No

Annual Fee Waiver Amount

₹50,000 or more in a year

Earn cashback on your fuel purchases

IDFC FIRST HPCL Power+ Credit Card is an upgraded version of the popular Power Credit Card. It offers a range of benefits specifically designed for frequent travellers and those who prioritise fuel savings. Key fuel-related perks include:

Other Benefits Offered:

Joining Fees

₹500 + Tax

Lifetime Free

No

Annual Fee Waiver Amount

₹50,000 or more in a year

5% Fuel Points on IndianOil Fuel Spends

The HDFC IndianOil Credit Card is a co-branded credit card made in collaboration with Indian Oil. It offers a unique rewards program where you can earn Fuel Points on your everyday spends. These points can then be redeemed for free fuel at IndianOil petrol pumps.

Other Benefits Offered:

Joining Fees

₹500

Lifetime Free

No

Annual Fee Waiver Amount

Nil

Fuel Spends In India at any Fuel outlet between INR 400 to INR 4000 to avail the offer

The IndianOil Axis Bank Credit Card offers a range of benefits tailored for fuel-savvy consumers. Key features include:

Other Benefits Offered:

Joining Fees

₹449

Lifetime Free

No

Annual Fee Waiver Amount

₹50,000 or more in a year

Enjoy a 4% discount on IndianOil fuel spends

The IndianOil Kotak Credit Card is a solid choice for those who frequently fill up at IndianOil petrol pumps. Its main features include:

Other Benefits Offered:

Joining Fees

₹500 + Tax

Lifetime Free

No

Annual Fee Waiver Amount

₹1,50,000 or more in a year

Enjoy cashback on your fuel purchases at HPCL petrol pumps

The ICICI HPCL Super Saver Credit Card is a great option for those looking to save on fuel, utility, and departmental store spends. With its fuel-centric features and other benefits, this card offers a rewarding experience for all users.

Other Benefits Offered:

<li>Movie Ticket Discounts: Enjoy discounts on movie tickets at BookMyShow and INOX.

Joining Fees

₹199 + Tax

Lifetime Free

No

Annual Fee Waiver Amount

₹50,000 or more in a year

Earn 2.5% cashback on fuel purchases at HPCL pumps (minimum transaction of Rs. 500)

The ICICI HPCL Coral Credit Card is a great option for people who are looking for a credit card with easy eligibility requirements and low annual fees. It offers you features such as:

Other Benefits Offered:

Joining Fees

₹499

Lifetime Free

No

Annual Fee Waiver Amount

₹50,000 or more in a year

Enjoy cashback on fuel purchases made at HPCL petrol pumps

HPCL ENERGIE RuPay BOBCARD is a fuel-centric credit card that offers a range of benefits for frequent travellers and those who frequently fill up their vehicles at HPCL petrol pumps. This card is designed to make your fuel purchases more rewarding and convenient.

Other Benefits Offered:

RuPay fuel cards are specifically designed to provide advantages for fuel purchases. These cards offer benefits like free fuel or cashback on fuel transactions. Here are some of the top reasons why you should choose a RuPay Credit Card:

RuPay Fuel Credit Cards can be seamlessly linked to popular UPI apps like Google Pay, PhonePe, and Cred. This integration allows for quick and convenient payments at fuel pumps.

Many RuPay fuel cards offer fuel surcharge waivers, eliminating the extra charges imposed by petrol pumps.

Using a RuPay fuel card can earn you cashback or rewards on your fuel purchases and other transactions. These rewards can be redeemed for various benefits.

RuPay fuel cards often come with exclusive offers and discounts on fuel, travel, and other categories. These benefits can help you save money on your daily expenses.

By choosing a RuPay Fuel Credit Card, you are supporting the Indian economy and contributing to the growth of domestic financial institutions.

When choosing a RuPay Fuel Credit Card, here are some factors you should consider:

Before picking a card, check how much you’ll need to pay as an annual or joining fee. Some cards come with low fees, while others offer benefits that make higher fees worth it. Make sure the cost fits your budget and provides good value.

It’s important to look at the interest rate on the card. This is the rate charged if you carry a balance or miss a payment. A lower interest rate can help you save money if you ever need to pay off your card over time.

One key feature of fuel credit cards is the fuel surcharge waiver. This percentage indicates how much you can save on fuel purchases, typically ranging from 1% to 2.5%. The higher the waiver, the more you’ll save on every refuel.

Consider whether the card offers cashback or reward points for fuel purchases or other transactions. Cards with good cashback or rewards can help you earn back a portion of what you spend, making them a great choice for frequent fuel buyers.

Look into any extra perks the card offers, such as discounts, exclusive deals, or insurance coverage. These additional benefits can add value and enhance your overall experience with the card.

Considering public opinion on Fuel Credit Cards over some social platforms, The IDFC First Power+ credit card emerged as a popular suggestion, praised for its cashback benefits and availability on the RuPay network, allowing for UPI transactions.

Comment

byu/sinbad_91 from discussion

inCreditCardsIndia

Which RuPay fuel card is best for low-income individuals?

For individuals with low income seeking a RuPay fuel credit card, the IDFC FIRST HPCL Power Credit Card is a commendable option. This card offers a low joining fee of ₹199 and provides up to 5% cashback on fuel purchases at HPCL pumps. Additionally, the annual fee is waived upon spending ₹50,000 or more in a year, making it accessible for those with modest incomes.

Yes, you can use your RuPay fuel credit card for a variety of purchases, just like you would with any other credit card. However, keep in mind that the special benefits and rewards offered for fuel transactions may not be available for other types of purchases.

You can apply for a RuPay fuel credit card either online through your bank’s website or by visiting a local branch. The exact process might differ depending on the bank or the specific card you're applying for.

In most cases, there are no specific restrictions on which fuel stations you can use your RuPay fuel credit card. It generally works at all fuel stations, but it's a good idea to check your bank’s guidelines for any exceptions.

Fuel credit cards offer a range of benefits that lower your fuel expenses. With a combination of cashback, reward points, fuel surcharge waivers, and vouchers, they can reduce your total fuel costs and also offer discounts on non-fuel spending.

Yes, it is definitely a good idea to use a credit card for fuel. Banks offer fuel credit cards, which will bring down the total fuel costs and increase your savings. Additionally, these cards also give you reward points and vouchers, which come in handy during your shopping sprees.

Fuel cards do not offer lifetime free benefits. However, they waive the annual fee if you spend a minimum amount during a calendar year.

The fuel surcharge is the excess charges levied by credit card companies on the purchase of fuel. When a credit card allows a fuel surcharge waiver, it absorbs the additional costs of fuel purchases, which will reduce your overall fuel expenses.

Best

Credit Cards

Fuel

Credit Cards

Premium

Credit Card

Business

Credit Card

Students

Credit Cards

Online Shopping Credit Cards

Airport Lounge Credit Cards

Book Flights Credit Cards

International Travel Credit Card

Movie Tickets Credit Cards

Rewards

Credit Cards

Lifetime Free Credit Card

Utility Bill Payment Credit Card

Insurance Payment Credit Card

Priyanka Rao is a content strategist for Jupiter.Money, and specializes in writing on topics related to finance, banking, budgeting, salary & wages, and other financial matters. She has a passion for creating engaging content that resonates with audiences across various digital platforms. In her free time, Priyanka enjoys traveling and reading, which allows her to gain new perspectives and inspiration for her work. With a keen eye for detail and a creative mindset, Priyanka is committed to creating content that connects well with her readers, enhancing their digital experiences.

Priyanka Sharma is the Head of Credit Cards (Sr. Director Business & Product - Credit Cards) at Jupiter Money, where she leads the growth and development of the company’s credit card portfolio. She is responsible for driving strategic initiatives and enhancing customer experiences through innovative credit products. Priyanka’s leadership is shaping Jupiter’s approach to simplifying personal finance for its customers.

Prior to her role at Jupiter Money, Priyanka was an Engagement Manager at McKinsey & Company, where she provided strategic advice to clients across various sectors. Her expertise in business strategy, growth, and operations was built on her strong analytical skills and client-focused problem-solving abilities. Earlier in her career, she worked at ZS, a global business consulting firm, where she contributed to various projects, gaining significant experience in data-driven business decisions.

Priyanka holds a Post Graduate Programme in Management with a focus on Finance, Strategy, and Leadership from the Indian School of Business (ISB), where she graduated with distinction, earning a place on the ISB Dean’s List. This prestigious academic achievement underscores her deep understanding of financial strategy and leadership, which she continues to leverage in her fintech leadership role.

Powerd by Issued by