Home Loan EMI Calculator

Taking out a home loan is a significant financial decision, one that requires careful planning and consideration. Whether you're a first-time homebuyer or looking to refinance, understanding your monthly commitments is crucial. That's where a Home Loan EMI Calculator becomes a useful tool. This calculator not only helps you estimate your monthly payments but also empowers you to make informed financial decisions with ease.

What is a Home Loan EMI Calculator?

A Home Loan EMI Calculator is a convenient online tool designed to help you calculate your monthly home loan payments. This home loan prepayment calculator acts as your personal loan advisor, helping you estimate the exact amount you'll need to pay each month (EMI) to repay your home loan. By using this calculator, you can:

- Plan Your Budget: Get a clear picture of how much you can afford to borrow based on your financial situation.

- Compare Loan Offers: Evaluate different loan options by comparing interest rates and EMIs from various lenders.

- Visualize Long-Term Costs: Understand the total repayment amount over the loan tenure, including both principal and interest, to make better financial decisions.

How to Use a Home Loan Calculator? Step-by-Step Guide

Using a home loan EMI calculator is easy and can help you get a quick estimate of your monthly loan payments. Here's how it works:

- Enter Loan Amount: Start by entering the total sum of money you plan to borrow for your home loan. This is known as the principal loan amount.

- Enter Interest Rate: Next, input the annual interest rate offered by your lender. This rate is typically a percentage. Be sure to confirm if it's a fixed or adjustable rate.

- Enter Loan Tenure: Input the timeframe for repaying the loan, usually specified in years. The chosen tenure significantly impacts your monthly EMI. Longer tenures result in lower EMIs, while shorter tenures lead to higher EMIs.

- Add Pre-Payment Amount (if applicable): Now, enter the amount you wish to pre-pay, if any, and related information or skip this step.

- Add Processing Fee Amount (if applicable): Next, enter the processing fee amount.

- Calculate Your EMI: Once you've entered all the details, the home loan emi prepayment calculator will process this information and quickly generate your EMI payment table or amortisation schedule.

- Review Your Results: The EMI calculator amortisation table provides insights into several key aspects:

- Monthly EMI: This is the fixed amount you'll pay each month.

- Principal Amount: This shows the total principal amount you'll pay over the entire loan tenure.

- Total Interest Payable: This shows the total interest you'll pay over the entire loan tenure.

- Pre-payment: This is the amount you have chosen to pay ahead and have entered into the calculator.

- Total Payment (Principal + Interest + Pre-payment): This is the sum of the principal loan amount, the total interest payable and your pre-payment amount.

- Loan Paid to Date: This reflects the loan you have paid and can help you figure out your outstanding loan balance after each EMI payment, allowing you to track the remaining loan amount over time.

Home Loan Prepayment Calculator

If you are looking to close your loan sooner and want to save on interest amount, you can use our Prepayment Calculator facility in the above calculator. See how a one-time prepayment impacts your total interest and tenure.

Enter Prepayment Amount (₹)

Choose Prepayment Timing (Year or Month)

Illustrative Example:

Example:

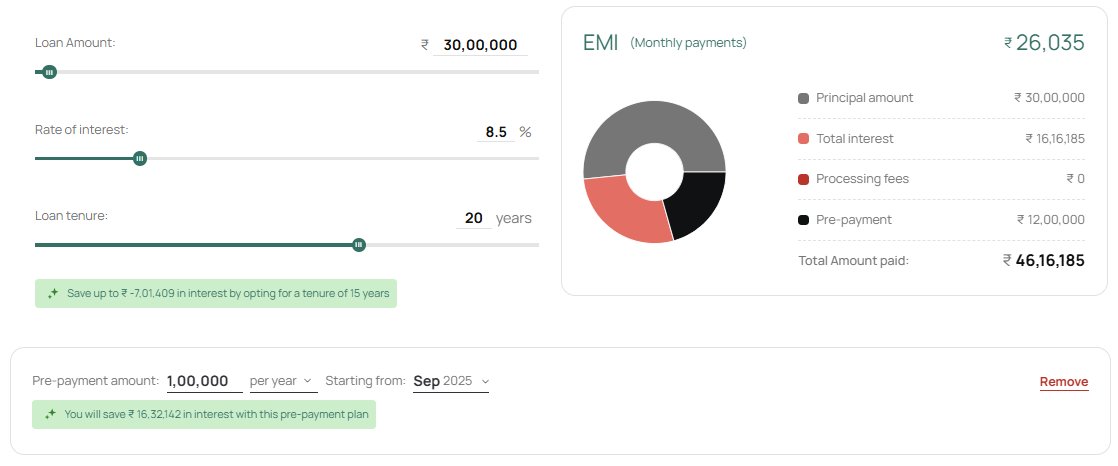

For a ₹30 lakh home loan at 8.5% p.a., 20-year tenure:

Without prepayment: Total interest ≈ ₹ 32,48,327

With ₹1 lakh prepayment every year:

Total interest saved ≈ ₹16,16,185

Total interest saved ≈ ₹16,32,142

→ You save ₹16.3 lakh in interest and reduce your tenure to 11 years and a few months instead of 30 years.

Common Home Loan EMI values:

Note: We have considered the interest rate at 8.75% for the home loan EMI calculations. Use this for informational purposes only. To know how to save on interest amount, check the insights on the Home Loan EMI calculator above.

How to Calculate Home Loan EMI?

EMIs are calculated using a formula that considers three key factors:

1. Principal Loan Amount (P): The total amount you borrow from the lender.

2. Interest Rate (R): The annual interest rate charged by the lender on the loan

amount.

3. Loan Tenure (N): The total duration (in years) for which you repay the loan.

The EMI calculation is based on a standard mathematical formula: EMI = [P x R x (1+R)^N] / [(1+R)^N - 1]

The EMI calculation is based on a standard mathematical formula:

EMI

=

P × r × (1+r)n

(1+r)n-1

Where:

- PPP is the principal loan amount

- r is the monthly interest rate (annual interest rate divided by 12 and then by 100)

- n is the loan tenure in months (loan tenure in years multiplied by 12)

Explanation with an Example Let’s consider an example to illustrate the calculation:

- Loan Amount (P): ₹30,00,000

- Annual Interest Rate: 8%

- Loan Tenure: 20 years

Step 1: Convert the annual interest rate to a monthly rate:

r

=

8

12 × 100

=

0.00667

Step 2: Convert the loan tenure to months:

n = 20 × 12 = 240

Step 3: Plug these values into the formula:

EMI

=

30,00,000 × 0.00667 × (1+0.00667) 240

( 1+0.00667 ) 240 -1

Step 4: Calculate the EMI:

EMI

=

30,00,000 × 0.00667 × 4.9307

4.9307 - 1

EMI

=

98663.307

3.9307

EMI ≈ ₹25,100

So, the monthly EMI for a loan amount of ₹30,00,000 at an 8% annual interest rate over 20 years would be approximately ₹25,100.

Benefits of Using a Prepayment Calculator for Home Loan

- Quick and Convenient: Using a home loan EMI calculator is straightforward. Just enter some basic details, and you'll get your results in seconds. Plus, it's completely free and doesn't require any registration.

- Accurate Estimates: Get reliable results without any manual calculation errors.

- Compares Loan Offers: Easily compare different loan options side-by-side to find the best fit for your needs.

- Detailed Breakdown: See a clear picture of how your repayments will be structured, including EMI amounts.

- Plan Your Tenure: The calculator can help you choose a loan term that aligns with your financial situation.

Home Loan EMIs Payment Options

- Online Transfers with Net Banking: Pay your EMI through online platforms from your computer or phone using your bank's mobile app. Ensure a secure internet connection and follow your bank's instructions for security.

- Unified Payments Interface (UPI): Connect your bank account to a UPI app and make payments quickly and easily. UPI offers instant and secure transfers.

- In-Person Payments at the Bank: Visit your bank branch to make your payment over the counter. This allows you to speak with a bank representative if you have any questions.

- ECS (Electronic Clearing Service): Authorise your bank to automatically deduct the EMI amount from your account on the due date, eliminating the need for paper checks or visiting a branch.

- Mobile Wallets: Use mobile wallet apps to manage your EMI payments. These apps offer features like transaction history, alerts, and reminders.

- Cheque Payments: Submit a cheque for your EMI payment at the bank branch. Cheques provide a physical record of payment but can be slower due to processing times.

- Electronic Standing Instruction (e-Mandate): Set up automated payments through e-Mandate for recurring payments. It combines the ease of automatic deductions with the speed of online platforms.

- National Automated Clearing House (NACH): Similar to ECS, NACH handles large numbers of transactions electronically. Authorise your bank to automatically deduct your EMI payment.

Charges Applicable on Non-payment of Home Loan EMIs

- Late Payment Penalties and Fees: Missing an EMI payment can result in late fees, interest on the overdue amount, and other penalties depending on your lender's policies. Typically, late fees range from 1% to 2% of the EMI amount due.

- NACH/SI/Cheque Bounce Charges: These charges apply when a home loan payment fails due to insufficient funds in the linked account or if the account is closed.

- Negative Impact on Credit Score: Making on-time payments helps build a good credit score. Missing a payment can lower your credit score significantly and affect the credit score of someone who co-signed your loan application.

- Can Affect Transfer Eligibility: Missed payments can make it harder to qualify for a balance transfer to a new lender with a lower interest rate.

- Non-Performing Asset (NPA) Status: If you miss your first two loan payments, your lender will send reminders. If you haven't made a payment in 90 days, your loan may be classified as a Non-Performing Asset (NPA).

- Increased Costs for Subsequent EMI Payments: Missing a home loan EMI can result in increased future payments due to added late fees and penalties.

What Factors Affect Your Home Loan EMI?

- Loan Amount (Principal): The total sum you borrow for your home purchase. A larger loan amount translates to a higher EMI payment.

- Interest Rate: The interest rate offered by the bank determines how much you pay in addition to the loan amount. A higher interest rate translates to a higher EMI.

- Processing Fee: The processing fee covers the cost of reviewing your home loan application. It's usually a percentage of the loan amount or set as a fixed fee.

- Loan Tenure: Longer loan tenures result in lower monthly EMIs but higher total interest paid over time. Shorter tenures lead to higher monthly EMIs but lower total interest.

- Prepayments: Making extra payments towards your home loan can significantly impact your EMIs. These prepayments reduce the outstanding principal amount, leading to lower EMIs.

What are Flexible and Fixed Home Loan EMIs?

While most home loan EMIs are fixed throughout the loan term, they might change in some situations:

- Flexible Home Loan EMIs: Step-up loans gradually increase your EMI amount over the loan term, while step-down loans see a decrease in EMI as time goes on.

- Partly Disbursed Loan: You may encounter pre-EMIs initially if your loan is disbursed in stages.

- Impact of Rising Floating Interest Rates: If the repo rate changes, it can affect your floating interest rate. If the interest rate goes up, your lender might extend your loan term or increase your EMI.

- Home Loan Prepayment: Making additional payments towards your home loan principal can affect your EMIs. You can lower your EMI amount or shorten the loan term.

Frequently Asked Questions (FAQs)

What is a home loan amortisation schedule?

A home loan amortisation schedule is a detailed breakdown of your monthly loan payments over the entire loan term, showing how much goes towards interest and how much towards reducing the principal loan amount.

Is a home loan EMI calculator accurate?

Home Loan EMI calculators are generally very accurate but should be used as an estimate. The actual EMI might differ slightly due to factors like rounding and processing fees.

Is it free to use Jupiter's home loan EMI Calculator?

Yes, Jupiter's Home Loan EMI Calculator is completely free to use.

Is GST applicable to home loan EMI?

No, GST is not applicable to the EMI amount itself. However, GST might be levied on processing fees or other charges associated with the home loan.

What is the eligibility criteria for getting a home loan?

Eligibility criteria vary by lender but generally consider your income, credit score, employment status, and down payment amount.

What happens if the home loan EMI is not paid?

Late or missed EMI payments can damage your credit score and lead to late payment penalties. In severe cases, the lender may repossess the property.

Does home loan EMI change with the increase in home loan interest rates?

No, your EMI amount typically remains fixed for the entire loan term with a fixed interest rate. However, with adjustable-rate mortgages, your EMI can fluctuate if the interest rate changes.

What are the different types of home loans available?

Several home loan types exist, including fixed-rate, adjustable-rate, and special programs for first-time homebuyers.

Is it possible to change my home loan EMI amount during the loan tenure?

Yes, your EMI can change in some cases, such as with adjustable-rate mortgages or if you make additional principal payments.

What are the tax benefits of paying home loan EMIs?

In many countries, you can deduct a portion of the interest paid on your home loan from your taxable income.

What is the EMI for a 20 Lakh home loan?

Use a home loan EMI calculator to estimate your EMI for a specific loan amount, interest rate, and loan term.

How to pay extra EMI for home loan?

Most lenders allow you to make additional principal payments towards your home loan. Contact your lender to learn about their specific process.

When does home loan EMI start for under construction property?

For under-construction properties, EMI payments often start after construction is complete and the property is ready for possession. There might be a pre-EMI interest charged during the construction phase.

Can I pay home Loan EMI through credit card?

Generally, paying your home loan EMI through a credit card is not advisable due to high credit card interest rates. Additionally, not many lenders offer this option.

Can we stop home loan EMI for a few months?

Most lenders don't offer the option to completely stop EMI payments. However, some might offer loan modification programs that could temporarily reduce your EMI amount.

How to reduce EMI of existing home loan?

There are ways to potentially reduce your EMI, such as refinancing your loan at a lower interest rate or making a larger down payment.

When does my home loan EMI start?

The start of your EMI payments typically depends on the loan type and property status. For already constructed properties, EMIs usually begin one month after loan disbursal.

What is a pre-EMI interest on a home loan?

Pre-EMI interest is the interest charged on the disbursed loan amount during the construction period of an under-construction property.

How does your home loan repayment work?

Your home loan repayment consists of monthly payments that include both principal and interest. The portion towards principal increases and the interest portion decreases over time.

How much home loan am I eligible for?

The maximum home loan amount you can qualify for depends on several factors, including your income, credit score, existing debts, and the lender's policies. Use a home loan eligibility calculator to get a starting estimate.

Are there any hidden fees associated with a home loan?

While the base interest rate is crucial, there can be additional charges like processing fees, valuation charges, and legal and documentation charges.

How much is 10 lakh home loan EMI?

The EMI for a loan amount of ₹ 10 lakh will be ₹7,867 for a tenure of 30 years OR ₹12,533 for 10 years at 8.75% rate of interest. An EMI on a loan amount of Rs. 10 Lakh will be dependent on the number of years the loan is taken for and the rate of interest set by the Banks or financial institutions.

How much is 20 lakh home loan EMI?

The EMI for a loan amount of ₹ 20 lakh will be ₹15,734 for a tenure of 30 years OR ₹25,065 for 10 years at 8.75% rate of interest. An EMI on a loan amount of Rs. 20 Lakh will be dependent on the number of years the loan is taken for and the rate of interest set by the Banks or financial institutions.

How much is 30 lakh home loan EMI?

The EMI for a loan amount of ₹ 30 lakh will be ₹23,601 for a tenure of 30 years OR ₹37,598 for 10 years at 8.75% rate of interest. An EMI on a loan amount of Rs. 30 Lakh will be dependent on the number of years the loan is taken for and the rate of interest set by the Banks or financial institutions.

How much is 40 lakh home loan EMI?

The EMI for a loan amount of ₹ 40 lakh will be ₹31,468 for a tenure of 30 years OR ₹50,131 for 10 years at 8.75% rate of interest. An EMI on a loan amount of Rs. 40 Lakh will be dependent on the number of years the loan is taken for and the rate of interest set by the Banks or financial institutions.

How much is 50 lakh home loan EMI?

The EMI for a loan amount of ₹ 50 lakh will be ₹40,231 for a tenure of 30 years OR ₹62,663 for 10 years at 8.75% rate of interest. An EMI on a loan amount of Rs. 50 Lakh will be dependent on the number of years the loan is taken for and the rate of interest set by the Banks or financial institutions.

In this article

Back to calculators

Back to calculators