Credit cards can be an excellent tool for navigating financial challenges when cash is tight. They allow you to access funds, make necessary purchases, and settle the balance later. A credit card provides you with significant financial freedom if you use it wisely.

What is Credit Card?

A credit card is one of the most popular financial products almost every bank offers. This works on the model of Buy Now Pay Later. This type of credit line allows you to buy something you need if you don’t have the money to purchase it right now. You are given a certain credit limit that is different for everyone based on their credit score, credit history, creditworthiness, and other factors. You can use your credit card up to the provided spending limit, but you must remember that you will have to pay back the amount. If you fail to do so, the outstanding balance will incur interest rates that will keep increasing the repayment amount till you completely get rid of it.

Since today, almost every bank provides a credit card, the competition has increased. Hence, banks are making an effort to attract customers by adding different rewards and benefits to their credit cards. And not just banks but several marketplaces have tied up with different financial partners to give you credit cards designed for your needs. One such platform is Jupiter!

With Jupiter’s Edge CSB Bank RuPay Credit Card, you can conveniently shop, travel, and dine without having to carry separate credit cards for all the different activities. Enabled with UPI, quickly scan and pay any QR code with no inconvenience!

Benefits and Uses of Credit Cards

A credit card is a great financial product to use when you are having a cash crunch. Further, the rewards and benefits available on it are another reason that makes a credit card so tempting to use.

Use it Conveniently

Eliminate the hassles of carrying cash everywhere you go with the convenience of a credit card. Whether you are making purchases online or offline, in the country or globally, a credit card is a great tool for going contactless!

Get Major Offers, Cashbacks, and Rewards

One of the best credit card benefits is that it comes with heaps of rewards, offers, and cashback. These rewards and offers vary depending on the credit card issuer, and you can redeem these benefits once you start making purchases with your credit card. Depending on your needs, you should get a credit card specifically tailored for you. For example, if you are a frequent traveller, having a credit card that has travel insurance or free airport lounge access will be a great choice. Today, there are credit cards for every need, so explore your options and see the cards’ rewards and offers.

Meet Your Financial Emergencies

Are you having a month-end cash crunch? Or do you need to make a payment that you cannot ignore? A credit card is a quick way to gain access to funds in an emergency. It can cover any type of cost as long as you are spending within the given credit limit. But remember that you will have to repay the amount to avoid adding interest rates to the outstanding balance.

Build Your Credit History

In order to get a loan in the future, you need to have a positive credit history with a great credit score. But how do you get started building your credit history? Get a credit card! If you use a credit card and make timely repayments in full amount, that will increase your credit score and build a good credit history.

Now, before getting a credit card to build a good credit history, make sure you have properly planned how you will use it and repay the amount. Even one missed payment will negatively affect your credit score, disrupting your plans.

Protect from Uncertainties with Purchase Protection

Purchase protection on credit cards is a valuable benefit that safeguards eligible purchases against damage, theft, or loss within a specified period after the purchase, typically ranging from 30 to 120 days, depending on the card issuer. This protection usually applies to new items bought with a credit card and covers incidents like accidental damage, theft, or loss.

To make a claim, cardholders generally need to provide proof of purchase and, in the case of theft, a police report. However, not all items are covered; exclusions commonly include perishable goods, motor vehicles, and certain electronics. The specific terms and conditions of purchase protection can differ based on the card issuer and card type.

Make Use of Travel Benefits

Depending on the credit card issuer and the type of credit card you have, there are tons of travel benefits on credit cards. This is best if you are a frequent traveller, as a credit card may offer you premium lounge access, flight and hotel discounts, travel insurance, and more based on your credit score and the type of credit card you have.

Manage Your Budget

Credit cards can be a great ally in managing your budget. They simplify tracking expenses with monthly statements and handy apps, so you always know where your money goes. Setting spending limits on your card can help you stay within your budget and avoid those impulse buys. Plus, many cards offer rewards and cashback, which can save you money on everyday purchases.

If you pay off your balance in full each month, you can take advantage of interest-free periods and avoid extra charges. Credit cards also send alerts and notifications to remind you about due dates and spending limits, keeping you on track and help building your credit score. The detailed spending categories in your statements can help you see patterns in your spending and make smarter budgeting decisions.

Easy Cash Withdrawals

You can now also withdraw cash with your card. However, withdrawing cash with your credit card isn’t preferred because it comes with a withdrawal fee that can be easily eliminated. But if you really need cash and don’t have any other options, you have this one benefit at your service as well.

Wide Global Acceptance

Some credit cards are globally accepted, meaning you can make product purchases or use services on international websites or stores with the card. But one thing to take care of is the foreign transaction fee. Using a credit card abroad comes with a high foreign exchange rate and foreign transaction fee. So, ensure you know the exact rate on your credit card before making a foreign purchase.

Easy Shopping Experience

If you are a regular shopper, having a credit card specifically meant for shopping purposes can make your shopping experience more rewarding. Make hassle-free payments with your credit card and even gain some vouchers, cashback, or other benefits like reward points for future savings on purchases. Having a credit card is also a great way to fund your shopping needs and avoid disturbing your monthly budget.

Looking for a credit card that offers more than just rewards?

Get the Edge CSB Bank RuPay Credit Card on Jupiter

How Do Credit Cards Work?

A credit card is one of the most useful financial products. It allows you to make purchases and pay for them later, covering your financial needs.

But how do you use a credit card? It’s pretty simple to understand how a credit card works once you understand all the components of your credit card carefully. Let’s begin by examining a credit card carefully.

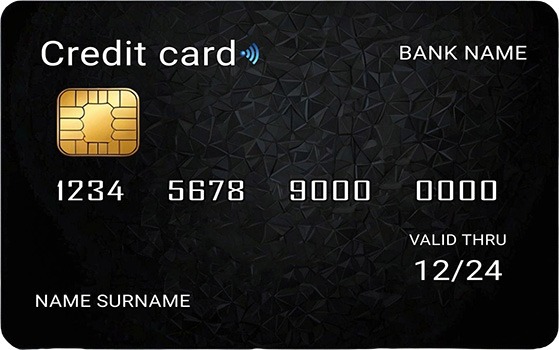

Look at the above image carefully. A credit card contains a number of components that work together. Let’s decode all the labels of the credit card:

- Smart Chip: The smart chip in a credit card is there to provide security. The chip creates a unique transaction code for each purchase, making it difficult for fraudsters to duplicate.

- Card Number: The card number is unique and identifies the credit card issuer and the cardholder. It facilitates transaction processing by providing essential information to merchants and payment processors.

- Cardholder Name: It identifies the authorised user of the credit card and helps verify the cardholder’s identity during transactions.

- Expiry Date: The expiry date mentioned on the credit card helps the merchant authorise your card to process transactions, ensuring the card is valid and current. It also allows banks to monitor card usage and replace cards that may be worn out or compromised.

- Magnetic Stripe: The magnetic stripe on a credit card stores essential information required for processing transactions. This includes the cardholder’s account number, card expiration date, and the card verification code.

- Signature Panel: The signature panel allows you to sign your name to verify your identity during transactions. Merchants can compare the signature on the card with the one on the receipt to help prevent unauthorised use of the card.

- CVV/CVC: The CVV (Card Verification Value) or CVC (Card Verification Code) enhances security during online transactions. It helps verify that you have physical possession of the card, reducing the risk of unauthorised use.

How to Use a Credit Card for Offline Transactions

- 01Once you give your credit card at the checkout counter, it gets swiped or inserted on the POS machine. You are then required to insert the four-digit PIN you have set for offline transactions to authenticate the transaction.

- 02After the card is scanned, the machine continues reading the chip or the stripe on the credit card along with the PIN and sends the information to the credit card issuer. Once everything seems good to go, like credit limit, validity, and identity, the bank will then approve the transaction.

- 03When a transaction gets the green light, the machine produces two charge slips or receipts. The retailer keeps one for their records and hands the other to you. In some uncommon situations where a PIN isn’t needed, the retailer may ask you to sign the charge slip instead.

How to Use a Credit Card for Online Transactions

With a credit card, you can also make online transactions. Here’s what the online store will ask you when purchasing a credit card:

Once you enter all of the above information, you need to move ahead to the payment page. Your transaction request will be sent to your credit card issuer through a payment gateway. Then, the credit card issuer will send you an OTP on your registered mobile number or email ID to authenticate the transaction. When you enter the OTP, your online transaction is completed.

Choose the type of credit card you have (MasterCard/Visa/Amex)

Enter your 16-digit credit card number

Give the remaining credit card details – credit cardholder name, credit card expiry date, CVV

Enter the billing and shipping address

Important Credit Card Terminologies to Understand

-

Interest Rate

When you use a credit card, you’re borrowing money from the issuer, similar to taking out a loan, which may incur interest. However, this interest is only applicable if you don’t pay off your full balance by the due date. If you carry a balance, you’ll be charged interest on that amount. It’s also important to note that interest is calculated monthly rather than annually.

-

Credit Limit

Your credit card will come with a credit limit determined by your credit history, creditworthiness, credit score, income, debts, and more. If you attempt to make a purchase that exceeds this limit, the credit card issuer may decline the transaction. If you have a positive payment record, the credit card issuer may offer you the opportunity to raise your credit limit.

-

Billing Cycle

This is the specific timeframe during which you can make purchases before receiving your bill. If you shop at the start of this period, you’ll enjoy an extended credit window, giving you more time to pay for those transactions.

-

Minimum Payment

When you pay your credit card bill, you will come across two options – pay the full amount or pay the minimum balance due. When you choose to make the minimum payment, you will be charged your monthly interest rate on the entire remaining balance until you pay the amount in full.

-

Balance

A credit balance is the amount that you have spent on your credit card from your credit limit. This is the balance that you haven’t yet paid back.

Types of Credit Cards

There are several different types of credit cards available in India, each serving a different purpose and catering to different financial goals. Below is a list of the most popular ones:

-

1. Regular Credit Cards

A regular credit card is perfect for a first-time credit card user as it is simple, convenient, and safe to use, and it offers benefits and rewards.

-

2. Premium Credit Cards

Once you become good at using a credit card wisely and have built a good credit score, it’s time to upgrade based on your needs. With a premium credit card, you get a higher credit limit, more benefits, and better reward points to cater to your premium lifestyle.

-

3. Super Premium Credit Cards

These cards mostly have super premium benefits like complimentary golf games, exclusive lounge access, personal concierge, best-in-class rewards, and fine dining discounts. Super premium cards are invite-only cards with a higher credit limit meant for people with great credit scores.

-

4. Co-branded Credit Cards

The co-branded credit cards are cards meant for a specific purpose. For example, if you are a frequent traveller, getting a co-branded card with a travel company will give you endless benefits like discounts on flights and hotels, lounge access, travel insurance, and more.

-

5. Commercial or Business Credit Cards

For managing business-related expenses, a commercial card is your best option. It helps you save on travel costs and simplifies the payment process for your purchases.

-

6. Cashback Credit Cards

Cashback or Moneyback cards enable you to earn money back on your regular purchases. The cashback you receive can be used as a reward to pay off your credit card balance.

-

7. Secured Credit Cards

Credit cards typically require a minimum income and a good credit score, which can be challenging for homemakers and small business owners. A secured credit card, backed by a fixed deposit (FD), is a viable alternative. This card doesn’t require income proof or a credit score, and the credit limit usually matches the FD amount, which earns interest. If payments are missed, the bank can deduct the owed amount from the FD.

-

8. Lifestyle Credit Cards

Lifestyle credit cards come with a range of perks and benefits tailored to enhance your everyday spending. Enjoy exclusive deals on shopping, dining, travel, and much more. Plus, as you use your credit card, you’ll accumulate fantastic rewards for your purchases.

-

9. Travel Credit Cards

A travel credit card is a specialised credit card designed to provide unique rewards for purchases related to travel.

-

10. Shopping Credit Cards

Shopping credit cards are unique credit cards that provide rewards and benefits specifically for purchases made with the card.

-

11. Fuel Credit Cards

A fuel credit card, like its name, is used for filling up gas in your vehicle. This type of credit card offers rewards for refilling fuel and even a surcharge fee waiver.

-

12. Student Credit Cards

To open your own credit card account, you need to be at least 18 years old. If you’re between 18 and 21, you might encounter more stringent verification processes, especially for student credit cards aimed at individuals aged 18 to 22. These student credit cards are tailored to meet the unique needs of students, who often have limited credit histories, low incomes, and specific spending patterns.

Want multiple card features in one?

Get the Edge CSB Bank RuPay Credit Card on Jupiter

Major Credit Card Networks in India

The primary credit card networks operating in India are:

RuPay

An Indian domestic payment network, gaining popularity for its focus on financial inclusion and government-backed initiatives. RuPay Credit Cards are ganing more and more market as they are compitiblewith UPI networks

Visa

A global leader, offering a wide range of cards with various benefits and acceptance worldwide.

Mastercard

Another global giant, known for its extensive network and innovative payment solutions.

American Express

Primarily targeting the premium segment with exclusive benefits and services.

Discover

Though less prevalent, it has a presence through partnerships with other networks.

How to Get a Credit Card

-

Research and Compare Cards

Research all the available credit card issuers and compare the different credit cards, their features, and benefits.

-

Pick the Right Card

Select the credit card that best fits your financial and personal goals and needs.

-

Enter Personal Details Online

Go to the credit card issuer’s website and fill out the personal information form.

-

Upload Required Documents

Upload the required documents asked by the credit card issuer.

-

Submit Application

Fill out the application form for the credit card and submit it.

-

Await Approval

Once you submit the form, the credit card issuer will verify your documents and contact you to let you know whether you are approved.

Eligibility Criteria for the Credit Card Application

Age should be above 18

Indian nationality

Must be earning enough income (subjective to different credit card issuers)

Good credit score

Documents Required for Credit Card

Income proof

Address proof

Residential proof

Credit Card Annual Fees and Charges

There are several charges and fees associated with a credit card on an annual basis that you need to be aware of before applying for a credit card. Take a look at some of the basic fees:

Maintenance Fee

Often called an annual fee, this charge applies once a year and can differ depending on your chosen credit card. Some banks offer credit cards with no annual fees, either for a limited time or even permanently, allowing you to avoid both joining and annual costs.

Cash Advance Charges

You are provided with a specific cash limit that represents a fraction of your overall credit limit that you can take out from an ATM. However, keep in mind that making a cash withdrawal or cash advance can be quite costly, with fees reaching as high as 2.5% of the withdrawn amount.

Late Payment Fee

If you can’t cover the entire balance on your credit card, banks typically allow you to make a minimum payment. However, if you can’t even manage that, you may incur a late payment fee. This fee is a fixed amount determined by your statement balance.

Over-Limit Charges

The ability to go beyond your credit card limit depends on your specific card. However, banks typically don’t allow this without consequences; they impose a significant over-limit fee for these transactions. While most banks charge a minimum fee of ₹500, the exact amount will vary based on how much you’ve surpassed your limit.

GST

Keep in mind that all credit card transactions will be subject to the current tax rates in your country. Hence, Goods and Services Tax (GST) applies to annual fees, interest payments, and processing fees for EMIs.